Impositions facts for kids

The English kings and queens traditionally had the power to add special taxes on goods brought into the country. These taxes were called impositions. They helped control trade and protect businesses in England.

Contents

What Were Impositions?

Impositions were like special fees or taxes. They were added to goods that came into England from other countries. The money from these taxes went straight to the King or Queen. This was a way for the ruler to earn money and control trade.

Kings, Queens, and New Taxes

Queen Elizabeth I started adding new impositions in 1601. She taxed things like currants (dried grapes) and tobacco. Later, in 1608, King James I decided to tax almost all imported goods. This happened after a special court case.

Elizabeth I and James I's New Taxes

In 1601, Queen Elizabeth I put new taxes on currants and tobacco. These were goods coming into England. King James I, who ruled after her, expanded these taxes. By 1608, he was taxing many more imported items.

The Case of John Bates

A famous court case helped King James I expand these taxes. It was called Bates' Case in 1606. This case was about a merchant named John Bates.

Why John Bates Refused to Pay

John Bates was a merchant from a trading group called the Levant Company. He brought currants into England. But he refused to pay the new tax on them. He believed the King did not have the right to create new taxes without Parliament's approval.

The Court's Decision

John Bates' case went to a special court. This court was called the Court of the Exchequer. It handled money matters for the government. John Bates lost his case. The court decided that the King *did* have the power to set these taxes. This ruling gave the King a lot of extra money.

Parliament's Protests Begin

The Parliament was not happy about these new taxes. They felt the King was taking too much power. In 1610, Parliament protested strongly. Because of their anger, the tax rules were changed. The new rules made sure that foreign merchants paid most of the tax.

The Great Contract: A Failed Deal

King James I later thought about giving up his power to impose these taxes. This was part of a big plan called the Great Contract in 1610.

What Was the Great Contract?

The Great Contract was a deal proposed by Robert Cecil. He was a top financial advisor to the King. The King would give up some of his special powers, like setting impositions. In return, Parliament would pay off the King's debts. They would also give him a large yearly payment. This would greatly increase the King's regular income.

Why the Deal Fell Apart

However, the negotiations for the Great Contract failed. Both the King and Parliament kept changing what they wanted. They could not agree on the terms. So, the deal fell apart. The King kept his power to impose taxes for a while longer.

How Impositions Ended

The King's power to create any kind of tax without Parliament's permission finally ended. This happened during a major event called the Glorious Revolution. In 1689, a very important law was passed. It was called the Bill of Rights 1689. This law officially took away the King's power to impose taxes without Parliament's approval.

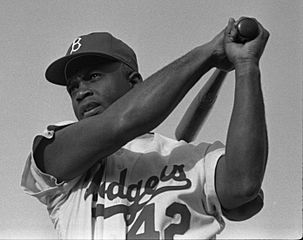

| Jackie Robinson |

| Jack Johnson |

| Althea Gibson |

| Arthur Ashe |

| Muhammad Ali |