Neoclassical synthesis facts for kids

The neoclassical synthesis was a big idea in economics that tried to bring together two different ways of thinking about how economies work. It combined ideas from neoclassical economics with the theories of John Maynard Keynes. This approach became the main way economists thought about the economy from the 1950s to the 1970s.

Key thinkers like John Hicks, Franco Modigliani, and Paul Samuelson helped create this synthesis. They wanted to explain how things like jobs, prices, and money work together.

However, in the 1970s, new problems like "stagflation" (when prices rise fast but jobs are hard to find) made economists question the neoclassical synthesis. This led to new ideas, which eventually formed a "new neoclassical synthesis" that is used today.

Contents

How the Neoclassical Synthesis Began

After World War II, many countries wanted to make sure everyone had jobs and the economy grew steadily. During the Great Depression, Keynes's ideas about government spending to boost the economy became very popular.

But other economists, called neoclassical economists, worried that too much government involvement could cause prices to rise too much. They believed that markets would naturally fix themselves over time.

So, in the 1950s and 1960s, economists like Paul Samuelson and Robert Solow worked to combine these views. The neoclassical synthesis said that in the long run, markets work best on their own. But in the short run, government actions could help the economy grow and create jobs. It also stressed the importance of controlling the money supply to keep prices stable.

This idea helped bring together different economic thoughts. It created a more complete way to understand how the economy functions.

Short-Run vs. Long-Run Views

One main idea of the neoclassical synthesis was to see Keynesian theory as explaining what happens in the short run. In the short run, things like wages and prices don't change instantly. This can lead to problems like not enough demand for goods.

On the other hand, traditional economic theory, based on ideas from Adam Smith, was seen as explaining the long run. In the long run, wages and prices are flexible. Markets can adjust to reach a balance.

So, the synthesis suggested that both ideas were true, but for different time periods. This helped economists connect how small parts of the economy (microeconomics) fit with the big picture (macroeconomics).

Important Economic Tools

Economists made big progress between 1940 and 1970. This time is sometimes called the "golden age" of macroeconomics. They developed important tools to understand the economy.

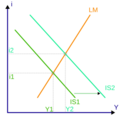

The IS–LM model, created by John Hicks in 1937, was a key tool. It helped show how the market for goods and services (IS curve) and the market for money (LM curve) interact. Where these two lines cross, you find the economy's output and interest rates.

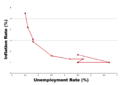

Another important discovery was the Phillips curve by William Phillips in 1958. This showed a link between how fast wages grew and how many people were unemployed. It suggested that lower unemployment might lead to higher prices.

These tools, the IS-LM model and the Phillips curve, helped economists understand important economic factors. These included output, jobs, interest rates, and inflation.

Economists also studied how people spend money (consumption), how businesses invest, and why people hold money. They wanted to put numbers on these ideas to make predictions and plan economic policies.

Understanding Spending and Saving

Milton Friedman and Franco Modigliani made big advances in understanding how people spend and save.

Friedman's idea was that people plan their spending based on their "permanent income." This is not just what they earn now, but what they expect to earn over their whole life.

Modigliani's "life cycle hypothesis" looked at how income changes over a person's life. Young people might borrow, expecting higher wages later. Older people might spend their savings. Both ideas showed that people try to keep their spending steady over time.

Why People Hold Money

James Tobin and William Baumol looked at why people hold money instead of investing it. They saw money as a tool for daily buying and selling.

They explained that people "trade off" the interest they could earn from investments against the costs of getting cash when they need it. This helped explain how much money people want to keep on hand.

Main Economists Who Contributed

Many leading economists helped build the neoclassical synthesis. John Maynard Keynes laid the groundwork with his ideas. Then, the first group of "neo-Keynesians" worked to combine his ideas with older "classical" economic theories.

Paul Samuelson is often credited with coining the term "neoclassical synthesis." He wrote a very influential textbook called Economics. He believed that while markets might not always provide full employment on their own, government policies could help. Once the economy was stable, classical ideas about prices and resources would apply.

