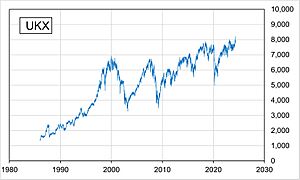

FTSE 100 Index facts for kids

FTSE 100 Index from 1984 to 2024

|

|

| Foundation | 3 January 1984 |

|---|---|

| Operator | FTSE Russell |

| Exchanges | London Stock Exchange |

| Trading symbol |

|

| Constituents | 100 |

| Type | Large-cap |

| Market cap | GB£2.203 trillion (May 2024) |

| Weighting method | Capitalisation-weighted |

| Related indices |

|

| Reuters | .FTSE |

| Bloomberg | UKX:IND |

The FTSE 100 Index is a special list of the 100 biggest companies whose shares are traded on the London Stock Exchange. People often call it the FTSE 100 or even just the "Footsie". It's like a report card for how well these large companies are doing.

This index includes companies from 32 different business areas. Four of these areas are very big, like medicine, oil and gas, mining, and banking. Together, these make up almost half of the index's total value. Some of the largest companies in the FTSE 100 are Shell, AstraZeneca, HSBC, and Unilever.

Every three months, the list of companies in the FTSE 100 is checked. Some companies might leave the list, and new ones might join. This can cause a lot of buying and selling of shares as investors update their investments.

Contents

What is the FTSE 100 Index?

The FTSE 100 Index has a special code, UKX. It is managed by FTSE Russell, which is part of the London Stock Exchange Group. The index was created by the Financial Times newspaper and the London Stock Exchange working together. Its value is updated every second when the market is open.

The FTSE 100 Index started on January 3, 1984. It began with a value of 1000. It took the place of an older index called the FT30. The FTSE 100 helps investors see how the biggest UK companies are performing.

The FTSE 100 generally includes the 100 largest UK companies. A company's value is found by multiplying its share price by the total number of shares it has. Many of these companies do business all over the world. This means the FTSE 100's movements don't always show exactly how the UK economy is doing. It can be affected a lot by how strong the British pound is against other currencies. The FTSE 250 Index is often a better guide for the UK economy because it has fewer international companies.

Even though the FTSE All-Share Index includes even more companies, the FTSE 100 is the most popular way to measure the UK stock market. Other related lists include the FTSE 250 Index (the next 250 largest companies), the FTSE 350 Index (the FTSE 100 and 250 combined), and the FTSE SmallCap Index (smaller companies).

How Companies are Valued in the Index

In the FTSE indexes, companies are valued based on their "free-float capitalisation." This means bigger companies, with more shares available for people to buy and sell, have a greater effect on the index's value.

The "free float adjustment factor" shows the percentage of a company's shares that are easily available for trading. It doesn't include shares held by people inside the company, like its founders or top managers.

What are FTSE Futures Contracts?

FTSE futures contracts are agreements to buy or sell the FTSE 100 at a set price on a future date. They are traded on the Euronext exchange. Each contract is worth 10 British pounds multiplied by the index points.

| Contract size | 10 GBP × index points |

|---|---|

| Exchange | EUREID |

| Sector | Index |

| Tick size | 0.5 |

| Tick value | 5 GBP |

| Basis Point Value | 10 |

| Denomination | GBP |

| Decimal places | 1 |

Highest Values Reached

The FTSE 100 has reached these record high values:

| Category | All-time highs | |

|---|---|---|

| Closing | 8,354.05 | 8 May 2024 |

| Intraday | 8,365.28 | 8 May 2024 |

The index started at 1000 on January 3, 1984. Its highest closing value was 8,354.05 on May 8, 2024. On the same day, it reached its highest value during trading, which was 8,365.28.

Yearly Changes

This table shows how the FTSE 100 Index has changed each year since 1984. It also shows the older FT 30 Index from 1969 to 1983.

