Irving Fisher facts for kids

Quick facts for kids

Irving Fisher

|

|

|---|---|

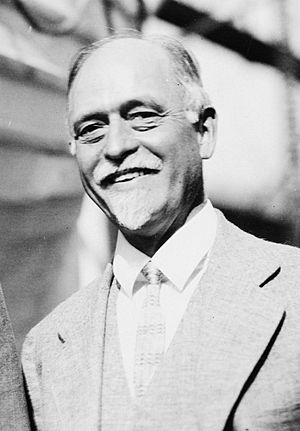

Fisher photographed by George Grantham Bain in 1927

|

|

| Born | February 27, 1867 |

| Died | April 29, 1947 (aged 80) |

| Nationality | American |

| Spouse(s) |

Margaret Hazard

(m. 1893; |

| Field | Mathematical economics |

| School or tradition |

Neoclassical economics |

| Alma mater | Yale University (BA, PhD) |

| Doctoral advisor |

Josiah Willard Gibbs William Graham Sumner |

| Influences | William Stanley Jevons, Eugen von Böhm-Bawerk |

| Contributions | Fisher equation Equation of exchange Price index Debt deflation Phillips curve Money illusion Fisher separation theorem Independent Party of Connecticut |

Irving Fisher (born February 27, 1867 – died April 29, 1947) was an American economist, statistician, and inventor. He was also involved in social campaigns. He was one of the first American economists to follow the "neoclassical" style of thinking. Later, his ideas about debt deflation became important to another group of economists called "post-Keynesians."

Some famous economists like Joseph Schumpeter and Milton Friedman called him "the greatest economist the United States has ever produced."

Fisher made big contributions to understanding how people make choices (called utility theory) and how different parts of the economy fit together (called general equilibrium). He also studied how people make choices over time, which helped him create theories about capital and interest rates. His work on the quantity theory of money started a major economic idea called "monetarism." Fisher also helped create econometrics, which uses math and statistics to study economic data.

Many economic ideas are named after him, such as the Fisher equation and the Fisher hypothesis.

Fisher was one of the first "celebrity" economists. However, his reputation was hurt when he said, just nine days before the Wall Street Crash of 1929, that the stock market had reached "a permanently high plateau." His later ideas about debt deflation as a reason for the Great Depression were mostly ignored. People paid more attention to the work of John Maynard Keynes instead.

However, Fisher's reputation has improved over time, especially after his ideas were rediscovered in the 1960s and 1970s. People have also become more interested in his debt deflation theory since the Great Recession.

Contents

About Irving Fisher's Life

Fisher was born in Saugerties, New York. His father was a teacher and a minister who taught him to always be a useful member of society. Even though he grew up in a religious family, he later became an atheist.

As a child, Fisher was very good at math and loved to invent things. His father died when Irving was admitted to Yale College. Irving then supported his mother, brother, and himself by tutoring. He graduated first in his class in 1888.

In 1891, Fisher earned the first PhD in economics from Yale. His teachers included the physicist Willard Gibbs and the sociologist William Graham Sumner. Fisher loved math, but he found that economics gave him more ways to use his skills and help society. His PhD paper, published in 1892, explained the idea of general equilibrium in a very detailed way. Even though others in Europe had similar ideas, Fisher's work was very important and was praised by famous economists.

After Yale, Fisher studied in Berlin and Paris. From 1890, he worked at Yale, first as a tutor, then as a professor, and later as a professor emeritus. He was involved in many academic groups and welfare organizations. He was president of the American Economic Association in 1918. In 1930, he helped start the Econometric Society, which uses math in economics, and was its first president.

Fisher wrote many books and articles, both for experts and for the general public. He wrote about social issues during World War I, the good times of the 1920s, and the tough times of the 1930s. He also invented practical things, like a "visible filing system" in 1913. He sold this invention in 1925, which made him wealthy until the stock market crash of 1929.

Fisher was also active in social and health campaigns. He supported vegetarianism and prohibition (making alcohol illegal). He also supported eugenics, a movement that aimed to improve the human race through controlled breeding. He helped found the Race Betterment Foundation in 1906 and was the first president of the American Eugenics Society.

He died in New York City in 1947 at the age of 80.

Fisher's Economic Ideas

Understanding Utility Theory

Irving Fisher's early work helped bring new economic ideas to America. He explained how people make choices based on what they value. His PhD paper was "brilliant" because it carefully looked at how we can measure how much people value things.

Fisher used math in his work, but he also wanted to make his ideas easy to understand. For example, to show how prices change with supply and demand, he built a special machine with pumps and levers. This machine helped people see his theories in action.

