Commerzbank facts for kids

|

|

Commerzbank Tower, the headquarters of Commerzbank in Innenstadt, Frankfurt.

|

|

| Public | |

| Traded as | FWB: CBK DAX |

| ISIN | [https://isin.toolforge.org/?language=en&isin=DE000CBK1001 DE000CBK1001] |

| Industry | Financial services |

| Founded | 26 February 1870 in Hamburg |

| Founders | Theodor Wille et al. |

| Headquarters | Commerzbank Tower,

,

Germany

|

|

Number of locations

|

15 operational foreign branches and 27 representative offices in over 40 countries (2023) |

|

Area served

|

Worldwide |

|

Key people

|

|

| Products |

|

| Brands |

|

| Revenue | |

| Total assets | €555 billion (2024) |

| Total equity | |

|

Number of employees

|

42,098 (2023) |

| Capital ratio | 14.7% (2023) |

| Rating |

|

| Footnotes / references Commerzbank Investor Relations |

|

Commerzbank AG, often just called Commerzbank, is a large bank based in Frankfurt am Main, Germany. It helps people, small businesses, and big companies with their money needs. The Commerzbank Group also includes the German bank Comdirect Bank and the Polish bank mBank.

As one of Germany's oldest banks, Commerzbank is very important to the country's economy. It helps German companies trade with other countries. It also has offices in major cities around the world. Since it started in 1870, Commerzbank has changed a lot. It was the first German bank to open an office in New York City in 1971.

A big event was when it bought Dresdner Bank in 2009. During the 2008 financial crisis, the German government became a major owner of Commerzbank. The government still owns a large part of the bank today. Commerzbank is listed on the DAX, which is a list of Germany's biggest companies. In recent years, the bank has become profitable again by cutting costs and changing how it does business.

Contents

History of Commerzbank

Early Years (1870–1918)

On February 26, 1870, Theodor Wille and other business people started the Commerz- und Diskonto-Bank in Hamburg. Their goal was to provide money for trade in Hamburg and help with international business. Other important banks also helped start it. In 1873, the bank helped create the London and Hanseatic Bank in London.

By 1891, it was the biggest bank in Hamburg for lending money. It helped Germany's industries grow by giving loans for shipping, electricity, mining, and manufacturing. In 1897, it bought Jacques Dreyfus & Co., a bank in Frankfurt and Berlin. After this, the bank changed its name to Commerz- und Disconto-Bank in 1898.

In 1901, the bank joined a group of banks that helped the German government get loans. In 1905, it bought Berliner Bank and had two main offices, one in Hamburg and one in Berlin. It also bought several smaller banks.

During World War I, the British government took over its London branch. After 1917, Commerzbank bought many local banks in Germany. By 1923, it had bought 40 local banks.

Growth and Challenges (1918–1933)

In 1920, the bank bought Mitteldeutsche Privat-Bank and changed its name to Commerz- und Privat-Bank AG. In 1923, during a time of very high inflation in Germany, the bank had many employees and branches. After the inflation ended, the number of employees went down.

In 1927, Commerzbank opened an office in New York City to do more business in the US. In 1929, it merged with Mitteldeutsche Creditbank. By 1930, Commerz- und Privatbank was Germany's fourth-largest bank.

After a banking crisis in 1931, the bank moved all its main offices to Berlin. In 1932, it had to take over another struggling bank, Barmer Bankverein. Because of this, the government owned 71 percent of the bank. In November 1932, the bank's leaders were among those who advised President Paul von Hindenburg to appoint Adolf Hitler as chancellor.

-

Former main office of Mitteldeutsche Privat-Bank in Magdeburg

-

Former main office of Hessischer Bankverein in Kassel, taken over by Commerzbank in 1922

World War II Era (1933–1945)

Commerz- und Privat-Bank started paying dividends again in 1935 and became privately owned again by 1937. The bank removed its Jewish employees, who made up a small percentage of its staff. Some former Jewish board members were later killed. By 1938, Commerzbank had no Jewish employees. In 1940, the bank officially changed its name to Commerzbank AG.

During World War II, the bank opened branches in areas Germany took over. It also gained from the forced sale of Jewish-owned banks. Its New York office closed in 1939. By late 1944, the bank's size had tripled, mostly due to German government debt. In early 1945, the main office moved from Berlin to Hamburg for safety.

Post-War Rebuilding (1945–1967)

After the war, many of the bank's offices in the Soviet zone were taken by the government. In West Germany, many branches were destroyed or damaged. From 1947 to 1948, the remaining branches were grouped into nine independent banks.

