Hedge fund facts for kids

A hedge fund is a special kind of investment fund that gathers money from many investors. It uses different and sometimes complex ways to invest this money. The main goal of a hedge fund is to make money for its investors, no matter if the overall market is going up or down. They try to protect investments from big market changes.

Hedge funds are different from regular mutual funds that most people can invest in. They often use strategies like selling borrowed stocks (hoping to buy them back cheaper) or using borrowed money to increase potential gains. Because of these more complex methods, hedge funds are usually only available to very wealthy individuals or large organizations like institutional investors.

Even though hedge funds have more freedom in how they invest, new rules were put in place after the 2008 financial crisis. These rules help governments keep a closer eye on them. Hedge funds can be risky, but some strategies are designed to be less bumpy than investing directly in the stock market. Research shows that when hedge funds get involved with companies, it can sometimes make those companies work better.

Hedge funds typically charge two types of fees. One is a yearly fee based on the total money in the fund (often 2%). The other is a "performance fee," which is a share of the profits the fund makes (often 20%). Hedge funds have been around for many years and have become a very big part of the money management world, holding trillions of dollars.

Contents

What does "Hedge" mean?

The word "hedge" originally meant a fence made of bushes. In finance, it became a way to describe trying to limit or reduce risk. Early hedge funds tried to protect their investments from big market changes. They did this by making opposite bets, like buying some stocks while also betting that other similar stocks would go down.

Today, hedge funds use many different ways to invest. Not all of these methods directly "hedge" or protect against risk in the same way the first funds did.

A Brief History of Hedge Funds

In the 1920s, there were many ways for rich people in the US to invest their money. One early example was the Graham-Newman Partnership. Famous investor Warren Buffett even called it an early type of hedge fund.

The idea of a "hedged fund" was first used by Alfred Winslow Jones in 1949. He created the first modern hedge fund structure. Jones used the term "hedged" because his fund aimed to manage investment risks from changes in the financial markets. He also set up the common fee structure: a 2% yearly fee on assets and a 20% fee on profits.

In the 1970s, many hedge funds focused on just one strategy. Many of them closed during tough economic times in the early 1970s because they lost a lot of money. But they became popular again in the late 1980s.

The number of hedge funds grew a lot in the 1990s, especially during the stock market boom. Investors liked that the managers' pay was linked to the fund's success. Over the next ten years, hedge funds started using many more types of strategies. Large organizations like pension funds in the US began putting more of their money into hedge funds.

Hedge funds became very popular worldwide in the early 2000s. By 2008, they managed about $1.93 trillion. However, the 2008 financial crisis caused many funds to limit withdrawals, and their total money managed went down. But they recovered, and by 2011, they managed almost $2 trillion. Most of this money came from large organizations.

By the mid-2010s, the hedge fund industry started to change. Many smaller, older funds struggled, while larger, more established firms grew. The number of new hedge funds starting up is now less than the number closing. In July 2017, hedge funds reached a record $3.1 trillion in money managed.

Famous Hedge Fund Managers

Many people have become very well-known for managing hedge funds. Here are a few examples:

- George Soros of Quantum Group of Funds

- Ray Dalio of Bridgewater Associates, which is one of the world's largest hedge fund firms.

- Steve Cohen of Point72 Asset Management.

- John Paulson of Paulson & Co..

- Kenneth Griffin of Citadel.

How Hedge Funds Invest (Strategies)

Hedge funds use many different ways to invest money. These are often grouped into four main types: global macro, directional, event-driven, and relative value. A fund might use just one strategy or a mix of several.

The fund's official document, called a prospectus, tells potential investors about its strategy. It also explains what types of investments it will make and how much borrowed money it might use.

Hedge fund strategies can involve different types of assets, like stocks, bonds, commodities (like gold or oil), and currencies. They might use tools like futures or options. Some funds have managers who pick investments, while others use computer programs to make decisions.

Sometimes, strategies are called "absolute return" if they aim to make money no matter what the market does. "Market neutral" funds try to avoid being affected by overall market ups and downs. "Directional" funds, on the other hand, try to profit from market trends and changes.

Global Macro Strategies

Global macro hedge funds make big bets on stocks, bonds, or currencies around the world. They try to predict how major global economic events will affect prices. For example, they might bet on a country's currency if they expect its economy to grow or shrink.

These funds have a lot of freedom to invest in many different markets. But timing is very important for them to make good profits. Global macro strategies can be based on human decisions or on computer models. They might try to follow existing market trends or predict when trends will reverse.

