Non-fungible token facts for kids

A non-fungible token (NFT) is a special digital item that lives on a blockchain. Think of a blockchain as a super secure digital record book. Each NFT is totally unique, like a one-of-a-kind trading card. You can't copy it, swap it for another identical one, or split it into smaller pieces. The blockchain keeps a record of who owns each NFT, and owners can sell or trade them. While NFTs were first seen as a new way to invest, by late 2023, many reports said that over 95% of NFTs had lost all their value.

Anyone can create an NFT, and you often don't need much coding skill. NFTs usually point to digital files like pictures, videos, or music. Because each NFT is unique, they are different from cryptocurrencies (like Bitcoin), which are all the same and can be swapped for each other.

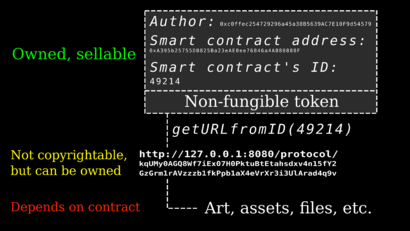

People who support NFTs say they offer a public certificate of authenticity or proof of ownership for digital things. However, the legal rules for NFTs can be unclear. Owning an NFT on the blockchain doesn't always mean you own the copyright or other intellectual property rights to the digital file it's linked to. An NFT also doesn't stop others from sharing or copying the digital file, or even from making new NFTs that link to the exact same file.

NFT trading grew a lot, from about US$82 million in 2020 to US$17 billion in 2021. People used NFTs for risky investments. They also faced criticism because some blockchains use a lot of energy, which creates a carbon footprint. There were also concerns about art scams. The NFT market has been compared to an economic bubble, where prices go up very fast then crash. The biggest NFT platforms were Ethereum, Solana, and Cardano. In 2022, the NFT market slowed down a lot, with sales dropping over 90% compared to 2021.

Contents

What Makes NFTs Special?

An NFT is a data file stored on a blockchain, which is a type of digital ledger. This file can be bought and sold. An NFT can be connected to a specific item, either digital or physical, such as an image, a piece of art, music, or a video of a sports event. It might give you certain rights to use that item for a specific purpose. NFTs, and any rights they come with, can be traded on digital marketplaces. However, because NFT trading is often outside traditional legal rules, owning an NFT often means little more than having a cool status symbol.

NFTs work like digital tokens. But unlike regular digital money (cryptocurrencies), NFTs are usually not interchangeable. This means they are "non-fungible." An NFT holds data links, which might point to where the linked art is stored. These links can sometimes stop working over time, a problem called link rot.

NFTs and Copyright

An NFT only proves you own a record on a blockchain. It doesn't automatically mean you own the intellectual property rights to the digital art or item the NFT is supposed to represent. Someone might sell an NFT of their artwork, but the buyer doesn't always get the copyright to that work. The seller might even be allowed to create and sell more NFTs of the same artwork. A legal expert, Rebecca Tushnet, explained that "the buyer gets whatever the art world thinks they got. They definitely don't own the copyright unless it's clearly given to them."

Some NFT projects, like Bored Apes, do give the intellectual property rights of individual images to their owners. The CryptoPunks NFT collection first stopped owners from using their digital art for business. But later, after the project was bought by another company, they allowed it.

How NFTs Started

Early NFT Projects

The very first known "NFT" was called Quantum. It was made by Kevin McCoy and Anil Dash in May 2014. It was a video clip made by McCoy's wife, Jennifer. McCoy recorded the video on the Namecoin blockchain and sold it to Dash for $4. This happened during a live talk in New York City. McCoy and Dash called their new technology "monetized graphics." This was the first time a unique, tradable blockchain marker was clearly linked to a piece of art using special data.

In October 2015, the first NFT project, Etheria, was shown at Ethereum's first developer conference in London. This was three months after the Ethereum blockchain started. Most of Etheria's 457 digital land tiles didn't sell for over five years. But on March 13, 2021, new interest in NFTs caused a buying rush. In just 24 hours, all the tiles from both the current and an older version were sold. Each tile was originally priced at 1 ETH (about US$0.43 at the time), and they sold for a total of US$1.4 million.

