Money supply facts for kids

The money supply (also called money stock) is the total amount of money available in an economy at a specific time. There are different ways to think about what "money" means. Usually, it includes cash people use and money in checking accounts. Each country's central bank decides exactly what it counts as money for its own purposes.

Governments or central banks usually keep track of and share information about the money supply. People who study the economy, both in public and private groups, watch changes in the money supply closely. They believe these changes can affect the cost of things, inflation (when prices go up), exchange rates (how much one country's money is worth compared to another's), and the overall business cycle (how the economy grows and shrinks).

What is Money?

Money is really useful! It helps us in three main ways:

- It's a medium of exchange: This means we use it to buy and sell things. Instead of trading a chicken for shoes, we use money.

- It's a unit of account: It helps us measure the value of things. We know a candy bar costs $1 and a bike costs $100, so the bike is worth 100 candy bars.

- It's a store of value: You can save money today and use it later to buy things. It keeps its value over time (mostly!).

How We Measure Money

Different types of money are often grouped into categories called "M"s. These usually go from M0 (the narrowest, meaning it includes the least amount of things) to M3 (the broadest, including more types of money). Which "M"s a country's central bank focuses on depends on their goals.

Here's a simple way to look at the different "M"s:

| Type of Money | M0 | MB | M1 | M2 | M3 | MZM |

|---|---|---|---|---|---|---|

| Cash and coins (outside banks) | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Cash in bank vaults | ✓ | |||||

| Money banks keep at the Federal Reserve | ✓ | |||||

| Traveler's checks (from non-banks) | ✓ | ✓ | ✓ | ✓ | ||

| Checking accounts | ✓ | ✓ | ✓ | ✓ | ||

| Other checkable deposits (like NOW accounts) | ✓ | ✓ | ✓ | ✓ | ||

| Savings accounts | ✓ | ✓ | ✓ | |||

| Small time deposits (under $100,000) and money-market accounts for people | ✓ | ✓ | ||||

| Large time deposits, big money market funds, and other large liquid assets | ✓ | |||||

| All money market funds | ✓ |

- M0: This is the most basic form of money. In some countries, it includes the money banks keep as reserves. It's often called the monetary base or "narrow money."

- MB: This is the monetary base or total currency. It's the starting point from which other types of money, like checking deposits, are created. It's the easiest money to use right away.

- M1: This includes M0 plus money in checking accounts and traveler's checks. It does not include bank reserves.

- M2: This is a broader measure. It includes everything in M1, plus "close substitutes" for M1. Think of it as M1 plus savings accounts and small time deposits. M2 is an important sign that economists use to guess if inflation might happen.

- M3: This is the broadest measure. It includes M2 plus large and long-term deposits. The US central bank stopped publishing M3 data after 2006, but some private groups still try to estimate it.

- MZM: This stands for "Money with Zero Maturity." It measures financial assets that you can get cash for immediately. The speed at which MZM changes hands (called velocity) has been pretty good at predicting inflation in the past.

The relationship between these measures, often M2 divided by M0, is called the money multiplier. It shows how much the total money supply can grow based on the monetary base.

Images for kids

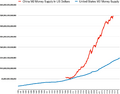

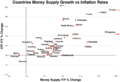

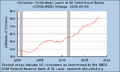

-

CPI-Urban (blue) vs M2 money supply (red); recessions in gray

-

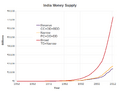

Japanese money supply (April 1998 – April 2008)

-

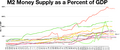

The euro money supplies M0, M1, M2 and M3, and euro zone GDP from 1980–2021. Logarithmic scale.

-

Money supply decreased by several percent between Black Tuesday and the Bank Holiday in March 1933 when there were massive bank runs across the United States.

-

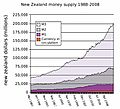

New Zealand money supply 1988–2008

See also

In Spanish: Masa monetaria para niños

In Spanish: Masa monetaria para niños

| Laphonza Butler |

| Daisy Bates |

| Elizabeth Piper Ensley |