Bank of America facts for kids

Bank of America Corporate Center in April 2006

|

|

| Public | |

| Traded as | |

| ISIN | [https://isin.toolforge.org/?language=en&isin=US0605051046 US0605051046] |

| Industry | Financial services |

| Predecessors |

|

| Founded | 1998 (via the merger of BankAmerica & NationsBank) |

| Headquarters | Bank of America Corporate Center,

,

United States

|

|

Number of locations

|

c. 3,700 retail financial centers, c. 15,000 ATMs (2024) |

|

Area served

|

Worldwide |

|

Key people

|

|

| Products |

|

| Revenue | |

|

Operating income

|

|

| AUM | |

| Total assets | |

| Total equity | |

| Owners | Berkshire Hathaway (9%) |

|

Number of employees

|

c. 213,000 (2024) |

| Divisions |

|

Bank of America Corporation, often called Bank of America or BoA, is a large American company that offers many financial services. It has its main office in Charlotte, North Carolina. The company helps people and businesses with things like banking, managing money, and investing.

Bank of America became the company it is today in 1998. This happened when two banks, NationsBank and an older Bank of America, joined together. It is now one of the biggest banks in the United States. It is also one of the largest banks in the world based on its market value. Bank of America is one of the "Big Four" banks in the U.S., serving a large number of American bank customers.

The history of Bank of America goes back a long way. One part of its history started in 1784 with the Massachusetts Bank. Another important part began in 1904. That's when Amadeo Giannini founded the Bank of Italy in San Francisco. He wanted to help Italian immigrants who sometimes had trouble getting banking services.

Over the years, Bank of America grew a lot through many mergers and acquisitions. It now includes well-known companies like Merrill Lynch, which helps with wealth management and investments.

Contents

- The Story of Bank of America

- How Bank of America Works

- Helping Communities

- Who Bank of America Competes With

- Important Buildings

- See also

The Story of Bank of America

The Bank of America we know today has a long and interesting history, built from many different banks joining together over time.

Early Beginnings and Growth

The story of Bank of America really began on October 17, 1904. A man named Amadeo Giannini started the Bank of Italy in San Francisco. He wanted to create a bank that would serve everyone, especially immigrants who were often treated unfairly by other banks.

In 1928, Giannini's Bank of Italy joined with another bank called Bank of America, Los Angeles. Two years later, in 1930, the combined bank was renamed Bank of America National Trust and Savings Association. This merger helped it become one of the largest banks in the country.

Growing Across California

Giannini was a pioneer in banking. He started opening many branches of the bank across California. By 1929, the bank had 453 offices in California. This made it very easy for people to access banking services.

Later, laws changed, and Bank of America had to separate from some of its other businesses, like insurance. Also, for a while, federal rules stopped the bank from opening branches outside California. It wasn't until the 1980s that Bank of America could start expanding its services to other states again.

In 1958, the bank introduced the BankAmericard. This was a new type of credit card that later became known as Visa in 1977. This was a big step in how people used credit.

Expanding Beyond California

After new laws were passed, Bank of America started to grow outside California. In 1983, it bought Seafirst Corporation in Seattle. This helped the bank expand its reach.

The bank faced some challenges in the 1980s due to some difficult loans. But it worked hard to recover and became strong again. In 1992, Bank of America made another big move by acquiring Security Pacific Corporation. This was a huge deal at the time and made Bank of America even larger.

In 1994, the bank expanded into Chicago by acquiring Continental Illinois National Bank and Trust Co. These mergers helped Bank of America become the largest U.S. bank based on deposits for a while.

Joining Forces: NationsBank and BankAmerica

In 1998, a major event happened: NationsBank, based in Charlotte, acquired BankAmerica. This was the largest bank acquisition in history at that time. Even though NationsBank was the buyer, the new company decided to use the more famous name: Bank of America. The main office for the combined bank stayed in Charlotte.

This merger created a giant bank with combined assets of $570 billion and 4,800 branches across 22 U.S. states.

