Masayoshi Son facts for kids

Quick facts for kids

Masayoshi Son

|

|

|---|---|

| 孫 正義 | |

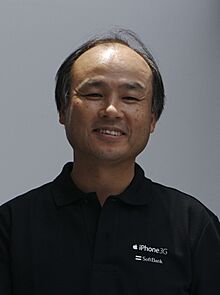

Son in 2008

|

|

| Born |

Masayoshi Yasumoto (安本 正義)

11 August 1957 Tosu, Saga, Japan

|

| Other names | Son Jeong-ui |

| Education | University of California, Berkeley (BA) |

| Occupation | Entrepreneur, investor, philanthropist |

| Known for | Founder of Softbank Group |

| Title |

|

| Spouse(s) |

Masami Ohno

(m. 1979) |

| Children | 2 |

Masayoshi Son (born August 11, 1957) is a famous entrepreneur, investor, and generous giver from Japan. He is the founder and leader of SoftBank Group (SBG). This company focuses on investing in technology. He also leads Arm Holdings in the UK and Stargate LLC in the US.

Masayoshi Son became well-known for his work in computer software, publishing books and magazines about computers, and telecommunications in Japan. This started in the 1980s and grew a lot through the 1990s and 2000s. He made an early investment of $20 million in Alibaba Group in 2000. This investment grew to be worth a huge amount, helping SoftBank become very successful. SoftBank's part of Alibaba was worth a lot of money. His company, SoftBank, changed from a phone company into a big investment firm called SoftBank Group Corp. This made him famous around the world as a smart investor. He is known for taking big risks with his investments. Sometimes these risks led to big losses, especially with his investment funds called SoftBank Vision Funds.

In 2013, Forbes magazine listed Son as one of the World's Most Powerful People. In 2017, he was named Entrepreneur of the Year at The Asian Awards. As of May 2025, he is one of the richest people in the world. He was known for losing a lot of money during the dot-com crash in 2000, when his SoftBank shares dropped.

Contents

Early Life and Education

Masayoshi Son was born on August 11, 1957, in Tosu, Saga, Japan. His family was Zainichi Korean. His grandfather moved to Japan from Daegu during the time Japan ruled Korea. Son's father raised animals and started a successful business. His family later moved so Son could go to a better school. Growing up, his family did not use their Korean names. Son faced some unfair treatment because of his Korean background.

Son looked up to Den Fujita, who started McDonald's Japan. Son tried many times to meet him. He even flew to Tokyo and showed up at McDonald's Japan headquarters. He got to speak with Fujita for 15 minutes. Fujita told Son to learn English and computer science. He also suggested moving to the United States for school. Son followed this advice. At 16, he left high school in Japan and moved to Oakland, California. He studied English and finished high school quickly. Then, he went to the University of California, Berkeley. He studied economics and computer science there, finishing in 1980.

He started his first businesses while still a student. With help from professors, Son created an electronic translator. He sold it to Sharp Corporation for a lot of money. He also made money by bringing used video game machines from Japan. He put them in dorms and restaurants. He even started a video game company called Unison World. He later sold this company.

After returning to Japan, he decided to use his Korean family name, Son, for his work. Some of his relatives were worried about this. But because of this and other actions, Son is seen as a role model for ethnic Korean children in Japan.

SoftBank's Journey

Masayoshi Son is the founder and CEO of SoftBank. He also owns the largest part of the company. He started SoftBank in 1981. At first, it sold computer software and published computer books.

SoftBank's Mobile Business

Masayoshi Son was the CEO of SoftBank Corp., which is the mobile phone part of SoftBank Group, until 2021.

Investing in Internet Companies

Son was one of the first people to invest in internet companies. He bought a part of Yahoo! in 1995. He also invested $20 million in Alibaba in 1999. For a short time, he was the richest person in the world before the stock market went down. SoftBank owned a big part of Alibaba. Son also helped start Yahoo! BroadBand in Japan. Even when SoftBank's value dropped, Son focused on making Yahoo! BB successful. Yahoo! BB later bought Japan Telecom, a large phone and internet provider. Today, Yahoo! BB is a top internet provider in Japan. In 2020, Son left the Alibaba board. By 2023, SoftBank had sold most of its shares in Alibaba.