In 1952, these nine banks were combined into three larger ones. On July 1, 1958, these three banks merged again to form Commerzbank AG. By 1962, Commerzbank had more branches than before the war.

In 1952, Commerzbank started its international business again. It opened offices in cities like Rio de Janeiro, Amsterdam, and Tokyo. In 1967, it opened an office in New York City. In 1969, it opened a branch in Luxembourg, which became its largest foreign office for many years. In 1971, the New York office became a full branch, the first for a German bank after the war.

European Partnerships (1970–1990)

Commerzbank and Crédit Lyonnais started a partnership called "Europartners Group" in 1970. They wanted to work together across borders. Other banks like Banco di Roma and Banco Hispano Americano joined later. This partnership ended in 1992.

In the 1970s, Eurocheques were introduced. This allowed customers to get cash in 30 European countries. The Eurocheque card with a magnetic strip for ATMs came out in 1981.

In 1970, Commerzbank also started the Commerzbank Foundation. This non-profit group helps with science, culture, and social welfare. It supports people who need help and promotes modern art.

In the early 1980s, Commerzbank faced some problems due to mistakes in predicting interest rates. But good economic times later helped the bank recover.

Expansion and Digitalization (1990–1998)

In 1990, Commerzbank moved its main office from Düsseldorf to Frankfurt am Main. After German reunification, many new customers joined the bank. Commerzbank also continued to grow internationally, opening offices in places like Bangkok and South Africa.

The bank's profits grew a lot in the early 1990s. To improve profits even more, it cut costs and jobs. Commerzbank then promised its shareholders higher dividends.

In 1991, Commerzbank announced a partnership with the French Crédit Lyonnais. Later, in 1993, it formed a three-country partnership with the British National Westminster Bank and the French Société Générale.

In 1994, Commerzbank started Comdirect Bank, becoming the first big German bank to offer direct banking. In 1999, Commerzbank even sold computers to help customers use online banking. The bank also updated its branches with new digital tools.

At this time, about two-thirds of the bank's income came from outside Germany. Commerzbank wanted to increase its profits even more to compete globally. The bank was seen as a possible target for a takeover because it was smaller than some other international banks. But the bank's leaders wanted it to remain independent.

The bank gained many new customers. It made more profit with fewer branches. It also created new services, like getting cash at gas stations and online banking for businesses.

In 1998, Commerzbank bought about 30 percent of the Korea Exchange Bank. It wanted to be more involved in growing Asian markets. The bank also focused on strengthening its presence in Europe through partnerships with other large banks.

Challenges and Mergers (2001–2009)

In the early 2000s, Commerzbank had problems with its investment banking unit and eventually closed it down. In 2001, Commerzbank changed how it organized its business in Germany. It created separate parts for private customers and for corporate and investment clients.

In 2004, it bought Schmidtbank, which added many branches and customers in Germany. This showed that Commerzbank did not want to merge with another German bank, HypoVereinsbank.

Commerzbank also expanded in Central and Eastern Europe. It took over Poland's BRE Bank (now mBank) in 2003. It also moved some of its back-office work, like IT systems, to Poland and the Czech Republic.

In 2001, three big banks in Frankfurt, including Commerzbank, decided to start a joint mortgage bank called Eurohypo. Commerzbank later faced losses from its share in Eurohypo. Despite challenges, Eurohypo became important for Commerzbank's earnings.

In November 2005, Commerzbank announced it would fully take over Eurohypo. This made Commerzbank the second-largest bank in Germany. The real estate business became a key part of the group.

There were rumors about Commerzbank merging with other European banks. After a planned merger between Deutsche Bank and Dresdner Bank failed, Commerzbank was seen as the most likely bank to buy Dresdner Bank. These talks started around June 2000.

Trade unions were worried about job cuts if the banks merged. But some major shareholders of Commerzbank supported the idea. The plans failed because the different groups could not agree.

During the 2008 financial crisis, talks about a merger between Commerzbank and Dresdner Bank started again. In mid-2008, it seemed likely. After months of talks, Commerzbank announced it would buy Dresdner Bank. This was a big step for the German financial industry.

The purchase price was first set at about 9.8 billion euros. Later, it was lowered to 5.5 billion euros. Analysts and investors criticized the merger during the crisis. Commerzbank used a special government fund called SoFFin because of the risks from Dresdner Bank.

The German government and the European Commission agreed on the help. Commerzbank received 8.2 billion euros. By the end of 2009, Commerzbank needed more state help. The German government bought over 25 percent of Commerzbank's shares, becoming a major owner. This was the first time the German government partly took over a German bank.

