Jamie Dimon facts for kids

Quick facts for kids

Jamie Dimon

|

|

|---|---|

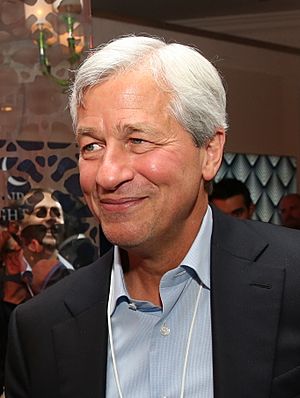

Dimon in 2016

|

|

| Born | March 13, 1956 New York City, U.S.

|

| Education | Tufts University (BA) Harvard University (MBA) |

| Occupation |

|

| Years active | 1979 – present |

| Spouse(s) |

Judith Kent

(m. 1983) |

| Children | 3 |

James Dimon (born March 13, 1956) is an American businessman. He has been the chairman and chief executive officer (CEO) of JPMorgan Chase since 2006. JPMorgan Chase is one of the biggest banks in the world.

Dimon started his career as a consultant. After getting his MBA degree from Harvard Business School in 1982, he worked at American Express. He learned a lot from his mentor, Sandy Weill. By age 30, Dimon became a chief financial officer (CFO) at a company called Commercial Credit. He later became its president. He also held important roles at other big companies like Travelers and Smith Barney. In 2000, he became CEO of Bank One. When Bank One joined with JPMorgan Chase in 2004, Dimon became a top leader there. He took over as CEO of JPMorgan Chase in 2006.

He was also on the board of directors for the Federal Reserve Bank of New York. This is an important part of the U.S. banking system. Time magazine has named him one of the world's 100 most influential people several times. In May 2025, Forbes magazine estimated his wealth at $2.5 billion.

Contents

Early Life and Education

Jamie Dimon was born on March 13, 1956, in New York City. He grew up in the Queens area. His family had Greek ancestry. His grandfather was a banker in Greece. He later changed the family name to Dimon. Jamie has two brothers, Peter and Ted. Both his father and grandfather worked as stockbrokers.

Dimon went to a private school called the Browning School in Manhattan. After that, he studied economics and psychology at Tufts University. He graduated in 1978 with high honors. While at Tufts, he worked a summer job at a company called Shearson. His mother helped him get this job.

After college, Dimon worked as a consultant for a few years. Then he went to Harvard Business School. He graduated in 1982 with an MBA degree. He was among the top students in his class. After Harvard, he joined American Express. He chose this over other big investment banks. His mentor, Sandy Weill, promised him it would be "fun."

Career Highlights

Building Financial Companies

In 1985, Sandy Weill left American Express, and Jamie Dimon followed him. They took over a company called Commercial Credit. Dimon became the chief financial officer at just 30 years old. He helped improve the company a lot. Through many mergers, Dimon and Weill created a huge financial company called Citigroup in 1998.

However, Dimon left Citigroup in November 1998. There were disagreements between him and Weill. Some say Dimon wanted to be treated as an equal partner.

Leading JPMorgan Chase

In March 2000, Dimon became the CEO of Bank One. This was the fifth largest bank in the U.S. In July 2004, Bank One joined with JPMorgan Chase. Dimon became a top leader in the new combined company. On December 31, 2005, he was named CEO of JPMorgan Chase. A year later, he also became its chairman.

Under Dimon's leadership, JPMorgan Chase has grown a lot. It has become a leading U.S. bank. It has many assets and a high stock value. In 2009, he was recognized as one of the "TopGun CEOs."

In 2012, JPMorgan Chase announced a big trading loss. It was at least $2 billion. Dimon said the trading strategy was "flawed" and "poorly executed." This event was investigated by several U.S. government groups.

