Milton Friedman facts for kids

Quick facts for kids

Milton Friedman

|

|

|---|---|

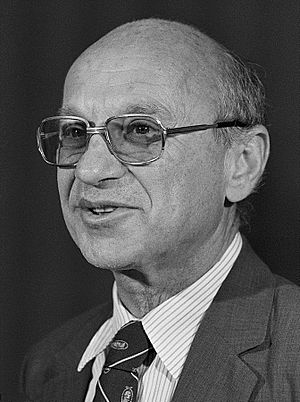

Friedman in 2004

|

|

| Born | July 31, 1912 |

| Died | November 16, 2006 (aged 94) |

| Spouse(s) | Rose Friedman |

| Institution |

|

| School or tradition |

Chicago School; Classical Liberalism |

| Alma mater | |

| Doctoral advisor |

Simon Kuznets |

| Doctoral students |

Phillip Cagan Harry Markowitz Lester G. Telser David I. Meiselman Neil Wallace Miguel Sidrauski Edgar L. Feige |

| Other notable students | Thomas Sowell |

| Influences | |

| Contributions |

|

| Awards |

|

| Information at IDEAS / RePEc | |

| Signature | |

Milton Friedman (July 31, 1912 – November 16, 2006) was an American economist and statistician. He won the 1976 Nobel Memorial Prize in Economic Sciences. He earned this award for his work on how people spend money, the history of money, and how to keep the economy stable.

Friedman was a key leader of the Chicago school of economics. This group of thinkers at the University of Chicago believed in free market ideas. They disagreed with Keynesian economics, which suggested more government involvement in the economy. Instead, Friedman and his group supported monetarism, which focuses on controlling the amount of money in circulation. Many of his students and colleagues became important economists themselves.

Friedman challenged the idea that government spending could easily fix economic problems. He believed that there was a natural rate of unemployment. He argued that trying to push unemployment below this rate would cause prices to rise too quickly (inflation). He also thought that a steady, small increase in the money supply was the best way to manage the economy. His ideas about money, taxes, and reducing government rules (deregulation) greatly influenced governments, especially in the 1980s.

After leaving the University of Chicago in 1977, Friedman advised leaders like U.S. President Ronald Reagan and British Prime Minister Margaret Thatcher. He believed in a free market system with very little government interference. He was most proud of his role in ending the military draft in the U.S. In his 1962 book Capitalism and Freedom, he supported ideas like a volunteer military, flexible currency exchange rates, and school vouchers.

Friedman's work covered many economic and public policy topics. His books and essays had a big impact worldwide, even in former communist states. Many economists consider him one of the most important economists of the 20th century.

Contents

Early Life and Education

Milton Friedman was born in Brooklyn, New York, on July 31, 1912. His parents, Sára Ethel and Jenő Saul Friedman, were Jewish immigrants from Hungary. They worked as merchants selling dry goods. Milton was their fourth child and only son. Soon after he was born, his family moved to Rahway, New Jersey.

His family often faced money problems. Milton's father died when Milton was in his last year of high school. This meant Milton and his two older sisters had to help care for their mother.

Milton was a very smart student and loved to read. He finished Rahway High School in 1928, just before he turned 16. Even though no one in his family had gone to college, Milton won a scholarship to Rutgers University. He had to pay for the rest of his college costs himself. He graduated from Rutgers in 1932.

Friedman first wanted to become a mathematician. But the Great Depression, a time of severe economic hardship, made him decide to study economics instead. He received scholarships for graduate studies in economics at the University of Chicago. He earned his master's degree there in 1933. At the University of Chicago, he met his future wife, economist Rose Director.

He also studied statistics at Columbia University for a year. Later, he returned to Chicago to work as a research assistant. During this time, he became lifelong friends with George Stigler and W. Allen Wallis, who also became famous economists.

Public Service Work

Friedman struggled to find a job in academics at first. In 1935, he moved to Washington, D.C., where Franklin D. Roosevelt's New Deal programs were creating jobs for economists. At this time, Friedman and his wife thought job-creation programs were helpful. However, they disagreed with government efforts to control prices and wages. Friedman believed that price controls stopped the economy from working properly.

He later argued that the Great Depression was caused by the Federal Reserve (the U.S. central bank) not doing enough to increase the money supply. He and his colleague Anna Schwartz wrote a famous book, A Monetary History of the United States, 1867–1960. This book argued that the Great Depression was made worse by banks failing and bad policies from the Federal Reserve.

In 1937, Friedman started working for the National Bureau of Economic Research. He helped study how people's incomes changed. This work led to his idea of "permanent income," which is how much income a person expects to earn over many years. This idea was a big part of his later work on how people spend money. He also suggested that rules requiring licenses for certain jobs, like doctors, could make those services more expensive.