In January 2009, Commerzbank became the full owner of Dresdner Bank. The merger was completed in May 2009. Commerzbank kept lending money to German businesses to help the economy. In March 2009, Commerzbank created a special unit called PRU to manage difficult assets. The "Dresdner Bank" brand was slowly removed, and Commerzbank adopted some of its features. By May 2011, the merger was mostly finished.

Modern Era (2011–Present)

In 2011, Commerzbank started paying back the government's investment. This was partly paid for by a large fundraising effort. The bank had lost public trust after the crisis and government involvement. In 2012, it launched an advertising campaign to admit past mistakes and show itself as a fair bank.

The Greek debt crisis affected Commerzbank's profits. The bank started a strict cost-cutting plan. It sold its fund company, Cominvest, to Allianz. Eurohypo was also to be sold or closed down because it was losing money. In 2012, the bank decided to close Eurohypo, accepting further losses.

The years after the Dresdner Bank merger brought more changes due to digitalization. Martin Zielke, who became CEO in 2016, announced a big reorganization. Commerzbank wanted to focus on helping private and corporate customers in Germany. It aimed to be a profitable bank that customers could reach in many ways, both online and through branches.

In 2019, Commerzbank and Deutsche Bank discussed merging. But after looking closely, both banks decided it would not add enough value. This led to disagreements with major shareholders about Commerzbank's future plans. The leaders of the bank's board resigned in the summer of 2020.

In January 2021, Manfred Knof became the chairman of Commerzbank's board. Under his leadership, the bank focused on making profits, helping customers, being sustainable, and using digital tools. They combined Commerzbank's advice with Comdirect's digital skills to create a "digital advisory bank." They also improved how customers could access services online and offline.

To stay independent and manage risks, costs were greatly reduced. By early 2023, about 10,000 jobs were cut, and about half of all branches in Germany closed.

In 2022, the bank reported its best results in over ten years. In 2023, it rejoined the DAX index. Many people said Commerzbank had made a "turnaround" after the 2008 financial crisis. The bank continued to do well in 2023, with its best profit in 15 years.

For 2022, Commerzbank gave 30 percent of its profit to shareholders. This was the first time since 2018. In June 2023, the bank bought back some of its own shares for the first time. For 2023, the bank plans to give 50 percent of its profit to shareholders. It aims to increase this to at least 70 percent for 2024. This would also benefit the German government, which is the largest single shareholder.

On February 14, 2024, the German government decided not to take part in Commerzbank's share buy-back program. This meant the government's ownership in the bank increased to 16.5%. In September 2024, the German government announced plans to sell a 4.5% part of Commerzbank. Later that month, it was revealed that UniCredit bought these shares. UniCredit's leader, Andrea Orcel, told the European Central Bank he wanted to own more than 30% of Commerzbank. German Chancellor Olaf Scholz was not happy about this plan.

In October 2024, Bettina Orlopp became the chairwoman of the board. As of 2025, Commerzbank was Germany's second-largest bank for everyday customers. In February 2025, Bettina Orlopp announced that about 3,900 jobs would be cut by 2028, mostly in Germany. The bank wants to prevent UniCredit from taking it over.

How Commerzbank Works

Bank Type

Commerzbank is a German public limited company. This means it is owned by shareholders and its goal is to provide all kinds of banking and financial services.

The European Central Bank (ECB) watches over Commerzbank. It is not considered a bank that is so big it could cause a global financial crisis if it failed.

Stock Market Listing

The bank's shares are traded on the Frankfurt Stock Exchange and through the Xetra trading system. They are listed in the DAX, which is a list of Germany's top companies.

Commerzbank's main meeting for shareholders happens at its headquarters or another big German city. During the global coronavirus pandemic in 2020, the bank held its meetings online.

The bank's financial reports include all companies it owns or is involved with. Its most important German company is Commerz Real. Internationally, it has four main companies, including the Polish mBank. Commerzbank also invests in new financial technology companies (fintechs).

Leadership

Board of Managing Directors

- Bettina Orlopp (chairwoman and chief executive officer, also Chief Financial Officer)

- Michael Kotzbauer (leads business for corporate clients)

- Sabine Mlnarsky (leads human resources)

- Jörg Oliveri del Castillo-Schulz (Chief Operating Officer)

- Thomas Schaufler (leads business for private and small-business customers)

- Bernhard Spalt (leads risk management)

Supervisory Board

The supervisory board gives advice to the management and checks how the bank is run. It has 20 members, with equal numbers representing shareholders and employees. The chairman is Jens Weidmann.