Other important contributors included John Hicks, Franco Modigliani, James Tobin, and Lawrence Klein. Their work helped create the models and ideas that defined this period of economics.

Key Ideas of the Neoclassical Synthesis

Here are some of the main beliefs of the neoclassical synthesis:

- People and businesses are mostly rational: They make decisions based on what makes sense for them.

- "Animal spirits" matter: People's feelings and confidence can affect how much businesses invest.

- Prices and wages don't change quickly: This means markets might not always be perfectly balanced.

- Government can help: Policies related to money and taxes can help the economy reach full employment.

- Active government role: The government should step in to fix market problems and help society.

- Balancing policies: Governments need to find the right mix of money and tax policies.

- Studying real-world impact: It was important to study how different economic policies actually worked.

- Using math: Math became a very important tool for analyzing economic ideas.

How the Synthesis Developed

The neoclassical synthesis grew from combining Keynes's ideas with older economic theories. Many models from this time were called "pragmatic macroeconomics" because they focused on practical solutions.

John Hicks's 1937 paper, "Mr. Keynes and the Classics," was a big step. He introduced the IS–LM model, which simplified Keynes's theory into a model with markets for goods, money, and financial assets.

Later, Franco Modigliani added the labor market to the IS-LM model in 1944. Paul Samuelson's textbook, first published in 1948, helped spread these ideas widely. He even created the "Keynesian cross" diagram to show how Keynesian ideas fit with classical price theories.

By the 1950s, the IS-LM model was well-established. Economists also understood the importance of rigid wages (wages that don't change easily) and how public debt affects the economy.

What Happened Next

The neoclassical synthesis was very successful in the 1950s and 1960s. Many economists believed that steady economic growth was possible with government help.

However, the 1973 oil crisis and other economic problems in the 1970s brought "stagflation". This was a big problem because it meant high unemployment and high inflation at the same time. This went against what the Phillips curve suggested.

Because of stagflation, the neoclassical synthesis was criticized. It couldn't explain these new economic events. This led to new schools of thought, like new classical macroeconomics and New Keynesian economics.

These new ideas eventually came together to form the "new neoclassical synthesis" that is the basis of mainstream economics today.

How the Neoclassical Synthesis Was Used

Monetary and Fiscal Policy

One of the clearest uses of the neoclassical synthesis was in how governments managed the economy. It suggested that changing the money supply (monetary policy) or government spending and taxes (fiscal policy) could affect demand in the short run. This would then impact jobs and economic output.

However, it also said that in the long run, these policies wouldn't change real economic things like jobs or output. This is because prices and wages would eventually adjust.

Trade and Globalization

The neoclassical synthesis also looked at international trade. It suggested that in the long run, free trade helps most countries. This is because it lets countries use their resources more efficiently. They can produce what they're best at and trade for other goods. This leads to more productivity and innovation for everyone.

But in the short run, free trade can cause problems for some workers or industries. They might face more competition from foreign companies, leading to job losses or lower wages. To help with this, the synthesis suggested governments could offer support like income help or job retraining programs.

Labor Markets

When it came to jobs, the neoclassical synthesis focused on how wages and employment are set in a competitive market.

It said that businesses hire workers based on how much extra product each worker can make. They will keep hiring until the cost of a worker (their wage) is about the same as the value of what they produce. So, if demand for goods goes up, businesses might hire more workers and wages might rise.

On the other side, people decide how much to work based on their wage compared to the value of their free time. If wages go up, more people might want to work.

The synthesis believed that over time, wages and job levels would naturally adjust to a balance in a competitive market. But it also recognized that things like minimum wage laws or labor unions could stop this from happening in the short run. In these cases, government policies could help promote competition and flexibility in the job market.

Images for kids

-

The Phillips curve in the U.S. in the 1960s

-

The IS–LM model is used to analyze the effect of demand shocks on the economy.

See also

In Spanish: Síntesis neoclásica para niños

In Spanish: Síntesis neoclásica para niños

- New classical macroeconomics

- New neoclassical synthesis

- General

- History of macroeconomic thought

- Mainstream economics

| Roy Wilkins |

| John Lewis |

| Linda Carol Brown |