Black-owned businesses facts for kids

Black-owned businesses, also known as African-American businesses, have a long and important history in the United States. They started even before 1865, when slavery was still legal. After slavery ended and civil rights were gained, Black business owners could officially open companies. This began during the Reconstruction Era (1863–77).

By the 1890s, thousands of small businesses run by Black people had opened in cities. The biggest growth happened in the early 1900s. This was when strict Jim Crow segregation laws pushed Black people into their own communities. These communities became large enough to support many businesses. Booker T. Washington, a famous college president, helped create the National Negro Business League. This group opened over 600 local chapters. It reached almost every city with a large Black population.

African-Americans have owned many types of companies. Some of the most well-known include insurance companies, banks, music labels, funeral homes, barber shops, and beauty salons. They also owned restaurants, record stores, and bookstores.

By 1920, there were tens of thousands of Black businesses. Most of them were quite small. The largest ones were insurance companies. The National Negro Business League grew very big. It helped create many other groups for Black bankers, publishers, lawyers, and more.

The Great Depression (1929-1939) was a tough time. Many Black people lost their jobs, so less money was available. This caused many smaller businesses to close. During World War II, many Black workers and owners took high-paying jobs in factories making weapons. Black business owners usually supported the Civil Rights Movement.

In the 1970s, government programs helped minority businesses get new funding. Also, Black entrepreneurs in music and sports became famous. They built their "brand" names, which led to success in advertising and media.

Contents

Early Black Businesses (Before 1865)

Black entrepreneurship began when Africans were first brought to North America. Many African-Americans who became free from slavery started their own businesses. Even some enslaved people ran businesses. They might be skilled workers or small traders. They did this with or without their owners' permission.

Free Black people often faced a difficult world. Still, they sometimes ran small businesses. More free and enslaved African-Americans created businesses than many people realize. When they saw a chance, they took it. Sometimes their owners even supported them. Businesses often grew from skills the person already had.

Here are some examples:

- Tobacconist – As a young enslaved man, Lunsford Lane started selling peaches. He soon focused on making money. In a few years, he saved enough to buy his freedom.

- Shoemaker – William J. Brown was born free in Rhode Island. He faced unfair treatment while trying to become a shoemaker.

- Sailmaker – James Forten Sr. learned sail-making after the American Revolution. He bought his employer's business. He became the richest Black man in Philadelphia.

- Barber – After gaining freedom in 1820, William Johnson became a successful businessman in Natchez, Mississippi. He ran a barber shop, loaned money, and bought land.

- Merchant – Mifflin Wistar Gibbs was born free in Philadelphia. He became a businessman, lawyer, and politician. He ran a clothing store in San Francisco for several years.

- Dressmaker – After buying her freedom, Elizabeth Keckley moved to Washington, D.C. She became the dressmaker for Mary Todd Lincoln. She made fancy dresses for important women.

Business Growth (1865–1900)

After slavery ended, Black business owners could work within the American legal system. By the 1890s, thousands of small Black-owned businesses had opened in cities.

One important leader was Robert Reed Church (1839–1912) from Memphis, Tennessee. He was a freedman who became the South's first Black millionaire. He earned his money by buying and selling city land. He started the city's first Black-owned bank, Solvent Savings Bank and Trust. This bank helped Black people get loans for businesses. He also played a big role in politics.

Racial segregation made it hard for Black communities. They were limited in where they could live. This slowed their social, educational, and economic progress. However, in Northern cities during the late 1800s, Black communities fought segregation. They started many new businesses. These owners used the limits placed on African-Americans to their advantage. They served a market of Black customers who couldn't easily shop in white-owned stores. This led to a rise in "negro markets." For example, in South Side Chicago, the number of Black-owned businesses reached 2,500 by 1937.

The "Golden Age" (1900–1930)

In the early 1900s, Black people faced more segregation. But the more they were separated from white communities, the more Black entrepreneurs succeeded. They opened many businesses that served only Black customers.

