BP facts for kids

|

|

Headquarters at 1 St James's Square in Westminster, London

|

|

|

Formerly

|

|

|---|---|

| Public | |

| Traded as | |

| ISIN | [https://isin.toolforge.org/?language=en&isin=GB0007980591 GB0007980591] |

| Industry | Oil and gas |

| Predecessors |

|

| Founded | 14 April 1909 (as the Anglo-Persian Oil Company) |

| Founders | |

| Headquarters | London, England, UK |

|

Area served

|

Worldwide |

|

Key people

|

|

| Products |

|

| Brands | |

|

Production output

|

|

| Services | Service stations |

| Revenue | |

|

Operating income

|

|

| Total assets | |

| Total equity | |

|

Number of employees

|

100,500 (2024) |

BP p.l.c. is a large British company that works with oil and gas. Its main office is in London, England. BP is one of the biggest oil and gas companies in the world. It handles all parts of the oil and gas business. This includes finding oil, taking it out of the ground, making it into useful products, and selling them.

BP started as the Anglo-Persian Oil Company in 1909. It was created to use the oil found in Iran. Over the years, its name changed several times. It became the Anglo-Iranian Oil Company in 1935 and British Petroleum in 1954. The British government used to own most of the company. However, it was sold to private investors between 1979 and 1987. BP joined with another company called Amoco in 1998. It then became BP Amoco p.l.c. The company's name was shortened to BP p.l.c. in 2001.

As of 2018, BP worked in almost 80 countries. It produced a lot of oil and gas every day. The company has about 18,700 gas stations around the world. These stations operate under the BP, Amoco, and Aral brands. BP is one of the largest oil companies owned by investors.

BP has been involved in several major environmental and safety incidents. These include the 2005 Texas City refinery explosion. This accident killed 15 workers. Another major event was the 2010 Deepwater Horizon oil spill. This was the largest accidental oil spill into the ocean in history. It caused serious environmental and economic problems.

Contents

- About BP

- Logo Evolution

- How BP Operates

- Corporate Information

- Environmental Impact

- Accidents and Violations

- Political Influence

- Market Investigations

- See also

About BP

Early History and Growth

In May 1908, British geologists found a large amount of oil in Iran. This was the first big oil discovery in the Middle East. It changed the history of the whole region. On April 14, 1909, the Anglo-Persian Oil Company (APOC) was formed. It was a part of the Burmah Oil Company.

Soon after, the British government helped APOC get land in Abadan to build an refinery. The refinery started working in 1912. In 1914, the British government bought a controlling share of the company. This was because Winston Churchill wanted the British navy to switch from coal to oil. APOC also agreed to supply oil to the Royal Navy for 30 years at a set price.

After World War I, APOC started selling its products in Europe. It built refineries in Wales and Scotland. It also worked with the Government of Australia to build Australia's first refinery. In 1923, Winston Churchill helped APOC get special rights to Iran's oil.

APOC also helped create the Turkish Petroleum Company (TPC) in 1912. This company looked for oil in what is now Iraq. By 1914, APOC owned half of TPC. In 1925, TPC got permission to explore for oil in Iraq. TPC found oil in Iraq in 1927. Later, APOC's share in TPC, which became Iraq Petroleum Company (IPC), was reduced.

In 1934, APOC and Gulf Oil started the Kuwait Oil Company. In 1935, Iran's ruler asked the world to call Persia 'Iran'. So, APOC changed its name to the Anglo-Iranian Oil Company (AIOC).

In 1937, IPC, partly owned by BP, signed an oil agreement with the Sultan of Muscat. IPC later helped the Sultan's forces take over parts of Oman. This led to the Jebel Akhdar War in 1954.

After World War II, people in the Middle East wanted more control over their own resources. In Iran, the AIOC and the government did not want to change the oil agreements. In 1951, Iran's government took control of its oil industry. The National Iranian Oil Company (NIOC) was formed. AIOC left Iran, and Britain stopped buying Iranian oil. The British government tried to fight this in court, but they lost.

In 1953, the US and British governments helped overthrow Iran's leader. This allowed AIOC to return to Iran.