In 2016, a project called Rare Pepes appeared on Bitcoin. It was a "semi-fungible" NFT project based on the Pepe the Frog meme. Artists added their works to a special collection using a system called Counterparty.

In 2017, more NFT projects started on Ethereum. These used a "fungible" token standard called ERC-20. Curio Cards in May 2017 is thought to be Ethereum's first art NFT project using this standard. It featured art shaped like cards, including funny versions of company logos. The generative art project of 10,000 pixel characters called CryptoPunks came out soon after in June. It later became one of the most successful NFT projects. In December, a collection of clipart rocks called EtherRock also appeared.

In November 2017, the popular blockchain game on Ethereum, CryptoKitties, was launched. This game is known for creating the first real non-fungible token standard, called ERC-721. It used an early version of ERC-721, which was later formally published in 2018.

ERC-721: The NFT Standard

Even though experiments with unique digital items existed on blockchains since 2012, a community-driven paper called ERC-721: Non-Fungible Token Standard was published in 2018. This paper, led by civic hacker William Entriken, is seen as the start of modern NFTs. It officially defined "Non-Fungible Token" or "NFT" in the blockchain world. It set a standard for smart contracts called "ERC-721." Tokens made with this standard would have unique features and ownership details, making sure no two tokens were exactly alike. This led to new standards on Ethereum (like ERC-1155 for semi-fungible tokens) and other blockchains. This new standard allowed for many new uses, such as digital art, deeds to physical items, virtual land, access passes, and game items. The arrival of ERC-721 truly changed how digital items are verified, proven, and owned.

Where the Term "NFT" Came From

Before the blockchain game CryptoKitties' started using ERC-721, the term "NFT" wasn't commonly used for earlier projects. While the ERC-721 paper was being written, people discussed other words like deed, distinguishable asset, title, token, asset, equity, and ticket. Finally, William Entriken (using the name "Fulldecent") held a vote, and "NFT" was chosen by the people involved.

The term "NFT" and the ERC-721 standard became very well known because of how popular CryptoKitties was in 2017. Even though CryptoKitties used the standard, it became known as the first big NFT app. The game was so popular that it even slowed down Ethereum's processing power at the time.

NFTs' Impact

When CryptoKitties became a huge success and ERC-721 tokens appeared in 2017, an NFT marketplace called OpenSea started. It quickly became a major player in the NFT market. By 2021, during the NFT boom, OpenSea was worth $1.4 billion.

In 2021, ArtReview's Power 100 listed ERC-721 as the most powerful art entity in the world. They praised it for creating a new art market that was different from traditional art rules and brought in new types of collectors. Artist Beeple sold an ERC-721 NFT of his artwork Everydays: The First 5000 Days at Christie's for $69 million. This was the first time a traditional art auction house dealt with NFTs.

The NFT Market Over Time

The NFT market grew very quickly in 2020, tripling its value to US$250 million. In the first three months of 2021, over US$200 million was spent on NFTs. Interest in NFTs increased in early 2021 after some very expensive sales and art auctions.

In May 2022, The Wall Street Journal reported that the NFT market was "collapsing." Daily sales of NFTs had dropped 92% since September 2021. The number of active users in the NFT market also fell 88% from November 2021. The Journal said that NFTs were "among the most speculative" investments, meaning they were very risky.

In December 2022, a programmer named Casey Rodarmor found a new way to add NFTs to the Bitcoin blockchain, called "ordinals." By February 2023, ordinals became popular, which led to higher fees for Bitcoin payments and might have helped Bitcoin's price go up.

A report from September 2023 claimed that 95% of NFTs had lost all their value.

What Are NFTs Used For?

