History of central banking in the United States facts for kids

This is the story of how central banking in the United States has changed over time. It covers everything from early, less regulated banks to the Federal Reserve System we have today. A central bank helps manage a country's money and banks.

Contents

Early Banks: 1781–1836

Bank of North America

Some of America's first leaders, called the Founding Fathers, disagreed about having a national bank. Some felt that England had tried to control the colonies' money too much. This was one reason for the American Revolutionary War.

But others thought a national bank was a good idea. Robert Morris, a finance leader, helped start the Bank of North America in 1782. People called him "the father of the system of credit" in the U.S. This bank was meant to be a national bank. However, some people worried about foreign influence and unfair practices. So, Pennsylvania stopped its charter in 1785.

First Bank of the United States

In 1791, Alexander Hamilton, the Secretary of the Treasury, worked out a deal. He got support for a national bank. In return, the nation's capital moved from New York City to the Potomac River area.

Soon after, the First Bank of the United States (1791–1811) was created. It was like the Bank of England. This bank was partly owned by people from other countries. It also didn't control all the country's money. State banks created most of the money.

Some leaders, like Thomas Jefferson, strongly disliked the bank. They thought it led to unfair money deals. In 1811, its twenty-year charter ended and was not renewed. Without a national bank, the government struggled to pay for the War of 1812. Many banks then stopped letting people trade their paper money for gold or silver.

Second Bank of the United States

Five years later, in 1816, the government created the Second Bank of the United States (1816–1836). President James Madison signed its charter. He wanted to stop the rising prices that had hurt the country. This bank was much like the first one, with branches everywhere.

Andrew Jackson became president in 1828. He believed the bank was corrupt. His fight against the bank was a big political issue in the 1830s. Democrats opposed banks, while Whigs supported them. Jackson could not close the bank, but he refused to renew its charter.

He tried to make all federal land payments in gold or silver. This was based on his reading of the Constitution of the United States. The Constitution says Congress can "coin" money, not print paper money. The Panic of 1837 happened soon after. The Bank's charter ended in 1836.

"Free Banking" Era: 1837–1862

In this time, only banks created by states existed. These banks could print their own paper money. This money was backed by gold and silver coins. States had rules about how much money banks had to keep. They also set rules for interest rates and loans.

These state banks had been around since 1781. In 1837, when the "free banking era" began, there were 712 of them. A law in Michigan in 1837 made it easier to start banks. This meant less state oversight. The real value of a bank's paper money was often less than its face value. Its value depended on how strong the bank was.

Banks during this time did not last long. Their average life was about five years. About half of them failed. About one-third closed because they could not trade their paper money for gold or silver. This was sometimes called "Wildcat banking".

Some local banks tried to act like a central bank. In New York, the New York Safety Fund helped protect money in member banks. In Boston, the Suffolk Bank made sure bank notes were worth almost their full value. It also helped banks exchange notes.

National Banks: 1863–1913

The National Banking Act of 1863 helped pay for the American Civil War. It also created a system of national banks. These banks had stricter rules for money reserves and business practices than state banks. The government created the office of Comptroller of the Currency to watch over these banks.

The Act also created a single national currency. All national banks had to accept each other's money at full value. This stopped people from losing money if a bank failed. The Comptroller of the Currency printed the notes. This made sure they were all the same and helped stop fake money.

To pay for the war, national banks had to buy government bonds. This helped the government raise money. Soon, the new national money was preferred over state bank money. The government put a 10% tax on state bank money. This made most state banks become national banks. By 1865, there were 1,500 national banks.

This tax also led to the use of checking accounts in the 1880s and 1890s. By the 1890s, most of the money supply was in checking accounts. State banking made a comeback.

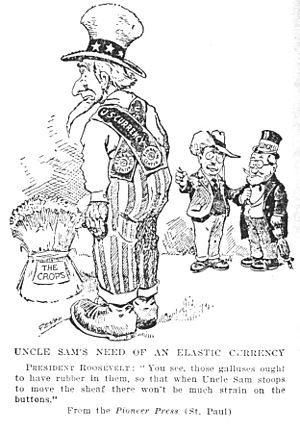

Two problems still existed. First, banks had to back their money with government bonds. If bond values changed, banks had to ask for loans back or borrow from other banks. Second, the system had seasonal money shortages. For example, rural banks needed more money during planting season. When many banks needed money at once, it caused problems.

