Comcast facts for kids

Comcast Center, the company's headquarters in Philadelphia

|

|||

|

Formerly

|

|

||

|---|---|---|---|

| Public | |||

| Traded as | |||

| Industry |

|

||

| Predecessors | AT&T Broadband | ||

| Founded | June 28, 1963 in Tupelo, Mississippi, U.S. | ||

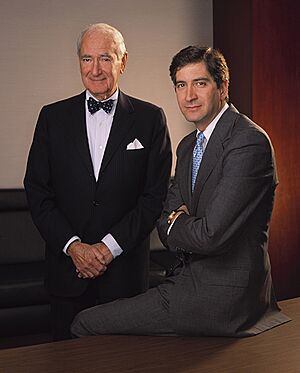

| Founder | Ralph J. Roberts | ||

| Headquarters | Comcast Center,

,

United States

|

||

|

Area served

|

Worldwide | ||

|

Key people

|

|||

| Products | |||

| Revenue | |||

|

Operating income

|

|||

| Total assets | |||

| Total equity | |||

| Owner | Brian L. Roberts (1% equity interest, 33% voting power) | ||

|

Number of employees

|

182,000 (2024) | ||

| Divisions |

|

||

| Subsidiaries | |||

|

|||

Comcast Corporation is a huge company that works with media, phones, and entertainment all around the world. It used to be called Comcast Holdings. Its main office is in Philadelphia, USA. In 2023, Forbes magazine listed it as the 51st largest company globally.

Comcast is one of the biggest telecommunications companies in the world. It is also the largest home Internet service provider in the United States. Comcast owns Xfinity, which provides cable TV, internet, and phone services for homes. It also has Comcast Business for companies. Comcast is a major player in the entertainment world too. It owns NBCUniversal and Sky Group, which means it creates and shares lots of movies, TV shows, and news.

Comcast has faced some criticism, especially about its customer service. From 2008 to 2010, its customer satisfaction was among the lowest in the cable industry. People have also worried about Comcast's power in the internet market. Despite this, the company has worked to improve its services.

Contents

About Comcast's Business

What Services Does Comcast Offer?

Comcast offers many services. It provides cable television, broadband internet, and home phone services through its Xfinity brand. For businesses, it offers similar services through Comcast Business. Comcast also owns Xfinity Mobile, which is a mobile phone service that uses Verizon's network.

Comcast's Entertainment World

Comcast owns NBCUniversal, which is a huge part of the entertainment industry. This includes:

- Movie Studios: Universal Pictures, DreamWorks Animation, Illumination, and Focus Features. These studios make many popular movies.

- TV Channels: The National Broadcasting Company (one of the biggest TV networks in the US), Spanish-language channels like Telemundo, and many cable channels such as MSNBC, CNBC, USA Network, Syfy, Oxygen True Crime, Bravo, and E!.

- News and Sports: NBC News, Noticias Telemundo, NBC Sports, and Telemundo Deportes.

- Streaming: The video streaming service Peacock.

- Theme Parks: Universal Destinations & Experiences operates popular theme parks like Universal Studios.

Comcast also owns Sky Group, which is a big media company in Europe. Sky provides TV, internet, and phone services in countries like the United Kingdom, Ireland, Germany, and Italy.

How Comcast Started and Grew

Early Days as American Cable Systems

Comcast started in 1963 when Ralph J. Roberts and his partners bought a small cable company called American Cable Systems in Tupelo, Mississippi. It had only five channels and 12,000 customers. In 1965, they bought a marketing company, and in 1968, they bought a Muzak franchise, which plays background music in stores.

Becoming Comcast Corporation

The company officially became Comcast Corporation on March 5, 1969. In 1972, Comcast became a public company, meaning its shares could be bought and sold on the stock market. In 1977, HBO was first offered on a Comcast system.

In the 1980s, Comcast grew by buying parts of other companies. In 1986, it bought 26% of Group W Cable, which doubled its customers to 1 million. It also invested in QVC, a shopping channel. In 1988, Comcast bought American Cellular Network Corporation, becoming a mobile phone operator for the first time.

Growing Bigger in the 1990s

In 1990, Ralph Roberts' son, Brian L. Roberts, became the president of Comcast. The company continued to grow rapidly. By 1994, Comcast was the third-largest cable company in the US with about 3.5 million customers.

In 1996, Comcast started offering internet service through the @Home Network. That same year, it formed Comcast Spectacor, which owns the Philadelphia Flyers hockey team. In 1997, Microsoft invested $1 billion in Comcast, and the company launched its digital television service. Comcast also gained control of E! Entertainment. By the end of the 1990s, Comcast had bought several more cable companies, adding millions of customers.

Becoming the Largest Cable Provider

In 2001, Comcast announced a huge deal to buy AT&T Broadband, which was the largest cable TV company at the time. This deal was completed in 2002, making Comcast the biggest cable TV company in the United States with over 22 million customers.

