Smoot–Hawley Tariff Act facts for kids

|

|

| Long title | An Act To provide revenue, to regulate commerce with foreign countries, to encourage the industries of the United States, to protect American labor, and for other purposes. |

|---|---|

| Nicknames | Smoot–Hawley Tariff, Hawley–Smoot Tariff |

| Enacted by | the 71st United States Congress |

| Effective | March 13, 1930 |

| Citations | |

| Public law | Pub.L. 71-361 |

| Statutes at Large | ch. 497, 46 Stat. 590 |

| Codification | |

| U.S.C. sections created | 589 |

| Legislative history | |

|

|

The Tariff Act of 1930, also known as the Smoot–Hawley Tariff, was a law in the United States. It put high taxes on goods brought into the country. This type of policy is called protectionism, which aims to protect local businesses.

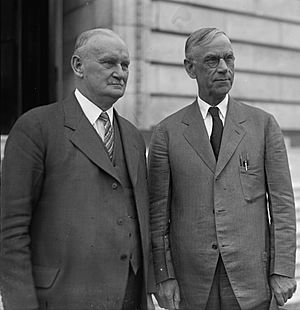

The law was named after its main supporters, Senator Reed Smoot and Representative Willis C. Hawley. President Herbert Hoover signed it into law on June 17, 1930. This act raised taxes on over 20,000 imported products.

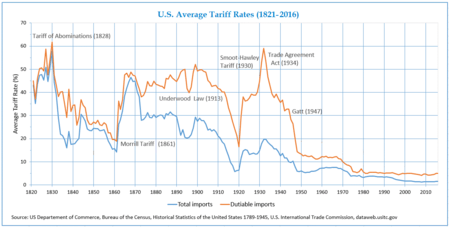

The taxes under this law were some of the highest in U.S. history. Only the Tariff of 1828 had higher rates. Other countries reacted by putting their own taxes on American goods. This led to a big drop in both American exports and imports during the Great Depression. Many experts believe the Smoot–Hawley Tariff made the Great Depression worse.

Contents

Why the Tariff Was Created

In 1922, the U.S. Congress passed a law called the Fordney–McCumber Tariff Act. This law also increased taxes on imported goods.

By the late 1920s, American factories were making a lot of products. This was partly because of new technologies like electrification. Farmers were also producing more food than people could buy. This situation was called overproduction.

Some leaders, like Senator Smoot, thought that raising taxes on imports would help. They believed it would protect American jobs and farmers from foreign competition. This was especially important as the world economy started to slow down in late 1929.

Senator Smoot was a Republican from Utah. He led the Senate Finance Committee. Representative Willis C. Hawley was a Republican from Oregon. He led the House Ways and Means Committee.

During his 1928 election campaign, President Herbert Hoover promised to help farmers. He said he would raise taxes on farm products from other countries. After he won, Hoover asked Congress to raise taxes on farm goods. He also wanted to lower taxes on industrial goods.

How the Law Was Passed

The House of Representatives passed their version of the law in May 1929. This version raised taxes on both farm and factory goods. The House voted 264 to 147 in favor of the bill.

The Senate discussed their bill until March 1930. Many senators changed their votes to help industries in their own states. The Senate passed their bill 44 to 42.

Then, a special committee combined the two versions of the bill. They mostly chose the higher tax rates from the House version. The House then approved this final bill 222 to 153. President Hoover signed it into law on June 17, 1930.

Who Opposed the Tariff?

Many people were against the Smoot–Hawley Tariff. In May 1930, over 1,000 economists in the U.S. signed a petition. They asked President Hoover to stop the law from passing.

Important business leaders also spoke out. Henry Ford, who founded Ford Motor Company, called the law "an economic stupidity." Thomas W. Lamont, a top executive at J. P. Morgan, begged Hoover not to sign it.

President Hoover himself did not like the bill. He called it "vicious" and thought it would hurt international cooperation. However, he eventually signed it. He was pressured by his own political party, his Cabinet, and other business leaders.

Hoover's worries came true. After the law passed, countries like Canada raised their own taxes on American goods.

Franklin D. Roosevelt also spoke against the act. He did this during his campaign for President in 1932.

Other Countries Reacted

The Smoot–Hawley Tariff caused other countries to react. Many protested and put their own trade restrictions on American products. American exports to countries that protested fell by 18%. Exports to countries that put up their own tariffs fell by 31%.

