Wall Street Crash of 1929 facts for kids

Crowd gathering on Wall Street after the 1929 crash

|

|

| Date | September 4 – November 13, 1929 |

|---|---|

| Type | Stock market crash |

| Cause | Fears of excessive speculation by the Federal Reserve |

The Wall Street Crash of 1929, also known as the Great Crash, was a huge event where stock prices fell sharply. It happened in the autumn of 1929 in the United States. This crash began in September and ended in late October. During this time, the value of shares on the New York Stock Exchange dropped dramatically.

This was the worst stock market crash in U.S. history. It had long-lasting effects. The Great Crash is often linked to two specific days: October 24, 1929, called Black Thursday, and October 29, 1929, called Black Tuesday. On Black Thursday, a huge number of shares were sold. On Black Tuesday, investors traded about 16 million shares in one day. This crash happened after a similar one in London in September. It marked the start of the Great Depression, a very difficult economic time.

Contents

What Led to the Crash?

The years before the crash, known as the "Roaring Twenties", were a time of great wealth and excitement. After World War I, many Americans felt hopeful. People moved from farms to cities, hoping to find better lives. They wanted to join the growing industries in America.

Many people believed the stock market would always go up. They invested, even though it was risky. This risky investing is called speculation. On March 25, 1929, the Federal Reserve (America's central bank) warned that people were investing too much. This caused a small crash as investors quickly sold their stocks. This showed that the market was not as strong as it seemed.

A few days later, a banker named Charles E. Mitchell announced that his bank would lend $25 million. This was meant to stop the market from falling further. His action helped calm things down for a short time. However, the American economy was already showing signs of trouble. Steel production was down, building was slow, and car sales were falling. People were also getting into a lot of debt because it was easy to borrow money.

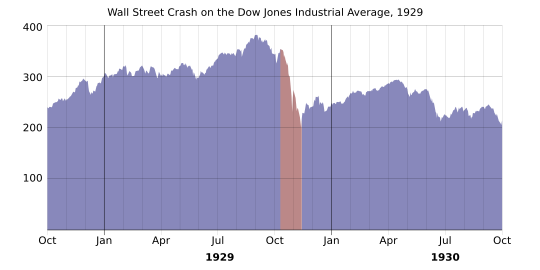

Even with these warnings, stock prices started to rise again in June 1929. They kept going up until early September. The Dow Jones Industrial Average, which tracks stock prices, went up by more than 20% between June and September. Over nine years, the Dow Jones had grown ten times its value. It reached its highest point of 381.17 on September 3, 1929.

Just before the crash, a famous economist, Irving Fisher, said that stock prices had reached a "permanently high plateau." This meant he thought they would stay high forever. But on September 8, financial expert Roger Babson warned that "a crash is coming." This caused the first drop in September, which was called the "Babson Break." Many investors thought this was just a small, healthy correction and a chance to buy more stocks.

On September 20, 1929, a top British investor named Clarence Hatry was jailed for fraud. This made some Americans less confident in their own companies. In the days leading up to the main crash, the market was very unstable. There were times of heavy selling, followed by short periods where prices went up.

The Crash Happens

Selling became much worse in mid-October. On October 24, known as "Black Thursday", the market lost 11% of its value right at the start of the day. So many stocks were being traded that the ticker tape, which showed prices in offices, was hours behind. Investors didn't know the current prices of most stocks.

Several important bankers from Wall Street met to try and fix the panic. They included Thomas W. Lamont from Morgan Bank, Albert Wiggin from Chase National Bank, and Charles E. Mitchell from National City Bank. They chose Richard Whitney, a vice president of the Exchange, to act for them.

With the bankers' money behind him, Whitney offered to buy 25,000 shares of U.S. Steel for $205 each. This was much higher than the current price. He then made similar offers for other valuable stocks. This plan had worked before to stop a panic in 1907. It seemed to work again. The Dow Jones Industrial Average recovered a bit, ending the day down only 6.38 points (2.09%).

But on October 28, "Black Monday", more investors decided to sell their stocks. They were facing margin calls, which meant they had to put more money into their accounts or sell. The Dow had its biggest loss for a single day, dropping 38.33 points, or 12.82%.

On October 29, 1929, "Black Tuesday" hit Wall Street. Investors traded about 16 million shares on the New York Stock Exchange in just one day. Billions of dollars were lost, and thousands of investors lost everything. The panic selling was so bad that some stocks had no buyers at all. The Dow lost another 30.57 points, or 11.73%. In just two days, the Dow had dropped a total of 68.90 points, or 23.05%.

On Black Tuesday, William C. Durant and members of the Rockefeller family tried to help. They bought many stocks to show people they believed in the market. But their efforts could not stop the huge drop in prices. So many stocks were traded that day that the ticker tape kept running until almost 7:45 p.m.

| Date | Change | % Change | Close |

|---|---|---|---|

| October 28, 1929 | −38.33 | −12.82 | 260.64 |

| October 29, 1929 | −30.57 | −11.73 | 230.07 |

After a small recovery on October 30, the market kept falling. It reached a low point on November 13, 1929, closing at 198.60. The market then recovered for a few months, reaching 294.07 on April 17, 1930. But then, the Dow began a much longer slide. It fell steadily from April 1930 until July 8, 1932, when it closed at 41.22. This was its lowest level in the 20th century, meaning the index had lost 89.2% of its value in less than three years.