Common Digital Files with NFTs

NFTs are used to trade digital tokens that link to a digital file. Owning an NFT often means you get a license to use the linked digital item, but usually not the copyright. Some agreements only let you use the item for personal, non-business reasons. Other licenses might allow you to use the digital item for commercial purposes. This new way of handling digital rights is different from how copyright is usually protected by governments and companies.

Digital Art

Digital art is a very common use for NFTs. Big auctions of NFTs linked to digital art have gotten a lot of public attention. The first major auction happened at Christie's in 2021. The artwork called Merge by artist Pak was the most expensive NFT, selling for US$91.8 million. Everydays: the First 5000 Days by artist Mike Winkelmann (known as Beeple) was the second most expensive, selling for US$69.3 million in 2021.

Some NFT collections, like Bored Apes, EtherRocks, and CryptoPunks, are examples of generative art. This is where many different images are made by putting together simple picture parts in various ways.

In March 2021, a blockchain company bought a $95,000 original print from the English graffiti artist Banksy. They filmed someone burning it with a cigarette lighter. Then, they uploaded (or "minted") and sold the video as an NFT. The person who destroyed the art, who called themselves "Burnt Banksy," said it was a way to move a physical artwork into the NFT world.

American art historian Tina Rivers Ryan, who studies digital art, said that most art museums are not convinced that NFTs will have "lasting cultural importance." Ryan compared NFTs to the net art trend before the dot-com bubble burst. In July 2022, after a controversial sale of NFT copies of Michelangelo's Doni Tondo in Italy, selling NFT reproductions of famous artworks was banned there. Because the topic is complex and not well regulated, the Ministry of Culture in Italy temporarily asked its institutions not to sign contracts involving NFTs.

There is no central way to check if stolen or fake digital works are being sold as NFTs. However, auction houses like Sotheby's, Christie's, and various museums and galleries around the world have started working with digital artists like Refik Anadol, Dangiuz, and Sarah Zucker.

NFTs linked to digital artworks can be bought and sold on NFT platforms. OpenSea, started in 2017, was one of the first marketplaces for many types of NFTs. In July 2019, the National Basketball Association (NBA), the NBA Players Association, and Dapper Labs (the creators of CryptoKitties) started a project called NBA Top Shot. This allowed basketball fans to buy NFTs of famous basketball moments. In 2020, Rarible was founded, allowing multiple types of digital items. In 2021, Rarible and Adobe teamed up to make it easier to check and secure data for digital content, including NFTs. In 2021, the cryptocurrency exchange Binance launched its NFT marketplace. In 2022, eToro Art by eToro started, focusing on supporting NFT collections and new artists.

Sotheby's and Christie's auction houses show artworks linked to NFTs in both virtual galleries and on physical screens.

Mars House, a digital architectural NFT created in May 2020 by artist Krista Kim, sold in 2021 for 288 Ether (ETH). At that time, this was worth about US$524,558.

Games

NFTs can represent items inside video games. Some people say that these items are controlled "by the user" instead of the game developer if they can be traded on other marketplaces without the game developer's permission. Game developers have had mixed feelings about NFTs. Some, like Ubisoft, have used the technology, but others, like Valve and Microsoft, have officially banned them.

- CryptoKitties was an early successful online blockchain game. Players could adopt and trade virtual cats. The game made money from NFTs and raised a $12.5 million investment. Some virtual cats sold for over $100,000 each. Because it was so successful, CryptoKitties helped create the ERC-721 standard, which was finalized in 2018.

- In October 2021, Valve Corporation banned games from their Steam platform if those games used blockchain technology or NFTs to trade value or game items.

- In December 2021, Ubisoft announced Ubisoft Quartz, an "NFT initiative" that let people buy rare digital items using cryptocurrency. Many people criticized this announcement. The Quartz announcement video got a lot of "dislikes" on YouTube, and Ubisoft later made it private. Ubisoft developers also criticized the idea internally. A 2022 report from the Game Developers Conference found that 70% of developers said their studios were not interested in adding NFTs or cryptocurrency to their games.

