ShoreBank facts for kids

|

|

| Community development bank | |

| Fate | Insolvency |

| Successor | Urban Partnership Bank |

| Founded | 1973 |

| Defunct | 2010 |

| Headquarters | Chicago, Illinois |

|

Key people

|

|

| Products | Financial services, microfinance |

| Total assets | $2.6B USD (2008) |

| Parent | ShoreBank Corporation |

ShoreBank was a special kind of bank, known as a community development bank. It was started in Chicago in 1973. This bank was the oldest and largest of its kind when it closed in 2010.

ShoreBank's main goal was to help communities grow and become stronger. It focused on lending money to people and businesses in neighborhoods that needed it most. In 2008, the bank had about $2.6 billion in assets.

ShoreBank had branches in Chicago, Cleveland, and Detroit. It also worked on projects in many other countries. The bank even thought about the environment, trying to make sure its projects helped people, made a profit, and were good for the planet.

ShoreBank got money from people all over the country through special savings programs. Even though it had a big mission, the bank usually did very well financially. However, it faced big problems in 2009 because of a tough economy.

Contents

About ShoreBank

ShoreBank was owned by ShoreBank Corporation. This company was the first to combine regular banking with real estate help and international advice. It started by helping low-income African-American communities in Chicago. Over time, ShoreBank grew to help people across the country and even around the world.

The bank tried to get more money to keep going, but it didn't get enough government help. So, in August 2010, ShoreBank had to close. Most of its money and customers were then taken over by a new bank called Urban Partnership Bank.

How ShoreBank Started

In 1973, a bank called South Shore Bank wanted to move out of the South Shore neighborhood in Chicago. This area was struggling, and many buildings were empty. Some people felt the bank was not treating all communities fairly when it came to lending money.

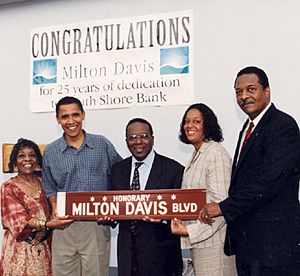

Because of this, a group of community leaders decided to buy the bank. These leaders included Milton Davis, James Fletcher, Mary Houghton, and Ron Grzywinski. They worked hard to stop the bank from moving and then bought it.

In 2000, the bank was renamed ShoreBank. It became the first community development bank in the United States. For 37 years, ShoreBank played a huge role in making Chicago's low-income neighborhoods better. It also became a model for similar banks worldwide.

ShoreBank grew its services and helped communities in other places too. These included Detroit, Cleveland, and parts of Michigan and Arkansas. Its work even inspired Bill Clinton, who was then the governor of Arkansas, to create a law to help community banks. ShoreBank also helped develop microfinance, which is giving small loans to people who might not get them from traditional banks.

How ShoreBank Was Organized

ShoreBank Corporation was the main company that owned ShoreBank. It also had other companies that helped with banking, investing, and environmental projects.

Some of these companies included:

- ShoreBank Pacific, which worked in Oregon and Washington. It was later sold and became part of Beneficial State Bank.

- ShoreBank International, which is now part of Palladium Impact Capital.

ShoreBank also created many non-profit groups to help communities. These groups offered financial help, advice, and other services. Some of them continued their work even after ShoreBank closed.

These non-profit groups included:

- Center for Financial Services Innovation, now called Financial Health Network.

- National Community Investment Fund (NCIF).

- Northern Initiatives, which helps communities in Michigan.

- ShoreBank Enterprise Cascadia, which helps people in Oregon and Washington. It is now called Craft3.

- ShoreBank Enterprise Cleveland, which helps in Cleveland.

- ShoreBank Enterprise Detroit, which helps in Detroit. It is now called Detroit Development Fund.

Awards and Recognition

ShoreBank and its founders received many awards for their work. They were recognized by magazines like Fast Company and U.S. News & World Report. They also received honors from universities and business groups.

Former President Bill Clinton was a big supporter of ShoreBank. He called it "the most important bank in America." He said ShoreBank's success inspired many other community development financial institutions (CDFIs) to start.

In the 1980s, ShoreBank also worked with Muhammad Yunus to help him grow Grameen Bank in Bangladesh. Muhammad Yunus and Grameen Bank later won the Nobel Peace Prize in 2006 for their work in microfinance.

Challenges and Closure

In 2010, ShoreBank faced big financial problems. Many of the neighborhoods where the bank lent money had high unemployment. This meant people struggled to pay their rent or mortgage. Property values also dropped a lot.

Because of these tough economic times, many people fell behind on their loan payments. This made it very hard for the bank to get its money back. Even though ShoreBank was not involved in risky lending practices, the widespread economic downturn hit it hard.

The bank tried to raise more money from private investors. It also asked the U.S. government for help. While it raised a lot of money from private groups, it did not get the government support it needed. This was a condition for the private investors to put in their money.

So, on August 20, 2010, ShoreBank was officially closed by regulators. Most of its assets were then taken over by Urban Partnership Bank. Interestingly, some of ShoreBank's newer managers were allowed to continue working at the new bank. Regulators said these managers were not responsible for ShoreBank's problems.

| May Edward Chinn |

| Rebecca Cole |

| Alexa Canady |

| Dorothy Lavinia Brown |