| Year | Closing level | Change in index | |

|---|---|---|---|

| (points) | (%) | ||

| 1969 | 313.16 | ||

| 1970 | 289.61 | −23.55 | −7.52 |

| 1971 | 411.03 | 121.42 | 41.93 |

| 1972 | 463.72 | 52.69 | 12.82 |

| 1973 | 318.30 | −145.42 | −31.36 |

| 1974 | 142.17 | −176.13 | −55.33 |

| 1975 | 335.98 | 193.81 | 136.32 |

| 1976 | 322.98 | −13.00 | −3.87 |

| 1977 | 455.96 | 132.98 | 41.17 |

| 1978 | 468.06 | 12.10 | 2.65 |

| 1979 | 488.40 | 20.34 | 4.35 |

| 1980 | 620.60 | 132.20 | 27.07 |

| 1981 | 665.50 | 44.90 | 7.23 |

| 1982 | 812.37 | 146.87 | 22.07 |

| 1983 | 1,000.00 | 187.63 | 23.10 |

| 1984 | 1,232.20 | 232.20 | 23.22 |

| 1985 | 1,412.60 | 180.40 | 14.64 |

| 1986 | 1,679.00 | 266.40 | 18.86 |

| 1987 | 1,712.70 | 33.70 | 2.01 |

| 1988 | 1,793.10 | 80.40 | 4.69 |

| 1989 | 2,422.70 | 629.60 | 35.11 |

| 1990 | 2,143.50 | −279.20 | −11.52 |

| 1991 | 2,493.10 | 349.60 | 16.31 |

| 1992 | 2,846.50 | 353.40 | 14.18 |

| 1993 | 3,418.40 | 571.90 | 20.09 |

| 1994 | 3,065.50 | −352.90 | −10.32 |

| 1995 | 3,689.30 | 623.80 | 20.35 |

| 1996 | 4,118.50 | 429.20 | 11.63 |

| 1997 | 5,135.50 | 1,017.00 | 24.69 |

| 1998 | 5,882.60 | 747.10 | 14.55 |

| 1999 | 6,930.20 | 1,047.60 | 17.81 |

| 2000 | 6,222.46 | −707.74 | −10.21 |

| 2001 | 5,217.35 | −1,005.11 | −16.15 |

| 2002 | 3,940.36 | −1,276.99 | −24.48 |

| 2003 | 4,476.87 | 536.49 | 13.62 |

| 2004 | 4,814.30 | 337.57 | 7.54 |

| 2005 | 5,618.76 | 804.46 | 16.71 |

| 2006 | 6,220.81 | 602.05 | 10.71 |

| 2007 | 6,456.91 | 236.10 | 3.80 |

| 2008 | 4,434.17 | −2,022.74 | −31.33 |

| 2009 | 5,412.88 | 978.71 | 22.07 |

| 2010 | 5,899.94 | 487.06 | 9.00 |

| 2011 | 5,572.28 | −327.66 | −5.55 |

| 2012 | 5,897.81 | 325.53 | 5.84 |

| 2013 | 6,749.09 | 851.29 | 14.43 |

| 2014 | 6,566.09 | −183.00 | −2.71 |

| 2015 | 6,274.05 | −292.04 | −4.45 |

| 2016 | 7,142.83 | 868.78 | 13.85 |

| 2017 | 7,687.77 | 544.94 | 7.63 |

| 2018 | 6,728.13 | −959.64 | −12.48 |

| 2019 | 7,542.44 | 814.31 | 12.10 |

| 2020 | 6,460.52 | −1,081.92 | −14.34 |

| 2021 | 7,384.54 | 924.02 | 14.30 |

| 2022 | 7,451.74 | 67.20 | 0.91 |

| 2023 | 7,733.24 | 281.50 | 3.78 |

Companies in the FTSE 100

This table lists the companies that were part of the FTSE 100 as of March 15, 2024.