During Dimon's time as head of JPMorgan Chase, the bank has faced many legal issues. It has paid large fines to the U.S. government. For example, the bank paid a $13 billion settlement. This was related to how some home loans were sold before the 2007–2008 financial crisis. Dimon said this settlement was "unfair." He noted that many claims were for companies JPMorgan Chase bought during the crisis. The government had encouraged these purchases.

How Jamie Dimon is Paid

Jamie Dimon is one of the few bank CEOs who has become a billionaire. This is mostly because of his ownership in JPMorgan Chase. In 2011, he received a $23 million pay package. This was more than any other bank CEO in the U.S. However, his pay was lowered to $11.5 million in 2012. This happened after the bank's trading losses.

In 2014, he received $20 million for his work in 2013. That year, the bank had record profits. More recently, Dimon received $34.5 million in 2022. He received $36 million in 2023. In 2024, his pay was $39 million.

His Business Style

Dimon is known for carrying a paper with lists of things to do. He likes to check things off as he finishes them. He has also talked about using a method called the OODA loop. This helps him evaluate different situations.

Political Involvement

From 1989 to 2009, Dimon mostly supported the Democratic Party. In 2012, he said he was "barely a Democrat." After Barack Obama became president in 2008, some thought Dimon might become the Secretary of the Treasury. Obama later chose someone else. Obama did say that Dimon did "a pretty good job" managing his company during the financial crisis.

Dimon has had good connections with people in the Obama White House. He was one of a few CEOs who had easy access to the Treasury Secretary. However, Dimon often disagreed with some of Obama's policies in public. During the 2016 vote for the United Kingdom to leave the European Union (Brexit), Dimon and JPMorgan Chase supported staying in the EU.

In December 2016, Dimon joined a business group for then-President-elect Donald Trump. This group gave advice on economic issues. The group later ended. During Trump's presidency, Dimon supported his tax cuts. But he did not agree with Trump's policies on immigration and trade. In 2019, Dimon said the U.S. economy was very strong. But he also pointed out problems like income inequality.

During the 2020 presidential election, Dimon asked candidates to respect the democratic process. He also asked for a peaceful transfer of power. He later spoke out against the attack on the U.S. Capitol in 2021. In 2021, Trump criticized Dimon because his company did business in China.

In 2023, some people encouraged Dimon to run for president in 2024. He said he had no plans to run for office at that time. He said he was happy leading JPMorgan Chase. He expects to stay there for several more years. In November 2023, Dimon said he preferred Nikki Haley as the Republican candidate for president. In August 2024, he wrote an article in The Washington Post. He said the next president must "restore our faith in America." He did not support either Trump or Kamala Harris in that article. However, in October 2024, The New York Times reported that Dimon was privately supporting Harris's campaign.

After Donald Trump became president again in January 2025, Dimon said he supported Trump's tariff policies. Tariffs are taxes on goods from other countries. Dimon had previously said that tariffs could harm the U.S. economy. In March 2025, he said tariffs were causing uncertainty in the markets.

Personal Life

In 1983, Jamie Dimon married Judith Kent. They met at Harvard Business School. They have three daughters: Julia, Laura, and Kara Leigh. His daughters went to different universities. Laura is a journalist and producer for ABC News.

In 2014, Dimon was diagnosed with throat cancer. He had radiation and chemotherapy treatments. He finished his treatment in September 2014. In March 2020, at age 63, Dimon had emergency heart surgery. He recovered well from the surgery. During his recovery, other leaders ran the bank. In April 2020, he returned to work remotely due to the COVID-19 pandemic.

Awards and Honors

- 1994: The Browning School Athletic Hall of Fame

- 2006: Golden Plate Award from the American Academy of Achievement

- 2010: The Executives' Club of Chicago's International Executive of the Year

- 2011: National Association of Corporate Directors Directorship 100

- 2012: Intrepid Salute Award

- 2016: Americas Society Gold Medal

- 2022: France's Legion of Honour

See also

In Spanish: Jamie Dimon para niños

In Spanish: Jamie Dimon para niños