2023 United States debt-ceiling crisis facts for kids

In early 2023, the United States faced a major money problem. On January 19, the government hit its "debt ceiling," which is the legal limit on how much money it can borrow. This started a debt-ceiling crisis.

The crisis was part of a big debate in the Congress about government spending and the national debt. The U.S. Treasury Secretary, Janet Yellen, had to use special accounting methods called "extraordinary measures" to keep paying the country's bills. She warned that the U.S. could run out of money by June 5, 2023.

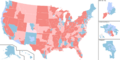

For years, Congress had raised the debt ceiling without much argument. But this time, Republicans, who controlled the House of Representatives, wanted to cut government spending before they would agree to raise the limit. Democrats, including President Joe Biden, wanted to raise the debt ceiling without any conditions, as had been done three times when Donald Trump was president.

If the government couldn't borrow more money, it would have to stop paying some of its bills. This could have been a disaster for the U.S. and the world economy. Some experts believed that the 14th Amendment of the Constitution required the government to pay its debts no matter what. President Biden considered using this amendment to solve the problem, but worried it might not work in time.

Finally, on May 27, President Biden and House Speaker Kevin McCarthy made a deal. They agreed to raise the debt ceiling but also limit some government spending. This deal became a law called the Fiscal Responsibility Act of 2023. President Biden signed it on June 3, ending the crisis.

Contents

Background

To understand the crisis, it's helpful to know about the government's money, debt, and the rules it has to follow.

The Government's Budget and Debt

What is the federal budget?

The federal budget is the government's plan for spending money. In 2022, the government collected $4.9 trillion in taxes but spent $6.27 trillion. This means it had a deficit of $1.38 trillion. A deficit happens when the government spends more money than it brings in.

The U.S. has had a deficit every year since 2001. To cover a deficit, the government has to borrow money. According to the U.S. Constitution, only Congress has the power to borrow money for the country.

What is the debt ceiling?

The United States debt ceiling is a limit set by Congress on the total amount of money the U.S. government can borrow. It was created in 1917 during World War I. Before then, Congress had to approve every single loan. The debt ceiling made it easier for the government to manage its borrowing.

Think of it like a credit card limit. The government can spend money that Congress has approved, but it can only borrow up to the debt ceiling to pay for it. Congress has raised this limit many times over the years.

What is the national debt?

The national debt is the total amount of money the U.S. government owes. It's the sum of all past deficits. Since 2009, the national debt has nearly tripled.

This happened for many reasons, including tax cuts, wars in Iraq and Afghanistan, and spending on big events like the Great Recession and the COVID-19 pandemic.

Why is the U.S. Dollar Important?

The United States dollar is the world's main reserve currency. This means it's used in most international business and trade. The dollar is popular because the U.S. economy is large and stable.

Because the dollar is so trusted, countries like China, Japan, and the United Kingdom are willing to lend money to the U.S. by buying its debt. This makes it easier and cheaper for the U.S. government to borrow money.

The Political Disagreement

The White House and the House of Representatives had different ideas about how to solve the crisis.

- Republicans, led by House Speaker Kevin McCarthy, wanted to cut government spending. They argued that the national debt was too high. They refused to raise the debt ceiling unless President Biden agreed to these cuts.

- Democrats, led by President Biden, said that raising the debt ceiling should not be used as a bargaining chip. They argued that Congress had already approved the spending, so it had a duty to pay the bills. They wanted a "clean bill" to raise the limit with no other conditions.

Senate Republican leader Mitch McConnell said that a deal had to be made between Biden and McCarthy to avoid a crisis.

Possible Solutions Without Congress

During the standoff, people discussed unusual ways the President might be able to act without Congress.

The Fourteenth Amendment

Section 4 of the 14th Amendment says that the "validity of the public debt of the United States... shall not be questioned." This was added after the Civil War to make sure the U.S. would always pay its debts.

Some legal experts believe this means the debt ceiling itself is unconstitutional. They argued that President Biden could use this amendment to order the Treasury to keep borrowing money, even if it went over the limit. However, this would have been a risky move. It could have led to a legal battle in the courts and created more uncertainty.

The Trillion-Dollar Coin

Another idea was to mint a trillion-dollar coin. A law allows the U.S. Treasury to mint platinum coins of any value. In theory, the Treasury could create a coin worth $1 trillion, deposit it at the Federal Reserve (the U.S. central bank), and use the money to pay bills.

However, Treasury Secretary Janet Yellen called this idea a "gimmick." She said the Federal Reserve might not even accept such a coin. Economists were divided on whether it would cause other economic problems, like inflation (rising prices).

Reaching an Agreement

After weeks of talks, President Biden and Speaker McCarthy finally found a compromise.

The Limit, Save, Grow Act

|

|

| Long title | To provide for a responsible increase to the debt ceiling, and for other purposes. |

|---|---|

| Legislative history | |

|

|

In April, House Republicans passed their own bill called the Limit, Save, Grow Act. This bill would have raised the debt ceiling by $1.5 trillion. In return, it would have cut government spending by $4.8 trillion over ten years.

The bill included cuts to clean energy programs and added work requirements for people receiving government aid. President Biden said he would veto the bill if it reached his desk. The bill passed the House by a very close vote of 217-215 but had no chance of passing the Democrat-controlled Senate. However, it was an important step in the negotiations.

The Fiscal Responsibility Act of 2023

|

|

| Long title | To provide for a responsible increase to the debt ceiling. |

|---|---|

| Enacted by | the 118th United States Congress |

| Effective | June 3, 2023 |

| Citations | |

| Public law | Pub.L. 118-5 |

| Statutes at Large | 137 Stat. 10 |

| Legislative history | |

|

|

The final deal between Biden and McCarthy was called the Fiscal Responsibility Act of 2023. It was a compromise that both sides could agree on. The bill passed the House with a strong bipartisan vote of 314-117 and the Senate with a vote of 63-36. President Biden signed it into law on June 3, just two days before the deadline.

The law included several key points:

- It suspended the debt limit until January 2025. This meant the government could keep borrowing money to pay its bills.

- It put caps on some government spending for the next two years.

- It took back some unspent money from COVID-19 relief programs.

- It changed work requirements for some people receiving food assistance through the SNAP program.

- It made it easier to get permits for energy projects.

The agreement angered some very conservative Republicans, who felt the spending cuts were not big enough. It also upset some Democrats who did not want any spending cuts. But in the end, a majority of both parties voted for the bill to avoid an economic crisis.

See also

- History of the United States debt ceiling

- 2011 United States debt-ceiling crisis

- 2013 United States debt ceiling crisis

Images for kids

| Georgia Louise Harris Brown |

| Julian Abele |

| Norma Merrick Sklarek |

| William Sidney Pittman |