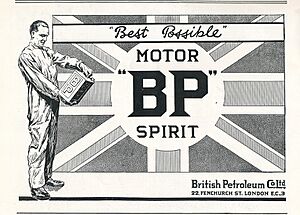

Becoming British Petroleum

In 1954, AIOC changed its name to the British Petroleum Company. After the events in Iran, a new company, Iranian Oil Participants Ltd (IOP), was formed. British Petroleum was a main member. IOP managed oil in Iran for NIOC. They agreed to share profits with Iran.

In the 1950s, British Petroleum started working in Canada and Alaska. In 1965, it was the first company to find oil in the North Sea. In 1969, BP entered the United States.

By the 1960s, British Petroleum was known for taking big risks. This brought huge profits but also led to safety problems. In 1967, the oil tanker Torrey Canyon crashed off the English coast. This caused Britain's worst oil spill. BP was chartering the ship.

In the 1970s, many countries took control of their oil assets. This happened in Libya, Kuwait, and Nigeria. In Iraq, IPC stopped its operations after the government took control in 1972.

Because of these changes, British Petroleum lost much of its direct oil supply from OPEC countries. This made the company look for oil in other places. In 1978, it bought a large share of Standard Oil of Ohio (Sohio).

BP continued to work in Iran until the Islamic Revolution in 1979. The new government took all of BP's assets without paying. BP lost 40% of its global oil supply.

Growth and Changes

The British government sold its shares in BP between 1979 and 1987. This made BP a fully private company.

In the 1980s, BP sold some of its refining businesses in Europe and Canada. In 1987, British Petroleum bought Britoil and more shares of Standard Oil of Ohio.

In 1981, British Petroleum started working in solar energy. It bought a company that made photovoltaic solar cells. This company later became BP Solar.

BP entered the Russian market in 1990. It opened its first gas station in Moscow in 1996. In 2003, BP invested a lot of money in a joint company with Russian businesses called TNK-BP.

In 1992, the company started working in Azerbaijan. It signed agreements for big oil and gas projects there.

Becoming BP Amoco and Beyond

Under its leader John Browne, British Petroleum bought other oil companies. This made BP the third largest oil company in the world. British Petroleum joined with Amoco in 1998. It became BP Amoco plc. Many Amoco gas stations in the US changed to the BP brand. In 2000, BP Amoco bought ARCO and Burmah Castrol.

In 2001, the company changed its name to BP p.l.c. It also adopted a new green and yellow sunburst logo. This logo was named "Helios" after the Greek sun god. BP also started using the slogan "Beyond Petroleum." This was to show its focus on new energy sources.

BP became a main partner in the Baku–Tbilisi–Ceyhan pipeline project. This pipeline opened a new way to transport oil from the Caspian region. In 2002, BP bought most of Veba Öl AG in Germany. It then changed its gas stations in Germany to the Aral name.

In 2004, BP sold its chemicals business to Ineos. In 2007, BP sold its company-owned convenience stores to local owners.

On March 23, 2005, 15 workers died and many were hurt in the Texas City refinery explosion. This happened because major upgrades to the refinery had been delayed to save money. After this, BP's leader promised to prevent future accidents.

In 2009, BP started a project to develop the large Rumaila field in Iraq.

Recent Developments

On April 20, 2010, the Deepwater Horizon oil rig exploded. This caused a huge oil spill in the Gulf of Mexico. This was a major industrial accident. After this, Bob Dudley became the new CEO of BP. BP announced plans to sell about $38 billion worth of its assets. This was to help pay for the costs of the accident.

BP also started to reduce its focus on alternative energy businesses. In 2011, it announced it would leave the solar energy market. In 2012, BP closed its biofuel projects.

In 2016, BP's Norwegian company merged with Det Norske Oljeselskap to form Aker BP. In 2017, BP sold its Forties pipeline system in the North Sea. It also invested in Lightsource Renewable Energy, a solar energy company.

In 2018, BP bought BHP's shale oil assets in Texas and Louisiana. It also bought Chargemaster, a company that runs electric vehicle charging stations in the UK.

In January 2019, BP found a lot of oil at its Thunder Horse location in the Gulf of Mexico.

In February 2020, BP set a goal to cut its greenhouse gas emissions to net-zero by 2050. This means balancing the amount of greenhouse gases released with the amount removed. The company also announced plans to invest more in low-carbon technologies.

In June 2020, BP sold its chemicals unit to Ineos. It also sold all its oil operations in Alaska to Hilcorp.