Banc of America Securities

Banc of America Securities (BAS) was the part of Bank of America that focused on investment banking. This means it helped companies with big financial deals, like buying other companies or raising money. It was based in New York City.

BAS was created in 1998 to offer a wide range of financial services. It helped businesses with loans and investment advice. In 2008, BAS joined with Merrill Lynch, which was another big step for Bank of America.

Growth and Changes (2005-2007)

In 2004, Bank of America bought FleetBoston Financial, a large bank based in Boston. This added many new branches and customers. In 2005, it also acquired MBNA, a big credit card company. These moves helped Bank of America become a leader in credit cards.

Bank of America also expanded its reach internationally. For example, it sold its operations in Brazil, Chile, and Uruguay to a Brazilian bank called Itaú. In 2007, Bank of America also bought The United States Trust Company, which specialized in managing money for wealthy clients. Later that year, it acquired LaSalle Bank Corporation, which greatly increased its presence in states like Illinois and Michigan.

Challenges and Major Acquisitions (2007-2010)

During a tough time for the economy, Bank of America made two very important acquisitions.

Buying Countrywide Financial

In 2008, Bank of America announced it would buy Countrywide Financial. Countrywide was a very large company that helped people get home loans. This purchase made Bank of America the biggest company for home loans in the U.S. The goal was to help Countrywide avoid bigger problems and give Bank of America a strong position in the mortgage business. Countrywide Financial later changed its name to Bank of America Home Loans.

Acquiring Merrill Lynch

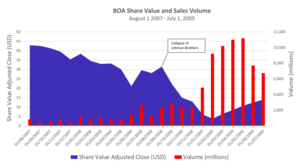

In September 2008, Bank of America decided to buy Merrill Lynch. Merrill Lynch was a major investment bank that was facing serious financial difficulties. This acquisition was a huge deal, making Bank of America the largest financial services company in the world. It helped save Merrill Lynch from going out of business.

After the merger, Merrill Lynch's operations became a key part of Bank of America's investment banking and wealth management services.

Government Support and Repayment

During the financial crisis, the U.S. government provided support to many banks, including Bank of America, through a program called TARP. This help was given to stabilize the financial system. Bank of America received money to help it through the difficult period and to complete its merger with Merrill Lynch.

By December 2009, Bank of America announced that it had repaid all the money it received from the TARP program, plus interest. This showed that the bank was becoming strong again.

Settling Issues

Bank of America also faced some legal issues related to its acquisitions and past practices. For example, it paid a fine related to not fully sharing information about bonuses at Merrill Lynch before the merger. These settlements helped the bank resolve past problems and move forward.

Changes and Growth (2011-Present)

Making the Company Smaller and More Efficient

From 2011 to 2014, Bank of America worked to become more efficient. This involved reducing the number of employees and selling some of its branches. The bank also focused on growing its mobile banking services, as more and more customers started using their phones for banking. This led to fewer people visiting physical bank branches.

Selling Stake in China Construction Bank

In 2005, Bank of America bought a part of China Construction Bank, one of the biggest banks in China. This was a way for Bank of America to expand its business in Asia. However, in 2011 and 2013, Bank of America sold its shares in China Construction Bank, completing its exit from that investment.

Major Settlement with the Justice Department

In 2014, Bank of America reached a large agreement with the U.S. Justice Department. This agreement was to resolve claims related to certain home loans and securities that had caused problems during the financial crisis. The bank agreed to pay a significant amount of money to help those affected. This was one of the largest settlements in U.S. corporate history.

Helping Military Personnel

Bank of America works with the U.S. Department of Defense to run the DOD Community Bank. This bank provides full banking services to military personnel at branches and ATMs on U.S. military bases around the world, including places like Germany, Japan, and South Korea.

Decision on Military-Style Guns

In 2018, Bank of America announced that it would stop providing money to companies that make military-style weapons. The bank stated it wanted to help reduce gun violence.

New Growth and Expansion (2015-Present)

Starting in 2015, Bank of America began opening new branches in cities where it didn't have a retail presence before. This included cities like Denver, Minneapolis–Saint Paul, and Indianapolis.

