Poll taxes in the United States facts for kids

A poll tax was a special kind of tax that everyone had to pay, usually a fixed amount for each adult. It didn't matter how much money someone earned or what they owned. This tax was used in many places, especially in the southern United States, but also in some northern and western states like California and Ohio.

In the early days of the United States, poll taxes were a big way for governments to get money. For example, in colonial Massachusetts, poll taxes made up a lot of the tax income. To make sure people paid, many important things, like being able to vote, getting a driver's license, or even hunting and fishing licenses, depended on paying this tax.

Over time, as more people moved west and land became more valuable, taxes on property became more common. Some western states didn't need poll taxes anymore. But in eastern states, poll taxes and the rules about paying them stayed. After the American Civil War, some connections between poll taxes and voting were changed. Finally, a new law called the 24th Amendment in 1964 and later court decisions made poll taxes illegal for voting.

Contents

Voting Rights and the Poll Tax

After the Civil War, the Fifteenth Amendment was added to the U.S. Constitution. This amendment said that people could not be stopped from voting because of their race. However, some states, especially in the South, found new ways to prevent certain groups from voting. One of these ways was the poll tax.

These poll tax laws were part of a group of unfair rules called Jim Crow laws. They were designed to make it hard for African-American people to vote. They also affected Asian-American and Native American voters, and even poor white people.

Many poll tax laws also included a "grandfather clause." This rule said that if your father or grandfather could vote before slavery ended, you didn't have to pay the poll tax. This meant that most white men could vote without paying, while most African-American men, whose ancestors were enslaved, still had to pay.

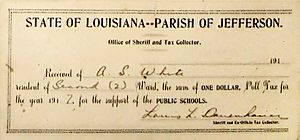

States like Florida, Alabama, and Texas used poll taxes to control who could vote. For example, in Texas in 1902, people had to pay between $1.50 and $1.75 to register to vote. This might not sound like much today, but it was a lot of money back then, especially for working-class and poor families.

In Georgia, starting in 1877, the poll tax added up over time. Men aged 21 to 60 had to pay for every year since they turned 21, or since the law started. This made it even harder for people to afford to vote.

Challenges to the Poll Tax

The poll tax affected many people, including white women. In Alabama, white women faced discrimination when trying to vote because of the poll tax. Groups like the Women's Joint Legislative Council of Alabama (WJLC) worked to get rid of it. African-American women also fought against these unfair laws. For example, in 1942, Lottie Polk Gaffney and other women, with help from the NAACP, tried to sue to get their voting rights.

Many states made it tricky to pay the tax. You often had to pay it at a different time than the election. Then, you had to bring a receipt to the voting place. If you lost your receipt, you couldn't vote. This was especially hard for farmers who moved often and might not have had a permanent address to keep records.

Sometimes, the poll tax was used with other unfair rules, like literacy tests. These tests were designed to be very difficult, making it hard for many people to pass and register to vote.

Ending the Poll Tax

For a long time, the U.S. Supreme Court said that poll taxes were legal. In 1937, in a case called Breedlove v. Suttles, the Court decided that Georgia's $1 poll tax was allowed. However, Georgia later got rid of its poll tax in 1945, and Florida did so in 1937.

A major change came in 1964 with the 24th Amendment. This amendment made it illegal to use a poll tax or any other tax to stop people from voting in federal elections (like for president or members of Congress).

Even after the 24th Amendment, some states still had poll taxes for state and local elections. But in 1966, another important Supreme Court case, Harper v. Virginia State Board of Elections, changed everything. The Court decided that poll taxes in state elections were also illegal. They said it violated the Equal Protection Clause of the 14th Amendment, which means everyone should be treated fairly under the law.

After the Harper ruling, federal courts quickly declared poll tax laws unconstitutional in the last four states that still had them: Texas, Alabama, Virginia, and Mississippi. Mississippi's $2 poll tax was the very last one to be struck down in April 1966.

Poll Taxes by State

The table below shows when some states used poll taxes and when they stopped.

| State | Cost | Implementation | Repeal |

|---|---|---|---|

| Alabama | $1.50 | 1901 | 1966 |

| Arkansas | $1.00 | 1891 | 1964 |

| California | $2.00 | 1850 | 1914 |

| Connecticut | ? | 1649 | 1947 |

| Delaware | ? | 1897 | |

| Florida | $1.00 | 1885 | 1937 |

| Georgia | $1.00 | 1877 | 1945 |

| Louisiana | $1.00 | 1898 | 1934 |

| Maine | $3.00 | 1845 | 1973 |

| Maryland | ? | 1896 | |

| Massachusetts | $3.00 | 1865 | 1890 |

| Minnesota | $1.00 | 1863 | ? |

| Mississippi | $2.00 | 1890 | 1966 |

| New Hampshire | ? | ? | ? |

| North Carolina | ? | 1900 | 1920 |

| Ohio* | ? | ? | ? |

| Oklahoma | $2.00 | 1907 | 1986 |

| Pennsylvania | ? | 1865 | 1933 |

| Rhode Island | ? | 1865 | 1890 |

| South Carolina | $1.00 | 1895 | 1951 |

| Tennessee | $1.00 | 1870 | 1953 |

| Texas | $1.50-1.75 | 1902 | 1966 |

| Vermont | $1.00 | 1778 | 1982 |

| Virginia | $1.50 | 1902 | 1966 |

| Wisconsin | ? | ? | ? |

| Jewel Prestage |

| Ella Baker |

| Fannie Lou Hamer |