In September 2020, BP partnered with Equinor to develop offshore wind farms. In December 2020, BP bought a large share in Finite Carbon, a company that develops forest carbon offsets.

In response to the 2022 conflict in Ukraine, BP announced it would sell its share in Rosneft, a Russian oil company.

In October 2022, BP announced it would buy Archaea Energy Inc., a company that produces renewable natural gas. This purchase was completed in December 2022. In February 2023, BP reported record profits for 2022. The same month, BP agreed to buy TravelCenters of America, a truck stop service company.

In June 2024, BP announced it would buy Bunge Bioenergia to increase its ethanol production. In November 2024, BP announced plans to invest in a carbon capture and gas field project in Indonesia. In January 2025, BP announced it planned to cut staff. In February 2025, BP said it would increase oil and gas production and reduce renewable energy investments. This decision caused concern among environmental groups. In July 2025, BP announced Albert Manifold would be its next chairman. In August 2025, the company announced a large oil and gas discovery in Brazil.

Logo Evolution

How BP Operates

As of December 31, 2018, BP worked in 78 countries. Its main office is in London, UK. BP's work is divided into three main parts: finding and producing oil and gas (Upstream), refining and selling products (Downstream), and renewables.

Since 1951, BP has published its Statistical Review of World Energy every year. This report is an important guide for the energy industry.

Operations in the United Kingdom

BP has a large office in Sunbury-on-Thames, UK. About 3,500 people work there. Its North Sea operations are based in Aberdeen, Scotland. BP also has three main research centers in the UK.

As of 2020, BP's operations in the UK North Sea focused on a few key areas. BP is in charge of the Clair oilfield, which is the largest oil and gas resource in the UK.

There are 1,200 BP gas stations in the UK. Since 2018, BP has run the UK's largest electric vehicle charging network through its company BP Pulse.

In February 2020, BP announced a partnership to develop offshore wind power in the UK. This was BP's first step into the UK's offshore wind market. In February 2022, BP bought a share in Green Biofuels Ltd. This company makes renewable fuels that can replace diesel.

Operations in the United States

BP's operations in the United States make up almost one-third of its total work. BP has about 14,000 employees in the US. In 2018, BP produced a lot of oil and natural gas in the US.

BP's main company in the US is BP America, Inc. It is based in Houston, Texas. BP Exploration & Production Inc. handles finding and producing oil. BP Corporation North America, Inc. refines petroleum and provides fuel and energy. BP Products North America, Inc. also works in finding, developing, and selling oil and gas.

BP's activities in the lower 48 states are managed by BPX Energy. This company works with shale gas in several states.

As of 2019, BP produced a lot of oil in the Gulf of Mexico. BP runs several large oil platforms there. In April 2023, BP launched a new oil rig called Argos in the Gulf.

BP operates refineries in Indiana and Washington. It used to own a refinery in Ohio but sold its share in February 2023.

BP runs nine onshore wind farms in six states. It also has a share in another wind farm in Hawaii. These wind farms produce a lot of electricity. BP is also planning to get a share in offshore wind farms near New York and Massachusetts.

Other Locations

In Egypt, BP produces about 15% of the country's oil and 40% of its gas. The company also has gas projects offshore.

BP is active in oil development in Angola. It has shares in several oil exploration and production areas.

BP has a share in exploring for oil in the South China Sea.

In India, BP owns a 30% share of oil and gas projects run by Reliance Industries. This is a large investment in oil and gas exploration in the country.

BP has major natural gas projects in Indonesia. It runs the Tangguh LNG project, which started producing in 2009.

BP works in Iraq as part of the Rumaila Field Operating Organization in the Rumaila oil field. This is one of the world's largest oil fields. A BBC investigation in 2022 found that waste gas was being burned close to homes. This caused air pollution and was linked to a rise in cancer in Basra. In February 2025, BP signed a deal to redevelop oil and gas fields in Kirkuk, Iraq.

In Oman, BP has a large share in Block 61. This is one of Oman's biggest gas blocks. In February 2021, BP sold some of its share in Block 61 but remains the operator.

Before March 2021, BP ran the Kwinana Oil Refinery in Western Australia. This was Australia's largest refinery. It was changed to an import terminal. As of 2025, it is becoming a biorefinery and green hydrogen plant. However, in 2025 BP announced it was ending its role in producing hydrogen in the region.