- Some fancy brands made NFTs for online video game items. In November 2021, an investment company said this could become a US$56 billion market by 2030.

- In July 2022, Mojang Studios announced that NFTs would not be allowed in Minecraft. They said NFTs went against the game's "values of creative inclusion and playing together."

Music and Film

NFTs have been suggested for use in the film industry. For example, movie scenes could be turned into NFTs and sold as collectibles. Artists in the entertainment industry could also get royalties (a share of future sales) through NFTs. NFTs have already been used in both the music and film industries.

- In May 2018, 20th Century Fox worked with Atom Tickets to release special Deadpool 2 digital posters to promote the movie. They were available on OpenSea.

- In March 2021, Adam Benzine's 2015 documentary Claude Lanzmann: Spectres of the Shoah became the first movie and documentary film to be sold as an NFT.

- Other examples of NFTs in film include a collection of NFT artworks for Godzilla vs. Kong. Also, the horror movie KillRoy Was Here by Kevin Smith and the 2021 film Zero Contact were released as NFTs in 2021.

- In April 2021, an NFT was released for the music score of the movie Triumph, composed by Gregg Leonard.

- In November 2021, film director Quentin Tarantino released seven NFTs based on uncut scenes from Pulp Fiction. Miramax later sued him, saying that their film rights were broken. They claimed their original 1993 contract with Tarantino gave them the right to make NFTs related to Pulp Fiction.

- In August 2022, the band Muse released their album Will of the People as 1,000 NFTs. It was the first album where NFT sales counted for the UK and Australian music charts.

By February 2021, NFTs had brought in US$25 million from selling artwork and songs. On February 28, 2021, electronic dance musician 3lau sold 33 NFTs for a total of US$11.7 million to celebrate his Ultraviolet album's three-year anniversary. On March 3, 2021, an NFT was made to promote the Kings of Leon album When You See Yourself. Other musicians who have used NFTs include rapper Lil Pump, Grimes, visual artist Shepard Fairey with record producer Mike Dean, and rapper Eminem.

A paper presented at a conference in Munich in 2019 suggested using NFTs as tickets for different events. This would allow event organizers or artists to get a share of the money each time a ticket was resold.

Other Uses for NFTs

- Many internet memes have been turned into NFTs and sold by their creators or the people in them. Examples include Doge (a picture of a Shiba Inu dog), as well as Charlie Bit My Finger, Nyan Cat, and Disaster Girl.

- Some virtual worlds, often called metaverses, have used NFTs to trade virtual items and virtual land.

- The first political protest NFT was a video filmed by Professor Stanislovas Tomas on April 8, 2019. It was turned into an NFT on March 29, 2021. In the video, Tomas uses a sledgehammer to destroy a government-sponsored plaque in Lithuania that honored a Nazi war criminal.

- In 2020, CryptoKitties developer Dapper Labs released the NBA TopShot project. This allowed people to buy NFTs linked to basketball highlights. The project was built on the Flow blockchain.

- In March 2021, an NFT of Twitter founder Jack Dorsey's first-ever tweet sold for $2.9 million. The same NFT was put up for sale in 2022 for $48 million, but the highest bid it got was only $280.

- On December 15, 2022, Donald Trump, a former president of the United States, announced a line of NFTs featuring pictures of himself for $99 each. Reports said he made between $100,001 and $1 million from this.

NFTs and Speculation

NFTs that represent digital collectibles and artworks are often seen as a risky investment. Experts have called the sudden rise in NFT buying an economic bubble, comparing it to the Dot-com bubble where internet company stocks soared then crashed. In March 2021, Mike Winkelmann (Beeple) called NFTs an "irrational exuberance bubble." By mid-April 2021, demand dropped, causing prices to fall a lot. A financial expert, William J. Bernstein, compared the NFT market to the 17th-century tulip mania, where tulip bulb prices became extremely high then crashed. He said any speculative bubble needs a new technology to get people excited, and part of that excitement comes from extreme predictions about the product. For governments, NFTs have made challenges like speculation, fraud, and big price changes even harder to deal with.