The fastest growth happened during this time. The strict Jim Crow laws pushed Black people into their own city areas. These communities became big enough to support many businesses. The National Negro Business League, led by Booker T. Washington, opened over 600 chapters. It reached every city with a large Black population.

By 1920, there were tens of thousands of Black businesses. Most were small. The largest were insurance companies. The League grew so big it supported many related groups. These included associations for Black bankers, publishers, funeral directors, and more.

The Great Depression hurt many businesses. Cash income fell in Black communities due to high unemployment. Many small businesses closed. During World War II, many Black workers took high-paying jobs in factories. Black business owners usually supported the Civil Rights Movement.

In cities, the Black population and their income grew. This created chances for many businesses. These ranged from barber shops to insurance companies. Funeral homes were especially important. They often played a role in politics too.

Historians call 1900–1930 the "Golden Age of Black Business." The number of Black-owned businesses doubled from 20,000 in 1900 to 40,000 in 1914. Undertakers grew from 450 to 1,000. Drugstores increased from 250 to 695. Small local retail stores jumped from 10,000 to 25,000.

Atlanta was a major center for Black businesses. White businessmen reduced contact with Black customers around 1900. Black entrepreneurs quickly filled this gap. They started banks, insurance companies, and many local stores. The number of Black doctors and lawyers also grew a lot.

Durham, North Carolina, was another important city for Black businesses. It was a new industrial city. It allowed Black entrepreneurs to succeed.

Booker T. Washington (1856–1915) was the most famous supporter of Black business. He traveled to different cities. He encouraged local business owners to join his National Negro Business League.

In 1915, C.R. Patterson and Sons made the first African-American car. It was called the Greenfield-Patterson car. The company stayed active until 1939.

By the 1920s, the government offered advice to Black entrepreneurs. But they did not provide financial help.

The most famous Black entrepreneur of this time was Charles Clinton Spaulding (1874–1952). He was president of the North Carolina Mutual Life Insurance Company in Durham. It was the largest Black-owned business in the nation. Its salespeople collected small payments, like 10 cents a week, from clients. This gave them insurance for the next week. If a client died, the company quickly paid about $100. This money covered a funeral, which was very important in the Black community. Black funeral home owners also became important businessmen.

African-Americans also started businesses in resort areas. Examples include Oak Bluffs, Massachusetts, and Idlewild, Michigan.

Newspapers and Magazines

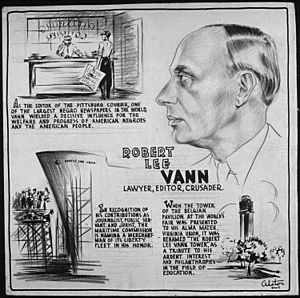

African-American newspapers became very popular in major cities. Publishers played a big role in politics and business. Important leaders included Robert Sengstacke Abbott of the Chicago Defender. Others were John Mitchell Jr. of the Richmond Planet and Robert Lee Vann of the Pittsburgh Courier.

John H. Johnson (1918–2005) started the Johnson Publishing Company in 1942. He went from being poor to a millionaire by age 31. In 1982, he was the first African-American on the Forbes 400 list. His magazines, Ebony and Jet, were very important Black media by 1950.

Beauty Entrepreneurs

Most Black business owners were men. However, women played a huge role, especially in the beauty industry. Black communities had their own beauty standards, focusing on hair care. Beauticians could work from home. So, many Black beauticians worked in the rural South, even without cities. They were among the first to use cosmetics.

Beauty shops were places where Black women could feel special and beautiful. Beauty contests also started in the 1920s. In the Black community, these contests grew from high school and college homecoming events.

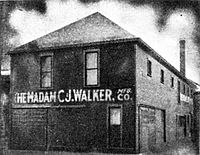

The most famous beauty entrepreneur was Madame C.J. Walker (1867–1919). She built a national business called Madam C. J. Walker Manufacturing Company. It was based on her invention of a successful hair straightening process. Marjorie Joyner (1896–1994) was the first Black graduate of a Chicago beauty school. She became Madame Walker's agent. By 1919, Joyner oversaw Walker's 200 beauty schools.