Arm Holdings Acquisition

In 2016, SoftBank announced it would buy Arm Holdings for a large sum of money. Arm Holdings is a UK company that designs computer chips. This was one of the biggest purchases of a European technology company ever. The deal was completed in September 2016.

In 2020, SoftBank Group planned to sell Arm Limited to Nvidia, a US chip-maker. This deal was worth many billions of dollars. SoftBank said that combining Arm and Nvidia would create a leading company in artificial intelligence. However, this deal did not happen. Regulators in the U.S. and EU had concerns about it. After the deal failed, Arm planned to list its shares on the U.S. stock market in 2023.

Sprint Corporation Investment

In the 2010s, SoftBank, led by Son, bought a large share of Sprint, a US mobile carrier. SoftBank later owned even more of Sprint.

Sprint and T-Mobile US merged in 2020. By 2021, SoftBank Group Corp. had bought shares in Deutsche Telekom, which owns T-Mobile.

Solar Power Projects

After the Fukushima Daiichi nuclear disaster in 2011, Masayoshi Son spoke out against nuclear power. He started investing in a large solar power network for Japan. In 2018, it was announced that Son was investing in a huge solar project in Saudi Arabia. This project is part of Saudi Arabia's plan for the future.

In 2018, reports also showed that Son would support a big part of new renewable energy projects in India.

Vision Fund Investments

In 2017, SoftBank Group created a huge investment fund called the Vision Fund. It had $100 billion to invest in new technologies. These included artificial intelligence (AI), robotics, and the internet of things. The fund aimed to invest in many AI companies. It also invested in companies that wanted to change real estate, transportation, and shopping. Son wanted to connect with the leaders of all the companies the Vision Fund supported. He hoped this would help them work together. Son planned to create new funds every few years, investing billions in new companies. A second Vision Fund was started in 2019.

By 2020, the first Vision Fund had invested in many companies. These included Coupang, Didi, Doordash, Fanatics, Grab, Oyo, Paytm, Uber, and WeWork. However, the fund faced challenges. The COVID-19 pandemic and new rules in China affected some of its investments. Son became known as a stock investor after Alibaba Group grew so much. He had invested in Jack Ma's Alibaba when it was a young company in 2000. He later regretted not investing early in companies like Amazon and Tesla.

After starting the SoftBank Vision Fund in 2017, Son became even more famous as an investor. But by 2021, he was still trying to convince investors of his fund's value. This was partly because of big losses with companies like WeWork, OneWeb, and others. SoftBank's own stock often traded for less than its assets were worth. This showed that investors were worried about risks and past losses. By October 2021, Masayoshi Son sped up his investments. He invested in many more companies with Vision Fund 2. In 2022, SoftBank Vision Fund reported a record loss. The value of its stock investments dropped a lot. Some of Son's investment choices, like with Klarna, lost value. In August 2022, Masayoshi Son said he was "embarrassed" about how he had managed the SoftBank Vision Fund.

By November 2022, Masayoshi Son personally owed SoftBank money because of the growing losses from the company's technology investments. This debt grew to billions of dollars by February 2023. This situation caused some discussion about how the company was run.

Stargate Project

In January 2025, Son was named chairman of The Stargate Project. This is an American project focused on artificial intelligence. It was formed by SoftBank, OpenAI, Oracle Corporation, and MGX.

Personal Life

Son met his wife, Masami Ohno, while they were both students at the University of California, Berkeley. They got married in 1979 and have two daughters. He lives in a large mansion in Tokyo. He also owns a home near Silicon Valley in Woodside, California. He owns the Fukuoka SoftBank Hawks, a professional Japanese baseball team. Son has three brothers. His youngest brother, Taizo Son, is also a successful entrepreneur and investor.

When he went to the United States at 16, he decided to use his real Korean family name. Son has said that if he had stayed in Japan, he might have become more traditional.

See also

In Spanish: Masayoshi Son para niños

In Spanish: Masayoshi Son para niños

- LY Corporation

| Selma Burke |

| Pauline Powell Burns |

| Frederick J. Brown |

| Robert Blackburn |