BP is a partner in the North West Shelf project in Australia. This project produces natural gas and oil. It is Australia's largest resource development.

BP runs the two largest oil and gas projects in Azerbaijan. These are the Azeri–Chirag–Guneshli oil fields and the Shah Deniz gas field. It also operates major pipelines that export oil and gas through Georgia.

BP's refining operations in Europe include a large oil refinery in Rotterdam, Netherlands. Other refineries are in Germany and Spain.

BP also has shares in oil projects in the Norwegian part of the North Sea. As of December 2018, BP owned a share in Russia's state-controlled oil company Rosneft.

BP sells motor fuels in many European countries. These include the UK, France, Germany (under the Aral brand), and others.

BP's Canadian operations are based in Calgary. The company mainly works in Newfoundland. It buys oil for its US refineries and has a share in offshore exploration.

BP is the largest oil and gas producer in Trinidad and Tobago. It has a large share in Atlantic LNG, a big natural gas plant.

In Brazil, BP has shares in offshore oil and gas exploration. BP also runs biofuel plants in Brazil. These include sugar mills that produce ethanol.

BP used to operate in Singapore but sold its businesses there in 2004.

BP has a big presence in South Africa. It runs refineries and 500 gas stations there.

Finding and Producing Oil and Gas

BP's Upstream activities include looking for new oil and natural gas. They also involve developing ways to get these resources. This includes producing, transporting, storing, and processing oil and natural gas. These activities happen in 25 countries. In 2018, BP produced a lot of oil and natural gas. It also had large proven reserves of oil and gas. BP also has a share in three oil sands projects in Canada.

BP had plans to reduce its oil and gas production by 40% by 2030. However, this plan was changed in October 2024. BP is now looking to increase its oil and gas production instead.

Refining and Selling Products

BP's Downstream activities include refining oil and selling petroleum products. This part of the business handles fuels and lubricants. It has major operations in Europe, North America, and Asia. As of 2018, BP owned or had a share in 11 refineries.

BP is one of the world's biggest oil traders. It trades a lot of oil and refined products every day.

Air BP is BP's aviation division. It provides aviation fuel and services in over 50 countries. BP Shipping moves BP's oil and gas by sea. It manages a large fleet of ships.

BP has about 18,700 gas stations worldwide. Its main retail brand is BP Connect. These stations often have a convenience store. In the US, some are changing to the ampm format. BP also owns half of Thorntons LLC, a convenience store company. In Germany, BP runs gas stations under the Aral brand. On the US West Coast, BP mainly uses the ARCO brand. In Australia, BP runs large travel centers with food places like McDonald's.

Castrol is BP's main brand for industrial and automotive lubricants. It is used for many BP oils and greases.

Clean Energy Efforts

BP often talks about shifting towards climate-friendly and low-carbon energy. However, a 2022 study found that BP's spending on clean energy was small. It did not seem to match what the company said it was doing.

BP was the first major oil company to say it would focus on other energy sources. It started an alternative and low carbon energy business in 2005. The company said it spent $8.3 billion on renewable energy projects by 2013. These included solar, wind, and biofuels. Environmental groups have criticized BP for "greenwashing". This means making themselves seem more environmentally friendly than they are. In 2018, BP's CEO said that only about $500 million of its yearly spending would go to low-carbon energy. In August 2020, BP promised to increase its low carbon investments to $5 billion by 2030. It set goals to have a lot of renewable energy by 2025 and 2030.

BP operates nine wind farms in the US. It is also working to get a share in offshore wind farms. BP and Tesla, Inc. are testing battery energy storage at a wind farm.

In Brazil, BP owns two ethanol producers. These mills produce a lot of ethanol. BP has also invested in a company that develops crops for biofuel. Its joint company with DuPont, Butamax, has developed technology to produce bio-butanol. BP also owns biomethane production plants. BP's company Air BP supplies aviation biofuel at some airports.

BP owns a large share in Lightsource BP. This company manages solar farms. As of 2017, Lightsource had built a lot of solar capacity. It plans to increase this capacity. BP has invested in a quick-charging battery company. It runs electric vehicle charging networks in the UK and China.

BP is planning a project to produce hydrogen using wind power at its refinery in Germany. Production is expected to start in 2024.

BP is a major shareholder in Finite Carbon, a company that develops carbon offsets. It also bought US solar projects in 2021.