| Company | Ticker | FTSE industry classification benchmark sector |

|---|---|---|

| 3i | III | Financial services |

| Admiral Group | ADM | Insurance |

| Airtel Africa | AAF | Telecommunications services |

| Anglo American plc | AAL | Mining |

| Antofagasta plc | ANTO | Mining |

| Ashtead Group | AHT | Support services |

| Associated British Foods | ABF | Food & tobacco |

| AstraZeneca | AZN | Pharmaceuticals & biotechnology |

| Auto Trader Group | AUTO | Media |

| Aviva | AV. | Life insurance |

| B&M | BME | Retailers |

| BAE Systems | BA. | Aerospace & defence |

| Barclays | BARC | Banks |

| Barratt Developments | BDEV | Household goods & home construction |

| Beazley | BEZ | Insurance |

| Berkeley Group Holdings | BKG | Household goods & home construction |

| BP | BP. | Oil & gas producers |

| British American Tobacco | BATS | Tobacco |

| BT Group | BT.A | Telecommunications services |

| Bunzl | BNZL | Support services |

| Burberry | BRBY | Personal goods |

| Centrica | CNA | Multiline utilities |

| Coca-Cola HBC | CCH | Beverages |

| Compass Group | CPG | Support services |

| Convatec | CTEC | Health care equipment & supplies |

| Croda International | CRDA | Chemicals |

| DCC plc | DCC | Support services |

| Diageo | DGE | Beverages |

| Diploma | DPLM | Industrial Support services |

| Entain | ENT | Travel & leisure |

| EasyJet | EZJ | Travel & leisure |

| Experian | EXPN | Support services |

| F & C Investment Trust | FCIT | Financial services |

| Flutter Entertainment | FLTR | Travel & leisure |

| Frasers Group | FRAS | Retailers |

| Fresnillo plc | FRES | Mining |

| Glencore | GLEN | Mining |

| GSK plc | GSK | Pharmaceuticals & biotechnology |

| Haleon | HLN | Pharmaceuticals & biotechnology |

| Halma plc | HLMA | Electronic equipment & parts |

| Hikma Pharmaceuticals | HIK | Pharmaceuticals & biotechnology |

| Howdens Joinery | HWDN | Homebuilding & construction supplies |

| HSBC | HSBA | Banks |

| IHG Hotels & Resorts | IHG | Travel & leisure |

| IMI | IMI | Machinery, tools, heavy vehicles, trains & ships |

| Imperial Brands | IMB | Tobacco |

| Informa | INF | Media |

| Intermediate Capital Group | ICG | Financial services |

| International Airlines Group | IAG | Travel & leisure |

| Intertek | ITRK | Support services |

| JD Sports | JD. | General retailers |

| Kingfisher plc | KGF | Retailers |

| Land Securities | LAND | Real estate investment trusts |

| Legal & General | LGEN | Life insurance |

| Lloyds Banking Group | LLOY | Banks |

| London Stock Exchange Group | LSEG | Financial services |

| M&G | MNG | Financial services |

| Marks & Spencer | MKS | Food & drug retailing |

| Melrose Industries | MRO | Aerospace & defence |

| Mondi | MNDI | Containers & packaging |

| National Grid plc | NG. | Multiline utilities |

| NatWest Group | NWG | Banks |

| Next plc | NXT | General retailers |

| Ocado Group | OCDO | Food & drug retailers |

| Pearson plc | PSON | Media |

| Pershing Square Holdings | PSH | Financial services |

| Persimmon | PSN | Household goods & home construction |

| Phoenix Group | PHNX | Life insurance |

| Prudential plc | PRU | Life insurance |

| Reckitt | RKT | Household goods & home construction |

| RELX | REL | Media |

| Rentokil Initial | RTO | Support services |

| Rightmove | RMV | Media |

| Rio Tinto | RIO | Mining |

| Rolls-Royce Holdings | RR. | Aerospace & defence |

| RS Group plc | RS1 | Industrials |

| Sage Group | SGE | Software & computer services |

| Sainsbury's | SBRY | Food & drug retailing |

| Schroders | SDR | Financial services |

| Scottish Mortgage Investment Trust | SMT | Collective investments |

| Segro | SGRO | Real estate investment trusts |

| Severn Trent | SVT | Multiline utilities |

| Shell plc | SHEL | Oil & gas producers |

| DS Smith | SMDS | General industrials |

| Smiths Group | SMIN | General industrials |

| Smith & Nephew | SN. | Health care equipment & supplies |

| Smurfit Kappa | SKG | General industrials |

| Spirax-Sarco Engineering | SPX | Industrial engineering |

| SSE plc | SSE | Electrical utilities & independent power producers |

| Standard Chartered | STAN | Banks |

| St. James's Place plc | STJ | Financial services |

| Taylor Wimpey | TW. | Household goods & home construction |

| Tesco | TSCO | Food & drug retailing |

| Unilever | ULVR | Personal goods |

| United Utilities | UU. | Multiline utilities |

| Unite Group | UTG | Real estate investment trusts |

| Vodafone Group | VOD | Mobile telecommunications |

| Weir Group | WEIR | Industrial goods and services |

| Whitbread | WTB | Retail hospitality |

| WPP plc | WPP | Media |

Older Stock Market Indexes

The FT 30, also known as the Financial Times Index, is the oldest stock market index in the UK. It started in 1935. Today, it's not used as much because the FTSE 100 is more popular. The FT 30 focuses on companies from industrial and commercial areas. It does not include financial companies or government stocks.

Out of the original companies in the FT 30, only three are currently in the FTSE 100. These are Tate & Lyle, Imperial Tobacco (now Imperial Brands), and Rolls-Royce. Tate & Lyle is the only original FT 30 company still in that specific index. Imperial Tobacco has been the best performer from the original list.

See also

In Spanish: FTSE 100 para niños

In Spanish: FTSE 100 para niños

- Other lists

- List of largest companies by revenue, worldwide

- List of largest companies in the United Kingdom

- List of largest United Kingdom employers, including the public sector

- Stock market lists

- AEX index

- Dow Jones Industrial Average and the DAX 30, similar to the FT 30 in the US and Germany

- Financial Times Global 500, the BBC Global 30 and the Fortune Global 500, lists of the world's largest companies by market value

- FTSE 250 and FTSE techMARK 100, other important UK stock lists

- List of European stock exchanges

- List of stock exchanges

- List of stock market indices

- S&P 100 and the HDAX, top 100 in the US and top 110 in Germany