Who Owns Commerzbank

| Shareholder | Stake (% of ordinary shares) |

|---|---|

| UniCredit | 20.17% |

| German government | 12.11% |

| BlackRock | 5.28% |

As of mid-2023, the German government, through the Special Fund for Financial Market Stabilization (SoFFin), was the largest single owner, with over 15 percent. The rest of the shares were owned by many different investors. BlackRock and Norges Bank also own significant parts of Commerzbank. About 25 percent of Commerzbank shares are owned by individual investors (as of February 2024).

In mid-2024, the German government sold 4.49 percent of its shares. Unicredit bought these shares, and by late September 2024, it owned 21 percent of Commerzbank.

Memberships and Partnerships

Commerzbank is a member of important banking groups in Germany, like the Association of German Banks. It is also active in business associations that support small and medium-sized businesses and international trade.

Commerzbank talks with all democratic political parties in Germany.

Services Commerzbank Offers

Services for People and Businesses

Commerzbank is a leading bank for people and small businesses in Germany. It offers many services, like checking accounts, trading stocks, investing, and getting loans. It provides advice both online and in person. The bank's "free checking account" has attracted many customers.

For companies, Commerzbank offers traditional services like accounts and loans. It also helps companies raise money by issuing shares or bonds.

International business is another key area. The bank helps German and international companies with things like foreign exchange and managing risks. Commerzbank helps finance about one-third of Germany's foreign trade.

Main Offices and Locations

Commerzbank has about 400 branches across Germany. These branches offer a variety of services.

The main office and most of the bank's central departments are in the Commerzbank Tower in Frankfurt am Main. There is also an office in Berlin and a contact office in Brussels.

Commerzbank also has international offices in cities like New York City and Singapore.

The Commerzbank Brand

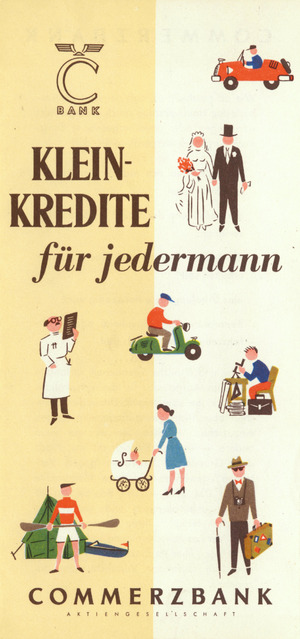

Early Commerzbank logos used the letters CDB and CPB. In 1940, a logo with a 'C' and Mercury wings was introduced. In 1972, the "Quatre Vents" logo, inspired by a wind rose, was used.

After buying Dresdner Bank in 2009, Commerzbank introduced a new logo. It features the bank's name in a new font, the color yellow, and a three-dimensional ribbon.

The Waldstadion sports stadium was once named 'Commerzbank Arena'. Since 2008, Commerzbank has been a partner of the German Football Association (DFB). Until 2021, it supported the men's national team. Now, it focuses on the women's national team. Commerzbank created a popular advertising campaign for the 2019 FIFA Women's World Cup with the national team.

Commerzbank and Climate Change

Commerzbank supports the goal of the Paris Agreement to limit global warming. The bank signed the United Nations Global Compact in 2006. It was also one of the first to sign the Principles for Responsible Banking in 2019.

In the 1980s, Commerzbank started helping to finance projects that use renewable energy. This commitment has grown over the years. Commerzbank also issues special bonds called Green Bonds to fund environmentally friendly projects. By June 2022, it had issued three Green Bonds worth 1.5 billion euros.

In 2016, Commerzbank made a rule about financing coal projects. In 2022, this rule was updated to cover all fossil fuels (coal, oil, and gas). The rule sets clear limits and things the bank will not finance.

Commerzbank uses scientific methods to make sure its investments help achieve carbon neutrality. It joined the Science Based Targets Initiative (SBTi) in 2022. In 2023, Commerzbank became the first German bank to have its 2030 reduction targets approved by SBTi.

Commerzbank also supports the German Sustainability Code and has signed the climate agreement for the German financial sector. The bank has a system to reduce its own greenhouse gas emissions. Since 2013, it has used only electricity from renewable sources in Germany.

See also

In Spanish: Commerzbank para niños

In Spanish: Commerzbank para niños

- Comdirect Bank

- mBank

| Bessie Coleman |

| Spann Watson |

| Jill E. Brown |

| Sherman W. White |