In 2023, after reporting record profits, BP reduced its emissions targets. It had promised a 35-40% cut by 2030. But it changed this to a 20-30% cut. This was to keep up with the demand for oil and gas. In February 2025, the company announced plans to significantly reduce its investment in renewable energy. It plans to increase investment in oil and gas production by 20%. This caused concern among some shareholders and environmental groups.

Corporate Information

Business Trends

Here are some key trends for BP:

| Year | Revenue (US$ bn) | Net income (US$ bn) | Employees (k) |

|---|---|---|---|

| 2017 | 240 | 3.4 | 74.7 |

| 2018 | 298 | 9.4 | 75.0 |

| 2019 | 278 | 4.0 | 70.1 |

| 2020 | 180 | –20.3 | 63.6 |

| 2021 | 164 | 7.6 | 64.0 |

| 2022 | 248 | –2.5 | 66.3 |

| 2023 | 213 | 15.2 | 66.5 |

Leadership

As of July 2025, these people are on BP's board:

- Helge Lund (chairman)

- Murray Auchincloss (chief executive officer)

- Kate Thomson (chief financial officer)

- Amanda Blanc (senior independent director)

- Melody Meyer (independent non-executive director)

- Tushar Morzaria (independent non-executive director)

- Hina Nagarajan (independent non-executive director)

- Satish Pai (independent non-executive director)

- Karen Richardson (independent non-executive director)

- Johannes Teyssen (independent non-executive director)

- David Hager (independent non-executive director)

- Ian Tyler (independent non-executive director)

- Ben Mathews (company secretary)

Stock Information

BP's shares are mainly traded on the London Stock Exchange. They are also listed on the Frankfurt Stock Exchange in Germany. In the United States, shares are traded on the New York Stock Exchange.

Branding and Public Relations

In 2001, BP started using its new "Helios" logo and the slogan "Beyond Petroleum." This was part of a big advertising campaign. BP said the slogan showed its focus on new energy.

By 2008, BP's branding campaign was very successful. Many people thought BP was one of the greenest oil companies. However, environmental groups said that BP's alternative energy work was only a small part of its business. They called it "greenwashing".

BP's public image was hurt by a series of accidents in the 2000s. The Deepwater Horizon oil spill severely damaged its image. BP was criticized for how it handled the situation.

In February 2012, BP North America started a large campaign to rebuild its brand.

Environmental Impact

Climate Policy

Before 1997, BP was part of a group that questioned global warming. But in 1997, BP left the group. It said that the link between greenhouse gases and climate change should be taken seriously. In 2002, BP's chief executive said that global warming was real and needed action. However, from 1988 to 2015, BP was responsible for a significant amount of global greenhouse gas emissions.

In February 2020, BP set a goal to cut its greenhouse gas emissions to net-zero by 2050. This includes emissions from its operations and the fuels it sells. BP said it was changing its business to meet these goals. It stopped being involved with some lobbying groups that disagreed on climate policies. However, an investigation found that BP still had ties to other groups that opposed climate action.

In August 2020, BP America's chairman said that federal rules for detecting methane leaks were important. BP is also a founding member of a group that aims to reduce methane emissions.

BP's 2020 energy outlook said that global oil demand would not go back to 2019 levels. It predicted that coal, oil, and natural gas use would drop. It also said that renewable energy would grow a lot. BP aimed to become an integrated energy company focusing on low-carbon technologies. It also planned to reduce its oil and gas production by 40% by 2030. However, this plan was changed in October 2024. BP is now looking to increase its oil and gas production.

In 2021, BP was ranked as one of the most environmentally responsible oil, gas, and mining companies in the Arctic.

In December 2022, a US House committee accused BP and other oil companies of "greenwashing". They said these companies promoted climate pledges but continued to invest in fossil fuels. They also said the companies tried to control how journalists reported on their climate actions.

After initially promising to reduce emissions by 35% by 2030, BP changed its target in 2023 to 20-30%. In February 2025, the company announced plans to reduce investment in renewable energy. It plans to increase investment in oil and gas production by 20%. This decision was criticized by environmental groups.

Company Impact on Climate

BP's work contributes to climate change. This is mainly through greenhouse gas emissions from oil extraction and refining. The refining process releases a lot of carbon dioxide and methane. These are major causes of global warming. Even with better operations, the oil industry still causes a lot of air pollution.