From 1941 to 1943, Friedman advised the U.S. Department of the Treasury on wartime tax policy. He helped create the system where taxes are taken directly from paychecks (payroll withholding tax). He later said he wished this system wasn't needed, even though it helped fund the war.

Academic Career and Key Ideas

Teaching at the University of Chicago

In 1946, Friedman began teaching economic theory at the University of Chicago. He stayed there for 30 years. At Chicago, he helped create a group of thinkers known as the Chicago school of economics. Many of them, like Friedman, won Nobel Prizes.

He also started a "Workshop in Money and Banking" at the university. This helped bring back the study of how money affects the economy. He began working with Anna Schwartz, an economic historian. Their work led to their important 1963 book, A Monetary History of the United States, 1867–1960.

Understanding How People Spend Money

One of Friedman's most famous works is A Theory of the Consumption Function, published in 1957. He challenged the common idea that people change their spending based only on their current income. Friedman introduced the idea of "permanent income." This is the average income a household expects to earn over several years.

He argued that people's spending habits are more affected by their expected long-term income than by short-term changes. For example, if someone gets a sudden bonus, they might save most of it rather than spend it all. This is because it's a "transitory" (temporary) income, not part of their "permanent" income. Friedman's ideas changed how economists thought about consumer behavior and helped him earn the Nobel Prize.

Ideas on Freedom and Capitalism

Friedman's book Capitalism and Freedom, published in 1962, brought him attention beyond universities. It explained his ideas about public policy using simple economic models. The book sold many copies and was translated into 18 languages.

In Capitalism and Freedom, Friedman argued that free markets help countries and individuals in the long run. He believed that economic freedom was key to a successful society. He discussed topics like the role of government, the money supply, and social welfare programs. He concluded that government should only get involved when absolutely necessary to protect people and the country. He felt that a country's strengths came from its free markets, while its problems often came from too much government involvement.

After Retirement

In 1977, at age 65, Friedman retired from the University of Chicago. He and his wife moved to San Francisco. He continued his work as a visiting scholar at the Federal Reserve Bank of San Francisco and the Hoover Institution at Stanford University.

Friedman and his wife, Rose, created a ten-part TV series called Free to Choose in 1980. This series explained his economic and social ideas to a wide audience. The book that went with the series, also called Free To Choose, was a bestseller.

Friedman was an unofficial advisor to President Ronald Reagan during his 1980 presidential campaign and throughout his presidency. In 1988, he received the National Medal of Science and the Presidential Medal of Freedom from President Reagan.

Milton Friedman is known as one of the most important economists of the 20th century. He continued to write articles and appear on TV in the 1980s and 1990s. He also visited countries in Eastern Europe and China to advise their governments.

Personal Life

Milton Friedman had two children, David and Jan. He met his wife, Rose Friedman, at the University of Chicago in 1932, and they married in 1938. Rose often said that Milton always made her feel that his achievements were her achievements too.

Friedman was a short man, about 5 feet tall. He described himself as an agnostic, meaning he wasn't sure if God existed. In their book Two Lucky People, Rose Friedman wrote that they raised their children with a Christmas tree, even though they were Jewish.

Milton Friedman died of heart failure in San Francisco on November 16, 2006, at age 94. He was still working as an economist. His wife, Rose, passed away in 2009.

Important Economic Ideas

Understanding Money and the Economy

Friedman is famous for bringing back interest in the money supply (the total amount of money in an economy). He believed that the amount of money in circulation strongly affects prices and economic activity. This idea is called monetarism.

He argued that there is a strong link between inflation (prices rising) and the money supply. He believed that inflation could be avoided if the money supply grew at a steady, controlled rate. He used the example of "dropping money out of a helicopter" to explain how injecting money into the economy would affect prices.

Friedman did not believe that government spending (fiscal policy) was a good way to manage the economy. He thought the government's role in the economy should be very limited. He studied the Great Depression and argued that it was made much worse because the Federal Reserve allowed the money supply to shrink too much. He called this period "The Great Contraction."

He also pushed for countries to use floating exchange rates, where the value of a country's money changes freely against other currencies. He thought this would help countries avoid economic problems and that fixed exchange rates were a bad form of government control.