Directional Strategies

Directional strategies involve picking investments based on market movements, trends, or differences in prices. These funds are more affected by the overall market's ups and downs. An example is "long/short equity" funds. They buy stocks they think will go up (long) and sell borrowed stocks they think will go down (short).

Some directional funds focus on specific areas like "Emerging markets" (countries with developing economies). Others specialize in certain industries like technology or healthcare. "Fundamental growth" funds invest in companies that are growing faster than average. "Fundamental value" funds look for companies that seem cheaper than they should be.

Event-Driven Strategies

Event-driven strategies look for investment opportunities related to specific company events. These events can include things like company mergers, acquisitions, bankruptcies, or liquidations (when a company sells off its assets). Managers try to find stocks that are priced incorrectly before or after these events.

Large investors like hedge funds often use these strategies because they have the knowledge to analyze complex company events. These events usually fall into three groups:

- Distressed Securities: Investing in bonds or loans of companies that are having serious financial trouble or are close to bankruptcy. The goal is to profit when these companies recover.

- Risk Arbitrage: Buying and selling stocks of companies that are merging. They try to profit from small price differences between the companies' stocks before the merger is complete. The "risk" is that the merger might not happen.

- Special Situations: Investing based on other events that could change a company's stock value. This could be a company changing its structure, buying back its own shares, or selling off parts of its business.

Relative Value Strategies

Relative value strategies look for small price differences between related investments. For example, if two similar bonds are priced differently, a fund might buy the cheaper one and sell the more expensive one. These strategies often try to be "market neutral," meaning they are not much affected by the overall market's direction.

Some examples of relative value strategies include:

- Fixed Income Arbitrage: Finding price differences between related bonds.

- Equity Market Neutral: Buying and selling stocks in the same industry or sector to profit from price differences, while also protecting against overall market changes.

- Convertible Arbitrage: Profiting from price differences between a company's convertible bonds and its regular stocks.

- Statistical Arbitrage: Using computer models to find tiny price differences between many securities.

What are the Risks?

Investing in hedge funds can add variety to an investor's overall portfolio, which might help reduce risk. Hedge fund managers often try to make returns that don't move exactly like the stock market. While "hedging" can reduce some risks, it can also create new ones. So, overall risk is reduced but never completely gone. Studies have shown that hedge funds can be less volatile (less up and down) than the general stock market.

Managing Risk

Most investors in hedge funds are expected to understand the risks involved. Hedge fund managers use many strategies to protect the fund and its investors. Large hedge funds often have very advanced ways of managing risk. It's common for them to have special risk officers who check and manage risks but don't make trading decisions.

They use different ways to measure risk, looking at how much borrowed money the fund uses, how easily assets can be bought or sold, and the investment strategy. Investors also check the fund's operations to make sure there are no errors or fraud. They look at how the fund is run and if its strategy can last.

Transparency and Rules

Hedge funds are private, so they don't have to share as much information publicly as other types of funds. This can sometimes make them seem less transparent. Also, some people think their managers don't have as much government oversight. However, new rules in the US and Europe since 2010 require hedge fund managers to report more information, which has increased transparency.

Large investors are also pushing for better risk management and more transparency from hedge funds. Funds are now sharing more details about how they value investments, what they own, and how much borrowed money they use.

Hedge funds share some risks with other types of investments. For example, there's liquidity risk. This means how easily an asset can be bought or sold. Hedge funds often have "lock-up periods" where investors can't take their money out for a certain time.

There's also "manager risk," which comes from how the fund is managed. This includes things like a manager moving away from their area of expertise. Other risks include:

- Valuation risk: The risk that the value of investments might not be accurate.

- Capacity risk: Putting too much money into one strategy, which can hurt performance.

- Concentration risk: Having too much money in one investment or sector.

- Leverage risk: The risk that comes from using borrowed money. While leverage can increase profits, it can also lead to bigger losses.

Compared to big banks, hedge funds generally use less borrowed money. Managers often invest their own money in the fund, which gives them an extra reason to manage risk carefully.

Fees and How Managers are Paid

Hedge fund management firms usually charge two types of fees: a management fee and a performance fee.

Fees Paid to Hedge Funds

- Management Fees: This is a yearly fee, usually 1% to 4% of the total money in the fund (2% is common). It's paid monthly or quarterly and covers the fund's running costs.

- Performance Fees: This is typically 20% of the fund's profits each year. It's meant to encourage managers to make money for investors. Some people, like Warren Buffett, have criticized these fees because managers share in the profits but not the losses, which might encourage risky behavior.

