Chinese head tax facts for kids

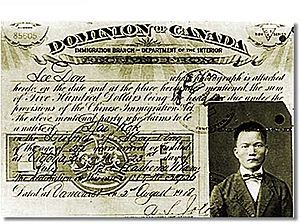

The Chinese Head Tax was a special fee that every Chinese person had to pay to enter Canada. This tax began in 1885 when the Canadian government passed a law called the Chinese Immigration Act. The main goal was to stop Chinese people from coming to Canada, especially after the Canadian Pacific Railway (CPR) was finished.

The head tax was finally removed in 1923. At that time, a new law, also called the Chinese Immigration Act, was passed. This new law almost completely stopped Chinese immigration to Canada. Only a few people, like business owners, religious leaders, teachers, and students, were allowed to enter.

Contents

Why Was the Head Tax Created?

In the mid-to-late 1800s, about 17,000 workers came from China to help build the Canadian Pacific Railway. They were paid much less than other workers, sometimes only about CA$1 a day.

Once the railway was built, there wasn't a big need for cheap labour anymore. People in British Columbia especially wanted to stop Chinese immigration. The provincial government tried to pass a law to prevent it in 1885, but the courts said they couldn't, because immigration was a federal matter.

Responding to these feelings, the Canadian government, led by Prime Minister John A. Macdonald, introduced the Chinese Immigration Act in 1885. This law made it so that every Chinese person entering Canada had to pay a $50 fee. This fee was later called the head tax.

Over the years, the fee increased. It went up to $100 in 1900 and then to $500 in 1903. To give you an idea, $500 was about two years' salary for an immigrant worker back then!

Who Had to Pay?

Not everyone had to pay the head tax. Some people were exempt, meaning they didn't have to pay. These were usually people who were better off or whose jobs suggested they might return to China.

People who didn't have to pay included:

- Students

- Teachers

- Missionaries (people who spread religious beliefs)

- Merchants (business people)

- Diplomats (government representatives from other countries)

The Canadian government collected about CA$23 million from around 81,000 people who paid the head tax. The tax did make it harder for Chinese women and children to join their family members in Canada. However, it didn't completely stop Chinese immigration, which was what some politicians wanted.

The head tax was finally ended by the Chinese Immigration Act of 1923. This law stopped almost all Chinese immigration to Canada. Some people called it the Chinese Exclusion Act because it excluded Chinese people.

Fighting for Justice: The Redress Movement

After the Chinese Immigration Act was cancelled in 1948, leaders in the Chinese community, like Wong Foon Sien, started asking the government to allow more Chinese immigrants.

The idea of getting "redress" (meaning a correction or payment for a past wrong) didn't really start until 1984. That's when Margaret Mitchell, a Member of Parliament from Vancouver, brought up the issue in the Canadian Parliament. She did this after the Canadian Charter of Rights and Freedoms was put into Canada's Constitution.

More than 4,000 head tax payers and their families registered with the Chinese Canadian National Council (CCNC). This group worked hard to bring attention to the issue. They held meetings, got support from other groups, and shared their stories in the media.

Early Talks and Rejections

In 1993, Prime Minister Brian Mulroney offered some ideas for redress. These included special medals and a museum section. However, Chinese Canadian groups rejected these offers because they wanted more.

Later that year, when Jean Chrétien became prime minister, his government refused to apologize or offer financial compensation. They said they "cannot rewrite history." Instead, they suggested funding a Canadian Race Relations Foundation.

The CCNC and other groups kept fighting. They even took their case to the United Nations Human Rights Commission. They argued that the Canadian government shouldn't benefit from racism and had a duty under human rights laws.

UN Report and Continued Efforts

In 2004, a United Nations special rapporteur (an expert who reports on specific issues) named Doudou Diène said that Canada should make up for the head tax. This report brought more attention to the issue around the world.

In 2005, Gim Wong, an 82-year-old man whose parents paid the head tax, rode his motorcycle across Canada to Ottawa. He wanted to meet Prime Minister Paul Martin, but the Prime Minister refused.

Failed Bill C-333

In late 2005, there was an attempt to create a deal. A group called the National Congress of Chinese Canadians (NCCC) announced an agreement with the government. This deal would create a foundation to teach Canadians about anti-Chinese discrimination, but it specifically said there would be no apology from the government.

Many in the Chinese Canadian community were very upset because this deal was made without their input. A bill, called Bill C-333, was introduced in Parliament to make this deal happen. However, it did not pass. The government lost a vote, and Parliament was dissolved, meaning the bill died.

The Official Apology

In the 2006 Canadian federal election, the Conservative Party won. Their leader, Stephen Harper, had promised to work with the Chinese community on redress.

After becoming Prime Minister, Stephen Harper repeated his promise. He said the Chinese Canadian community deserved an apology for the head tax and proper recognition.

Discussions began in March 2006. The government held public meetings across Canada, where elders and community members shared their stories.

Finally, on June 22, 2006, Prime Minister Stephen Harper delivered an official apology to Chinese Canadians in the House of Commons of Canada. He even spoke a few words in Cantonese, saying "Canada Apologizes."

However, many in the Chinese Canadian community were disappointed with the details. Only the original head tax payers who were still alive, or their surviving spouses, would receive CA$20,000. This was a very small number of people compared to the 81,000 who originally paid the tax. In 2006, only about 20 Chinese Canadians who had paid the tax were still alive.

Because no further redress was offered, the Chinese Canadian community continued to fight for more justice. They held protests across Canada to keep the issue in the public eye.

See also

- Chinese Canadian National Council

- Lost Years: A People's Struggle for Justice

- White Australia Policy

- Chinese Exclusion Act

- Internment of Japanese Canadians

Images for kids