In 2004, Comcast tried to buy Disney for $54 billion, but Disney rejected the offer, and Comcast dropped the plan. In 2005, Comcast and Sony Pictures Entertainment bought MGM and United Artists studios.

In 2006, Comcast bought the software company thePlatform, which helps other companies manage their online media. In 2008, Comcast bought Plaxo, a company that helps manage contact information.

Buying Adelphia Cable

In 2005, Comcast and Time Warner Cable teamed up to buy the assets of Adelphia Cable, which was going through bankruptcy. This deal was finalized in 2006. As part of the deal, Comcast and Time Warner Cable traded customers in different areas to make their service regions more organized.

Acquiring NBCUniversal

In 2009, Comcast began talks to buy NBC Universal from General Electric. The deal was completed in January 2011. Comcast bought a 51% stake in NBCUniversal, which included the NBC television network, cable channels like USA Network and Syfy, and Universal Pictures. In 2013, Comcast bought the remaining 49% of NBCUniversal, making it a fully owned part of Comcast.

In 2020, Comcast's profits were affected by the COVID-19 pandemic, especially because its theme parks like Universal Studios had to limit visitors or close.

Attempted Purchase of Time Warner Cable

In 2014, Comcast tried to buy Time Warner Cable for $45.2 billion. This would have added many major cities like New York City and Los Angeles to Comcast's service areas. However, many people worried that this deal would give Comcast too much power in the cable and internet market. The US Department of Justice and the Federal Communications Commission (FCC) investigated the deal. In April 2015, the deal was called off due to these concerns.

Buying DreamWorks Animation

On April 28, 2016, Comcast announced that its NBCUniversal part would buy DreamWorks Animation for $3.8 billion. This deal was completed in August 2016. DreamWorks Animation, known for movies like Shrek, How to Train Your Dragon, and Kung Fu Panda, became part of Universal Pictures.

Starting Xfinity Mobile

In September 2016, Comcast announced it would launch its own cellular network service using Verizon Wireless's network. This service, called Xfinity Mobile, officially launched in April 2017. It allowed Comcast to offer a "quadruple play" of services: TV, internet, home phone, and mobile phone.

Acquiring Sky Group

In 2018, Comcast got into a bidding war with Disney to buy 21st Century Fox. However, Comcast later dropped its bid for Fox to focus on buying Sky Group, a large media company in Europe. On September 22, 2018, Comcast outbid Fox and bought Sky for $40 billion. Sky became a fully owned part of Comcast in November 2018.

Recent Investments

In 2022, Comcast bought Levl, a company that develops technology to help prevent hacking of wireless devices. In 2023, Comcast and Disney agreed that Comcast would sell its 33% share in Hulu, a streaming service, to Disney. This deal valued Hulu at $27.5 billion.

In October 2024, Comcast announced it was thinking about spinning off some of its cable networks into a separate company. This new company, called "Versant," is expected to be completed in 2025. It will include channels like USA Network, CNBC, MSNBC, and digital services like Fandango. NBC, Telemundo, Bravo, Peacock, Universal Studios, and the theme parks will remain with NBCUniversal.

Comcast's Divisions and Brands

Xfinity

Xfinity is the brand name for Comcast's services for homes. It provides cable television, high-speed internet, and home phone services. Comcast Business offers similar services to companies.

NBCUniversal

NBCUniversal creates and distributes a lot of TV shows and movies. It owns many popular cable channels like E!, Oxygen, Golf Channel, Universal Kids, and Bravo. It also includes the NBC Sports Regional Networks.

DreamWorks Animation

Since 2016, DreamWorks Animation has been part of NBCUniversal. This means Comcast owns the rights to popular characters and stories from franchises like Shrek, How to Train Your Dragon, Kung Fu Panda, Trolls, and Madagascar. It also includes Classic Media, which has a huge library of older characters like Postman Pat, Felix the Cat, Noddy, Rudolph the Red-Nosed Reindeer, Frosty the Snowman, Casper the Friendly Ghost, and VeggieTales.

Sky Group

Sky Group is a major media company in Europe owned by Comcast. It provides TV, internet, and phone services to millions of customers in countries like the United Kingdom, Ireland, Germany, and Italy. Sky is Europe's largest pay-TV provider.

Xumo

Xumo is a free streaming TV service that Comcast bought in 2020. It offers many channels and shows for free, supported by ads. In 2022, Comcast and Charter Communications announced they would work together to create a new streaming platform using the Xumo name. This platform includes Xfinity Flex and XClass TV, which are now called Xumo Stream Box and Xumo TV.

Professional Sports

Comcast also has a big presence in professional sports through Comcast Spectacor. This includes owning the Philadelphia Flyers hockey team and their home arena, the Wells Fargo Center. Comcast is also a sponsor of NASCAR's second-tier racing series, which is now called the NASCAR Xfinity Series.

Images for kids

See also

In Spanish: Comcast para niños

In Spanish: Comcast para niños