Tokyo Stock Exchange facts for kids

| Tokyo Stock Exchange | |

|---|---|

Quick facts for kids 東京証券取引所 |

|

|

|

| Tokyo Stock Exchange Main Building (1988).jpg | |

| Type | Stock exchange |

| Location | Tokyo, Japan |

| Coordinates | 35°40′53″N 139°46′40″E / 35.68139°N 139.77778°E |

| Founded | May 15, 1878 (as Tokyo Kabushiki Torihikijo) May 16, 1949 (as Tokyo Stock Exchange) |

| Owner | Japan Exchange Group |

| Key people |

|

| Currency | Japanese yen |

| No. of listings | 3,953 (September 2024) |

| MarketCap | ¥973.4 trillion ($6.93 trillion) (September 2024) |

| Indexes | Nikkei 225 TOPIX |

The Tokyo Stock Exchange (TSE) is a very important place in Tokyo, Japan. It is where people and companies buy and sell shares of other companies. Think of it like a big marketplace for parts of businesses.

The TSE is also known as Tosho or TSE/TYO. It is owned by a larger company called the Japan Exchange Group (JPX). JPX was created in 2013 when the Tokyo Stock Exchange Group joined with another exchange.

Contents

What is the Tokyo Stock Exchange?

The TSE is set up as a type of company called a kabushiki gaisha. This is a common way for businesses to be organized in Japan. Its main office is in Nihonbashi-Kabutocho, a busy financial area in Tokyo.

How the Stock Market is Measured

The main ways to see how well the stock market is doing at the TSE are through special numbers called indexes.

- The Nikkei 225 index tracks 225 of Japan's biggest companies. It's like a report card for the top businesses.

- The TOPIX index looks at the share prices of many companies listed in the "Prime" market.

These indexes help people understand if the market is going up or down.

The Kabuto Club

The TSE has a special press club called the Kabuto Club. This is where reporters from major news companies gather. They meet to get the latest news about companies and the stock market. It's especially busy when companies share their yearly financial reports.

Trading Hours and Holidays

The Tokyo Stock Exchange is open for trading on weekdays.

- Morning session: 9:00 a.m. to 11:30 a.m.

- Afternoon session: 12:30 p.m. to 3:30 p.m.

It is closed on Saturdays, Sundays, and Japanese national holidays. Some of these holidays include New Year's Day, Children's Day, and Culture Day.

How Companies are Listed on the Stock Market

Companies that want to have their shares traded on the Tokyo Stock Exchange are listed in different groups. These groups help people understand the size and type of company.

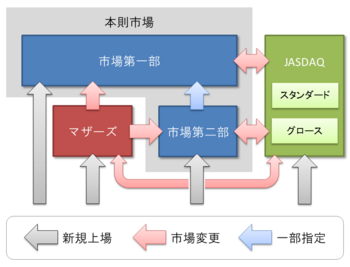

Old Market Sections (Before April 2022)

Before April 4, 2022, the TSE had five main market sections:

- The First Section was for very large companies.

- The Second Section was for medium-sized companies.

- JASDAQ and Mothers were for newer, growing companies.

- The TOKYO PRO Market was for smaller companies, often those that were just starting out.

As of March 31, 2022, there were 3,821 companies listed across these sections.

| Business size | Market names | Total | (Overseas

companies) |

|

|---|---|---|---|---|

| Large | Main Market

(本則市場) |

First Section (市場第一部) | 2,176 | (1) |

| Mid-sized | Second Section (市場第二部) | 475 | (1) | |

| Emerging | Mothers (マザーズ) | 432 | (3) | |

| JASDAQ | Standard (スタンダード) | 652 | (1) | |

| Growth (グロース) | 34 | (0) | ||

| Small | TOKYO PRO Market | 52 | (0) | |

| Total | 3,821 | (6) | ||

New Market Sections (Since April 2022)

On April 4, 2022, the TSE changed how it groups companies. Now there are three main market divisions:

- Prime market: For large, well-established companies.

- Standard market: For mid-sized companies.

- Growth market: For companies that are still growing and developing.

Companies chose which new division they wanted to be in. For example, many companies from the old First Section moved to the Prime market.

As of August 21, 2023, there were 3,899 companies listed on the Tokyo Stock Exchange.

| Business size | Market names | Total | (Overseas companies) |

|---|---|---|---|

| Large | Prime Market (プライム市場) | 1,834 | (1) |

| Mid-sized | Standard Market (スタンダード市場) | 1,440 | (2) |

| Emerging | Growth Market (グロース市場) | 546 | (3) |

| Small | TOKYO PRO Market | 79 | (0) |

| Total | 3,899 | (6) | |

History of the Tokyo Stock Exchange

Early Years

The Tokyo Stock Exchange first opened its doors on May 15, 1878. It was called the Tokyo Kabushiki Torihikijo back then. Trading officially began a few weeks later, on June 1, 1878.

In 1943, during World War II, the exchange joined with other stock exchanges in Japan. This new combined exchange closed down on August 1, 1945.

After the War

The Tokyo Stock Exchange reopened on May 16, 1949, after the war ended. It started with its current Japanese name.

In the 1980s, the TSE grew very quickly. By 1990, it was the largest stock market in the world. However, its value later decreased, and it became one of the top four largest exchanges.

The current TSE building opened in 1988. In 1999, the trading floor where people used to shout orders was closed. The exchange switched to fully electronic trading. A new electronic trading facility called TSE Arrows opened in 2000.

In 2001, the TSE changed its structure to become a "stock company." This meant its members became shareholders. The TSE has also worked with other exchanges around the world, like the Singapore Exchange and the London Stock Exchange.

Technology Challenges

Like any big computer system, the Tokyo Stock Exchange has faced some technology problems over the years. These issues sometimes caused trading to slow down or even stop.

For example, in 2005, a new system had bugs that caused trading to be interrupted. Another time, a mistake by a trader led to a large financial loss because of a typing error. The exchange's system initially blocked attempts to fix the mistake. These events showed the importance of having strong error-checking and backup systems.

In 2006, a surge in trading volume almost overloaded the system, causing trading to be suspended early. The exchange quickly worked to increase its capacity to handle more trades.

On October 1, 2020, the Tokyo Stock Exchange had to stop all trading for an entire day. This was the first time this had happened since it became an all-electronic exchange. The problem was a technical glitch in the system that shares market information. This incident highlighted the need for reliable backup systems. Normal trading started again the next day.

See also

In Spanish: Bolsa de Tokio para niños

In Spanish: Bolsa de Tokio para niños

- List of East Asian stock exchanges

- List of stock exchanges

| Audre Lorde |

| John Berry Meachum |

| Ferdinand Lee Barnett |