2020 stock market crash facts for kids

The 2020 stock market crash was a big drop in stock prices around the world. It started on February 20, 2020, during the 2019–20 coronavirus pandemic. Major stock indexes like the Dow Jones Industrial Average, S&P 500 Index, and the NASDAQ-100 all fell sharply. This happened on February 27, making it one of the worst trading weeks since the financial crisis of 2007–08.

The next week, from March 2 to March 6, markets were very unstable. Prices often changed by 3% or more each day. On March 9, all three main Wall Street indexes dropped by more than 7%. Most markets worldwide also lost a lot of value. This was due to worries about the 2019–20 coronavirus pandemic and a fight over oil prices called the Russia–Saudi Arabia oil price war.

This day became known as Black Monday. At the time, it was the biggest drop since the Great Recession in 2008. Just three days later, on Black Thursday, stocks in Europe and North America fell by more than 9%.

Contents

What is a Stock Market Crash?

A stock market crash happens when stock prices fall very quickly and unexpectedly. Stocks are small parts of companies that people can buy. When you buy a stock, you own a tiny piece of that company. If many people suddenly want to sell their stocks, prices drop fast. This can happen because people are worried about the economy or big world events.

Why Did the Market Crash in 2020?

The 2020 stock market crash had two main reasons. One was the spread of the coronavirus. The other was a disagreement between Russia and Saudi Arabia about oil prices. Both of these events made people worried about the future.

The 2019–20 coronavirus pandemic caused a lot of fear. Governments started to close businesses and tell people to stay home. This meant that many companies could not make or sell their products. Investors worried that companies would lose money. They also worried that people would stop buying things. This made many investors sell their stocks quickly.

The Oil Price War

At the same time, Russia and Saudi Arabia had a disagreement. They both produce a lot of oil. They could not agree on how much oil to produce. This led to an "oil price war." Both countries started to produce much more oil. This made the price of oil drop very low. Low oil prices hurt oil companies. It also added to the overall fear in the markets.

Key Dates and Events

The crash happened very quickly over a few weeks.

- February 20, 2020: The first big drops started.

- February 27, 2020: Major indexes like the Dow Jones and S&P 500 fell sharply.

- March 9, 2020: This day was called Black Monday. Stock markets around the world saw huge losses.

- March 12, 2020: This day was called Black Thursday. Stocks in Europe and North America fell even more.

How Did People React?

When the stock market crashes, governments and banks often try to help. The Federal Reserve in the United States is like the country's central bank. On March 3, 2020, the Federal Reserve cut interest rates. This means it became cheaper for banks to borrow money. The goal was to encourage spending and investing. They hoped this would help the economy.

Images for kids

-

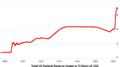

The Federal Reserve expanded its balance sheet greatly through three quantitative easing periods since the financial crisis of 2007–2008. In September 2019, a spike in the overnight repo market interest rate caused the Federal Reserve to introduce a fourth round of quantitative easing; the balance sheet would expand parabolically following the stock market crash.

-

Federal Reserve chairman Jerome Powell announces a 50 basis point cut in the federal funds rate target on 3 March 2020 in light of "evolving risks to economic activity" from the coronavirus

-

On 11 March 2020, the Dow Jones Industrial Average ended an 11-year bull market run and entered a bear market. Symbolic statues from the Frankfurt Stock Exchange pictured.

See also

In Spanish: Colapso del mercado de valores de 2020 para niños

In Spanish: Colapso del mercado de valores de 2020 para niños