State Bank of India facts for kids

The Banker to Every Indian

|

|

State Bank Bhavan, Nariman Point, Mumbai

|

|

| Public | |

| Traded as | |

| ISIN | [https://isin.toolforge.org/?language=en&isin=INE062A01020 INE062A01020] |

| Industry | Banking, financial services |

| Predecessor |

Imperial Bank of India

(1921 – 1955)

|

| Founded | 1 July 1955 State Bank of India

|

| Headquarters | State Bank Bhavan, M.C. Road, Nariman Point, Mumbai, Maharashtra, India |

|

Number of locations

|

22,542 branches 63,580 ATMs |

|

Area served

|

India |

|

Key people

|

|

| Products |

|

| Revenue | |

|

Operating income

|

|

| Total assets | |

| Total equity | |

|

Number of employees

|

2,36,221 |

| Parent | Government of India (57.54%) |

| Subsidiaries |

|

| Capital ratio | Tier 1 14.28%(2024) |

| Rating |

|

The State Bank of India (or SBI) is a very big bank from India. It's like a huge company that helps people with their money. Its main office is in Mumbai. SBI is the largest bank in India. It handles a big part of all the money in the country, like loans and savings. It's also one of the biggest employers in India, with almost 250,000 people working there. As of last year, SBI had 500 million customers, which is a lot of people!

India's central bank, the Reserve Bank of India (RBI), sees SBI as a very important bank. They call it "too big to fail" because it's so important for the country's economy. Globally, SBI is one of the largest banks. It was ranked 178th among the world's biggest companies in 2024 by Fortune Global 500. It was the only Indian bank on that list.

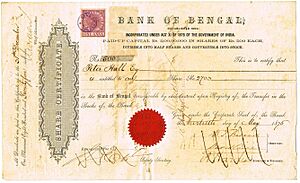

SBI has a long history. It started from the Bank of Calcutta, which was founded way back in 1806. This makes it one of the oldest banks in the Indian subcontinent. Over its 200-year history, many smaller banks have joined with SBI. The Indian government took control of the Imperial Bank of India in 1955. It then became the State Bank of India on July 1, 1955.

Contents

History of SBI

The story of the State Bank of India began in the early 1800s. The Bank of Calcutta was started on June 2, 1806. It was later renamed the Bank of Bengal. This bank was one of three "Presidency banks." The other two were the Bank of Bombay (started in 1840) and the Bank of Madras (started in 1843). These three banks were allowed to print their own money until 1861.

In 1921, these three Presidency banks joined together. They formed a new bank called the Imperial Bank of India. This bank was still a private company, but it was very important.

Becoming the State Bank of India

In 1955, the Indian government decided to take control of the Imperial Bank of India. The Reserve Bank of India, which is India's central bank, bought most of its shares. On July 1, 1955, the Imperial Bank of India officially became the State Bank of India. Later, in 2008, the government bought the RBI's shares in SBI. This was to make sure there was no conflict of interest, as RBI also regulates banks.

Expanding Across India

In 1959, the government passed a law to help SBI grow even more. This law allowed eight banks from former Indian princely states to become part of SBI. This was important for helping people in rural areas get banking services. For example, in 1963, SBI merged with the State Bank of Jaipur and the State Bank of Bikaner.

SBI also helped out by taking over smaller banks that were having problems. For instance, it acquired the Bank of Bihar in 1969. It also took over the National Bank of Lahore in 1970. In 1985, SBI acquired the Bank of Cochin in Kerala.

Modern Growth and Mergers

In 2001, SBI teamed up with a French company called BNP Paribas. They created a life insurance company together called SBI Life Insurance Company.

Around the mid-2000s, there was a plan to combine all the smaller banks linked to SBI into one big bank. This would make SBI even stronger. The first step happened in 2008 when the State Bank of Saurashtra merged with SBI. Then, in 2010, the State Bank of Indore also joined SBI.

In 2013, Arundhati Bhattacharya made history. She became the first woman to be the chairperson of SBI.

In 2014, the Indian government launched a plan called Pradhan Mantri Jan Dhan Yojana. This plan aimed to help more people open bank accounts. SBI played a big part in this, opening millions of new accounts.