In Iraq, BP's oil production has been linked to environmental damage. This includes oil spills that have polluted the soil. BP has promised to reduce its emissions. However, recent plans show a focus on expanding oil and gas. This raises concerns about its climate goals.

At the same time, climate change creates problems for BP. More extreme weather, like hurricanes, has disrupted oil drilling and refining. This leads to higher costs and delays. In Iraq, rising temperatures affect oil extraction. BP has said that people affected by pollution above limits should get paid. Growing pressure from rules and the public might make BP adopt stricter emissions policies in the future.

Accidents and Violations

BP has faced many fines and legal issues for safety and environmental problems. Between 2007 and 2010, BP refineries in Ohio and Texas had most of the serious safety violations found by US regulators. An official said that BP had a "serious, systemic safety problem."

1965 Sea Gem Offshore Oil Rig Disaster

In December 1965, Britain's first oil rig, Sea Gem, tipped over. This happened when two of its legs broke while it was being moved. Thirteen crew members died. No oil was spilled in this accident.

Texas City Refinery Incidents

The former Amoco oil refinery in Texas City, Texas, had many environmental problems. These included chemical leaks and a big explosion in 2005. The explosion killed 15 people and hurt hundreds. BP later admitted guilt to a charge related to the Clean Air Act. The refinery was sold in 2012.

2005 Explosion

In March 2005, the Texas City refinery exploded. This caused 15 deaths and injured 180 people. A vapor cloud formed and caught fire. The explosion caused all the deaths and a lot of damage. This accident happened after several smaller incidents at the refinery. Safety and maintenance had been cut to save money.

Many investigations found that BP's management had failed. Regulators said that safety problems could be traced from Texas to London. The company pleaded guilty to a serious violation of the Clean Air Act. It was fined $50 million, the largest fine ever under that act.

In October 2009, US safety regulators fined BP an additional $87 million. This was for not fixing safety problems from the 2005 explosion. BP appealed the fine. In July 2012, the company agreed to pay $13 million to settle new violations. In November 2011, BP agreed to pay Texas $50 million for polluting the air at its Texas City refinery.

2010 Chemical Leak

In August 2010, the Texas Attorney General accused BP of illegally releasing harmful air pollutants from its Texas City refinery. BP admitted that broken equipment caused the release of over 530,000 pounds of chemicals into the air. This included benzene and carbon monoxide. The state said BP did not properly maintain its equipment.

In June 2012, over 50,000 Texas City residents sued BP. They said they got sick from the emissions release. BP said the release did not harm anyone. In October 2013, a trial found BP was careless but not responsible for illnesses.

Prudhoe Bay Oil Spills

In March 2006, a BP oil pipeline in Prudhoe Bay, Alaska, leaked. This was the largest oil spill on Alaska's North Slope. About 212,252 gallons of oil spilled. BP admitted that cutting costs led to less monitoring and maintenance of the pipeline.

After the spill, BP was ordered to inspect its pipelines. In July 2006, inspectors found more corrosion. BP then shut down part of the Alaskan field for repairs. In total, a smaller amount of oil was spilled in this second incident. BP pledged to replace parts of its Alaskan pipelines. In November 2007, BP Exploration, Alaska pleaded guilty to negligently discharging oil. It was fined $20 million.

In July 2011, BP Exploration, Alaska paid a $25 million civil penalty. This was for failing to properly inspect and maintain its pipeline. It also agreed to improve its pipeline maintenance.

2008 Caspian Sea Gas Leak

On September 17, 2008, a small gas leak happened at the Central Azeri platform in the Azeri oilfield in the Caspian Sea. The platform was shut down and workers were moved. Production started again later that year. Leaked documents suggested BP thought the leak was caused by a bad cement job. Some of BP's partners complained that the company was too secretive.

California Storage Tanks

BP was sued for not properly inspecting and maintaining underground fuel storage tanks in California. In November 2016, BP settled the lawsuit for $14 million. The lawsuit said BP violated laws for hazardous materials at about 780 gas stations over ten years.

Deepwater Horizon Explosion and Oil Spill

The Deepwater Horizon oil spill was a huge industrial accident in the Gulf of Mexico. It killed 11 people and injured 16. About 4.9 million barrels of oil leaked. This made it the largest accidental marine oil spill ever. It cost BP more than $65 billion in cleanup and penalties.

