Kevin Brady facts for kids

Quick facts for kids

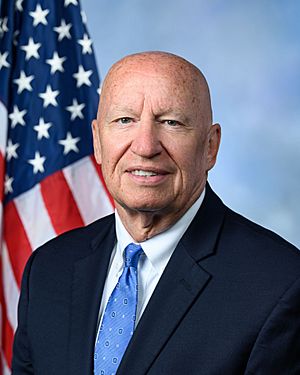

Kevin Brady

|

|

|---|---|

|

|

| Ranking Member of the House Ways and Means Committee | |

| In office January 3, 2019 – January 3, 2023 |

|

| Preceded by | Richard Neal |

| Succeeded by | Richard Neal |

| Chair of the House Ways and Means Committee | |

| In office November 5, 2015 – January 3, 2019 |

|

| Preceded by | Paul Ryan Sam Johnson (Acting) |

| Succeeded by | Richard Neal |

| Member of the U.S. House of Representatives from Texas's 8th district |

|

| In office January 3, 1997 – January 3, 2023 |

|

| Preceded by | Jack Fields |

| Succeeded by | Morgan Luttrell |

| Member of the Texas House of Representatives from the 15th district |

|

| In office January 10, 1991 – January 3, 1997 |

|

| Preceded by | Mike McKinney |

| Succeeded by | Tommy Williams |

| Personal details | |

| Born |

Kevin Patrick Brady

April 11, 1955 Vermillion, South Dakota, U.S. |

| Political party | Republican |

| Spouse |

Cathy Patronella

(m. 1991) |

| Children | 2 |

| Education | University of South Dakota (BA) |

Kevin Patrick Brady (born April 11, 1955) is an American politician. He served as a U.S. representative for the 8th district of Texas from 1997 to 2023. He is a member of the Republican Party. His district included northern Houston, especially The Woodlands. He retired from Congress after the elections in 2022.

Contents

Early Life and Education

Kevin Brady was born in Vermillion, South Dakota. He was one of five children. His father passed away when Kevin was 12 years old. Kevin graduated from Central High School in 1973. He earned a degree in mass communications from the University of South Dakota.

After college, Brady worked for the Chamber of Commerce in Rapid City. He was elected to the Rapid City common council when he was 26. In 1982, he moved to Texas. He worked for the Chamber of Commerce in Beaumont, Texas. Later, in 1985, he started working for the South Montgomery County Woodlands Chamber of Commerce.

Serving in the Texas House

In 1990, Kevin Brady was elected to the Texas House of Representatives. He represented District 15, which included The Woodlands and parts of Montgomery County. He began his term as a state representative on January 10, 1991. He served in this role until 1997.

Representing Texas in the U.S. House

Kevin Brady served in the United States House of Representatives for 26 years. He represented Texas's 8th congressional district.

How He Was Elected

In 1996, the current U.S. Representative for the 8th district, Jack Fields, decided to retire. Kevin Brady ran for this open seat. He won the election and became the new representative.

From 1998 to 2008, Brady was reelected many times. He always won with a large number of votes. In 2010, he faced challengers in the Republican primary but won with 79% of the vote. He was then reelected in the general election. He continued to win his elections in 2012, 2014, 2016, 2018, and 2020. The 2020 election was his last time running for Congress.

Key Actions in Congress

- In 2002, Brady voted to allow the U.S. to use military force in Iraq.

- He supported trade agreements, like the one with Central American countries in 2005. He also supported agreements with South Korea, Colombia, and Panama in 2011.

- Brady proposed a "sunset law" for federal programs. This law would require government programs to prove they are still needed every 12 years or be stopped.

- In 2012, he suggested the Sound Dollar Act. This bill would have changed how the Federal Reserve works. It would have focused the Federal Reserve on keeping the U.S. dollar stable.

- From 2015 to 2019, Brady was the chairman of the House Committee on Ways and Means. This committee handles tax laws and other important financial matters.

- In 2017, he supported the Tax Cuts and Jobs Act of 2017. He said it would help people at all income levels.

- In 2019, Brady worked with another representative to create the SECURE Act of 2019. This law helps people save for retirement.

- In 2020, he supported giving more money to small businesses during the COVID-19 pandemic. He helped create the Coronavirus Aid, Relief, and Economic Security Act.

- In April 2021, Brady announced he would not run for reelection. He retired from Congress in 2022.

Committee Roles

During his time in Congress, Kevin Brady was part of several important committees:

- Committee on Ways and Means

- He also chaired the Joint Economic Committee and the Joint Committee on Taxation.

Groups He Joined

Brady was a member of various groups in Congress, including:

- Army Caucus

- Congressional Missing and Exploited Children Caucus

- Congressional Rural Caucus

- United States Congressional International Conservation Caucus

- Sportsmen's Caucus

- Congressional Constitution Caucus

- Congressional Western Caucus

- Republican Study Committee

Political Views

Taxes and Economy

Brady believed that the tax cuts and other policies from the first Trump administration helped the U.S. economy before the COVID-19 pandemic.

Healthcare

He strongly opposed Medicare for All, a plan for a government-run healthcare system for everyone.

Energy

In 2012, Brady voted for a law that changed some policies about coal mining. In 2021, he was concerned that new government rules on drilling for oil and gas could cause many job losses in Texas.

LGBT Rights

Brady's voting record showed he did not support some LGBT rights legislation. For example, he voted against the Equality Act in 2021.

Personal Life

Kevin Brady lives in The Woodlands with his wife, Cathy, and their two sons.

| Bayard Rustin |

| Jeannette Carter |

| Jeremiah A. Brown |