Most performance fees include a "high water mark". This means the fund only charges a performance fee if it makes new profits, after recovering any losses from previous years. This stops managers from getting paid for simply recovering past losses.

Some funds also have a "hurdle" rate. This means the performance fee is only paid if the fund's profits go above a certain benchmark (like a specific interest rate). This ensures managers are rewarded only for returns that are better than what investors could get elsewhere.

Sometimes, hedge funds charge a "redemption fee" if investors take out their money too soon. This discourages short-term investing and helps the fund manage its money better. Unlike other fees, redemption fees usually stay in the fund and are shared among all investors.

How Portfolio Managers are Paid

The people who manage hedge funds often own the management firms. So, they get to keep the profits the business makes. This means performance fees (and any extra management fees) go to the owners.

Top hedge fund managers can earn huge amounts of money, sometimes billions of dollars in a good year. The earnings for the top 25 hedge fund managers are often more than what all 500 chief executives of the largest US companies earn combined. However, most hedge fund managers earn much less, especially if their funds don't make big profits.

If a portfolio manager breaks rules, like engaging in insider trading (using secret information to make trades), they can lose their past earnings. For example, one manager had to pay back $31 million to his employer because he broke the company's rules. This kind of behavior can also harm the firm's reputation.

How Hedge Funds are Set Up

A hedge fund is usually set up as a special type of company, often in another country. It is managed by an "investment manager," which is a separate company. Many hedge funds also use other companies to help them run their operations. These are called "service providers."

Prime Brokers

Prime brokers are usually parts of big investment banks. They help hedge funds with their trades, lend them money, and provide stocks for strategies like selling borrowed stocks. They can also hold the fund's assets and help with trading.

Administrators

Hedge fund administrators are responsible for figuring out the value of the fund's investments. They also handle the fund's daily operations and accounting. A key job is calculating the fund's "net asset value" (NAV), which is the price at which investors buy and sell shares. It's very important that the NAV is calculated correctly and on time.

Administrators also handle new investments and withdrawals from the fund. While US hedge funds don't have to use an administrator, most do. This helps avoid conflicts of interest and provides more transparency.

Auditors

An auditor is an independent accounting firm that checks the fund's financial records. They make sure the fund's financial statements are correct and follow standard accounting rules. Auditors may also check the fund's NAV and the total money it manages.

Distributors

A distributor helps market the fund to potential investors. Many hedge funds don't have a separate distributor; the investment manager handles the marketing themselves.

Where Funds are Located and Taxes

The legal setup of a hedge fund, including where it's based, often depends on the tax rules for its investors. Many hedge funds are set up in "offshore financial centers" (like the Cayman Islands) to help foreign or tax-exempt investors avoid certain taxes.

For example, US organizations that don't pay taxes (like pension plans) often invest in offshore hedge funds. This helps them keep their tax-exempt status. The investment manager, usually in a major financial city, pays taxes based on their local laws. In 2011, about half of all hedge funds were registered offshore. The Cayman Islands was the most popular offshore location.

Some hedge funds have used complex financial products to manage their tax obligations. For instance, some used "basket options" to delay reporting profits, which could affect how those profits were taxed. In 2015, the US tax agency (IRS) said these types of options must be declared on tax returns.

Where Investment Managers are Located

While many funds are offshore, the companies that manage them are mostly "onshore." The United States is the biggest center for hedge fund management. New York City and parts of Connecticut are key locations for US hedge fund managers.

London used to be the main center for hedge fund managers in Europe. However, after Brexit, some funds moved to other European cities like Frankfurt or Dublin, or even back to New York City. Interest in hedge funds has also grown a lot in Asia, especially in Japan, Hong Kong, and Singapore.

Types of Funds

- Open-ended funds: These funds keep issuing shares to new investors and allow investors to take out money regularly based on the fund's value.

- Closed-ended funds: These funds issue a fixed number of shares at the beginning, and these shares can be traded on stock exchanges.

- Listed hedge funds: Shares of these funds are traded on stock exchanges and can be bought by regular investors, not just wealthy ones.

Side Pockets

A "side pocket" is a way for a fund to separate investments that are hard to sell quickly or value accurately. When an investment is put into a side pocket, its value is calculated separately. Investors can't usually take their money out of side-pocketed investments as easily as from the main fund. This practice was used a lot during the 2008 financial crisis to hold investments until markets improved. However, it can be unpopular with investors because it limits their access to their money.

