Pinnacle West Capital facts for kids

| Public company | |

| Traded as | |

| ISIN | ISIN: [https://isin.toolforge.org/?language=en&isin=US7234841010 US7234841010] |

| Industry | Electric utilities |

| Founded | 1985 |

| Headquarters | Phoenix, Arizona, U.S. |

|

Key people

|

Jeffrey B. Guldner (Chairman & CEO) |

| Revenue | |

|

Operating income

|

|

|

Number of employees

|

6,292 (2017) |

Pinnacle West Capital Corporation is a company in the United States. It owns Arizona Public Service (APS), which is a big electric company. Its shares are traded on the New York Stock Exchange. It's also part of the S&P 500, which is a list of 500 large companies. APS is the biggest electric company in Arizona. It is overseen by the Arizona Corporation Commission (ACC).

Contents

How the Company Started

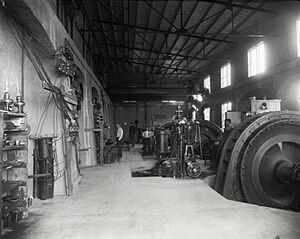

The company's story began in 1884. That's when the Phoenix Light and Fuel Company was created. It brought electricity and heat to the town of Phoenix. In 1901, it built two power stations that used water to make electricity.

The company changed its name to Pacific Gas and Electric Company in 1906. Then, in 1920, it became Central Arizona Light and Power. The Childs-Irving Hydroelectric Facilities started making power in 1909. This helped local mining businesses. The company paid out money to its shareholders every year from 1920 to 1989.

In 1925, the company joined a larger group called American Power and Light. But it became an independent company again in 1945. In 1949, it joined with Northern Arizona Power and Light. Then, in 1952, it merged with Arizona Edison. At that time, it changed its name to Arizona Public Service (APS).

Growth and Changes

In the 1970s, the company's stock price grew a lot. It also paid a good amount of money to its shareholders. By then, most of its power came from coal plants. Some also came from natural gas and oil. APS shares were traded on the New York Stock Exchange.

APS also did well during the early 1980s. But by 1983, the company had a lot of debt. In 1985, Arizona Public Service Company changed how it was set up. It became a larger company called AZP Group Inc. APS was its main part.

In 1987, AZP Group changed its name again to Pinnacle West Capital Corporation. It started trading under the new name PNW. The electric company continued to be its main business. Pinnacle West bought a bank called MeraBank in 1986. It became the largest bank of its kind in Arizona. However, the bank was taken over by the government in 1990. This was partly because real estate prices in Arizona went down.

Challenges and Recovery

By 1990, the company faced difficulties. Its earnings dropped a lot. It also tried to start other types of businesses, but they didn't work out. By 1991, the company was losing money. It stopped paying money to its shareholders. This was the first time since 1920 that it didn't pay them. The stock price dropped very low. The company's debt also grew.

However, by 1992, the company started making money again. Its earnings went up. The stock price grew a lot by the end of 1993. The company also started paying money to its shareholders again that year.

Pinnacle West faced some disagreements about how it ran its Palo Verde power plant. It also had issues with employees who reported problems. The company was told to pay money to some employees.

By 1995, Pinnacle West Capital was added to the S&P MidCap 400 index. This means it was recognized as a growing company. That year, its earnings were good again. The company also opened the first solar power plant in Arizona in 1997.

After a big business scandal involving a company called Enron, Pinnacle West lost some money. This was in the early 2000s. Before 2010, Pinnacle West also built real estate through a part of its company called Suncor.

Power Outage in 2011

On September 8, 2011, there was a very large power outage. It affected areas from Yuma, Arizona, to San Diego, California. Parts of Northern Mexico also lost power. This outage happened because of many events on five power grids. These events happened very quickly. One of the events was at the APS North Gila Substation.

Officials looked into what happened and why the power went out so widely. Most of the areas affected were served by San Diego Gas & Electric. Their entire service area lost power. It seemed that the outage was caused by an APS employee at the North Gila substation. It was not clear why safety systems did not stop the outage from spreading.

The outage happened just before the tenth anniversary of the September 11 attacks. The government had warned about possible attacks. But the Federal Bureau of Investigation and SDG&E quickly said it was not terrorism. In 2014, APS agreed to pay $3.25 million to settle issues related to the 2011 blackout.

Policy Change in 2018

On September 7, 2018, APS turned off the power for a 72-year-old person. This was because of an unpaid electric bill of $51. On that same day, the temperature in Phoenix was very hot. Within a week, the person died from heat. This event was reported widely in the news. It led to protests about APS's policy of turning off power. Because of this, Arizona regulators banned power shutoffs on hot summer days.

Where APS Provides Service

APS provides electricity to about two-thirds of the Phoenix area. It mainly serves downtown and northern Phoenix. It also covers a large area north and west of the city. Downtown areas of Chandler, Gilbert, Glendale, Peoria, Scottsdale, and Tempe are also served. Outside of the Phoenix area, APS serves Flagstaff, Prescott, Yuma, and Douglas.

Power Plants

Pinnacle West owns and runs several power plants through its company, Arizona Public Service. Most of the power Pinnacle West provides, and most of the power for Arizona, comes from these plants.

Coal Power Plants

Pinnacle West owns three coal plants: Cholla Power Plant, Four Corners Generating Station, and Navajo Generating Station. The coal mainly comes from land leased from the Navajo Nation. The Navajo generating plant stopped working in 2019. The land was cleaned up and given back to the Navajo Nation in March 2024. Cholla stopped working in March 2025. Since 2023, Four Corners has been working at half power during certain times of the year. It works at full power in the summer when more energy is needed in Arizona. This has helped Arizona use less coal power.

Nuclear Power Plants

Pinnacle West runs and partly owns the Palo Verde Nuclear Generating Station. This plant stores its used fuel safely. It has enough storage until 2047.

Natural Gas Power Plants

Pinnacle West owns and runs six power plants that use natural gas or oil. In 2019, it updated one of its gas plants called Ocotillo. This made it able to produce much more power.

Solar Power Systems

Pinnacle West owns and runs two large solar power systems. It also has thirty smaller solar places. One large system, AZ Sun, received a lot of investment from Pinnacle West. It can provide a lot of power. Another solar plant, Red Rock, also produces power. Smaller solar systems are being added to buildings owned by Pinnacle West, government buildings, and homes.

Pinnacle West spent money to influence elections for the ACC in 2012. This was part of an effort to change rules about solar power. In 2017, this led to a complete stop of a program that paid people for extra solar energy they produced.

Future Energy Plans

Pinnacle West plans to build many new energy storage systems. This would be almost all of Arizona's energy storage. Pinnacle West also plans to increase how much renewable energy it produces. It aims to make 50% more renewable energy than it did in 2023 by the year 2025.

See also

- Path 46

- Palo Verde Nuclear Generating Station

- Four Corners Generating Station