Transaction account facts for kids

A transaction account is like your everyday money home at a bank or credit union. It's also called a checking account or current account. You can get to your money whenever you need it, which is why it's sometimes called a "demand deposit account." This account is super handy for paying bills, buying things, and getting cash.

You can use your transaction account in many ways:

- Taking out cash.

- Using a debit card to pay for stuff.

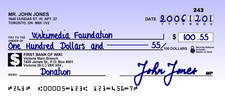

- Writing cheques (checks).

- Sending money electronically.

In simple terms, the money in these accounts is considered "liquid," meaning it's easy to access and use right away.

Banks and other financial places offer these accounts to both people and businesses. Sometimes, banks might charge a small fee to keep your account open, or they might charge for extra services like an overdraft (when you spend more money than you have).

Contents

How Checking Accounts Started

The idea of checking accounts began a long time ago in Holland, around the 1500s. Amsterdam was a busy trading city. People who had a lot of cash started giving it to "cashiers" to keep it safe. These cashiers charged a fee for looking after the money.

Over time, cashiers started offering more services. They would pay money to anyone who had a written note from a person who had deposited money with them. They kept the note as proof that they had paid.

This idea spread to other places, including England and its colonies in North America. In Boston in 1681, landowners would mortgage their land to cashiers. This meant they could then write checks against the money the cashier held for them.

In the 1700s in England, pre-printed checks and serial numbers started appearing. The word "cheque" also became common. It used to be hard to move checks between different banks, so places called "clearing houses" were created to make this easier.

Ways to Use Your Account

Transaction accounts give you a list of all your money movements. You can see these on a bank statement or in a passbook.

Here are common ways to use your account:

- ATM Cards: Use these to get cash from an ATM.

- Debit Cards: Pay directly for things at stores without using cash.

- Cash: Deposit or withdraw coins and banknotes at a bank branch.

- Cheques and Money Orders: Write a paper instruction for your bank to pay someone.

- Direct Debit: Allow companies to take money from your account automatically for bills.

- Standing Order: Set up automatic regular payments, like for rent.

- Electronic Transfers: Send money to another account using computers.

- Online Banking: Manage your money and send funds using the internet.

Sometimes, banks let your account go into overdraft. This means you spend more money than you have. If this happens, you are borrowing money from the bank, and they usually charge interest and fees.

How Accounts Differ by Country

In the United Kingdom and some other countries, transaction accounts are called "current accounts." They offer many ways to pay directly. A big difference is that UK current accounts often earn interest, sometimes as much as a savings account. Also, there are usually no charges for taking cash out at ATMs.

Money Transfer Systems

How money is transferred can be different in each country:

- Giro: A system for transferring funds, common in European countries.

- In the United Kingdom, the Faster Payments Service sends money almost instantly. BACS transfers take a few days, while CHAPS transfers happen on the same day.

- Canada has an Interac e-Transfer service.

- In India, NEFT and RTGS services clear funds within a day.

Accessing Your Money

Bank Branches

You can visit a bank branch for many things, like getting cash or asking for financial advice. Sometimes, you might need to tell the bank ahead of time if you want to withdraw a very large amount of cash.

Many things you used to only do at a branch can now be done in other ways, like using ATMs, online, or with your phone.

Automated Teller Machines (ATMs)

ATMs let you do banking tasks without going inside a bank. You can get cash from your account even when the bank is closed. However, ATMs usually have limits on how much cash you can take out each day.

Mobile Banking

With mobile banking, you can use your mobile phone to do banking tasks, pay bills, see your balance, and check statements. In the UK, mobile banking has become the most popular way for people to manage their money.

Internet Banking

Internet or online banking lets you do banking tasks, pay bills, and check your account from anywhere you have internet access. This is very convenient because you don't have to travel to a bank or wait in line. However, there are usually limits on how much money you can transfer online in one day.

Telephone Banking

Telephone banking lets you do banking tasks over the telephone. Often, telephone banking services are open for longer hours than bank branches.

Mail Banking

Some banks let you deposit cheques into your account by mail. This is useful for customers of virtual banks (banks without physical branches) or for people who live far from a bank.

Stores and Merchants

Many stores and businesses now accept debit cards for purchases. This is very common, as many people prefer to pay electronically.

Cost of Accounts

The fees for a transaction account depend on many things, like the country's rules, interest rates, and the bank's size. For example, a direct bank (which mainly operates online) might offer low-cost or free banking because they don't have as many physical branches.

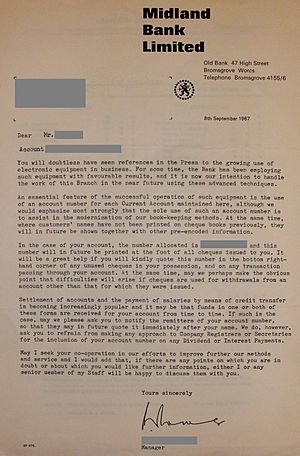

In the United Kingdom, most current accounts have been free since 1984. This happened when Midland Bank stopped charging fees to attract more customers. Other banks had to do the same to keep their customers. Now, free banking account holders are usually only charged if they use an extra service, like an overdraft.

Some banks might charge a fee for each transaction or a flat monthly fee. Often, youths, students, or senior citizens don't pay fees for basic banking. Some accounts offer free transactions if you keep a very high amount of money in your account. Other charges might apply for overdrafts or if you don't have enough money in your account for a payment.

In the United States, some checking accounts don't have monthly fees. While many US checking accounts do charge fees, about one-third do not. The average monthly fee for checking accounts in the US is around $13.47, which adds up to about $161.64 per year.

Interest on Accounts

The main purpose of a transaction account is to help you manage your daily money, not to earn a lot of interest. So, most banks either pay no interest or a very small amount on the money in these accounts. This is different from savings accounts, which are designed to help your money grow with interest.

In the United Kingdom, some online banks offer higher interest rates on current accounts, sometimes even more than savings accounts. This is often because these online-only banks have lower operating costs.

High-Yield Accounts

Some special accounts, called high-yield accounts, pay a higher interest rate than typical checking accounts. Banks sometimes offer these to encourage customers to do more banking with them.

Borrowing Money with Your Account

Accounts can also be linked to ways of borrowing money, like overdrafts.

Overdraft

An overdraft happens when you spend more money than you have in your bank account. This makes your account balance go negative, meaning you are borrowing money from the bank. If you have an agreement with your bank for an overdraft, and you stay within that agreed limit, you'll usually be charged interest at a set rate. If you go over your agreed limit, you might face extra fees and a higher interest rate.

In the UK, most current accounts come with a pre-agreed overdraft limit. This limit is based on how much the bank thinks you can afford to repay. You can use this overdraft whenever you need it, and it can stay in place for a long time. Even though the bank can technically ask for the money back at any time, this rarely happens because overdrafts are profitable for banks.

See also

In Spanish: Cuenta corriente (banca) para niños

In Spanish: Cuenta corriente (banca) para niños

| Shirley Ann Jackson |

| Garett Morgan |

| J. Ernest Wilkins Jr. |

| Elijah McCoy |