Starting in March 1933, and through the rest of the 1930s, the Dow slowly began to gain back what it had lost. The biggest percentage increases happened in the early and mid-1930s. There was a sharp drop in late 1937, but prices stayed much higher than the 1932 lows. The Dow Jones did not return to its September 3, 1929, peak until November 23, 1954, which was 25 years later.

What Happened After?

In 1932, the Pecora Commission was set up by the U.S. Senate to study why the crash happened. The next year, the U.S. Congress passed the Glass–Steagall Act. This law made sure that regular banks (which take deposits and give loans) were separate from investment banks (which help companies sell stocks and bonds).

After the crash, stock markets around the world put rules in place. These rules allow them to stop trading if prices fall too quickly. This is meant to prevent panic selling. However, there have been other big one-day crashes. For example, on Black Monday, October 19, 1987, the Dow Jones fell 22.6%. Also, on Black Monday of March 16, 2020, it fell 12.9%. These were worse in percentage terms than any single day of the 1929 crash. But the combined 25% drop on October 28–29, 1929, was still larger than the 1987 crash.

World War II and the Economy

When America got ready for World War II at the end of 1941, about ten million people left their regular jobs to join the war effort. World War II had a huge impact on the economy. It may have helped end the Great Depression in the United States. Before the war, the government spent only 5% of its money on industrial growth in 1940. By 1943, the government was spending 67% on industrial growth.

How the Crash Affected People

In the United States

The 1929 stock market crash and the Great Depression together were the biggest financial crisis of the 20th century. The panic of October 1929 became a symbol of the economic slowdown that affected the whole world. Stock prices fell almost instantly in all financial markets, except in Japan.

The Wall Street Crash had a huge effect on the U.S. and global economy. People have debated its causes and effects ever since. Some believed that certain companies contributed to the crash. Many blamed banks that risked people's savings in the stock market.

In 1930, 1,352 banks failed, holding over $853 million in deposits. In 1931, a year later, 2,294 banks failed with nearly $1.7 billion in deposits. Many businesses also closed down. In 1931, about 28,285 businesses failed, which was 133 failures every day.

The 1929 crash brought the exciting Roaring Twenties to a sudden stop. Some historians believe that in 1929, there was no "lender of last resort." This means there was no strong financial institution that could step in to stop the crisis. If there had been, it might have made the economic slowdown shorter.

Historians still discuss whether the 1929 crash caused the Great Depression. Or if it just happened at the same time as an economic bubble burst. Only 16% of American households had invested in the stock market before the Depression. This suggests the crash might not have been the only cause.

However, the crash had a big psychological effect across the country. Businesses became unsure about getting money for new projects. This uncertainty affected job security for workers. As Americans worried about their income, they naturally spent less money. The fall in stock prices led to bankruptcies and serious economic problems. These included less credit, business closures, job losses, bank failures, and a decrease in the money supply.

The rise of mass unemployment is seen as a result of the crash. But the crash was not the only thing that led to the Depression. The Wall Street Crash is usually seen as having the biggest impact on what followed. It is widely thought to have started the economic slide into the Great Depression. The results were terrible for almost everyone. Most experts agree that the crash wiped out billions of dollars in wealth in one day. This immediately made people stop buying things.

The crash also caused a worldwide rush to withdraw gold from U.S. banks. This forced the Federal Reserve to raise interest rates, even during the economic slump. About 4,000 banks and other lenders eventually failed. Also, a rule called the uptick rule was put in place after the crash. It allowed people to sell stocks they didn't own only when the stock's price had just gone up. This was to stop people from driving prices down on purpose.

In Europe

The stock market crash of October 1929 directly led to the Great Depression in Europe. When stocks fell sharply on the New York Stock Exchange, the world noticed right away. Even though leaders in the United Kingdom and the United States didn't fully understand how bad the crisis would be, it soon became clear. The world's economies were more connected than ever before. The problems in global finance, trade, and production, and the collapse of the American economy, were soon felt all over Europe.

In 1930 and 1931, unemployed workers in the UK went on strike and protested in public. They wanted to show how much they were suffering. Protests often focused on the means test. This was a government rule from 1931 that limited how much unemployment money people could get. For working people, the means test felt unfair and harsh. The police often broke up these protests, arresting people and charging them with breaking public order laws.

Why Experts Still Discuss It

Economists and historians still debate what role the crash played in later economic, social, and political events. The Economist magazine wrote in 1998 that the Depression didn't start with the stock market crash. They also said it wasn't clear at the time that a depression was beginning. They asked, "Can a very serious Stock Exchange collapse cause a serious problem for industry when industry is mostly healthy?" They thought there would be some problems, but not necessarily a long, general industrial depression.

However, The Economist also warned that some bank failures were expected. And some banks might not have had enough money to lend to businesses. They concluded that the banks' situation was key, but no one could have known what would happen.

Milton Friedman's book A Monetary History of the United States, written with Anna Schwartz, argues something different. They say that what made the "great contraction" so bad was not just the economic downturn, or the 1929 stock market crash. Instead, it was the collapse of the banking system during three waves of panics from 1930 to 1933.

See also

- Causes of the Great Depression

- Criticism of the Federal Reserve

- Great Contraction

- List of largest daily changes in the Dow Jones Industrial Average

In Spanish: Crac del 29 para niños

In Spanish: Crac del 29 para niños

| Roy Wilkins |

| John Lewis |

| Linda Carol Brown |