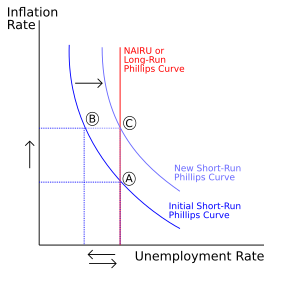

The Phillips Curve and Unemployment

Friedman also made important contributions to understanding the Phillips curve. This idea originally suggested a simple trade-off between inflation and unemployment. Friedman, along with Edmund Phelps, argued that a government could not permanently lower unemployment by causing more inflation. They said that unemployment might drop for a short time if inflation was unexpected. But in the long run, unemployment would return to its "natural rate," which is determined by how the job market works.

Views on Public Policy

The Federal Reserve and Money Rules

Friedman was very critical of the Federal Reserve because he felt it had not managed the economy well. He even thought it should be replaced by a simple computer program that would automatically control the money supply.

He suggested a "k-percent rule," where the money supply would grow by a fixed percentage each year. He believed this steady growth would lead to a more stable economy.

Foreign Policy and the Military

Friedman was a strong supporter of a volunteer military and is often credited with helping to end the military draft in the U.S. He believed the draft was unfair and went against the idea of a free society. He said that ending the draft was his proudest achievement.

While he supported the U.S. involvement in World War II, his views on foreign policy became more cautious over time. He later opposed the Gulf War and the Iraq War.

Government's Role in the Economy

Friedman believed that many services provided by the government could be done better by private businesses. He criticized Social Security, saying it could create dependence on welfare.

However, he also recognized that some people live in poverty. He suggested a "negative income tax" as a way to help those in need. This would be a simple system where people earning below a certain amount would receive money from the government, rather than paying taxes. He thought this would be less costly and more efficient than many existing welfare programs.

Friedman also supported environmental taxes. He believed that taxing pollution would give companies and people an incentive to reduce it, which would be better than strict government rules.

He was a big supporter of school vouchers. This idea would allow public money to be used for students to attend private schools, giving families more choices in education. In 1996, he and his wife founded a foundation to promote school choice.

Friedman argued for strong legal protections for economic rights and freedoms. He believed this would help economies grow, make countries more prosperous, and support democracy.

Social Issues

Friedman supported gay rights, saying there should be no discrimination against gay people.

He also favored immigration, believing it had a positive impact on the U.S. economy. He thought immigrants, especially undocumented ones, often took jobs that others didn't want and didn't use welfare services. However, he believed that if there was a welfare system, immigrants should not have access to it.

Friedman was against public housing and minimum wage laws. He thought public housing increased taxes and didn't truly help low-income people in the long run. He believed minimum wage laws actually caused unemployment, especially for low-income workers.

Honors and Legacy

Milton Friedman is seen as one of the most important and influential economists of the time after World War II. In 1971, he received the Golden Plate Award. The Cato Institute, a libertarian think tank, named its Milton Friedman Prize for Advancing Liberty after him.

When Friedman died, Lawrence Summers, a former Harvard President, called him "The Great Liberator." He said that "any honest Democrat will admit that we are now all Friedmanites," meaning that many of Friedman's ideas about free markets had become widely accepted.

Nobel Memorial Prize

Friedman won the Nobel Memorial Prize in Economic Sciences in 1976. He received it for his work on how people spend money, the history and theory of money, and the challenges of keeping the economy stable. His award was somewhat controversial because of his connection to the military leader Augusto Pinochet in Chile.

Influence Around the World

Friedman often said, "If you want to see capitalism in action, go to Hong Kong." He believed Hong Kong was a great example of a free market economy.

In 1975, Friedman visited Chile to give lectures on economic freedom. At that time, Chile was facing a severe economic crisis under a military government. Friedman advised them to quickly reduce inflation by cutting government spending and increasing the money supply at a steady rate. Many Chilean economists who studied at the University of Chicago, known as the Chicago Boys, took on important roles in the government. Friedman believed that economic freedom in Chile eventually led to political freedom.

Friedman also influenced Estonia. Its prime minister, Mart Laar, said Friedman's book Free to Choose was the only economics book he read before taking office. Laar's reforms helped transform Estonia from a poor Soviet republic into a successful economy.

In the United Kingdom, Friedman's ideas gained popularity in conservative circles. He met with Margaret Thatcher in 1978, and his monetarist ideas strongly influenced her policies when she became Prime Minister in 1979.

Criticisms of His Work

Some economists have criticized parts of Friedman's work. For example, some disagreed with his conclusion that the Federal Reserve was entirely to blame for the Great Depression. They argued that the Fed's actions were limited by the gold standard at the time.

Other critics have questioned some of his economic models, saying that his assumptions were sometimes unrealistic. Some economists also argue that Friedman's ideas, when put into practice, led to lower wages for workers and increased income inequality in the United States.

Images for kids

See also

In Spanish: Milton Friedman para niños

In Spanish: Milton Friedman para niños