Interest Rates and Capital

Fisher is well-known for his ideas about capital, investment, and interest rates. He wrote about these in his books The Nature of Capital and Income (1906) and The Rate of Interest (1907). His 1930 book, The Theory of Interest, brought together all his research on these topics.

Fisher understood that the value of goods and services depends not only on how much there is, but also on when you can get them. Something available now has a different value than the same thing available later. The interest rate measures the cost of getting something now instead of waiting. Fisher used simple diagrams in his teaching, showing "consumption now" versus "consumption next period." This helped explain his powerful ideas about capital and interest.

Money and the Economy

Fisher's work on how money affects the economy became a main focus of his later career.

He helped explain the quantity theory of money using the "equation of exchange:"

Here, M is the total amount of money, P is the average price level, T is the number of transactions (things bought and sold), and V is how fast money moves around the economy (its velocity). Later, economists often replaced T with Y (or Q), which stands for the total amount of goods and services produced, like the Gross domestic product (GDP).

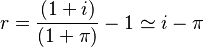

Fisher also studied how interest rates behave when prices are changing. He showed the difference between real and nominal interest rates:

In this formula,  is the real interest rate,

is the real interest rate,  is the nominal interest rate (what banks advertise), and

is the nominal interest rate (what banks advertise), and  is inflation (how much prices are going up). When inflation is low, the real interest rate is roughly the nominal rate minus the expected inflation rate. This is called the Fisher equation.

is inflation (how much prices are going up). When inflation is low, the real interest rate is roughly the nominal rate minus the expected inflation rate. This is called the Fisher equation.

Fisher believed that people often had a "money illusion." This means they focused on the amount of money they had, not on what that money could actually buy. He thought that inflation (and deflation, when prices fall) could cause serious problems because of this illusion. For many years, Fisher worked on ways to "stabilize" money, meaning to keep prices steady. He was one of the first to use statistics to study economic data like money supply, interest rates, and prices.

In the 1920s, he developed a technique called distributed lags. In 1973, a paper he wrote in 1926 about the link between unemployment and inflation was republished and called "I discovered the Phillips curve." His work on index numbers (ways to measure price changes) is still important today.

Understanding Debt-Deflation

After the stock market crash of 1929 and the start of the Great Depression, Fisher developed a theory called debt-deflation. This theory explained economic crises as being caused by a "credit bubble" bursting.

Here's how it works:

- First, people borrow too much money because they expect to make big profits.

- When the economy slows down, this causes a series of problems:

* People try to pay off their debts by selling things quickly. * As loans are paid back, the amount of money in the economy shrinks. * Asset prices (like stocks and houses) fall. * Businesses lose value, leading to bankruptcies. * Profits drop. * Production, trade, and jobs decrease. * People become worried and lose confidence. * People start saving money instead of spending it. * Nominal interest rates fall, but real interest rates (after adjusting for falling prices) actually rise.

The main problem is that as people try to pay off their debts, prices fall even more. This makes the real value of their debt even higher, making it harder to pay off.

Fisher's theory was mostly ignored at the time, partly because his reputation was damaged by his wrong predictions about the stock market. However, interest in debt-deflation has grown since the 1980s, especially after the Late-2000s recession.

The Stock Market Crash of 1929

The stock market crash of 1929 and the Great Depression that followed cost Fisher a lot of his money and hurt his academic standing. He famously said, just nine days before the crash, that stock prices had "reached what looks like a permanently high plateau." He kept telling investors that the market was just "shaking out the lunatic fringe" and that prices would go much higher.

For months after the crash, he continued to say that the economy would recover soon. Once the Great Depression was in full swing, he warned that the severe deflation (falling prices) was causing businesses to fail. This was because deflation made the real value of debts much higher. However, because of his earlier wrong predictions, few people listened to his debt-deflation ideas. Instead, they turned to the ideas of John Maynard Keynes.

Despite this, Fisher's debt-deflation theory has gained new attention since the 1980s.

Social and Health Campaigns

In 1898, Fisher was diagnosed with tuberculosis, a serious lung disease. He spent three years recovering. This experience made him want to help others with their health. He helped start the Life Extension Institute and co-wrote a popular book called How to Live: Rules for Healthful Living Based on Modern Science in 1915. He encouraged regular exercise and avoiding red meat and tobacco. In 1924, he wrote an anti-smoking article, saying that "tobacco lowers the whole tone of the body."

Images for kids

- Chicago plan

- Eugenics in the United States

- Library of Economics and Liberty

- Marginalism

- Milton Friedman

See also

In Spanish: Irving Fisher para niños

In Spanish: Irving Fisher para niños

| James Van Der Zee |

| Alma Thomas |

| Ellis Wilson |

| Margaret Taylor-Burroughs |