Robert J. Shiller facts for kids

Quick facts for kids

Robert J. Shiller

|

|

|---|---|

Shiller in July 2017

|

|

| Born |

Robert James Shiller

March 29, 1946 Detroit, Michigan, U.S.

|

| Institution | Yale University |

| Field | Financial economics Behavioral finance |

| School or tradition |

New Keynesian economics Behavioral economics |

| Alma mater | Kalamazoo College University of Michigan (BA) Massachusetts Institute of Technology (SM, PhD) |

| Doctoral advisor |

Franco Modigliani |

| Doctoral students |

John Y. Campbell |

| Influences | John Maynard Keynes George Akerlof Irving Fisher |

| Contributions | Irrational Exuberance, Case-Shiller index, CAPE-ratio |

| Awards | Deutsche Bank Prize (2009) Nobel Memorial Prize in Economics (2013) |

| Information at IDEAS / RePEc | |

| Signature | |

|

|

Robert James Shiller (born March 29, 1946) is an American economist, a university professor, and an author. He is a professor of Economics at Yale University. He has also been a researcher for the National Bureau of Economic Research since 1980. Shiller was the president of the American Economic Association in 2016. He also helped start an investment company called MacroMarkets LLC.

Shiller is famous for several important ideas:

- He helped create the Case-Shiller housing price index. This index uses a special math method to figure out a house's value. It looks at recent sales prices of other houses.

- He questioned the Efficient Market Hypothesis (EMH). This idea says that stock prices always reflect all available information. Shiller showed that the U.S. stock market changed more than it should if the EMH were completely true.

- He helped create a simple way to value the stock market. This is called the Cyclically-Adjusted Price-Earnings (CAPE) ratio. It uses the average earnings of the stock market over the last ten years. This helps to smooth out how business ups and downs affect earnings.

- He has often warned about "bubbles" in the stock market and housing market. A bubble happens when prices go up very quickly and might crash later.

In 2003, he wrote a paper warning about a possible housing market bubble. In 2005, he said that big price increases could lead to big drops later. He warned that this could cause a decline in confidence and a worldwide recession. In 2006, he again warned about a possible recession. In 2007, he predicted a crash in the U.S. housing market. This happened about a year before a major financial crisis.

Shiller was named one of the world's most important economists in 2008. He was still on this list in 2019. In 2013, he shared the Nobel Memorial Prize in Economic Sciences. He won it with Eugene Fama and Lars Peter Hansen. They were honored for their work on understanding asset prices.

Contents

About Robert Shiller's Life

Robert Shiller was born in Detroit, Michigan. His mother was Ruth R. Shiller and his father was Benjamin Peter Shiller, an engineer. His family background is from Lithuania. He is married to Virginia Marie, who is a psychologist. They have two children. He was raised in the Methodist faith.

Shiller first went to Kalamazoo College. After two years, he moved to the University of Michigan. He earned his Bachelor of Arts degree there in 1967. He then went to the Massachusetts Institute of Technology (MIT). He received his Master of Science degree in 1968. He earned his Ph.D. from MIT in 1972. His Ph.D. paper was about "Rational expectations and the structure of interest rates." His advisor was Franco Modigliani.

Robert Shiller's Work and Ideas

Shiller has taught at Yale University since 1982. Before that, he taught at other universities. He has written about many economic topics. These include how people's behavior affects money decisions and how to manage risks. He also helped organize workshops on behavioral finance. His book Macro Markets won an award. He writes articles for newspapers and magazines regularly.

Challenging Old Ideas

In 1981, Shiller wrote an article that challenged a popular idea. This idea was the efficient-market hypothesis. It said that stock prices always reflect all known information. Shiller argued that in a smart stock market, investors would base prices on future earnings. He looked at the U.S. stock market since the 1920s. He found that the stock market changed much more than it should. This was true even if people had smart ideas about the future. Shiller concluded that the stock market's ups and downs were too big to be explained by only rational thinking. This article was later called one of the "top 20" articles in the 100-year history of the American Economic Association.

After the stock market crash in October 1987, Shiller's ideas became more popular. His work included surveys that asked investors why they made trades. The results showed that emotions often played a big part in these decisions. This was instead of just careful calculations. He has been collecting this survey data since 1989.

Creating the Case-Shiller Index

In 1991, Shiller started a company with economists Karl Case and Allan Weiss. This company was called Case Shiller Weiss. They created an index that tracked home sales prices across the country. This index helped study trends in home prices. Shiller and Case developed this index while studying housing booms. The index was later bought and improved by other companies. This led to the well-known Case-Shiller index.

Warnings About Bubbles

His book Irrational Exuberance (2000) became a bestseller. In it, he warned that the stock market had become a bubble. He said this in March 2000, which was the peak of the market. He predicted a sharp decline, which later happened.

