Dodd–Frank Wall Street Reform and Consumer Protection Act facts for kids

|

|

| Long title | An Act to promote the financial stability of the United States by improving accountability and transparency in the financial system, to end "too big to fail", to protect the American taxpayer by ending bailouts, to protect consumers from abusive financial services practices, and for other purposes. |

|---|---|

| Nicknames | Dodd–Frank Act |

| Enacted by | the 111th United States Congress |

| Effective | July 21, 2010 |

| Citations | |

| Public law | Pub.L. 111-203 |

| Statutes at Large | 124 Stat. 1376–2223 |

| Codification | |

| Acts amended | Commodity Exchange Act Consumer Credit Protection Act Federal Deposit Insurance Act Federal Deposit Insurance Corporation Improvement Act of 1991 Federal Reserve Act Financial Institutions Reform, Recovery, and Enforcement Act of 1989 International Banking Act of 1978 Protecting Tenants at Foreclosure Act Revised Statutes of the United States Securities Exchange Act of 1934 Truth in Lending Act |

| Titles amended | 7 U.S.C.: Agriculture 12 U.S.C.: Banks and Banking 15 U.S.C.: Commerce and Trade |

| Legislative history | |

|

|

| Major amendments | |

| Economic Growth, Regulatory Relief and Consumer Protection Act | |

| United States Supreme Court cases | |

|

|

The Dodd–Frank Wall Street Reform and Consumer Protection Act, often called Dodd–Frank, is a United States federal law passed on July 21, 2010. This law completely changed how financial regulation worked after the Great Recession. It affected almost every part of the nation's financial industry and all federal agencies that oversee it.

After the financial crisis, many people wanted big changes to the financial system. In June 2009, President Barack Obama suggested a major overhaul. He said it would be the biggest change since the reforms that followed the Great Depression.

Congressman Barney Frank and Senator Chris Dodd introduced the bill in Congress. Most members of the Democratic Party supported Dodd–Frank. Three Republicans in the Senate also voted for it, which helped it pass.

Dodd–Frank changed the financial regulatory system. It got rid of the Office of Thrift Supervision. It gave new tasks to existing agencies like the Federal Deposit Insurance Corporation. It also created new agencies, such as the Consumer Financial Protection Bureau (CFPB). The CFPB's job is to protect people from unfair practices with credit cards, mortgages, and other financial products.

The law also created the Financial Stability Oversight Council and the Office of Financial Research. These groups help find risks to the financial stability of the United States. The Federal Reserve also got new powers to oversee very large financial companies. To help manage big companies that might fail, the law created the Orderly Liquidation Authority.

One important part, the Volcker Rule, stops banks from making risky investments with their own money. The law also made sure that certain complex financial products, like credit-default swaps, were regulated. This meant they had to be traded through special exchanges or clearinghouses. Other parts of the law dealt with how companies are run and how credit rating agencies work.

Dodd–Frank is seen as one of the most important laws passed during the presidency of Barack Obama. Studies show it has made the financial system more stable and improved consumer protection. However, there has been some debate about its effects on the economy. In 2017, Federal Reserve Chairwoman Janet Yellen said that the new rules had made the financial system much stronger. She also said they did not limit access to loans or economic growth too much. Some critics argued the law did not regulate the financial industry enough. Others said it hurt economic growth and small banks. In 2018, parts of Dodd–Frank were changed by the Economic Growth, Regulatory Relief and Consumer Protection Act. However, its main structure stayed in place.

Contents

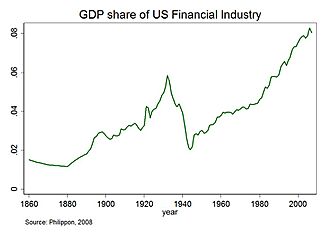

Why the Law Was Needed: The Financial Crisis

The financial crisis of 2007–2008 caused many problems. It led to widespread calls for changes in how the financial system was regulated. In June 2009, President Obama suggested a major overhaul of the system. He said it would be a transformation not seen since the reforms after the Great Depression.

When the final bill was ready, President Obama said it included most of the changes he had proposed. Here are some of the main ideas from his original plan:

- Bringing together different regulatory agencies.

- Creating a new council to check for big risks in the financial system.

- Regulating financial markets more fully, including making complex financial products more open.

- Protecting consumers better with a new agency and clear rules for common financial products.

- Giving tools to handle financial crises, like a way to safely close down failing companies.

- Improving international standards and cooperation, especially for accounting and credit rating agencies.

Later, in January 2010, Congress added the Volcker Rule to this plan at President Obama's request.

How Dodd–Frank Works

The Dodd–Frank Wall Street Reform and Consumer Protection Act is divided into 16 main parts, called titles. It also required regulators to create many new rules and conduct studies.

