Kerr-McGee Corp. v. Navajo Tribe facts for kids

Quick facts for kids Kerr-McGee v. Navajo Tribe |

|

|---|---|

|

|

| Argued February 25, 1985 Decided April 16, 1985 |

|

| Full case name | Kerr-McGee Corp. v. Navajo Tribe of Indians |

| Citations | 471 U.S. 195 (more)

105 S. Ct. 1900; 85 L. Ed. 2d 200; 1985 U.S. LEXIS 2738

|

| Prior history | 731 F.2d 597 (9th Cir. 1984); cert. granted, 469 U.S. 879 (1984). |

| Holding | |

| An Indian tribe is not required to obtain the approval of the Secretary of the Interior in order to impose taxes on non-tribal persons or entities doing business on a reservation | |

| Court membership | |

| Case opinions | |

| Majority | Burger, joined by Brennan, White, Marshall, Blackmun, Rehnquist, Stevens, O'Connor |

| Powell took no part in the consideration or decision of the case. | |

| Laws applied | |

| 25 U.S.C. § 461 | |

Kerr-McGee v. Navajo Tribe was an important case decided by the Supreme Court of the United States in 1985. The Supreme Court is the highest court in the U.S. This case was about whether a Native American tribe needed permission from the U.S. government to collect taxes from businesses on their land. The Court decided that tribes do not need this approval to tax companies that operate on their reservations.

Contents

What Led to the Case?

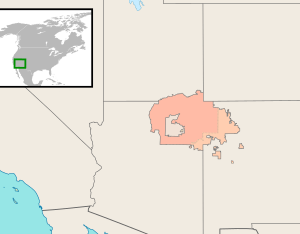

The Navajo Nation is a large Native American tribe. Their land, called a reservation, covers parts of Arizona, Utah, and New Mexico. In 1978, the Navajo tribal council created two new laws. These laws were about collecting taxes.

- One tax was 3% on leases, like those for mineral rights. Mineral rights allow companies to dig for resources like oil or gas.

- The second tax was 5% on business activities happening on the reservation.

The Navajo Tribe sent these new tax laws to the Bureau of Indian Affairs (BIA). The BIA is part of the U.S. government's Department of the Interior. The BIA told the tribe that no federal law required them to get approval for tribal taxes.

The Court Battle Begins

Kerr-McGee was a company that had many mineral rights on the Navajo reservation. They did not want to pay the new taxes. So, Kerr-McGee filed a lawsuit in a federal court. They asked the court to stop the Navajo Tribe from collecting the taxes.

Kerr-McGee argued that any tax a tribe put on non-Native American businesses needed approval. They believed this approval had to come from the Secretary of the Interior. The first court agreed with Kerr-McGee and stopped the tribe from collecting the taxes.

Appeals and the Supreme Court

The Navajo Tribe did not give up. They appealed the decision to a higher court, the Ninth Circuit Court of Appeals. This court disagreed with the first one. It found no federal law that said tribal taxes needed government approval.

After this, Kerr-McGee asked the Supreme Court to hear the case. The Supreme Court agreed to review the decision.

The Supreme Court's Decision

Who Argued the Case?

Lawyers from both sides presented their arguments to the Supreme Court. Alvin H. Shrago argued for Kerr-McGee. Elizabeth Bernstein argued for the Navajo Tribe. The United States government also supported the Navajo Tribe in this case.

Other groups, called amicus curiae (friends of the court), also sent in written arguments. Some supported Kerr-McGee, like Arizona Public Service Co. and Texaco, Inc.. Others supported the Navajo Tribe, such as the Association on American Indian Affairs.

Kerr-McGee argued that two specific laws required approval for tribal taxes. They said the Indian Reorganization Act (IRA) and the Indian Mineral Leasing Act (IMLA) meant the Secretary of the Interior had to approve these taxes.

The Court's Opinion

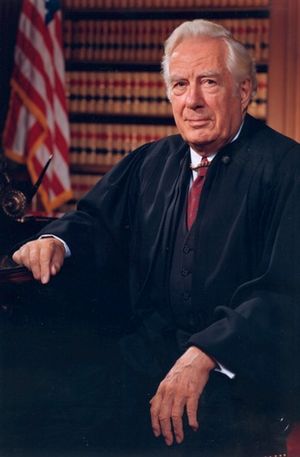

Chief Justice Burger wrote the decision for the Supreme Court. All the judges agreed with his opinion. He explained that the IRA only required approval for tribal constitutions, not for their power to tax. He also pointed out that the Navajo Tribe had chosen not to accept parts of the IRA.

Chief Justice Burger also noted that tribes had the right to tax long before the IRA was created. He said the IMLA also did not require approval for taxes. It only required the Secretary to make rules about oil and gas leases. These rules did not say anything about needing approval for tribal taxes.

Burger emphasized that the U.S. government's goal was to help tribes govern themselves. The power to tax is a very important part of any government. When a tribe signs a mineral lease, they are acting like a business. But this does not stop them from using their tribal sovereignty to create taxes. Since no federal law stopped the Navajo Tribe from taxing, they had the right to do so. The Supreme Court upheld the decision of the Ninth Circuit Court.

What Happened Next?

The Kerr-McGee case was one of several times the Supreme Court said tribes could tax non-Native Americans. These decisions helped tribes gain more control over their own lands and resources. Tribes were able to renegotiate old mineral leases. They also formed their own agencies to manage natural resources.

For the Navajo Tribe, this decision was very important. They had a long history of uranium mining on their land. This mining caused radioactive contamination for their people and water. The Kerr-McGee decision helped the tribe ban uranium mining completely. It also supported their right to control their natural resources. This included having civil authority over non-Native Americans on their land.

To celebrate this important decision, the Navajo tribal council made the date of the decision a tribal holiday. They called it "Navajo National Sovereignty Day."

| William M. Jackson |

| Juan E. Gilbert |

| Neil deGrasse Tyson |