Her stylists went door-to-door, selling and using products in customers' homes. Joyner taught about 15,000 stylists. She also created new products, like a permanent wave machine. She helped write the first cosmetology laws for Illinois. She also started groups for Black beauticians. Joyner was friends with Eleanor Roosevelt. She helped found the National Council of Negro Women.

The Cardozo Sisters Hair Stylists was a leading beauty salon in Washington. It was run by Elizabeth Cardozo Parker (1900–1981) and Margaret Cardozo Holmes (1898–1991). From 1929 to 1971, they had five shops near Howard University. They had 25 employees and served up to 200 clients daily. They fought against unfair practices in the beauty industry.

Rose Meta Morgan (1912–2008) started the House of Beauty salon. She wanted to promote Black beauty standards. She opposed "white" standards that favored straight hair and light skin. She moved to New York City in 1938. Her small shop became the world's largest African-American beauty parlor. She held fashion shows in Harlem. She sold cosmetics made for "a woman of color." In 1965, she started New York City's only Black commercial bank, Freedom National Bank.

Small Businesses

Besides the larger companies, African-Americans have a long history of owning small businesses. These include restaurants, drug stores, newsstands, and corner stores. They also owned candy shops, liquor stores, grocery stores, bars, and gas stations.

African-Americans also owned music-related businesses. These included record stores, nightclubs, and record labels. African-American bookstores were often linked to political movements. These included Black Power and black nationalism.

African-American-owned funeral homes were also important during the Civil Rights Movement. These places allowed the public to see photos and TV images of violence against Black people.

"Double Duty Dollars"

The phrase "double duty dollar" was used from the early 1900s to the 1960s. It meant that money spent at businesses that hired Black people did two things. It bought a product and also helped the Black community. If a store didn't hire Black people, it was seen as not wanting Black customers either.

Leaders like Booker T. Washington and Marcus Garvey encouraged their communities to spend money with businesses that were fair to African-Americans. In the 1940s and 1950s, Leon Sullivan used the term "selective patronage." This meant choosing where to shop to influence businesses to treat African-Americans better. It also aimed to create demand for Black-owned businesses.

Government Support

In 1927, the government started a Division of Negro Affairs. It gave advice to Black and white business owners on how to reach Black customers. During World War II, this division tried to help Black businesses get defense contracts. But most Black businesses were too small for big contracts.

President Lyndon Johnson linked Black entrepreneurship to his "War on Poverty." He created special programs in the Small Business Administration. These programs offered loans to help more Black people own businesses. President Richard Nixon greatly expanded this program. He hoped Black entrepreneurs would help ease racial tensions.

The National Market

Before the 1960s, most big companies ignored the Black market. They didn't focus on working with Black merchants or hiring Black people for important jobs. Pepsi-Cola was different. It wanted to compete with Coca-Cola. Pepsi hired Edward F. Boyd, a Black advertising pioneer. Boyd hired local Black promoters. They reached Black markets across the South and Northern cities.

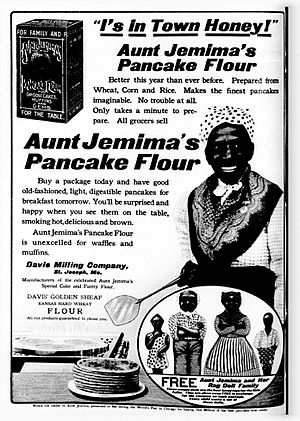

Pepsi's ads avoided old stereotypes like Aunt Jemima. Instead, they showed Black customers as confident middle-class people. They had good taste in soft drinks. Pepsi bottles were also twice the size, making them a good value.

In 1968, the first Black-owned McDonald's restaurant opened in Chicago.