The main goals of the law are:

- To make the United States financial system more stable.

- To make financial companies more responsible and open.

- To stop companies from being "too big to fail," meaning they are so large that their failure would harm the entire economy.

- To protect taxpayers by ending government bailouts of financial companies.

- To protect consumers from unfair financial practices.

The Act changed the existing system by creating new agencies and combining or removing others. This was done to make the regulatory process smoother. It also increased oversight of certain institutions that could pose a risk to the financial system. The law also updated the Federal Reserve Act and aimed to make things more transparent.

The law's purpose is to set strong standards to protect the economy, consumers, investors, and businesses. It also aims to provide an early warning system for economic stability. New rules were made for how much company executives are paid and how companies are run. It also closed some loopholes that contributed to the 2008 economic recession.

New important agencies created by the Act include the Financial Stability Oversight Council, the Office of Financial Research, and the Bureau of Consumer Financial Protection.

Existing agencies also saw changes, from getting new powers to transferring powers. This was all done to improve the regulatory system. Many agencies that monitor the financial system were affected. These include the Federal Deposit Insurance Corporation (FDIC), the U.S. Securities and Exchange Commission (SEC), and the Federal Reserve (the "Fed"). The law also completely removed the Office of Thrift Supervision.

Before Dodd–Frank, many investment advisers did not have to register with the SEC. This was true if they had fewer than 15 clients and did not present themselves to the public as advisers. The Act removed this exemption. This meant many more investment advisers, including hedge funds and private equity firms, had to register. However, the Act also moved the oversight of smaller investment advisers to state regulators. A study found that this change led to more misconduct among these advisers. This was likely because state regulators often have fewer resources than the SEC.

Some financial companies that are not banks and their smaller companies are now overseen by the Fed. They are regulated in the same way as bank holding companies.

Because Dodd–Frank affected almost all federal financial regulatory agencies, it changed how America's financial markets will work in the future. Few parts of the Act became active right after the bill was signed.

Key Parts of the Law

The Dodd–Frank Act has many different sections, or titles. Each title focuses on a specific area of financial reform. Some of the important areas covered include:

- Making the financial system more stable.

- Setting up a way to safely close down large failing companies.

- Transferring powers to important agencies like the Comptroller, the FDIC, and the Fed.

- Regulating advisers to hedge funds and other investment groups.

- Improving rules for the insurance industry.

- Making Wall Street more transparent and accountable.

- Overseeing how payments and financial transactions are cleared.

- Protecting investors and improving securities regulation.

- Creating the Bureau of Consumer Financial Protection.

- Adding new rules for the Federal Reserve System.

- Helping people get better access to regular financial institutions.

- Reforming mortgages and stopping unfair lending practices.

Images for kids

-

President Barack Obama meeting with Rep. Barney Frank, Sen. Dick Durbin, and Sen. Chris Dodd, at the White House prior to a financial regulatory reform announcement on June 17, 2009

-

Representative Barney Frank, who helped create the Act

-

Senator Richard Shelby, a leading Republican on the Senate Banking Committee

See also

- Brown–Kaufman amendment

- Chicago Stock Exchange

- Commodity Futures Trading Commission

- Financial crisis of 2007–2010

- Financial privacy laws in the United States

- Financial regulation

- List of financial regulatory authorities by country

- NASDAQ

- New York Stock Exchange

- Office of Financial Research

- Regulation D (SEC)

- Regulatory responses to the subprime crisis

- Securities Commission

- Securities regulation in the United States

- Stock exchange

- Subprime mortgage crisis solutions debate

- Swiss referendum "against corporate Rip-offs" of 2013

- Trading Places

- Volcker Rule

- Wall Street reform

- Comprehensive Capital Analysis and Review

- Related legislation

- 1933: Securities Act of 1933

- 1934: Securities Exchange Act of 1934

- 1938: Temporary National Economic Committee (establishment)

- 1939: Trust Indenture Act of 1939

- 1940: Investment Advisers Act of 1940

- 1940: Investment Company Act of 1940

- 1968: Williams Act (Securities Disclosure Act)

- 1975: Securities and Exchange Act

- 1982: Garn–St. Germain Depository Institutions Act

- 1999: Gramm–Leach–Bliley Act

- 2000: Commodity Futures Modernization Act of 2000

- 2002: Sarbanes–Oxley Act

- 2003: Fair and Accurate Credit Transactions Act of 2003

- 2006: Credit Rating Agency Reform Act of 2006

- 2018: Economic Growth, Regulatory Relief and Consumer Protection Act

| Emma Amos |

| Edward Mitchell Bannister |

| Larry D. Alexander |

| Ernie Barnes |