In 2005, on a TV show, he said that housing prices could not keep rising faster than inflation forever. He explained that house prices would eventually be limited by building costs. Another expert on the show disagreed with him. However, Shiller's prediction about the housing market bubble proved to be accurate.

In 2003, he wrote a paper asking, "Is There a Bubble in the Housing Market?" He later added to his book Irrational Exuberance (2005). He warned that further rises in markets could lead to big declines. He said this could cause a drop in confidence and a worldwide recession. In 2006, he again warned of a "very bad period" for housing. In September 2007, he predicted a housing market collapse and financial panic. This happened about a year before the Lehman Brothers collapse.

Awards and Recognition

Shiller received the Deutsche Bank Prize in Financial Economics in 2009. This was for his important research on how asset prices change. His work has helped shape economic theory and policy. His ideas on risk, market changes, bubbles, and crises are well-known. In 2010, he was named one of the top global thinkers.

In 2011, he was on the Bloomberg 50 most influential people in global finance list. In 2012, he was considered a top candidate for the Nobel Memorial Prize in Economic Sciences. This was for his work on how financial markets change and how asset prices move.

On October 14, 2013, it was announced that Shiller had won the 2013 Nobel Memorial Prize in Economic Sciences. He shared it with Eugene Fama and Lars Peter Hansen.

Nobel Prize Lecture and Market Efficiency

In his Nobel Prize lecture, Shiller explained why markets are not always efficient. He argued against Eugene Fama's Efficient Market Hypothesis (EMH). The EMH says that an asset's price always reflects all information. Shiller showed that market movements are very unpredictable. This is unlike Fama's idea that movements would be smoother if they reflected true value. Shiller called this the "excess volatility puzzle." His charts showed a clear difference from the EMH. For example, stock dividend growth was only 2% per year. This did not match the expected dividends that the EMH would suggest.

Shiller believes that more information about the asset market is important for it to work well. He also mentioned John Maynard Keynes's idea about stock markets. Keynes compared the stock market to a beauty contest. In this contest, people bet on who they think most people will find attractive, not who they truly find attractive. Shiller thinks people do not use complex math when making market decisions. He argued that a lot of data is needed for the market to be efficient. Since there was little data available, he created the Case-Shiller index. This index provides information about home price trends. He added that modern technology can help economists collect more data. This would make markets more informed and prices more efficient.

In 2015, Shiller warned about a possible stock market crash. In August 2015, after a quick drop in some stocks, he still saw "bubbly" conditions. This was true for stocks, bonds, and housing.

In 2017, Shiller said that Bitcoin was the biggest financial bubble at that time. He used the example of an old "time store" to suggest that cryptocurrencies like Bitcoin are a "speculative bubble" that might burst.

In 2019, Shiller published Narrative Economics. This book was well-received and was named one of the "Best books of 2019" by the Financial Times.

In June 2024, Shiller and 15 other Nobel Prize winners signed a letter. They argued that certain economic policies could cause inflation in the United States.

Books by Robert J. Shiller

- Narrative Economics: How Stories Go Viral and Drive Major Economic Events, (2019)

- Phishing for Phools: The Economics of Manipulation and Deception, (2015)

- Finance and the Good Society, (2012)

- Animal Spirits: How Human Psychology Drives the Economy, and Why It Matters for Global Capitalism, (2009)

- The Subprime Solution: How Today's Global Financial Crisis Happened, and What to Do about It, (2008)

- The New Financial Order: Risk in the 21st Century, (2003)

- Irrational Exuberance, (2000)

- Macro Markets: Creating Institutions for Managing Society's largest Economic Risks, (1993)

- Market Volatility, (1990)

Images for kids

-

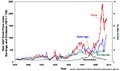

Robert Shiller's chart of the S&P Composite Real Price Index, Earnings, Dividends, and Interest Rates. This chart is from his book Irrational Exuberance. In the book, Shiller warns that the stock market's price-earnings ratio was still very high in 2005. He said people put too much trust in markets. They believe paying attention to investments will make them rich. So, they do not prepare for bad outcomes.

-

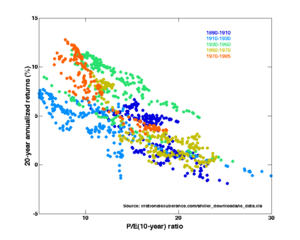

Price-earnings ratios as a way to predict twenty-year returns. This chart is based on Robert Shiller's work. It shows that long-term investors did well when prices were low compared to earnings. Shiller suggests that investors should lower their stock market investments when prices are high. They should invest more when prices are low.

See also

In Spanish: Robert J. Shiller para niños

In Spanish: Robert J. Shiller para niños

| Leon Lynch |

| Milton P. Webster |

| Ferdinand Smith |