Barclays facts for kids

|

|

|

Formerly

|

Barclays Bank PLC (1896–1985) |

|---|---|

| Public | |

| Traded as |

|

| ISIN | [https://isin.toolforge.org/?language=en&isin=GB0031348658 GB0031348658] |

| Industry | Financial services |

| Founded | 17 November 1690 in the City of London, Kingdom of England |

| Headquarters | |

|

Area served

|

Worldwide |

|

Key people

|

|

| Products |

|

| Revenue | |

|

Operating income

|

|

| Total assets | |

| Total equity | |

|

Number of employees

|

100,000 (2025) |

| Divisions |

|

Barclays PLC is a large British bank with its main office in London, England. It's a global company that offers many different financial services. Barclays helps people and businesses with things like saving money, getting loans, and managing investments.

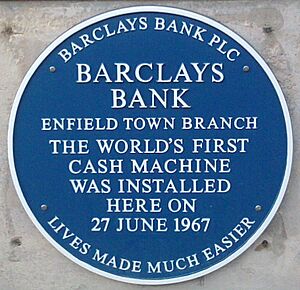

Barclays started a very long time ago, in 1690, as a small banking business in London. Over the years, it grew by joining with other banks. In 1967, Barclays made history by installing the world's first cash machine. Today, Barclays is one of the biggest banks in Europe and operates in over 40 countries. It has more than 100,000 employees around the world.

Contents

What's in a Name?

The bank's name, Barclays, has always been spelled without an apostrophe. It was first registered in 1896 as "Barclay and Company, Limited." Later, it changed to "Barclays Bank Limited" in 1917 and then to "Barclays Bank PLC" in 1982.

A Look Back in Time

Early Days: 1690 to 1900

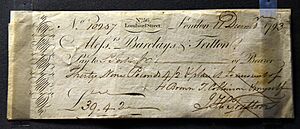

Barclays began on November 17, 1690. Two people, John Freame and Thomas Gould, started a business as goldsmith bankers in London. The name "Barclays" became part of the business in 1736 when James Barclay joined as a partner. The bank's symbol, the "Black Spread Eagle," became a key part of its identity.

In 1896, twelve different banks from London and other parts of England joined together. They formed a new company called Barclays and Co. This made Barclays a much bigger bank, holding a large share of deposits from private banks in England.

Growing Bigger: 1900 to 1945

Between 1905 and 1916, Barclays grew its network by buying smaller banks in England. More growth happened in 1918 when it joined with the London, Provincial and South Western Bank. In 1919, Barclays also acquired the British Linen Bank.

In 1925, Barclays combined its overseas operations under the name Barclays Bank (Dominion, Colonial and Overseas), or Barclays DCO. This helped the bank expand its reach around the world. During World War II, a Barclays branch in Paris operated under difficult circumstances.

Modern Era: 1946 to 1980

In 1958, Barclays made history by appointing the first female bank manager in the UK, Hilda Harding.

In 1966, Barclays launched the first credit card in the UK, called Barclaycard. A year later, on June 27, 1967, Barclays introduced the world's first cash machine in Enfield Town. A British actor named Reg Varney was the first person to use it.

In 1969, Barclays acquired Martins Bank. Later, in 1971, Barclays DCO changed its name to Barclays Bank International.

Changes and Challenges: 1980 to 2000

In 1985, Barclays Bank and Barclays Bank International merged. This created a new structure for the company, with Barclays Bank PLC becoming the main holding company.

In 1986, Barclays bought some stockbroking and jobbing firms to create Barclays de Zoete Wedd (BZW). That same year, Barclays sold its business in South Africa due to protests against its involvement during the apartheid era.

Barclays introduced the Connect card in June 1987. This was the first debit card in the United Kingdom.

In 1996, Barclays bought Wells Fargo Nikko Investment Advisors and combined it with BZW Investment Management to form Barclays Global Investors.

In 1998, parts of the BZW business were sold. Barclays kept the parts that focused on debt and structured capital markets, which became the foundation of Barclays Capital (BarCap).

In 1999, Barclays launched its own Internet service provider called Barclays.net, which was later acquired by British Telecom in 2001.

New Millennium: 2000 to 2010

In August 2000, Barclays acquired the Woolwich Building Society. The Woolwich name was kept for Barclays mortgages.

In 2001, Barclays and CIBC combined their operations in the Caribbean to create FirstCaribbean International Bank (FCIB).

In 2003, Barclays bought the American credit card company Juniper Bank, renaming it "Barclays Bank Delaware." They also acquired Banco Zaragozano, a Spanish bank.

Barclays became the main sponsor of the Premier League in 2004. In 2005, Barclays moved its main office to One Churchill Place in Canary Wharf. Also in 2005, Barclays took over Absa Group Limited, a large retail bank in South Africa.

In 2007, Barclays planned to buy ABN AMRO, a large bank in the Netherlands, but the deal did not go through.

During the 2008 financial crisis, Barclays decided to raise money from private investors instead of taking money from the UK government. This helped them stay independent.

In 2009, Barclays sold its Global Investors unit, including its iShares business, to BlackRock.

Lehman Brothers Acquisition

On September 16, 2008, Barclays announced it would buy the investment banking and trading parts of Lehman Brothers. Lehman Brothers was a large US financial company that had filed for bankruptcy. This move helped Barclays grow its presence in the US. The deal was approved by a US bankruptcy court on September 20, 2008.

Rate-fixing Investigation

In June 2012, Barclays Bank was fined a large amount of money for trying to manipulate important interest rates like Libor and Euribor. The bank was found to have made "inappropriate submissions" of rates to make a profit or to make the bank look stronger during the 2008 financial crisis. This led to changes in the bank's leadership.

