Hard currency facts for kids

A hard currency (also called a safe-haven currency or strong currency) is a type of money that is trusted and stable around the world. It's like a reliable savings account for countries and people. This means its value doesn't usually change a lot or quickly lose its buying power.

A currency becomes "hard" because of several things:

- The country's government and laws are stable and reliable.

- There isn't much corruption.

- The currency has kept its value for a long time.

- The country's politics and money situation are strong.

- The central bank (the main bank of the country) manages the currency well.

A safe-haven currency is like a financial "shelter." When the world economy is shaky or risky, people and countries often put their money into these currencies because they are seen as very safe.

On the other hand, a soft currency is one that is expected to change a lot or lose its value compared to other currencies. This usually happens when a country has weak laws, political problems, or an unstable economy.

Contents

History of Hard Currencies

Over time, the paper money of some developed countries has become known as hard currencies. These include the United States dollar, the euro, the Japanese yen, the British pound sterling, and the Swiss franc. The Canadian dollar and Australian dollar are also sometimes seen as hard currencies, but to a lesser extent.

It's important to remember that a currency's strength can change. A currency that is considered weak at one time might become stronger later, or vice versa. One way to see which currencies are considered "hard" is to look at how much of them other countries keep in their foreign-exchange reserves.

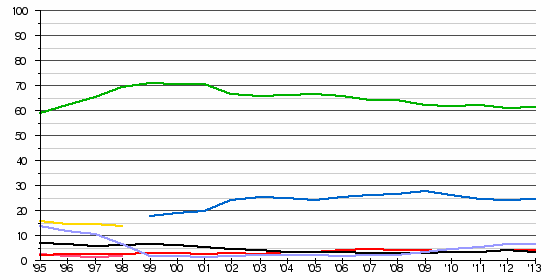

The percental composition of currencies of official foreign exchange reserves since 1995.

| US dollar | Euro | German mark | French franc |

| Pound sterling | Japanese yen | Other |

Times of Trouble

The United States dollar (USD) has been seen as a strong currency for most of its history. Even after big changes like the Nixon shock in 1971 and the US having more debt, many money systems around the world have been linked to the US dollar. This is partly because of agreements like the Bretton Woods system. Countries often buy dollars for their money reserves, use dollars to price goods for international trade, or even use dollars inside their own country. All of this helps keep the dollar's value high.

The euro (EUR) has also been considered a hard currency for most of its relatively short history. However, financial problems in Europe, like the European sovereign debt crisis, have made some people less confident in it.

The Swiss franc (CHF) has been known as a hard currency for a very long time. It was actually the last paper currency in the world to stop being directly linked to gold in 2000. In 2011, during the European debt crisis, many people moved their money from the euro to the franc, causing the franc's value to go up very quickly. To protect its trade, the Swiss National Bank decided to buy many euros to keep the exchange rate stable. This action temporarily made the franc less of a hard currency compared to the euro, but this policy was stopped in 2015.

Why People Want Hard Currencies

Investors and even regular people often prefer hard currencies over soft currencies. This happens especially when prices are rising quickly (inflation), when there's a lot of political or military risk, or when they feel that official exchange rates are not realistic. Sometimes, there are also rules that make it better to invest money outside of one's home currency. For example, a local currency might have "capital controls," which make it hard to spend that money outside the country.

For instance, during the Cold War, the Soviet ruble in the Soviet Union was not a hard currency. You couldn't easily spend it outside the Soviet Union. Also, the exchange rates were set artificially high for people with hard currency, like Western tourists. The Soviet government also made it very hard for its own citizens to exchange rubles for hard currencies. After the Soviet Union broke apart in 1991, the ruble quickly lost a lot of its value, while the purchasing power of the US dollar stayed more stable. This made the dollar a much harder currency than the ruble. For example, a tourist could get 200 rubles for one US dollar in June 1992, but only a few months later, in November 1992, they could get 500 rubles for the same dollar.

In some countries with soft currencies, there used to be special stores that only accepted hard currency. Examples include Tuzex stores in former Czechoslovakia, Intershops in East Germany, Pewex in Poland, or Friendship stores in China in the early 1990s. These stores offered a wider variety of goods, many of which were hard to find or were imported, compared to regular stores.

Mixed Currencies

Because hard currencies can sometimes have legal restrictions, people might create a black market to trade them. In some cases, a country's central bank might try to make people trust their local currency more by linking its value to a hard currency. This is called "pegging" and is done with currencies like the Hong Kong dollar or the Bosnia and Herzegovina convertible mark. However, this can cause problems if economic conditions force the government to break the link, leading to a sudden change in the currency's value, as happened in Argentina during its economic crisis from 1998 to 2002.

In some situations, a country might decide to stop using its own money completely and instead adopt another country's currency as its official money. This is called dollarization (even if it's not the US dollar). Examples include Panama, Ecuador, El Salvador, and Zimbabwe using the US dollar. Kosovo and Montenegro adopted the German mark and later the euro.

See also

In Spanish: Moneda fuerte para niños

In Spanish: Moneda fuerte para niños

| Bessie Coleman |

| Spann Watson |

| Jill E. Brown |

| Sherman W. White |