In 2017, a major merger happened. The remaining five smaller banks linked to SBI, along with a bank called Bharatiya Mahila Bank, all merged into SBI. This made SBI one of the 50 largest banks in the world!

More recently, in March 2020, SBI helped out another bank called Yes Bank. SBI bought a large part of Yes Bank to help it recover. As of early 2024, SBI still holds a significant share in Yes Bank. In August 2022, SBI opened a special branch in Bengaluru to support new start-up businesses in India.

How SBI Works

SBI offers many different banking services to people in India and around the world. It has many branches and offices. SBI has 17 main regional offices called Local Head Offices (LHOs). Under them are 57 administrative offices, and then many smaller regional offices. Each smaller office manages about 40 to 50 branches.

Banking in India

SBI has a huge network of branches across India. According to its website, it has over 22,400 branches. Most of SBI's income comes from its operations within India.

As of July 2023, the SBI group had over 65,600 ATMs. In 2017, SBI launched a special app and online platform called YONO. This platform helps people do their banking digitally. YONO had 87.7 million users in the financial year 2025.

Banking Around the World

SBI also has a big presence outside India. As of 2024–25, it had 241 offices in 36 different countries. This makes it the Indian bank with the most international locations.

Some of its international operations include:

- SBI Canada Bank: Started in 1982 in Canada.

- PT Bank SBI Indonesia: SBI bought a large share of this bank in Indonesia in 2006.

- SBI (Mauritius) Ltd: This bank was formed in Mauritius in 1989.

- Nepal SBI Bank Limited: SBI owns a majority share in this bank in Nepal.

- Commercial Indo Bank LLC, Moscow: This bank in Russia was a joint venture, and SBI took full ownership in 2022.

- SBI Singapore: SBI opened an office in Singapore in 1977.

- SBI South Korea: SBI opened its first branch in Seoul, South Korea, in 2016.

- SBI Sri Lanka: This is a very old bank, founded in 1864, and has branches in Sri Lanka.

- SBI US: SBI has a subsidiary in the United States, with branches mainly in California.

Former Partner Banks

In 1960, SBI took control of seven banks that used to belong to Indian princely states. These banks were renamed with "State Bank of" in front of their names. They all used the same blue keyhole logo as SBI.

The plan to merge all these partner banks into one big SBI started in 2008. The State Bank of Saurashtra merged first. Then, the State Bank of Indore merged in 2010. The remaining five partner banks, along with Bharatiya Mahila Bank, completed their merger with SBI in April 2017. This made SBI even larger and stronger.

Other Companies SBI Owns

SBI also has other companies that are not banks but offer financial services. Some important ones are:

- SBI Capital Markets Ltd. (helps companies with investments)

- SBI Cards & Payments Services Ltd. (deals with credit cards)

- SBI Life Insurance Company Ltd. (provides life insurance)

- SBI General Insurance Company Ltd. (provides general insurance)

- SBI Funds Management Ltd. (manages money for investments)

As of June 2024, the Government of India owns about 57.54% of SBI's shares. This means the government has the biggest say in how the bank is run. The Life Insurance Corporation of India, which is also owned by the government, is another large shareholder.

You can buy and sell shares of SBI on the Bombay Stock Exchange and the National Stock Exchange of India. SBI is part of important stock market indexes like the BSE SENSEX and the NIFTY 50.

SBI Employees

SBI is one of the biggest employers in the world. As of March 31, 2024, it had 232,296 employees. About 27% of its employees are women. Each employee helped the bank earn a net profit of about 2.6 million Indian Rupees during the financial year 2023–24.

SBI Logo

The famous SBI logo was created in 1971 by the National Institute of Design, Ahmedabad. It was designed by Shekhar Kamat. The logo looks like a keyhole, which represents security and safety for your money. All the banks that merged with SBI also used this blue keyhole logo. Today, the SBI name usually appears next to the keyhole logo.

Helping the Community

State Bank of India has a special group called SBI Foundation. This group helps with development projects in India. They support initiatives that are part of the bank's corporate social responsibility efforts. This means they give back to the community and help make things better.

See also

In Spanish: State Bank of India para niños

In Spanish: State Bank of India para niños

- List of banks in India

- List of largest banks

| Aaron Henry |

| T. R. M. Howard |

| Jesse Jackson |