Wilson–Gorman Tariff Act facts for kids

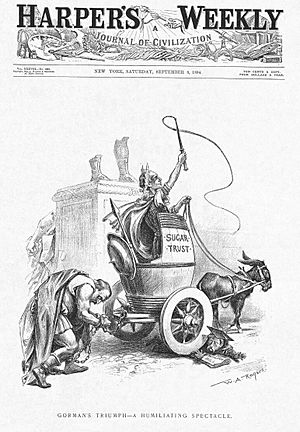

The Wilson-Gorman Tariff of 1894 was a law passed by the United States Congress. It was also called the Income Tax Act of 1894. This law reduced the taxes, called tariffs, on some goods brought into the United States from other countries.

The final version of the law lowered some taxes a little. But it also added new rules. One big change was a 2% federal income tax. This meant people had to pay a small part of their earnings to the government.

Some items like coal, lumber, and wool became tax-free. But sugar, which used to be tax-free, now had a tax on it. This was a big change from an earlier law, the McKinley Tariff of 1890.

For a long time, there had been many debates in America about tariffs. As the US became more industrialized, these debates got more intense. The Wilson-Gorman Act was an attempt by the Democrats to help the country recover from the Panic of 1893. This was a very serious economic depression.

The Democrats hoped that lowering tariffs would help the economy. They also thought that if the US lowered its tariffs, other countries would do the same. They planned to make up for lost money by adding a federal income tax. However, the act did not achieve its goals. About a year later, the Supreme Court said the income tax part was unconstitutional. This decision was called Pollock v. Farmers' Loan & Trust Co. The tariff also played a small part in causing the Spanish–American War.

Why the Tariff Was Needed

In the late 1800s, the US economy faced big problems. Just before President Grover Cleveland took office, a major company, the Reading Railroad, went into serious financial trouble. This caused many other problems. Hundreds of banks and businesses that relied on the railroads had to close.

The US stock market dropped a lot. People in Europe who had invested money in the US got scared and took their funds out. The economic problems spread to Europe too. At the same time, farmers in the south and western United States were also struggling. This made the economy even worse.

When President Cleveland became president, over 4 million people had already lost their jobs. But Cleveland believed the government should not do much. He thought the economy would fix itself over time.

Democrats in Congress had wanted to lower tariffs for a long time. The Wilson-Gorman tax act planned for a 2% income tax on any earnings over $4,000. This income tax was meant to replace the money the government would lose from lowering tariffs.

The New Income Tax

This was the first income tax in the US since the Civil War. Unlike the tax during the war, there was a lot of pressure in Congress to create a direct tax on income. Between 1874 and 1893, Democrats in Congress had suggested almost 70 income tax laws.

The main reason for this new income tax was not just to get more money. It was mostly about fairness. Most of the government's money came from tariffs. All Americans had to pay these tariffs when they bought imported goods. But huge businesses like railroads, steel makers, and sugar companies were making large profits that were not being taxed. Investments like stocks and bonds were also not being taxed. So, an income tax seemed like a fair way to fix this situation.

People who did not like the income tax often lived in big cities in the east. They called it "class legislation" because they felt it unfairly targeted their group. Many thought it was a tax on the rich, since 90% of Americans would not have to pay it. Others worried that a federal income tax would take money away from the state governments.

What Happened Next

The Wilson-Gorman Tariff actually made the economy worse. It led to cheaper goods being imported from other countries. These cheaper goods competed with products made in America. This hurt American businesses and their profits. At the same time, American companies did not find many new markets overseas to sell their goods.

The tariff act also hurt the economy of Cuba. This made Cubans more angry at Colonial Spain, which ruled Cuba at the time. This anger was one of the reasons that led to the Spanish-American War in 1898.

However, it was the income tax part of the Wilson-Gorman Act that caused its downfall. Wealthy citizens and high-earning companies strongly resisted the income tax. As the economy got worse, a newspaper called the Los Angeles Times joked, "The Democrats are in favor of an income tax for the reason that Democrats, as a rule, have no incomes to tax."

About a year later, the Supreme Court overturned the act in a 5–4 decision in the Pollock case. That decision, however, was later overturned when the Sixteenth Amendment to the United States Constitution was passed. This amendment made federal income taxes legal.

| Jewel Prestage |

| Ella Baker |

| Fannie Lou Hamer |