First Bank of the United States facts for kids

Quick facts for kids |

|

|

First Bank of the United States

|

|

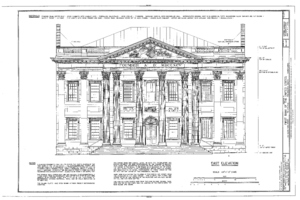

3rd Street facade (2009)

|

|

| Location | 120 S 3rd Street Philadelphia, Pennsylvania |

|---|---|

| Built | 1791 |

| Architect | Samuel Blodgett, and James Hoban |

| Architectural style | Greek Revival |

| NRHP reference No. | 87001292 |

| Added to NRHP | May 4, 1987 |

The First Bank of the United States was a very important bank in early American history. The United States Congress created it on February 25, 1791. It was meant to last for twenty years. This bank was the first of its kind in the United States. It helped the new country manage its money.

Alexander Hamilton, who was the first Secretary of the Treasury, had a big idea. He wanted to make the country's money system strong. He thought a national bank was key to this. It would help the government handle its money better. It would also make the nation's credit (its ability to borrow money) more stable.

The main building for the First Bank is in Philadelphia, Pennsylvania. It was finished in 1797. Today, it is part of Independence National Historical Park. It is known as a National Historic Landmark because of its history and beautiful design.

Contents

Why the First Bank Was Needed

In 1791, the United States was a very new country. It needed a strong financial system. Alexander Hamilton had a plan with three main parts. These parts would help the country's money matters.

First, he wanted the U.S. government to take on the war debts from the states. Second, he proposed creating a national bank. Third, he wanted to set up a national mint to make coins. He also suggested a federal tax on certain goods.

Hamilton's main goals were:

- To bring order and clear rules to the new nation's money system.

- To build trust in the U.S. financial system, both at home and with other countries.

- To fix problems with the paper money (called "Continentals") used during the American Revolutionary War.

In simpler terms, Hamilton wanted to:

- Have the U.S. government pay off the states' debts from the war.

- Raise money for the new government.

- Create a national bank and a single, common currency for everyone.

The tendency of a national bank is to increase public and private credit. The former gives power to the state for the protection of its rights and interests, and the latter facilitates and extends the operations of commerce amongst individuals.

Hamilton's Plan for the Bank

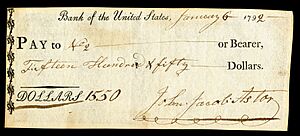

Hamilton presented his plan to the First Congress in 1790. He suggested that the First Bank of the United States would start with $10 million in stock. The U.S. government would buy the first $2 million of these shares.

Since the government didn't have $2 million, Hamilton had a clever idea. The bank would lend the money to the government. The government would then pay back this loan over ten years. The remaining $8 million in stock would be sold to the public. People in the U.S. and other countries could buy these shares. A key rule was that one-fourth of the price had to be paid in gold or silver. The rest could be paid with government bonds.

The bank's main job was to lend money. It would lend to the government and to private businesses. This would help with projects like building roads and other economic growth. The bank also handled the government's money. It stored collected taxes and made short-term loans to the government.

There were also important rules for the bank:

- The bank would have a twenty-year charter, from 1791 to 1811.

- During this time, no other federal bank could be created. States, however, could create their own banks.

- To prevent unfairness, the bank could not buy government bonds.

- Its directors had to rotate, meaning new people would take turns leading.

- The bank could not issue more money or debt than its actual value.

- People from other countries could own stock but could not vote.

- The Secretary of the Treasury could check the bank's records and remove government money if needed.

To make sure the government had enough money, Hamilton suggested a new tax. He wanted to increase the tax on imported alcohol. He also wanted to add a tax on whiskey made in the U.S. This tax led to a protest known as the Whiskey Rebellion.

Arguments Against the Bank

Jefferson's views:

"Hamilton's financial system had then passed. It had two objects; 1st, like a puzzle, to exclude popular understanding and inquiry; 2nd, as a machine for the corruption of the legislature; for he avowed the opinion, that man could be governed by one of two motives only, force or interest; force, he observed, in this country was out of the question, and the interests, therefore, of the members must be laid hold of, to keep the legislative in unison with the executive. And with grief and shame, it must be acknowledged that his machine was not without effect; that even in this, the birth of our government, some members were found sordid enough to bend their duty to their interests, and to look after personal rather than public good.

It is well known that during the war the greatest difficulty we encountered was the want of money or means to pay our soldiers who fought, or our farmers, manufacturers, and merchants, who furnished the necessary supplies of food and clothing for them. After the expedient of paper money had exhausted itself, certificates of debt were given to the individual creditors, with an assurance of payment so soon as the United States should be able. But the distresses of these people often obliged them to part with these for the half, the fifth, and even a tenth of their value; and speculators had made a trade of cozening them from the holders by the most fraudulent practices, and persuasions that they would never be paid. In the bill for funding and paying these, Hamilton made no difference between the original holders and the fraudulent purchasers of this paper."