The 21st Century

In 2002, African-American-owned businesses made up 1.2 million of the 23 million businesses in the U.S. By 2011, this number grew to about 2 million. Black-owned businesses had the biggest growth among minority groups from 2002 to 2011. The internet helped Black-owned businesses like McBride Sisters Wine Company become more visible. They could reach more customers than before.

The Dodd–Frank Wall Street Reform and Consumer Protection Act of 2010 aimed to help Black-owned businesses get more government contracts. It made federal agencies create offices to track their diversity efforts.

More Black businessmen became famous. These include billionaire BET founder Robert L. Johnson. Also, private equity manager Robert F. Smith. In 2015, the U.S. Census reported 2.6 million Black-owned firms in 2012. This was a 34.5% increase from 2007. Many apps and websites now list Black-owned businesses. Examples are The Nile List and Official Black Wallstreet: http://officialblackwallstreet.com/: http://officialblackwallstreet.com/.

Black entrepreneurs from music and sports built strong "brand" names. This led to success in advertising and media. Oprah Winfrey is a famous example. She became involved in many businesses, like her book club. Basketball star Magic Johnson was named one of America's most important Black businessmen in 2009. He owns many businesses. He was also part-owner of the Lakers basketball team. He is part of groups that bought the Los Angeles Dodgers in 2012 and the Los Angeles Sparks in 2014.

In the 21st century, Black-owned businesses have gained public attention in new ways. The TV show Shark Tank has helped many Black-owned businesses. They can get investors, promote their business, and share their story. U-Lace, a no-tie shoelace company owned by Tim Talley, got a $200,000 investment on Shark Tank. This helped their revenue grow to over $3 million.

The COVID-19 pandemic affected Black-owned businesses more severely. A study by the Federal Reserve found this was due to their location and weaker ties to banks. Counties with many Black-owned businesses had more COVID-19 cases. This led to longer closures and fewer customers.

The Paycheck Protection Program offered loans to small businesses. But fewer loans went to areas with many Black-owned businesses. This was partly because many large banks helped existing customers first. Black-owned businesses were less likely to have a recent relationship with a bank.

During the 2020–21 United States racial unrest, people looked for Black-owned businesses to support. Google searches for "Black-owned businesses near me" hit record highs. Restaurant apps added features to find Black-owned restaurants. Businesses on social media lists saw much higher sales. Black-owned bookstores especially had trouble keeping up with demand. The Black-owned Greenwood digital bank opened in 2020. It aims to provide financial services for people of color.

There are now many public resources for Black-owned businesses. These help them succeed, especially after the COVID-19 challenges. Resources offer guidance. The Black Business Association in Los Angeles helps with networking and training. Black Founders focuses on technology businesses. Black Owned Everything uses Instagram to advertise Black businesses.

Important Black Business Leaders

| Date | Name | Achievement | Field |

|---|---|---|---|

| 1858–1927 | Alonzo Herndon | Founder of Atlanta Life and Atlanta's first Black millionaire | Insurance |

| 1867-1919 | Madam C.J. Walker | The first self-made Black female millionaire | Beauty |

| 1874–1952 | Charles Clinton Spaulding | President of North Carolina Mutual Life Insurance Company, America's largest Black-owned business | Insurance |

| 1918-2005 | John H. Johnson | Founder of the Johnson Publishing Company, a very important Black-owned media company | Publishing |

| 1929- | Berry Gordy | Founder of Motown Records, a top-earning Black-owned music business for decades | Music |

| 1942–1993 | Reginald Lewis | The first Black man to build a billion-dollar company, TLC Beatrice International Holdings Inc. | Finance |

| 1954- | Chris Gardner | Founder of the stock brokerage firm Gardner Rich & Co | Finance |

| 1954- | Oprah Winfrey | The first Black woman billionaire in media and entertainment | Media and Entertainment |

| 1962- | Robert F. Smith | Billionaire financier and CEO of Vista Equity Partners | Finance |

Images for kids

See also

- American business history

- African-American history

- African-American newspapers

- Double-duty dollar