NFTs and Unclear Money Sources

NFTs, like other blockchain assets and traditional art sales, can potentially be used to hide where money comes from. This is sometimes called "money laundering." NFTs can be used for wash trading. This is when someone creates several digital wallets for themselves and makes many fake sales. They then sell the NFT to a third party. A report by Chainalysis said these types of fake trades are becoming popular because transactions on NFT marketplaces are often anonymous. Looksrare, an NFT marketplace created in early 2022, became known for the huge amounts of money made from NFT sales in its early days, reaching US$400,000,000 a day. Much of this was from wash trading. The Royal United Services Institute said that risks related to hiding money through NFTs could be reduced by using "KYC best practices" (rules to know who your customers are), strong online security, and a stolen art registry.

Auction platforms for NFTs might face pressure from governments to follow rules against hiding money. Gou Wenjun, a director from the People's Bank of China, said that NFTs could "easily become tools to hide money." He pointed out that people doing illegal things often pretend to be innovators in new financial technology.

A 2022 study from the United States Treasury found "some evidence of risk in the high-value art market" for hiding money, including through "the emerging digital art market, such as the use of non-fungible tokens (NFTs)." The study looked at how NFT transactions might be an easier way to hide money through art, as they avoid the problems of moving or insuring physical art. Several NFT exchanges were called virtual asset service providers, which might need to follow Financial Crimes Enforcement Network rules. In March 2022, two people were charged for a million-dollar NFT scheme using wire fraud.

The European Commission announced in July 2022 that it plans to create rules to fight unclear money sources by 2024.

Other Uses for NFTs

- In 2019, Nike patented a system called CryptoKicks. It would use NFTs to check if its physical products were real. It would also give a virtual version of the shoe to the customer.

- Some NFT releases have also offered special access, like entry to private online clubs.

NFT Standards on Blockchains

Many blockchains have started to support NFTs since Ethereum created its ERC-721 standard.

ERC-721 is a "inheritable" smart contract standard. This means that developers can create new contracts by copying from a main example. ERC-721 provides basic ways to track who owns a unique digital item and how the owner can transfer it to others. Another standard, ERC-1155, offers "semi-fungibility." This means a token can represent a group of items that are interchangeable within that group.

Problems and Criticisms of NFTs

Content Ownership Issues

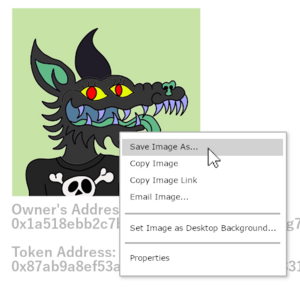

Because NFT content is usually public, anyone can easily copy a file that an NFT points to. Also, owning an NFT on the blockchain doesn't automatically give you legal intellectual property rights to the file.

It's well known that you can copy or save an NFT image from a web browser by using a right-click menu to download the picture. People who support NFTs sometimes make fun of this by calling it a "right-clicker mentality." One collector told Vice that the value of a purchased NFT (compared to a copied version) is like a status symbol "to show off that they can afford to pay that much."

The phrase "right-clicker mentality" became very popular, especially among those who criticized the NFT market. They used the term to show how easy it was to copy digital art linked to NFTs. This criticism was pushed by Australian programmer Geoffrey Huntley. He created "The NFT Bay," which looked like The Pirate Bay. The NFT Bay advertised a torrent file that claimed to contain 19 terabytes of digital art NFT images. Huntley compared his work to an art project and hoped the site would help people understand what NFTs are and are not.

Environmental Concerns

Buying and selling NFTs has been linked to high energy use and greenhouse gas emissions. This is because some blockchains use a lot of electricity. While all Ethereum transactions used energy, the exact impact depended on the transaction size. The proof-of-work system, which was used to check and confirm blockchain transactions (including on Ethereum until 2022), uses a lot of electricity. To guess the carbon footprint of an NFT transaction, you need to make many guesses about how the transaction is set up, how blockchain miners behave (and how much energy their equipment uses), and how much renewable energy is used on these networks.

