History of monetary policy in the United States facts for kids

This article is about the history of money rules in the United States. These rules, called monetary policy, are connected to how much it costs to borrow money (interest rates) and how easy it is to get loans (credit).

Contents

Understanding Money Rules

Money rules, or monetary policy, help control how much money is available in a country. This includes managing short-term interest rates and the money banks keep.

The idea of a central bank, which manages a country's money, started with the Bank of England in 1694. This bank printed money and backed it with gold. The main goal was to keep the value of money stable and prevent coins from disappearing. Many countries set up central banks to link their money to gold, which meant they had to adjust interest rates often.

By the early 1900s, most industrial countries had central banks, including the Federal Reserve in the US, created in 1913. People realized that central banks could act as a "lender of last resort" – helping banks in trouble. They also understood that interest rates affected the whole economy.

Early American Banking

In the early 1800s, many small banks started in New England. Laws made it easy to create these banks. They helped wealthy people invest in new projects and allowed others to get loans. These early banks helped new businesses grow and were quite stable.

First National Banks

In 1781, during the American Revolutionary War, the Bank of North America was created in Philadelphia. It was the first bank allowed to print money for the whole country. Robert Morris, a key finance leader, wanted a national bank like the Bank of England to manage the government's money. This was important because earlier attempts to fund the war had failed badly.

Later, in 1791, the First Bank of the United States was set up. However, its permission to operate was not renewed in 1811. The Second Bank of the United States was then created in 1816 but closed in 1836.

Jackson's Fight Against the Bank

The Second Bank of the United States started in 1817. It was created because the US faced high inflation and struggled to pay for the War of 1812. The country's ability to borrow money was very low.

The Second Bank's permission to operate was set to end in 1836. It became a political target because it held the government's money, which state-chartered banks disliked. President Andrew Jackson strongly opposed renewing the bank's charter. He believed that giving so much power to one bank caused inflation and other problems.

In September 1833, President Jackson ordered that government funds be moved out of the Bank of the United States. These funds were then placed in state banks, often called Jackson's "pet banks".

The "Free Banking" Era (1837–1863)

Before 1838, a bank needed a special law to start. But in 1838, New York passed a "Free Banking Act," allowing anyone to start a bank if they met certain rules. This idea spread quickly. Banks could print their own money, backed by gold and silver coins. States set rules for how much money banks had to keep and what interest rates they could charge.

However, many banks started during this time were not stable. In some Western states, banking became "wildcat" banking. This meant banks printed money with little or no security. This led to many bank failures during economic downturns. It was confusing because different state bank notes had different values.

Late 1800s Banking Changes

National Bank Act

To fix the problems of "wildcat" banking, Congress passed the National Bank Act in 1863. This law created a system of banks that would be approved and watched by the federal government. It also created a national currency, backed by US government bonds. The Office of the Comptroller of the Currency was set up to check and regulate these national banks.

In 1865, Congress added a 10% tax on money printed by state banks. This encouraged many state banks to become national banks. It also led state banks to use "checking accounts" more often, which became a main way for banks to make money. Today, the US has a "dual banking system," where new banks can choose to be approved by either the state or federal government.

Gold Standard Debate

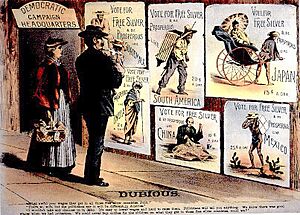

Toward the end of the 1800s, there was a big political fight over whether the US should use both gold and silver for its money (bimetallism) or just gold. During the American Civil War, the US used paper money not backed by gold or silver. In 1873, the government stopped allowing unlimited silver coinage, effectively putting the US on a gold-only standard. This angered people who wanted silver, calling it "The Crime of ’73." They believed it stopped inflation.

The Panic of 1893, a severe economic downturn, brought the money issue to the front. Those who wanted silver argued that using silver would increase the money supply, leading to more cash and prosperity. Those who favored gold said that silver would hurt the economy, and only a gold standard would bring back prosperity.

William Jennings Bryan led the Democratic Party in 1896, pushing for "Free Silver." The Republican Party, led by William McKinley, supported the gold standard. Bryan's famous "Cross of Gold speech" argued for silver. However, he lost the election. One reason was the discovery of new ways to get gold, which increased the world's gold supply and caused some inflation, making the need for silver less urgent.

20th Century Banking

The Federal Reserve System

The Panic of 1907 was a financial crisis that was stopped by a group of private banks acting together. This led to calls for a government agency to do the same. In response, the Federal Reserve Act of 1913 created the Federal Reserve System. This new central bank was meant to be a formal "lender of last resort" for banks during financial panics, when people try to take out all their money at once.

The Federal Reserve System includes several regional Federal Reserve Banks and a governing board. All national banks had to join. The Fed also created Federal Reserve notes (our paper money today) to make sure there was enough money in the country. The Federal Reserve System brought all US banks under its authority.

Leaving the Gold Standard

To fight the economic problems of the Great Depression in the 1930s, the US stopped linking its money directly to gold. In 1933, the government ordered people to exchange their gold coins for US dollars. The US dollar was no longer directly convertible to gold. This meant the dollar's value could change freely against other currencies. Markets reacted well, hoping it would end the fall in prices.

Bretton Woods System

After World War II, the Bretton Woods system was created. This was a set of rules for how countries would manage their money and trade. It was the first time countries agreed on a system to govern international money relations.

This system created the International Monetary Fund (IMF) and the International Bank for Reconstruction and Development (IBRD), which is now part of the World Bank Group. A key part of Bretton Woods was that each country tied its money to the US dollar, and the US dollar was tied to gold. The IMF helped countries with temporary payment problems.

Nixon Shock

In 1971, President Richard Nixon made several economic changes known as the Nixon shock. The most important change was ending the direct link between the United States dollar and gold. This effectively ended the Bretton Woods system of international money exchange.

Modern Central Banking

Central banks influence interest rates by changing the amount of money available. They do this mainly by buying or selling government debt. If a central bank wants to lower interest rates, it buys government debt, which puts more money into circulation. This allows banks to lend more money, making credit easier to get.

A central bank can only truly control its money policy if its country's money value (exchange rate) is allowed to float freely. If the exchange rate is fixed, the central bank has to buy or sell foreign money, which affects the amount of money in its own country.

In the 1980s, many experts believed that central banks should be independent from the government. This helps prevent politicians from using money rules for their own political goals, like winning elections. Independence usually means that the people who make money policy decisions have long, fixed terms.

In the 1990s, central banks started setting clear, public goals for inflation, like aiming for 2% inflation each year. If inflation goes higher, the central bank usually has to explain why. For example, the Bank of England became independent in 1998 and set an inflation target.

Experts still debate whether money rules can smooth out economic ups and downs. Some believe central banks can boost demand in the short term, while others think money only affects prices in the long run.

| Ernest Everett Just |

| Mary Jackson |

| Emmett Chappelle |

| Marie Maynard Daly |