Rules and Regulations

Hedge funds must follow the laws and rules in the countries where they operate. In the US, hedge funds have different rules than mutual funds. Mutual funds have very detailed rules under the Investment Company Act of 1940. Hedge funds are often exempt from some rules because they only accept wealthy investors.

The most common rules for hedge funds focus on preventing fraud by financial advisers and managers. In 2010, new laws like the US Dodd-Frank Act and Europe's Alternative Investment Fund Managers Directive (AIFMD) added more reporting requirements for hedge funds.

In 2007, some leading hedge fund managers created their own voluntary rules called the Hedge Fund Standards. These were designed to promote transparency and good management in the industry. Groups like the Managed Funds Association in the US and the Alternative Investment Management Association in Europe also work to support the industry.

United States Rules

Hedge funds in the US have rules about reporting and keeping records. Many also fall under the Commodity Futures Trading Commission. The Securities Act of 1933 requires companies to register with the SEC before selling to the public. Most hedge funds avoid this by selling only to "private placement" investors. The Investment Advisers Act of 1940 has anti-fraud rules for hedge fund managers.

In 2004, the SEC started requiring some hedge fund advisers to register. This rule was later challenged. In 2007, the SEC adopted a new rule to increase the risk of action against negligent or fraudulent behavior. Managers with over $100 million must file public reports about their stock holdings. Registered advisers must also share their business practices and disciplinary history.

The US Dodd-Frank Act, passed in July 2010, requires SEC registration for advisers managing over $150 million. They must file forms with the SEC, sharing information about their assets and trades. This law also created the Financial Stability Oversight Council to monitor financial stability.

European Rules

In the European Union (EU), hedge funds are mainly regulated through their managers. In the United Kingdom, where most European hedge funds are based, managers must be authorized by the Financial Conduct Authority (FCA). Each country has its own rules, like limits on borrowed money in France.

The EU's Directive on Alternative Investment Fund Managers (AIFMD) aims to better monitor and control alternative investment funds. It requires EU hedge fund managers to register with national regulators and report more information. It also introduced a "passport" allowing funds authorized in one EU country to operate across the EU.

Offshore Rules

Some hedge funds are set up in offshore centers like the Cayman Islands or Luxembourg. These places have different rules regarding investors, privacy, and fund manager independence.

South Africa Rules

In South Africa, investment fund managers must be approved and registered by the Financial Services Board (FSB).

How Hedge Funds Perform

It can be hard to get performance numbers for individual hedge funds. They don't have to report their results publicly, and they often don't advertise. However, some industry groups and databases share summaries of their performance.

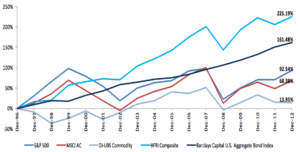

One estimate suggests that, on average, hedge funds returned about 11.4% per year before fees. Another study found that between 2000 and 2009, hedge funds generally did better than other investments and were less volatile. This was a very unpredictable time, including the dot-com bubble and a recession. However, more recent data shows that hedge fund performance has sometimes been lower than the overall market since 2009.

Hedge fund performance is often measured by comparing their returns to their risk. Tools like the Sharpe ratio are used. New ways to measure performance have also been developed to address some of the challenges in evaluating hedge funds.

Hedge Fund Indexes

In regular stock markets, indexes (like the S&P 500) show how the market is doing. But hedge fund indexes are more complicated. Hedge funds aren't traded on exchanges, and they don't have to publish their returns.

- Non-investable indexes: These try to show the average performance of hedge funds from a database. But they can have biases. For example, funds that choose to report might be doing better than those that don't. Also, if only surviving funds are looked at, it can make past returns seem better than they were.

- Investable indexes: These try to create an index that investors can actually put money into. But to do this, the hedge funds in the index must agree to certain terms, which means these indexes might not include the most successful managers.

- Hedge fund replication: This newer approach uses math to create a model of how hedge funds perform based on other financial assets. Then, they build an investment portfolio that tries to copy that performance.

Closures

In 2016, more hedge funds closed than during the 2009 recession. Some large pension funds pulled their money out because the funds weren't performing well enough to justify their high fees. Even though the total money managed by hedge funds reached over $3 trillion in 2016, the number of new hedge funds starting up was lower than before the 2008 financial crisis.

See also

In Spanish: Fondo de cobertura para niños

In Spanish: Fondo de cobertura para niños

- Activist shareholder

- Alternative investment

- Corporate governance

- Investment banking

- List of hedge funds

| Aurelia Browder |

| Nannie Helen Burroughs |

| Michelle Alexander |