FTX facts for kids

|

|

| Private | |

| Industry | Cryptocurrency |

| Fate | Filed for Chapter 11 bankruptcy in November 2022 |

| Founded | May 2019 |

| Founders | Sam Bankman-Fried Gary Wang |

| Headquarters | , |

|

Key people

|

John J. Ray III (CEO) |

| Products |

|

| Revenue | |

|

Operating income

|

|

|

Number of employees

|

c. 300 (2022) |

FTX Trading Ltd., known as FTX, was a big company that ran a cryptocurrency exchange. Think of a cryptocurrency exchange like a special online marketplace where people can buy and sell digital money, like Bitcoin. FTX was started in 2019 by Sam Bankman-Fried and Gary Wang.

At its best, in 2021, FTX had over a million users. It was one of the largest places to trade digital money. But in 2022, the company faced big problems. It was found that money from customers was used improperly. This led to FTX going bankrupt. This means the company could no longer pay its debts.

FTX was based in the Bahamas. It also had a linked company called FTX.US for people in the United States. In November 2022, FTX officially filed for bankruptcy in the US. This happened after people worried about how the company was handling customer money. A rival company, Binance, first offered to help FTX but then changed its mind. On December 12, 2022, Sam Bankman-Fried was arrested. The current CEO, John J. Ray III, is working to get money back for those who lost it.

Contents

How FTX Started and Grew

FTX was founded in May 2019 by Sam Bankman-Fried and Gary Wang. It started as part of another company called Alameda Research. Alameda Research was a trading firm that Sam Bankman-Fried had also helped start.

About six months after FTX began, the CEO of Binance, Changpeng Zhao, bought a part of FTX. This helped FTX grow. In 2020, FTX bought a popular app called Blockfolio. This app helped people keep track of their digital money.

In 2021, FTX raised a lot of money from many investors. This made the company worth a huge amount, about $18 billion. Sam Bankman-Fried then bought back the part of FTX that Binance owned. Later that year, FTX moved its main office from Hong Kong to The Bahamas.

In 2022, FTX launched a special fund called FTX Ventures. This fund was meant to invest in new projects. FTX also announced that its US company, FTX.US, would soon let customers trade regular stocks.

FTX also planned to create a gaming part of its business. This would help video game makers use digital money and NFTs in their games. In July 2022, FTX made a deal to buy another crypto company called BlockFi.

However, FTX also faced some issues. In August 2022, a US government agency told FTX to stop saying that customer deposits were insured. FTX quickly clarified that they were not. In September 2022, FTX.US won a bid to buy the digital assets of another bankrupt crypto company. But after FTX's own problems, this deal went to Binance instead.

Why FTX Collapsed in 2022

| FTX Token | |

|---|---|

| Development | |

| White paper | FTT Whitepaper |

| Initial release | May 5, 2019 |

How FTX and Alameda Research Were Connected

FTX and Alameda Research were very closely linked. Alameda Research was a trading company that Sam Bankman-Fried also started. It was found that Alameda Research had a special advantage on FTX. It could trade in ways that other users could not.

Later, it was revealed that FTX had lent a huge amount of its customers' money to Alameda Research. This was done without customers knowing. Alameda used this money for its own investments and to pay back its loans. The new CEO of FTX said this was a "complete failure" of how the company was run.

The Crisis Begins: Binance and a Big Sell-Off

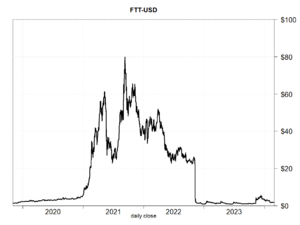

In November 2022, a news report showed that Alameda Research held a lot of its money in FTT. FTT was a digital token created by FTX. This news made people worried.

Soon after, the CEO of Binance, Changpeng Zhao, announced that his company would sell all its FTT tokens. This made the price of FTT drop very quickly. Many FTX customers became scared and tried to take their money out of FTX. This was like a "bank run" but for a digital money exchange.

FTX could not handle all the requests for withdrawals. Binance first offered to buy FTX to help, but then changed its mind. Binance said it found problems with how FTX handled customer money. On November 9, FTX stopped letting people withdraw their money. Sam Bankman-Fried said FTX had enough assets, but not enough ready cash to pay everyone.

Bankruptcy and Missing Funds

On November 11, 2022, FTX, FTX.US, and Alameda Research officially filed for bankruptcy. Sam Bankman-Fried stepped down as CEO. A new CEO, John J. Ray III, took over. He is an expert in helping companies that have failed.

After the bankruptcy filing, over $473 million in funds were taken from FTX in what was called "unauthorized transactions." Some called it a "hack." The money was quickly moved and changed into other digital currencies. This made it hard to get back.

Reports later said that between $1 billion and $2 billion of customer money could not be found. The new CEO, John J. Ray III, said he had "never seen such a complete failure of corporate controls." He said the company had very poor records, even using simple accounting software for billions of dollars.

Wider Problems in the Crypto World

The collapse of FTX caused problems for other companies in the digital money world. The value of some other digital currencies dropped. Other crypto lenders, like BlockFi and Genesis, also had to stop customers from taking out their money. This was because they had connections to FTX.

Many big investors lost money because they had invested in FTX. These included large investment firms and pension plans. Famous people like Tom Brady and Gisele Bündchen had also promoted FTX. They faced lawsuits after the company failed. The FTX crisis made many people more careful about investing in digital money.

Legal Actions and Investigations

After FTX collapsed, police in the Bahamas started an investigation. The US government also began looking into what happened. The US House Committee on Financial Services planned meetings to discuss the collapse.

On December 13, 2022, Sam Bankman-Fried was charged with serious financial crimes. He was arrested in the Bahamas and later brought to the US. He was released on a very large bond and stayed at his parents' home. He said he was not guilty of the charges.

Other people who worked at FTX, like Gary Wang and Caroline Ellison, pleaded guilty to charges. They are now helping the government with its investigation. Another former executive, Nishad Singh, also pleaded guilty and is cooperating.

FTX Sponsorships

FTX used to sponsor many sports teams and events. They paid a lot of money to have their name on things. For example, they bought the naming rights for the Miami Heat basketball stadium. It was called FTX Arena. They also partnered with Major League Baseball and the Mercedes-AMG Petronas F1 Team. The esports team TSM also became TSM FTX.

FTX also sponsored chess tournaments. They even talked about a big sponsorship deal with singer Taylor Swift, but it never happened.

After FTX went bankrupt, many of these partnerships ended. The Miami Heat looked for a new name for their arena. Mercedes-AMG F1 and TSM also cut ties with the company.

|

| Dorothy Vaughan |

| Charles Henry Turner |

| Hildrus Poindexter |

| Henry Cecil McBay |