In 2022, Ethereum cut its energy use by 99.99% by switching to a new system called proof of stake. Other ways to reduce electricity include using "off-chain" transactions when creating an NFT. Some NFT markets have offered the option to buy carbon offsets when you buy an NFT, but people have questioned if this really helps the environment. In some cases, NFT artists have decided not to sell some of their work to help reduce carbon emissions.

Artist and Buyer Fees

Sales platforms charge artists and buyers fees for creating, listing, claiming, and reselling NFTs. An analysis of NFT markets in March 2021 found that most NFT artworks sold for less than US$200, with a third selling for less than US$100. Those selling NFTs below $100 were paying platform fees between 72.5% and 157.5% of that amount. On average, the fees made up 100.5% of the price. This means artists were often paying more in fees than they made from sales.

Plagiarism and Fraud

There have been cases where artists and creators had their work sold as NFTs by others without their permission. After the artist Qing Han died in 2020, someone pretended to be her and sold many of her works as NFTs. Similarly, a seller pretending to be Banksy managed to sell an NFT supposedly made by the artist for $336,000 in 2021. The seller gave the money back after the media reported on the case. In 2022, it was found that an NFT company that voice actor Troy Baker partnered with had copied voice lines from 15.ai, a free AI text-to-speech project, for their NFT marketing.

The anonymity of NFTs and how easy they are to fake make it hard to take legal action against people who copy others' work.

In February 2023, artist Mason Rothschild was ordered to pay $133,000 to Hermès by a New York court. A jury decided that Rothschild's 2021 digital pictures of the brand's Birkin handbag violated Hermès' copyright.

Some NFT marketplaces have responded to copying cases by creating "takedown teams" to handle artist complaints. The NFT marketplace OpenSea has rules against copying and deepfakes (private images shared without permission). Some artists criticized OpenSea's efforts, saying they are slow to respond to takedown requests and that artists are targeted by scams from users pretending to be from the platform. Others argue that NFT marketplaces don't have a reason to stop copying.

- A process called "sleepminting" allows a scammer to create an NFT in an artist's digital wallet and then move it back to their own account without the artist knowing. This allowed a white hat hacker to create a fake NFT that seemed to come from the wallet of artist Beeple.

- Concerns about copying led the art website DeviantArt to create a computer program. It compares user art on DeviantArt with art on popular NFT marketplaces. If the program finds similar art, it tells the artist how to contact NFT marketplaces to ask them to remove their copied work.

- The BBC reported a case of insider trading. An employee of the NFT marketplace OpenSea bought specific NFTs before they were launched, knowing that those NFTs would be promoted on the company's main page. NFT trading is not regulated, so there are no legal ways to deal with such problems.

- When Adobe announced they were adding NFT support to their graphics editor Photoshop, the company suggested creating an InterPlanetary File System database. This would be another way to prove that digital works are real.

- The price paid for certain NFTs and the number of sales by an NFT creator can be artificially inflated by wash trading. This is common because there are no government rules for NFTs.

Security Concerns

In January 2022, it was reported that some NFTs were being used by sellers to secretly collect users' IP addresses. This "exploit" works because NFTs often link to content that is not on the blockchain. When your computer tries to show the content, it automatically goes to the web address in the NFT. The server at that address can then record your IP address. In some cases, it can even change the content it sends back. OpenSea had a specific weakness to this because it allowed HTML files to be linked.

Risks of NFT Investments

Critics compare the structure of the NFT market to a system where early buyers might profit at the expense of those who buy later. In June 2022, Bill Gates stated his belief that NFTs are "100% based on greater fool theory" – meaning people buy them hoping someone else will pay even more, not because of their true value.

See also

- Decentralized autonomous organization

- Web3

- William Entriken (Lead author of ERC-721)

- Deed

- Certificate of Authenticity

- Title (Property)

Images for kids