Fischer Black facts for kids

Quick facts for kids

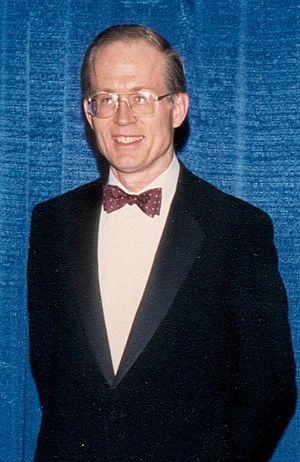

Fischer Black

|

|

|---|---|

|

|

| Born | January 11, 1938 Washington, D.C., U.S.

|

| Died | August 30, 1995 (aged 57) New York City, U.S.

|

| Citizenship | American |

| Alma mater | Harvard University |

| Known for | Black–Scholes equation Black-76 model Black–Derman–Toy model Black–Karasinski model Black–Litterman model Black's approximation Treynor–Black model |

| Awards | 1994, IAFE Financial Engineer of the Year |

| Scientific career | |

| Fields | Economics Mathematical finance |

| Institutions | University of Chicago Booth School of Business

MIT Sloan School of Management Goldman Sachs |

| Doctoral advisor | Patrick Carl Fischer |

Fischer Sheffey Black (January 11, 1938 – August 30, 1995) was an American economist. He is most famous for helping create the Black–Scholes equation. This equation is very important in the world of finance.

Contents

Fischer Black's Early Life and Education

Fischer Black went to Harvard University. He finished his first degree in 1959. Later, he earned a Ph.D. in applied mathematics from Harvard in 1964. A Ph.D. is a very high university degree.

At first, he had some trouble deciding what to study. He switched from physics to math, then to computers and artificial intelligence. He even worked for a company called Bolt, Beranek and Newman, helping with artificial intelligence systems. He also spent time at the RAND Corporation.

Black became a student of Marvin Minsky, a famous professor at MIT. This helped him finish his research and get his Ph.D. from Harvard.

After his studies, Black worked at a company called Arthur D. Little. Here, he learned about economics and finance. He also met Jack Treynor, who would become an important partner in his work.

In 1971, Black started working at the University of Chicago. Later, in 1975, he moved to the MIT Sloan School of Management. In 1984, he joined Goldman Sachs, a big financial company. He worked there until he passed away.

Fischer Black's Career in Economics

Black started thinking deeply about how money works in an economy around 1970. At that time, there was a big discussion among economists. Two main groups were the Keynesians and the monetarists.

Understanding Money and the Economy

Keynesians believed that money markets can be unstable. They thought the government should use money and tax policies to help the economy grow smoothly. They felt that central banks needed special powers to do this.

Monetarists, led by Milton Friedman, disagreed. They thought that too much government control was the problem. Friedman believed that the amount of money in the economy should grow at a steady rate, like 3% each year. This would help the economy grow in a predictable way.

Black studied these ideas. He used a model called the capital asset pricing model. He concluded that government money policies couldn't do as much good as Keynesians hoped. He thought these policies should be more hands-off. But he also believed they couldn't do as much harm as monetarists feared.

In 1972, Black wrote a letter to Friedman. He explained that if the government tries to add money to the economy, people might just use it to buy government bonds. If the government takes money out, people might let their bonds expire without replacing them.

The Famous Black–Scholes Equation

In 1973, Black and his partner Myron Scholes published a very important paper. It was called 'The Pricing of Options and Corporate Liabilities'. This paper was published in a journal called 'The Journal of Political Economy'.

This paper contained their most famous work: the Black–Scholes equation. This equation helps people figure out the fair price of financial options. Options are like contracts that give someone the right, but not the obligation, to buy or sell something at a certain price.

Black's Ideas on Business Cycles

In 1976, Black suggested that human skills and businesses have ups and downs. He thought these changes were mostly unpredictable. This is because we don't know exactly what people will want in the future. We also don't know what the economy will be able to produce.

He said that a "boom" happens when technology matches well with what people want. A "bust" happens when there's a mismatch. This idea made Black an early thinker in what's called real business cycle theory. This theory looks at how real factors, like technology, cause economic changes.

Black believed that his work on money, business cycles, and options were all connected. He saw a "beauty and symmetry" in these models. He spent many years trying to share this knowledge. He felt that people understood his work on options best.

His Book: Business Cycles and Equilibrium

Fischer Black wrote many academic papers. One of his most well-known books is Business Cycles and Equilibrium.

In this book, Black asks readers to imagine a world without money. He suggests that economic and financial markets are always in a state of balance. He also creates models and challenges other money theories. He especially questioned ideas about how much money exists and how easily it can be used.

Black believed that banks are the main places for money transactions. He also said that money is an endogenous resource. This means it comes from within the economic system, created by banks trying to make a profit. This was different from monetarists, who thought money was exogenous (coming from outside the system, like from the government).

Some of his statements were quite strong. For example, he said that "Monetary and exchange rate policies accomplish almost nothing." He also said that "fiscal policies are unimportant in causing or changing business cycles." These ideas made both Keynesians and Monetarists disagree with him.

Later Life and Legacy

His Health and Passing

In early 1994, Fischer Black was diagnosed with throat cancer. He had surgery, and at first, it seemed to work well. Black was even able to attend a meeting in October 1994. There, he received an award as the Financial Engineer of the Year. However, the cancer returned, and Black passed away in August 1995.

Awards and Recognition After His Death

The Nobel Prize is not given to people after they have died. So, Fischer Black did not receive the Nobel Prize in 1997. However, his co-author Myron Scholes did receive the award that year for their work on option pricing. Robert C. Merton, another expert in this field, also shared the award. When the Nobel committee announced the prize, they made sure to mention Black's very important role.

Black also received recognition for other work. He helped create the Black–Derman–Toy model. This model helps value certain financial products related to interest rates. He also co-authored the Black–Litterman model. This model helps manage investments around the world. Both of these models were developed while he worked at Goldman Sachs.

In 2017, Black was added to the Performance & Risk Measurement Hall of Fame. This honor recognizes people who have made big contributions to measuring investment performance and risk.

The Fischer Black Prize

In 2002, the American Finance Association created a special award in memory of Fischer Black. It's called the Fischer Black Prize. This award is given every two years. It honors a young researcher whose work shows the same original thinking as Fischer Black's. The research must also be useful for finance in the real world.

See also

In Spanish: Fischer Black para niños

In Spanish: Fischer Black para niños