In 2018, the bank expanded into Pittsburgh and Ohio, including cities like Cleveland, Columbus, and Cincinnati. This showed that Bank of America was growing its physical presence again to serve more customers across the country.

How Bank of America Works

Bank of America makes most of its money in the United States. Its main goal is to be a top bank in its home market. It does this through different parts of its business.

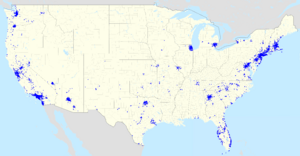

Consumer Banking

This is the biggest part of Bank of America. It helps everyday people and small businesses. Services include checking and savings accounts, loans for homes and businesses, and credit cards. It also offers investment services through Merrill Edge. This division makes money from interest on loans and various fees. Bank of America has over 4,600 branches and about 15,900 ATMs.

Bank of America is part of the Global ATM Alliance. This means if you have a Bank of America debit card, you might pay lower fees when you use an ATM from another bank in the alliance while traveling internationally.

Global Banking

This part of the bank helps larger businesses and companies. It offers services like investment banking, which means helping companies with big financial deals, and lending money for their projects. This division includes different groups that focus on corporate banking and investment banking.

Global Wealth and Investment Management

This division helps individuals and organizations manage their money and investments. It includes Merrill Lynch Global Wealth Management and U.S. Trust. They help clients with things like planning for the future and investing their money wisely. This part of the bank manages a lot of money for its clients.

Global Markets

This division works with large financial organizations. It helps them trade financial securities, like stocks and bonds. It also provides research and helps manage financial risks.

Workforce and Pay

Bank of America is a large employer. In 2019, the company announced that it would increase its minimum wage for employees. It aimed to reach $20.00 an hour by 2021.

Main Offices

The main executive offices of Bank of America are in the Bank of America Corporate Center in Charlotte, North Carolina. This tall skyscraper was finished in 1992.

Bank of America also has international offices in places like Dublin, Hong Kong, and Singapore.

Helping Communities

Bank of America has made efforts to support communities. In 1998, it promised to provide $350 billion over ten years to help with affordable housing, support small businesses, and create jobs in areas that needed them. In 2004, it pledged another $750 million for community development.

The bank has also supported environmental efforts. In 2007, it offered employees money back for buying hybrid cars. It also gave rebates or lower interest rates to customers whose homes were energy efficient. Bank of America has also donated money to health centers and homeless shelters. In India, the bank supports arts and culture, including children's museums.

Who Bank of America Competes With

Bank of America competes with many other large banks and financial companies. Some of its main competitors include Wells Fargo, Chase Bank, Citigroup, US Bank, and PNC Financial Services.

Important Buildings

Bank of America has its name on many important buildings across the United States and even in other countries. These include:

- Bank of America Tower in Phoenix, Arizona

- 555 California Street in San Francisco, California (a former world headquarters)

- Bank of America Plaza in Atlanta, Georgia (the tallest building in the Southern United States)

- Bank of America Tower in New York City

- Bank of America Corporate Center in Charlotte, North Carolina (the main corporate headquarters)

- Bank of America Plaza in Dallas, Texas

- Bank of America Fifth Avenue Plaza in Seattle, Washington

- Bank of America Tower in Hong Kong

The bank also has its name on the Bank of America Stadium in Charlotte, North Carolina, which is home to the Carolina Panthers football team.

Past Buildings

Some buildings that were once named after Bank of America include:

- The Robert B. Atwood Building in Anchorage, Alaska.

- The Bank of America Building (Providence) in Providence, Rhode Island, which is the tallest building in that state.

- The Miami Tower in Downtown Miami, Florida, which was known as Bank of America Tower for many years.

See also

In Spanish: Bank of America para niños

In Spanish: Bank of America para niños

| Kyle Baker |

| Joseph Yoakum |

| Laura Wheeler Waring |

| Henry Ossawa Tanner |