Chase Bank facts for kids

The current logo, in use since 2005

|

|

|

Trade name

|

Chase Bank |

|---|---|

| Subsidiary | |

| Industry | Banking |

| Predecessor | The Manhattan Company |

| Founded | 1799 |

| Founder | John Thompson |

| Headquarters |

,

U.S.

|

|

Number of locations

|

4,700 branches 15,000 ATMs nationwide 100 countries |

|

Area served

|

United States |

|

Key people

|

Jamie Dimon (chairman and CEO) |

| Products | Financial services |

| Services | Retail Financial Services Card Services Commercial Banking |

| Revenue | US$124.54 billion (2022) |

| US$42.12 billion (2022) | |

| Total assets | US$4 trillion (2022) |

|

Number of employees

|

250,355 (2022) |

| Parent | JPMorgan Chase |

Chase Bank is a large American bank. It is part of a bigger company called JPMorgan Chase. Chase Bank helps regular people and businesses with their money. It has its main office in New York City.

Chase Bank was once known as Chase Manhattan Bank. This name changed after it joined with J.P. Morgan & Co. in 2000. Before that, Chase Manhattan Bank was formed in 1955 when Chase National Bank and the Manhattan Company merged. Over the years, Chase has grown by joining with other banks like Chemical Bank and Bank One Corporation. In 2008, it took over most of Washington Mutual's business. More recently, in May 2023, it also acquired parts of First Republic Bank.

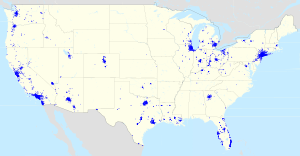

Chase has over 4,700 branches and 15,000 ATMs across the United States. As of 2023, it had 18.5 million checking accounts. JPMorgan Chase & Co. has many employees and works in over 100 countries. In 2022, it was the largest bank in the United States based on its total assets. It also has the most branches in the U.S. and is present in all the connected states. Chase is one of the "Big Four" banks in the United States.

Contents

The Story of Chase Bank

The history of Chase Bank goes back to two main banks: The Bank of The Manhattan Company and Chase National Bank. These two banks joined together in 1955 to create The Chase Manhattan Bank.

The Manhattan Company

The Manhattan Company started on September 1, 1799. It was founded by Aaron Burr, who was a famous American politician. The company was first set up to bring clean water to New York City. But it also quickly started a bank, which was a clever way to create a new bank in the city.

In 2006, the modern Chase Bank bought the part of the Bank of New York that served regular people. The Bank of New York later joined with another company to become BNY Mellon.

Chase National Bank

Chase National Bank was started in 1877 by John Thompson. It was named after Salmon P. Chase, who was a very important government official. However, Salmon P. Chase had no direct connection to the bank, as he had passed away four years earlier.

In the 1920s, Chase National Bank grew by buying smaller banks. A very important purchase was the Equitable Trust Company of New York in 1930. This made Chase the biggest bank in the U.S. and even the world at that time. A major owner of Equitable Trust was John D. Rockefeller Jr., whose family was very wealthy.

Chase mainly worked with other big financial companies and large businesses. It had strong ties to the oil industry and helped finance major projects like Rockefeller Center.

Joining Together: Chase Manhattan Bank

In 1955, Chase National Bank and The Manhattan Company merged. The new bank was called The Chase Manhattan Bank. Even though Chase was much bigger, the deal was set up so that The Manhattan Company officially bought Chase National. This was because The Manhattan Company had a very old rule that made it easier to do the merger this way.

For the new Chase Manhattan Bank, a special octagon-shaped logo was created in 1961. This shape is still part of the bank's logo today. The octagon is meant to look unique and modern. Chase says the sides of the octagon show forward movement, and the empty space in the middle means progress starts from the center. It also shows that the bank is one unit made of different parts.

Under leaders like David Rockefeller, the bank changed its structure in 1969. It became a "bank holding company" called the Chase Manhattan Corporation. This allowed it to own other companies. Chase Manhattan also expanded into states like Arizona and Connecticut by buying other banks.

Mergers with Chemical and J.P. Morgan

In 1995, Chemical Bank of New York and Chase Manhattan Bank decided to merge. This merger was completed in 1996. Even though Chemical Bank was technically the one that survived, the new company kept the Chase name. This was because the original rules for Chase said its name had to be kept in any future business. That's why it's known as JPMorgan Chase today.

In 2000, the combined Chase Manhattan bought J.P. Morgan & Co.. This was one of the biggest bank mergers ever. The new company was named JPMorgan Chase. In 2004, the bank bought Bank One, which made Chase the largest issuer of credit cards in the United States. JPMorgan Chase also acquired Bear Stearns and Washington Mutual in 2008 and 2009. After these mergers, Chase closed some branches that were too close to each other.

The chart below shows some of the major mergers and acquisitions that led to Chase Manhattan Bank before 1995:

| Chase Manhattan Bank (merged 1995) |

|

||||||||||||||||||||||||||||||

Joining with Bank One

In 2004, JPMorgan Chase merged with Bank One Corp. from Chicago. This merger brought Jamie Dimon to JPMorgan Chase. He became the president and later the CEO. Dimon quickly made changes to save money and put Bank One executives into important roles. He became CEO in 2006.

Bank One Corporation was formed in 1998 when Banc One and First Chicago NBD merged. These companies had also grown by joining with many other banks. The merger between Bank One and JPMorgan Chase meant that the main office stayed in New York City. However, the part of Chase that deals with regular customers moved its main operations to Chicago.

The chart below shows some of the major mergers and acquisitions that led to Bank One:

| Bank One (merged 1998) |

|

|||||||||||||||||||||

Taking Over Washington Mutual

On September 25, 2008, JPMorgan Chase bought most of the banking business of Washington Mutual. This happened after Washington Mutual Bank was taken over by the government because it was failing. This was the largest bank failure in American history. JPMorgan Chase bought the bank's assets and customer accounts for $1.888 billion. Washington Mutual's shareholders lost all their money. Chase then changed all the Washington Mutual branches to Chase branches by late 2009.

Other Recent Expansions

In 2006, Chase bought Collegiate Funding Services, which became the basis for Chase Student Loans. In the same year, Chase also acquired the retail banking network of the Bank of New York Co.. This added 338 branches and 700,000 new customers in several states.

In 2019, Chase started opening new branches in Pittsburgh and other parts of Western Pennsylvania. This was a new step for Chase, as it was entering a market where it didn't have many branches before. Chase had to get special permission to open these branches because of its large size.

In August 2021, Chase announced that it had branches in all 48 of the connected United States. The last state to get a Chase branch was Montana, with the first branch opening in Billings.

Growing Outside the U.S.

In September 2021, JPMorgan Chase started offering retail banking services in the United Kingdom. They launched an app-based bank account under the Chase brand. This was the first time the company offered banking services to regular people outside of the United States.

See also

In Spanish: Chase Manhattan Bank para niños

In Spanish: Chase Manhattan Bank para niños