Government debt facts for kids

A country's government debt (also called public debt) is the total amount of money its government owes. Think of it like a family budget: sometimes a family spends more than it earns. When a government does this, it creates a "deficit." To cover this extra spending, the government borrows money, which adds to its debt.

Governments might borrow for many reasons. They might need to fund important projects like building schools or roads. They also borrow to help the country during tough times, like a major economic slowdown or a health emergency. For example, after the Great Recession and during the COVID-19 recession, many governments borrowed more to help their citizens and businesses.

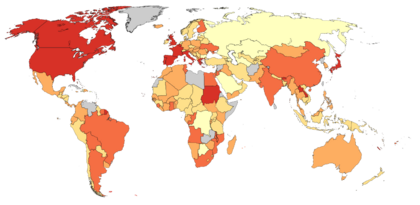

In 2020, governments around the world owed about US$87.4 trillion. This was about 99% of the total value of all goods and services produced globally that year (called GDP). This amount was almost 40% of all debt in the world, including money owed by companies and households.

Governments borrow from many different places. They can get loans from their own citizens, from banks, from international organizations like the World Bank, or even from other countries. When governments borrow, they often issue special promises to pay back the money, called "sovereign bonds." These bonds can then be bought and sold by investors.

Contents

What is Government Debt?

Government debt is simply the total financial promises a government has made to pay back money. It's the sum of all the loans and other financial obligations a government has.

Why Governments Borrow Money

Govern Governments borrow money for several key reasons:

- To Fund Public Services: They need money to pay for schools, hospitals, defense, and other services.

- To Boost the Economy: During a recession, when people lose jobs and businesses struggle, governments might spend more to create jobs and help the economy recover. This is like a "shock absorber" for the economy.

- For Big Projects: They might borrow to invest in large projects that benefit the country for a long time, like new infrastructure.

- During Emergencies: Major events like wars, natural disasters, or health crises (like the COVID-19 pandemic) require a lot of unexpected spending. Borrowing helps governments respond quickly.

- To Avoid Raising Taxes: Sometimes, borrowing allows governments to keep taxes stable instead of increasing them, which can be unpopular.

Who Lends Money to Governments?

Many different groups and organizations lend money to governments:

- Private Investors: These are individuals or companies who buy government bonds.

- Commercial Banks: Banks often lend money to governments.

- International Organizations: Groups like the World Bank lend money, especially to countries that might be considered riskier by private investors.

- Other Governments: One country might lend money to another.

Credit rating agencies, like Moody's or Standard & Poor's, check how likely a government is to pay back its debts. Their ratings can affect how much interest a government has to pay on its loans.

How We Measure Government Debt

When we talk about government debt, we usually mean the gross debt of the general government.

- Gross debt is the total amount of money owed.

- The general government includes all levels of government: national, state, regional, and local. It also includes social security funds. This helps us compare debt fairly between countries.

The most common way to measure a country's debt burden is the debt-to-GDP ratio.

- GDP (Gross Domestic Product) is the total value of all goods and services produced in a country in a year. It shows how big a country's economy is.

- The debt-to-GDP ratio tells us how much debt a country has compared to its economic size. A lower ratio usually means the debt is more manageable. For example, if a country's debt is 50% of its GDP, it means the debt is half the size of its annual economic output. This ratio helps us compare countries of different sizes.

Why Governments Get Into Debt

Governments often borrow to help their economies during difficult times.

- Economic Downturns: During a recession, tax revenues fall because people earn less. At the same time, government spending on things like unemployment benefits might increase. Borrowing helps governments keep services running without cutting them or raising taxes, which could make the recession worse.

- Major Crises: Big events like a major war, a public health emergency (like COVID-19), or a severe economic crisis often lead to a lot of government borrowing.

Sometimes, governments might have a "deficits bias." This means politicians might be tempted to spend more money to make people happy, even if it means increasing debt. To prevent too much debt, many countries have rules. For example, Germany and Switzerland have a "debt brake," and the European Union has an agreement to keep government debt below 60% of GDP.

A Look Back: History of Government Debt

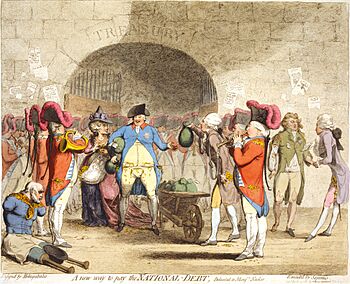

Governments have been borrowing for thousands of years. Ancient Greek city-states borrowed from their citizens. But modern government debt really changed with the founding of the Bank of England in 1694. This made it easier for the British government to borrow money because lenders trusted that they would be repaid. This stability helped create modern financial markets and economic growth.

