Digital currency facts for kids

Digital currency (also called digital money or electronic money) is like regular money, but it only exists on computers and the internet. You can't hold it in your hand like coins or paper money. Instead, it's stored and managed using computer systems.

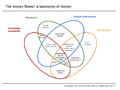

There are different kinds of digital currencies, such as cryptocurrency, virtual currency, and central bank digital currency. This money can be recorded in many ways, like on a special internet database, a company's computer system, or even on a stored-value card (like a gift card).

Digital currencies work a lot like regular money. You can use them to buy things and services, just like you would with cash or a debit card. But sometimes, they might only be used within certain online groups, like in a video game.

One cool thing about digital money is that it can be sent almost instantly over the internet. It also costs much less to move around than physical cash. For example, in the UK, most of the money is actually digital, not physical notes and coins.

Digital money can be controlled in two main ways:

- Centralized: This is when one main group, like a bank, controls the money supply.

- Decentralized: This means no single group controls the money. Instead, rules are set beforehand, or decisions are made by many people together.

Contents

A Quick Look at History

The idea of digital money started a long time ago. In 1983, a smart person named David Chaum wrote about "digital cash." He even started a company called DigiCash in 1989 to try and make it real, but it didn't last.

One of the first widely used internet moneys was e-gold, which came out in 1996. It had millions of users before the US government shut it down in 2008. Around the same time, in 1997, Coca-Cola even tried letting people buy drinks from vending machines using their phones!

PayPal started its online payment service in 1998, making it easier to send money digitally. Then, in 2009, something big happened: bitcoin was launched. Bitcoin was special because it was the first digital currency that didn't have a central server or a company in charge. It used a new technology called blockchain, which made it very hard for governments to control or shut down. These types of digital currencies are also known as cryptocurrencies.

Different Kinds of Digital Money

The term "digital currency" can be a bit confusing because it's used in two ways:

- It can mean a specific type of electronic money with certain features.

- It can also be a general term that includes all the different kinds of digital money.

Governments and experts often have their own definitions for terms like digital currency, virtual currency, and cryptocurrency.

Digital vs. Virtual Currency

Imagine a virtual currency as a type of digital money that isn't issued by a central bank or a regular financial institution. It's often created and managed by its developers and used within a specific online community.

For example, the European Central Bank described virtual currency in 2012 as "unregulated, digital money, which is issued and usually controlled by its developers, and used and accepted among the members of a specific virtual community". The US Department of Treasury said it's "a medium of exchange that operates like a currency in some environments, but does not have all the attributes of real currency." This means it might work like money, but it's not official legal tender.

Digital vs. Cryptocurrency

Cryptocurrency is a special type of digital currency. It uses strong computer codes, called cryptography, to keep transactions safe and to create new units of the currency. Cryptocurrencies often use a peer-to-peer network, meaning people send money directly to each other without a bank in the middle.

The most famous cryptocurrency is bitcoin. It was the first to use a technology called blockchain, which is like a digital record book that's shared across many computers. This makes it very secure and hard to change.

Digital vs. Traditional Currency

You might think that most of the money we use today is already digital. When you check your bank account online, you see numbers, not physical cash. This "bank money" is held on computers and is a form of digital currency. So, in a way, our world is becoming more and more digital when it comes to money.

How Digital Money Systems Work

Centralized Systems

In centralized systems, a main authority, like a bank, controls the money. When you use a debit card or credit card, you're using a centralized digital money system. Your bank manages your money and approves your payments.

Mobile Digital Wallets

Many digital money systems use "mobile wallets" on your phone. These let you pay easily by just tapping your phone.

- In 1997, Mondex and National Westminster Bank tried an "electronic purse" in a town in England.

- PayPal launched its service in 1998.

- In 2010, Venmo started as a way for friends to pay each other back for small things, like coffee or splitting a restaurant bill. It's popular with students.

- Google Wallet came out in 2011, letting you keep all your credit and debit cards on your phone.

- In 2014, Apple Pay was launched for Apple devices, working similarly to Google Wallet.

Central Bank Digital Currency

A central bank digital currency (CBDC) is a new type of digital money issued by a country's central bank (like the Bank of England or the US Federal Reserve). It's like a digital version of a country's paper money and has the same value.

Unlike the money in your regular online bank account (which is held by a commercial bank), CBDCs are directly backed by the government. Many countries are now looking into or already using CBDCs to help their financial systems.

Decentralized Systems

Decentralized digital currencies don't have a central authority. Instead, they rely on a network of computers to manage and verify transactions. This means no single person or company can control the money supply or shut it down.

The Bank for International Settlements (BIS) says that these systems let people send money across borders easily and quickly, no matter where the sender or receiver is.