These money shortages led to "bank runs." People rushed to withdraw their money. This caused serious economic problems, like the Panic of 1907.

National banks printed National Bank Notes. These notes were backed by U.S. government debt. So, they were worth similar amounts. Unlike the "Free Banking" era, where notes from different banks had different values. The government also printed greenbacks. In 1879, the U.S. returned to the gold standard. All currency could be exchanged for gold.

Creating the Federal Reserve System: 1907–1913

Panic of 1907 Alarms Bankers

In 1907, a financial expert named Paul Warburg suggested a plan for a central bank. He thought it could stop money problems. Another leader, Jacob Schiff, warned that without a central bank, the country would face a huge money crisis. The "Panic of 1907" hit hard in October.

Bankers felt the U.S. needed a central bank. It could bring stability and emergency money during financial crises. Many financial leaders wanted a central bank. They wanted a money supply that could grow or shrink as needed. After the 1907 panic, bankers demanded changes. Congress then created a group of experts to find a solution.

Aldrich Plan

Senator Nelson Aldrich led this group. They studied central banks in Europe. They were impressed by how Britain and Germany managed their economies. Aldrich's plan in 1912 aimed to bring central banking to the U.S. He promised financial stability and expert control.

Aldrich said a central bank had to be somewhat spread out. Otherwise, local politicians and bankers would attack it. His plan was introduced in Congress but did not get enough support. This was because Democrats won control of Congress and the White House in 1912.

A Regional Federal Reserve System

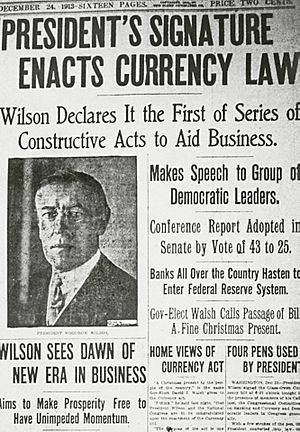

The new President, Woodrow Wilson, then pushed for banking changes. He worked with leaders in Congress. Wilson insisted that regional Federal Reserve banks be controlled by a central board. The president would appoint this board.

Farmers' Demands Met

William Jennings Bryan, the Secretary of State, was a long-time critic of Wall Street. He threatened to stop the bill. Wilson found a compromise that pleased both bankers and Bryan. Bryan's supporters were happy that Federal Reserve money became the government's responsibility. They also liked that farmers could get federal loans.

Wilson convinced Congress members who were against banks. He said that because Federal Reserve notes were government obligations, the plan met their demands. Wilson also told people in the South and West that the system would be spread out into 12 districts. This would lessen New York City's power and help other areas.

After much discussion, Congress passed the Federal Reserve Act in late 1913. President Wilson signed it into law on December 23, 1913.

The Federal Reserve Today: Since 1913

The Federal Reserve System, also known as the Fed, is the central banking system of the United States today. When it was created, the Fed was mainly meant to be a backup. It was there to create money if banks faced a crisis.

When World War I started, the Federal Reserve was better able to sell war bonds than the Treasury. So, it became the main seller of war bonds. After the war, the Federal Reserve gained more power. It could now both create and reduce the money supply.

In the 1920s, the Federal Reserve tried different ways to manage money. Some believe these actions helped cause the stock market crash and the Great Depression.

After Franklin D. Roosevelt became president in 1933, the Federal Reserve worked under the Executive Branch. In 1951, the Fed and the Treasury agreed that the Federal Reserve would be fully independent on money matters. The Treasury would handle government spending.

The Federal Reserve's powers did not change much for the rest of the 20th century. But in the 1970s, Congress gave it specific goals. These included promoting "maximum employment, stable prices, and moderate long-term interest rates." It also got the job of regulating many consumer credit laws.

Since the Global Financial Crisis, central banks around the world, including the Federal Reserve, have used new ways to manage money. These are called "Unconventional Monetary Policy Tools." They help achieve their goals for the economy.