Rincon Island (California) facts for kids

Rincon Island (which means "Corner" in Spanish) is a small, man-made island located off the coast of Ventura County, California. It's about 3,000 feet (914 meters) from the shore in water that's 55 feet (17 meters) deep. The island was built in 1958 to drill for oil and gas. It's close to the beach towns of Mussel Shoals and La Conchita. A long bridge, called the Richfield Pier, connects the island to the mainland.

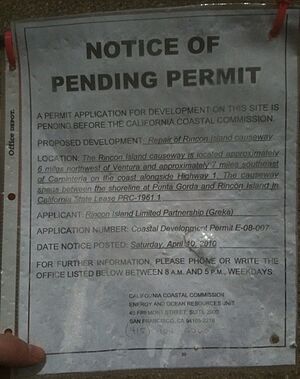

The area around Rincon Island, including the island itself, covers about 1,700 acres (6.9 square kilometers). The island is 2.3 acres (0.93 hectares) big. The causeway (the bridge connecting it to land) is 2,700 feet (823 meters) long and carries oil and gas pipelines, also allowing vehicles to drive to the island. The last oil company that operated here, Greka Energy, had many problems with safety and following rules.

Contents

Island History

The name "Rincon" means "corner" in Spanish. Long ago, the Chumash people lived in this area. They were the largest group of Native Americans in California. Ventura County, where the island is located, was formed in 1873 from Santa Barbara County.

In 1913, a road called the Rincon Sea Level Road opened between Santa Barbara and Ventura. Parts of this road were built on wooden planks and stilts because the area could only be crossed at low tide before.

Oil production first started near Rincon Beach in 1928. This part of the coast is also famous for its great surfing spots, like Rincon Point, which is just north at the county line.

Island Features

Rincon Island has about one acre (0.4 hectares) of usable space inside a sunken area. This area is surrounded by a raised wall, called a berm, which is about 30 feet (9 meters) high on the ocean side. The berm has palm trees planted on it. The island's total area on the surface is about 2.3 acres (0.93 hectares), but its base on the ocean floor is larger, about 6 acres (2.4 hectares). The oil production equipment is partly hidden inside the island and by the palm trees. A single-lane causeway, 3,000 feet (914 meters) long, connects the island to the shore.

Island Environment

The area around Rincon Island includes the Pacific Ocean, coastal mountains, U.S. Highway 101, and some beach homes. There's also a hotel about 3,000 feet (914 meters) north near the Mussel Shoals exit on Highway 101, and the community of La Conchita nearby. Other oil facilities are also in the area.

In 1978, a study looked at how the island affected the environment. It found that the rocks and concrete blocks (called tetrapods) around the island created a special habitat. This habitat supports many different kinds of sea animals and plants. This is different from the natural seafloor nearby, which has fewer types of life.

Rincon Oil Field Operations

Oil drilling in the Rincon Oil Field started between 1929 and 1931 when companies were given permission to use the land. Over the years, several different oil companies operated here. By the late 1980s, companies like Atlantic Richfield Company (ARCO) and Berry Petroleum Company held most of the rights to drill at Rincon.

In 1992, the California State Lands Commission allowed ARCO to transfer its interests to Berry. However, ARCO (and later British Petroleum (BP), which bought ARCO) remained responsible for removing Rincon Island and its causeway when operations stopped.

Oil Production

In early 1997, Windsor Energy Corp. started drilling more wells on Rincon Island. Oil production increased a lot, from about 200 barrels of oil per day in 1995 to about 3,000 barrels per day by 1998.

When Windsor took over the Rincon Island Field, 16 wells were producing oil, and 51 were not. Windsor quickly got six of the non-producing wells working again. They also drilled 19 new wells that produced oil. The wells at Rincon drilled for oil at depths between 1,700 and 2,800 feet (518 to 853 meters).

Company Challenges

In 1998, Rincon Island Limited Partnership (RILP) and its main partner, Windsor Energy, faced financial difficulties and filed for bankruptcy. This meant they needed help to manage their debts. A private investment firm had planned to buy some of their assets, including Rincon Island, but the deal fell through because oil prices were too low.

Rincon Island operations continued for a while under the supervision of the Bankruptcy Court. Compass Bank, a major lender to RILP, took control of the company in 2001. Compass Bank wanted to sell the properties as quickly as possible.

Greka Energy Takes Over

In October 2002, Greka Energy Corp. bought the Rincon Island operation, which included 56 wells. Greka is a major oil producer in Santa Barbara County and also owns an asphalt plant that makes asphalt for roads.

In 2003, Greka's CEO, Randeep S. Grewal, took the company private, meaning it was no longer traded on the stock market.

In 2005, Greka Energy also faced financial problems and filed for bankruptcy. They had many debts and faced legal issues and environmental lawsuits. Greka paid the state about $143,000 in royalties for the oil and gas pumped from Rincon Island in the first half of 2007.

Safety Concerns and Island Closure

Rincon Island's history includes some oil spills and safety problems. In February 1998, it was reported that 130 gallons (492 liters) of crude oil spilled from the island facility.

From 1999 onwards, the Santa Barbara Air Pollution Control District inspected Greka's facilities many times and found about 300 violations. Over nine years, Greka had more than 200 spills, with 20 of them threatening or polluting state waters.

Because of unsafe conditions on the bridge that carries oil from the island to the shore, the California State Lands Commission shut down Rincon Island on January 3, 2008.

Greka started oil production again for a short time. However, by October 2008, production was stopped again. Tests showed that the causeway to the island had serious structural problems. Employees had to use a golf cart to get to the island because it was too dangerous for regular vehicles. By the end of 2008, the island had produced 2,622 barrels of oil that year.

In June 2011, the government sued Greka for over $2.4 million to cover cleanup costs.

Facing the possibility of losing its lease (permission to operate) from the State Lands Commission due to "careless oil and gas operations," Rincon Island Limited Partnership (a part of Greka Energy) filed for bankruptcy again on August 9, 2016. At that time, the company had not produced oil or gas from Rincon Island since October 2008.

On November 30, 2017, the Bankruptcy Court approved giving control of Rincon Island back to the State Lands Commission. This happened on December 6, 2017. As a result, Rincon Island became part of the California Coastal Sanctuary, and the last oil drilling operation in the Santa Barbara Channel came to an end.

Future of the Island

The California State Lands Commission plans to remove Rincon Island and its causeway in the future. This process will involve studying the environmental impact, getting public feedback, and receiving approval from various government agencies. They will also need to find funding and hire a company to do the removal work. The environmental study for this removal was expected to begin in 2020.

See also

In Spanish: Isla Rincón para niños

In Spanish: Isla Rincón para niños

| Sharif Bey |

| Hale Woodruff |

| Richmond Barthé |

| Purvis Young |