Rules and Regulations

Governments and financial groups around the world are trying to figure out how to manage digital currencies. It's a new area, and they want to make sure it's safe for everyone and doesn't lead to illegal activities.

For example, the European Union has rules for electronic money institutions. In the United States, different government groups like the US Commodity Futures Trading Commission (CFTC) and the US Internal Revenue Service (IRS) have given guidance on how digital currencies are treated, often calling them "commodities" or "property" for tax purposes.

Countries Using Digital Money

Many countries are exploring or using digital money in different ways:

- Hong Kong: Their Octopus card system, launched in 1997, is a very successful electronic payment card used for public transport and in many shops.

- London: The Oyster card system is similar to Hong Kong's, used for buses, trains, and trams.

- Japan: FeliCa is a contactless smart card used for transport, e-money, and even as door keys.

- Marshall Islands: In 2018, this country became the first to create its own cryptocurrency, called "the sovereign," as legal money.

- United States: The US government has issued warnings about the risks of virtual currencies, especially about scams.

- Canada: The Bank of Canada has explored creating a digital version of its currency using blockchain technology.

- China: The People's Bank of China (PBOC) has been working on a digital version of its currency, the renminbi, since 2016. They've even done trials where people received digital money to spend.

- Denmark: The Danish government has suggested that some shops might not have to accept cash anymore, moving towards a "cashless" society.

- Ecuador: In 2015, Ecuador launched its own state-run electronic payment system, making it the first country to do so.

- El Salvador: In 2021, El Salvador became the first country to officially make Bitcoin a legal currency.

- Netherlands: The Dutch central bank is experimenting with a blockchain-based virtual currency called "DNBCoin."

- India: The Unified Payments Interface (UPI) is a very popular system for instant money transfers between bank accounts. It's available all the time and is very easy to use, even for people who aren't tech-savvy.

- Russia: The government-controlled Sberbank of Russia owns YooMoney, an electronic payment service.

- Sweden: Sweden is becoming very cashless. The Riksbank (Sweden's central bank) is thinking about creating an "e-krona" to complement physical cash.

- Switzerland: In 2016, the city of Zug started accepting bitcoin for small city fees. The Swiss Federal Railways also sells bitcoins at its ticket machines.

- UK: The Bank of England is researching a central bank digital currency and believes it could boost the economy.

Big Companies and Digital Money

Big financial companies are usually careful about new technologies. But some, like Fidelity Investments, are starting to offer services for cryptocurrencies like Bitcoin and Ethereum. This shows that digital money is becoming more accepted in the financial world.

Hard vs. Soft Digital Currencies

- Hard electronic currency: Once you send this type of digital money, it's almost impossible to get it back. It's like handing over cash – once it's gone, it's gone.

- Soft electronic currency: With this type, payments can sometimes be reversed. There's usually a "clearing time" before the payment is final.

Things to Think About

Even though digital currencies are exciting, there are some things to be aware of:

- Many digital currencies are not yet widely used, so they might not be easy to spend everywhere.

- Banks often don't offer services for them.

- Cryptocurrencies can be very risky because their value can go up and down a lot, very quickly. This is called volatility. There's also a risk of scams.

- Some digital currencies are controlled by a central group, meaning they could be shut down by a government.

- The more anonymous a currency is, the more attractive it might be to criminals.

- Some cryptocurrencies, like Bitcoin, use a lot of energy to work.

However, digital currencies are becoming popular because they are convenient. Many people like that they can transfer money quickly and easily. In some countries, people use digital currency because they don't trust their traditional banking systems or their economy. Digital currencies can also offer more freedom in spending habits because they often have fewer rules than regular money. They might even help protect a user's money during financial problems in a country.

List of Non-cryptocurrencies

| Currency | Code | Year Est. | Active | Founder |

|---|---|---|---|---|

| Beenz | 1998 | No | Charles Cohen | |

| e-gold | 1996 | No | Gold & Silver Reserve Inc. | |

| Rand | 1999 | No | James Orlin Grabbe | |

| Ven | 2007 | Yes | Hub Culture |

See also

In Spanish: Moneda digital para niños

In Spanish: Moneda digital para niños

- Complementary currency

- Automated clearing house

- Cashless catering

- Cashless society

- Community Exchange System

- Cryptocurrency exchange

- Cryptocurrency wallet

- Central bank digital currency

- Digital wallet

- E-commerce payment system

- Electronic Money Association

- Electronic funds transfer

- Local exchange trading system

- Payment system

- Private currency

Images for kids

| Georgia Louise Harris Brown |

| Julian Abele |

| Norma Merrick Sklarek |

| William Sidney Pittman |