Many people were against Hamilton's bank plan. They worried it would give too much power to the federal government. Secretary of State Thomas Jefferson and James Madison were key leaders of this opposition.

They argued that the bank was against the Constitution. They also felt it would mostly help rich merchants and investors. They thought it would not help the majority of regular people.

Jefferson and Madison, like many Southern members of Congress, also opposed the idea of a national mint. They believed that centralizing money power away from local banks was risky. They felt it would mostly benefit businesses in the North. They argued that the Constitution did not give Congress the power to create a bank. The Constitution only said Congress could regulate weights and measures and make coins.

The idea of a national mint passed easily. But the bank and the excise tax faced more debate. The House of Representatives passed the bank bill, even with strong objections. The Senate also passed it with fewer arguments.

The creation of the bank brought up important questions about the Constitution. Hamilton argued that the bank was a good way to use the government's powers. These powers, he said, were "implied" in the Constitution. Jefferson argued that the bank went against property laws. He also said it had little to do with the powers listed in the Constitution.

James Madison believed Congress did not have the power to create a bank. He pointed to the Tenth Amendment. This amendment says that any powers not given to Congress belong to the states or the people. He felt that if the Constitution's writers wanted Congress to have this power, they would have written it clearly.

The final decision rested with President George Washington. He carefully listened to his cabinet members' different opinions.

President Washington Approves

President George Washington was unsure about signing the "bank bill." He asked all his cabinet members for their written advice. Edmund Randolph, the Attorney General, thought the bill was unconstitutional. Jefferson agreed, saying it went against the spirit and words of the Constitution.

Hamilton, however, strongly defended the bank. He argued that if the government could create a company for a person, it could do the same for a business. He said the First Bank was a private business, not a government agency. He also argued that any government has the power to do what is needed to reach its goals, as long as the Constitution doesn't forbid it.

On February 25, 1791, President Washington was convinced. He believed the Constitution allowed for the bank. He then signed the "bank bill" into law.

On March 19, 1791, Washington chose three people to help start the bank. They were Thomas Willing, David Rittenhouse, and Samuel Howell. Thomas Willing later became the bank's first President in October 1791. He served until 1807. David Lenox took over until the bank's charter ended in 1811.

End of the Bank's Charter

After Alexander Hamilton left his job in 1795, the new Secretary of the Treasury, Oliver Wolcott, Jr., told Congress that the government needed more money. He suggested selling the government's shares in the bank. Congress quickly agreed to this. Hamilton disagreed, believing the money from these shares was meant to pay off the national debt. He tried to stop the sale but was not successful.

In 1811, the U.S. Senate voted on whether to renew the bank's charter. The vote was a tie. Vice President George Clinton cast the deciding vote against renewing the charter. Because of this, the First Bank's charter ended in 1811.

A few years later, in 1816, a new bank was created to take its place. This was called the Second Bank of the United States.

The Bank Building After 1811

After the First Bank's charter ended in 1811, a wealthy businessman named Stephen Girard bought most of its stock. He also bought the bank building and its furniture in Philadelphia. Girard then opened his own bank there, which later became known as Girard Bank.

Girard hired George Simpson, who had been the cashier at the First Bank. With seven other employees, Girard's bank opened on May 18, 1812. He even let the old First Bank's leaders use some offices to finish closing down their business.

Girard was the only owner of his bank. This allowed him to avoid a Pennsylvania law. This law said that groups of people needed a special charter from the state to open a bank. Since he owned it alone, he didn't need one.

The Historic Bank Building

The First Bank of the United States was built in Philadelphia, Pennsylvania. At that time, Philadelphia was the capital of the United States (from 1790 to 1800). The bank first started its work in Carpenters' Hall in 1791. This was about 200 feet from where its permanent building would be.

The design of the bank building is often credited to Samuel Blodgett. He was in charge of buildings for the new capital in Washington, D.C. Some people also think James Hoban designed it. The building was completed in 1795.

The First Bank building is recognized as a historic site. It became part of Independence National Historical Park in 1956. Experts from the Historic American Buildings Survey studied its architecture in 1958. On October 15, 1966, it was added to the National Register of Historic Places. Then, on May 4, 1987, it was named a National Historic Landmark. It is seen as an early example of important Classical Revival architecture.

Until about 2000, the building was used for offices by Independence National Historical Park. There were plans to put the Philadelphia Civil War Museum collection there, but the money for it didn't come through. Future plans for the building include housing the National Park Service's archaeology lab.

Images for kids

See also

In Spanish: Primer Banco de los Estados Unidos para niños

In Spanish: Primer Banco de los Estados Unidos para niños

| Delilah Pierce |

| Gordon Parks |

| Augusta Savage |

| Charles Ethan Porter |