Recent Years: 2010 to Present

In July 2013, a US energy regulator ordered Barclays to pay a fine for trying to manipulate the electricity market in the US.

In May 2014, the Financial Conduct Authority fined Barclays for issues related to the gold fixing process.

In June 2014, the state of New York filed a lawsuit against Barclays. It claimed the bank had misled investors about its trading system called a dark pool. Barclays settled this case in January 2016, agreeing to pay $70 million.

To prepare for Brexit, Barclays borrowed money from the Bank of England between April and June 2017. In August 2021, Barclays invested $400 million into its business in India.

In June 2015, Barclays announced it would sell its US wealth and investment management business. In May 2017, it sold shares of its Barclays Africa Group subsidiary. By September 2017, Barclays had sold most of its retail banking in continental Europe.

In February 2020, Barclays used tracking software at its London headquarters to see how long employees spent at their desks. After staff concerns, the bank changed the system so individual data was not visible to managers.

In September 2020, Barclays invested in Barrenjoey Capital Partners, an Australian investment bank startup. In May 2022, Barclays increased its ownership in this firm.

On October 31, 2021, the group CEO, Jes Staley, stepped down. He was replaced by C. S. Venkatakrishnan, who became the first person of Indian origin to lead Barclays.

In March 2023, Barclays acquired Kensington Mortgages, a specialist mortgage lender.

In July 2023, Arron Banks stated that Barclays closed his bank accounts in 2018 due to his political views.

In February 2024, Barclays announced it would acquire Tesco Bank's credit cards, loans, and savings operations. This transfer became effective on November 1, 2024.

In July 2024, Barclays announced the sale of its German consumer finance business. This is part of its plan to simplify its business and focus on retail banking in the UK.

In early February 2025, Barclays experienced a significant IT issue that affected online and mobile banking services for several days. Customers could not access accounts or view balances. Barclays confirmed that ATMs and card payments still worked.

In February 2025, the bank set aside £90 million for possible compensation claims related to a car finance mis-selling issue. In March 2025, Barclays told the Treasury Select Committee it might pay up to £12.5 million in compensation for technical outages over the past two years.

Environmental Concerns

Barclays has faced criticism from environmental groups. In 2017, there were protests because Barclays owned a company that planned to extract natural gas using hydraulic fracturing (fracking). Barclays later sold this company in 2020.

In 2020, a group called ShareAction raised concerns at Barclays' annual meeting. They pointed out Barclays' role as a major funder of fossil fuel companies in Europe.

How Barclays Works Today

In February 2024, the CEO, C.S. Venkatakrishnan, shared a plan to make Barclays simpler and better. As part of this plan, Barclays was reorganized into five main divisions:

- UK Consumer Bank: This part handles personal and business banking for customers in the UK, including Barclaycard UK.

- Barclays UK Corporate Bank: This division works with many UK businesses, from small to large, helping them with financial services and advice.

- Barclays Private Bank and Wealth Management (PBWM): This offers financial services for managing wealth, including digital investing and expert advice for clients around the world.

- Barclays Investment Bank: This part provides services like advising, financing, and managing risks for large companies, institutions, and governments globally.

- Barclays US Consumer Bank: This offers credit cards, loans, and online savings accounts to customers in the United States.

Before February 2024, Barclays operated as two main divisions: Barclays UK (BUK) and Barclays International (BI).

Main Parts of Barclays

Barclays has several important parts and companies:

- Barclaycard – its global credit card business.

- Barclays Bank plc – the UK corporate bank.

- Barclays Bank UK plc – the UK retail bank.

- Barclays Bank Delaware – its US credit card business.

- Barclays Corporate – for larger businesses.

- Barclays Investment Bank – for investment banking services.

- Barclays Private Clients International – based in the Isle of Man with branches in the Channel Islands.

- Kensington Mortgages – a specialist mortgage lender.

- Barclays Private Bank – for high-net-worth individuals.

Branches and Cash Machines

Barclays has many branches and ATMs around the world. In the UK, it has about 1,600 branches. Most Barclays branches have ATMs that are open 24/7. In the UK, Barclays ATMs can be used for free by Barclays customers and customers of many other banks. Barclays is also part of the Global ATM Alliance, which lets customers of member banks use ATMs for free when traveling internationally.

Leaders of Barclays

- Chairman: Nigel Higgins (since May 2019)

- Chief Executive: C. S. Venkatakrishnan (since November 2021)

Sponsorships

Barclays has sponsored various events and places:

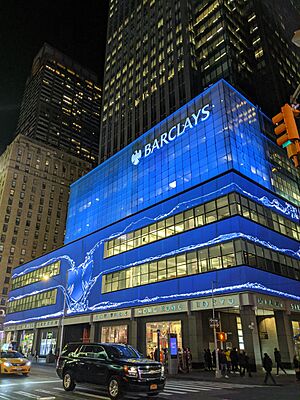

- In 2007, Barclays agreed to a 20-year deal for the naming rights of the Barclays Center in Brooklyn, New York City. This is the home of the Brooklyn Nets basketball team.

- Barclays sponsored the 2008 Dubai Tennis Championships.

- From 2010 to 2015, Barclays was the sponsor of the Barclays Cycle Hire scheme in London.

- Barclays was also the main sponsor of the Premier League football league from the 2003–04 season until the 2015–16 season.

- In January 2025, Apple had discussions with Barclays about becoming a credit card partner.

Coat of Arms

Barclays Bank Limited was given its own Coat of Arms on October 22, 1937. It features a black eagle with ducal coronets on its body and wings.

See also

In Spanish: Barclays para niños

In Spanish: Barclays para niños

- List of largest banks

- List of banks in the United Kingdom

| Emma Amos |

| Edward Mitchell Bannister |

| Larry D. Alexander |

| Ernie Barnes |