Public debt became a safe investment. People could use government bonds as a guarantee for their own private loans. This helped both public and private money systems grow together.

After the Napoleonic Wars in 1815, British government debt was very high, more than 200% of its GDP. But the government slowly paid it off over 90 years by spending less than it earned.

By 1900, France had the most total debt, followed by Russia and the United Kingdom. In 2018, global government debt was about $66 trillion. By 2020, it reached $87 trillion, or 99% of global GDP. The COVID-19 pandemic caused this debt to increase sharply, especially in richer countries that spent a lot to support their economies.

What Happens When Governments Have Too Much Debt?

Too much government debt can cause problems:

- Higher Interest Rates: When governments borrow a lot, they might have to offer higher interest rates to attract lenders. This can make it more expensive for businesses to borrow money, which can slow down private investment and economic growth.

- Debt Crises: If a country's debt gets too high, it might struggle to make its payments. This is called a debt crisis. During a crisis, a country might not be able to borrow more money, and it could face serious economic problems. Examples include the Latin American debt crisis in the 1980s and Argentina's crisis in 2001.

- Future Generations Pay: When a government borrows money today, the people who benefit from that spending are often different from the people who will have to pay back the debt in the future (through taxes). This is like an "intergenerational transfer."

Some people compare government debt to a household's debt. However, economists generally say these are very different. Governments can print their own money (if they have their own currency), raise taxes, and have a much longer planning horizon than a family. Also, cutting government spending too much can actually make economic problems worse.

Different Kinds of Debt Risks

Governments face different types of risks when they borrow money.

Default Risk

Default risk is the chance that a government cannot or will not pay back its debt.

- Historical Defaults: Throughout history, many governments have defaulted. For example, Spain did this several times in the 16th and 17th centuries. The Confederate States of America did not repay its debt after the American Civil War.

- Currency Matters: If a government borrows in its own currency, it can sometimes print more money to pay its debts. This reduces the risk of default but can lead to other problems like inflation. However, some governments, like cities or countries in the eurozone, don't control their own currency, making default a real risk.

- Sub-National Debt: Debt from local or state governments is often less risky if a national government guarantees it. For instance, when New York City faced financial trouble in the 1970s, the state and national governments helped out.

Inflation Risk

If a government prints too much money to pay its debts, it can lead to inflation. Inflation means that prices for goods and services go up very quickly, and your money buys less than it used to. A famous example is Weimar Germany in the 1920s, where the government printed huge amounts of money after World War I, causing prices to skyrocket.

Exchange Rate Risk

When a government borrows money from other countries, it might face exchange rate risk. This happens if the value of its currency changes compared to the currency it borrowed. For example, if the U.S. dollar becomes weaker, it costs more U.S. dollars to pay back a loan made in a stronger foreign currency. To avoid this, governments sometimes borrow in foreign currencies, but then they take on the risk themselves.

Hidden Debts and Future Promises

Governments also have "contingent liabilities," which are like promises that might become debts in the future, but aren't counted as debt right now.

- Loan Guarantees: An example is when a government guarantees a loan for a company. If the company can't pay, the government promises to step in.

- Future Obligations: Governments often have promises for future payments, like pensions for retired workers or money for disaster relief. These are not usually counted in the official government debt until they actually need to be paid.

For example, in the U.S., programs like Medicare (for healthcare) and Social Security (for retirement) are "pay-as-you-go." This means current workers' contributions pay for current retirees' benefits. According to reports from 2018, Medicare was facing a $37 trillion unfunded liability over the next 75 years, and Social Security was facing a $13 trillion unfunded liability over the same time. These huge future promises are not included in the U.S. national debt, which was $34 trillion in 2024.

The European Commission has required countries in the EU to be very clear about all their debts, including those that might have been hidden before. This helps everyone understand the true financial picture.

See also

In Spanish: Deuda pública para niños

In Spanish: Deuda pública para niños

- Credit default swap

- Crowding-in effect

- Crowding out

- Debt clock

- Debt Sustainability Analysis

- Financial repression

- Fiscal multiplier

- Fiscal sustainability

- Generational accounting

- Global debt

- Government budget balance

- Municipal bond

- Public finance

- Warrant of payment

By country:

- 1980s austerity policy in Romania

- Latin American debt crisis

- Euro area crisis

- National debt of the United States

Lists:

- List of countries by credit rating

- List of countries by external debt

- List of countries by net international investment position

- List of countries by government debt

- List of sovereign debt crises