Countries started threatening to react even before the law was passed. By September 1929, Hoover's government had received protests from 23 trading partners. But these warnings were not listened to.

In May 1930, Canada, a close trading partner, put new taxes on 16 American products. These products made up about 30% of U.S. exports to Canada. Canada also started to trade more with the British Empire. Other countries like France and Britain found new trade partners.

The Great Depression got worse for workers and farmers. This happened even though Smoot and Hawley had promised prosperity. As a result, Hawley lost his chance to run for re-election. Smoot was one of 12 Republican Senators who lost their seats in the 1932 elections.

How High Were the Taxes?

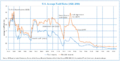

The taxes on goods that could be taxed reached 59.1% in 1932. This was the second highest rate in U.S. history. The highest was 61.7% in 1830.

However, many goods were not taxed at all. In 1933, 63% of all imports were tax-free. When you include both taxed and untaxed goods, the average tax rate was 19.8% in 1933. This was still lower than the average rate of 29.7% from 1821 to 1900.

The average tax rate on taxable imports went up from 40.1% in 1929 to 59.1% in 1932. This was a big jump. However, tax rates had been high before, between 1865 and 1913. They had also risen sharply at other times without causing a global depression.

What Happened After the Law?

At first, the tariff seemed to work. Factory jobs, building projects, and industrial production all increased. But bigger economic problems were happening, like weak banks. When a major bank in Austria failed in 1931, the problems with the Smoot–Hawley Tariff became clear.

U.S. imports dropped by 66% from $4.4 billion in 1929 to $1.5 billion in 1933. Exports also dropped by 61%. Overall, world trade fell by about 66% between 1929 and 1934.

Unemployment was 8% in 1930 when the law passed. But the new law did not help lower it. The unemployment rate jumped to 16% in 1931 and 25% in 1932–1933. Some people argue if the tariff was the only reason for this.

Unemployment only fell below 1930s levels during World War II. At that time, the American economy grew very quickly.

Some economists believe the Smoot–Hawley Act was only a small cause of the Great Depression. They point out that imports and exports were a small part of the U.S. economy at the time.

Ending the High Tariffs

In 1932, the Democratic Party promised to lower tariffs. After winning the election, President Franklin D. Roosevelt and the Democratic Congress passed the Reciprocal Trade Agreements Act of 1934.

This new law allowed the President to make agreements with other countries to lower tariffs. These agreements only needed a simple majority vote in Congress. This was a key step in how the U.S. handled trade after World War II. It was understood that the "tit-for-tat" reactions from other countries had greatly reduced trade in the 1930s.

After World War II, leaders wanted to prevent similar situations. They pushed for international trade agreements. The General Agreement on Tariffs and Trade (GATT) was signed in 1947. This agreement helped slowly lower tariffs around the world for the next 50 years.

Even after World War II, the U.S. continued to lower its tariffs. Other countries often kept their tariffs high. A study in 1951 found that only seven nations had lower tariffs than the U.S. (5.1%). Many countries, including the United Kingdom, had higher rates than the Smoot–Hawley peak of 19.8%.

The Tariff in Modern Talks

The Smoot–Hawley Tariff is still talked about today. For example, during a debate about the North American Free Trade Agreement (NAFTA) in 1993, Vice President Al Gore mentioned it. He gave Ross Perot a picture of Smoot and Hawley shaking hands.

In 2009, Representative Michele Bachmann mistakenly called it the "Hoot–Smalley Act." She also wrongly said Franklin Roosevelt signed it and blamed it for the Great Depression.

Some people have compared the Smoot–Hawley Act to newer laws. For example, the 2010 Foreign Account Tax Compliance Act (FATCA) has been called "the worst economic idea... since Smoot–Hawley."

Forced Labor and the Tariff Act

Before 2016, the Tariff Act had a rule about goods made with forced labor. It said that products made by prisoners or forced labor could not be brought into the U.S. However, there was an exception. If the U.S. did not make enough of a product to meet demand, then forced labor goods could be imported.

This exception was removed in 2016. A new bill, signed by President Barack Obama, made it illegal to import goods made with forced labor, no matter what.

Images for kids

See also

In Spanish: Ley Hawley-Smoot para niños

In Spanish: Ley Hawley-Smoot para niños