On April 20, 2010, the Deepwater Horizon oil rig exploded after a blowout. The rig sank after burning for two days. The well was finally stopped on July 15, 2010. Most of the leaked oil entered the Gulf waters. A lot of Corexit dispersant was used.

The spill had a big economic impact on the Gulf Coast. It affected fishing and tourism.

Environmental Impact

The oil spill harmed many animals and habitats in the Gulf. Researchers found that the oil and dispersant mixture spread through the food chain. It affected fish, mammals, birds, and corals. It caused more deaths and problems with finding food and reproducing. In 2013, it was reported that dolphins were still dying in large numbers. Infant dolphins were dying at six times the normal rate.

Studies in 2013 suggested that a lot of the oil remained in the Gulf. Further research showed that oil on the seafloor was not breaking down. Oil in coastal areas increased erosion. This was because mangrove trees and marsh grass died.

Researchers found high levels of toxic compounds in the water and seafood. These were due to the oil and dispersants. A 2014 study found that toxins from the oil spill caused heart problems in bluefin tuna. BP disagreed with the study. Another study found that tuna and amberjack exposed to the oil developed heart deformities.

Effects on Human Health

Research showed that oil spill cleanup workers had chemicals from the oil and dispersants in their bodies. Another study looked at the health of women and children affected by the spill. Many Gulf residents reported mental health problems like anxiety and depression. A study found that over a third of parents living near the coast reported health problems in their children.

Some reports said that people living along the Gulf coast were getting sick from the mixture of Corexit and oil. BP had said Corexit was harmless. But BP's own safety sheet for Corexit warned of "high and immediate human health hazards." Cleanup workers were often not given safety equipment. They were also told not to use respirators.

A study found that people exposed to the oil and dispersants had changes in their blood. This put them at higher risk for liver cancer and other problems. BP disagreed with the study's methods.

Legal Settlements

In June 2010, BP agreed to pay $20 billion into a trust fund. This fund was used to pay people affected by the oil spill. BP also set aside $100 million for oil workers who lost their jobs.

In March 2012, BP reached a settlement with businesses and residents affected by the spill. BP estimated this would cost over $9.2 billion.

In 2015, BP and five states agreed to an $18.5 billion settlement. This money was for penalties and other claims related to the Clean Water Act.

2022 Ohio Refinery Fire

On September 20, 2022, a fire at BP's Toledo refinery in Ohio killed two workers. The refinery was shut down but started working again in April 2023.

Political Influence

Working with Governments

BP has worked with the British government on agreements. BP said it pushed for a prisoner transfer agreement with Libya. This was because delays could hurt its business interests. However, BP said it was not involved in talks about a specific prisoner's release.

Political Contributions

In 2002, BP's chief executive said the company would stop making political contributions from its corporate funds. However, in 2010, it was reported that BP North America had donated millions to political groups. BP said this only applied to contributions to individual candidates.

In 2009, BP spent a lot of money working with the U.S. Congress. In 2011, BP spent over $8 million on lobbying.

Oman 1954 War

In 1937, Iraq Petroleum Company (IPC), partly owned by BP, signed an oil agreement with the Sultan of Muscat. In 1952, IPC offered money to help the Sultan's forces take over parts of Oman. This led to the Jebel Akhdar War in Oman in 1954.

Market Investigations

US authorities accused BP of trying to control the propane market in 2004. In 2007, BP paid $303 million in fines and payments. It was charged with trying to unfairly control propane prices. BP paid a large civil penalty and agreed to have its trading activities watched.

In November 2010, US regulators started investigating BP for possibly trying to control the gas market. BP denied any wrongdoing. In May 2013, the European Commission investigated BP for possibly reporting wrong oil prices. This investigation was dropped in 2015 due to lack of evidence.

Documents from a 2016 bid showed BP claimed a large oil spill cleanup would "boost local economies." BP also said a diesel spill would be "socially acceptable."

In April 2018, an internal email from BP in New Zealand was leaked. It showed plans to raise gas prices in some areas. This led to a government investigation into regional gas prices.

See also

In Spanish: BP para niños

In Spanish: BP para niños

| Delilah Pierce |

| Gordon Parks |

| Augusta Savage |

| Charles Ethan Porter |