Government budget facts for kids

A government budget is like a big financial plan for a country. It shows how much money the government expects to collect (called revenues) and how much it plans to spend (called expenditures) over a certain time, usually a year. This year is often called a fiscal year.

Most of the government's money comes from taxes. These can be taxes on what people earn (like income tax), what companies earn (like corporation tax), or even taxes on things brought into the country (like import taxes). The government spends this money on many important things. This includes healthcare, education, defense, building infrastructure (like roads and bridges), and social benefits for people who need help.

The government or another official group creates this budget. In many countries, the budget needs to be approved by the legislature (like a parliament or congress). Once approved, the budget helps the government carry out its economic policy and achieve its main goals. The word "budget" comes from an old French word, bougette, which means "little bag."

Contents

History of Budgets

The idea of a clear, yearly budget that parliament could check started a long time ago. The Netherlands introduced them in 1572, and England followed in 1689. Other countries like France (1830) and Sweden (1866) adopted them later. These early budgets helped parliaments agree to new taxes. They also helped countries spend more on their military during wars, which often led to victories.

Sir Robert Walpole, who was in charge of England's money, began the practice of showing budgets to parliament. He did this to help people trust the government again after a big financial crisis in 1720, known as the South Sea Bubble. In 1733, Walpole suggested a new tax on things like wine and tobacco. This would lower taxes for landowners. People were very angry about this idea. A politician named William Pulteney wrote a pamphlet called The budget opened. This was the first time the word 'budget' was used for government money plans. Walpole's tax idea was eventually dropped.

By the 1760s, the idea of an annual budget report was well-established. For example, George Grenville talked about the Stamp Act in his budget speech in 1764.

Modern Government Budgets

How Modern Budgets Started

Modern government budgets developed as countries became more capitalist and people demanded more democracy. As businesses grew, the middle class (bourgeoisie) gained more economic power. They wanted more say in how the government spent money.

At first, the goal was to give the legislature (parliament) control over taxes. After a long struggle with kings and queens, the legislature finally got this power. Once they could approve tax laws, they also wanted to control how the money was spent. So, they demanded yearly budget reports showing both income and spending.

England was one of the first countries to have a modern government budget. After a revolution in 1640, England became a parliamentary monarchy. This meant Parliament controlled all financial decisions. The Bill of Rights of 1689 stated that the king could not collect taxes without Parliament's approval. It also required Parliament to approve how taxes were spent and that budgets be made yearly. Other countries adopted similar systems later, like France in 1817 and the United States in 1921.

In short, government budgets were created to help the people's representatives (the legislature) control how the government manages its money.

Why Budgets Are Important

The government budget is a key part of how a country's money is managed. It's a way for people to approve and oversee what the government does with its finances. You could say that the history of modern politics is linked to the history of how budgets developed.

From an economic point of view, a budget is a plan that compares what the government earns and what it spends. It helps decide how a country's resources are used. The budget, decided through political discussions, determines how much money goes to different parts of society. It shows the size and direction of financial spending.

Basically, the budget is a way for taxpayers and their elected representatives to control the government's money. It helps make sure that government spending matches what the taxpayers want. It's a system of checks and balances that supports democracy. Taxpayers provide the money for the government, so they need a way to make sure that money is used wisely and fairly.

Types of Budget

Budgets can be different types:

- National budget: This is the main budget made by the central government for the whole country.

- State budget: In countries with states (like the USA), individual states also make their own budgets.

- Plan budget: This document shows money set aside for big projects and programs in a country's main plan. It also shows money given to states or territories.

- Performance budget: Government departments that work on development create these. They show how government projects aim to meet specific goals and what they achieved in past years.

- Supplementary budget: This budget looks ahead to the next year's income and spending.

- Zero-based budget: In this system, every government department has to explain and justify all its spending from scratch each year. Nothing is automatically approved based on previous years.

Elements of a Budget

The two main parts of any budget are money coming in (revenues) and money going out (expenses). For a government, most revenues come from taxes. Government expenses include paying for everyday goods and services, investing in things like infrastructure or research, and giving out transfer payments like unemployment or retirement benefits.

Government Revenue

Government revenue is the money the government collects. It's the financial fuel the government needs to work. The ways governments collect money have changed over time. Today, it mostly comes from:

- Tax revenues: This is money the government gets by collecting different types of taxes. Taxes usually make up most of a government's income. Examples include income tax, sales tax, property tax, or corporate tax.

- Fees and charges: These are payments for extra services the government provides. Examples include fees for sewage treatment, education, permits, or even fines for breaking laws.

- Loans: The government can borrow money by selling bonds or other investments. This increases the country's government debt.

- Grants and aid: Sometimes, international groups give money to a government for specific projects. Aid can also come from private groups, other governments, or international organizations.

- Sale of assets: The government might sell public property like land, buildings, or equipment to get more money. This is sometimes called privatization.

Government Expenditures

Government expenditures are how the money collected by the government is spent. This money supports many different causes, helps citizens, and encourages economic growth through various programs. Spending can be divided into categories:

- General public services: Money spent on services for everyone. This includes funding for government leaders, financial actions, and international aid.

- Defense: Money the government spends on the military, civil defense, or research related to defense.

- Public order and safety: Services that keep people safe. This includes money for the police or fire-protection services.

- Economic affairs: Money put into different parts of the economy to help it grow.

- Environmental protection: Money spent on protecting the environment. This includes efforts to fight climate change, improve air and water quality, and protect wildlife.

- Housing and community amenities: Money spent on things like housing development, water supply, or street lighting.

- Health: Money spent on healthcare, including prevention and research.

- Recreation, culture and religion: Money spent on fun activities, cultural services, and sometimes religious activities.

- Education: Money spent to support the country's education system, including all levels of schooling.

- Social protection: Extra services for specific groups of people to help achieve fairness and provide social security. This often includes pensions and unemployment benefits.

Special Considerations for Budgets

Government budgets are not just about numbers. They have economic, political, and technical parts. They aren't only designed to use money in the best economic way. Government budgets also involve politics, where different groups try to get benefits and avoid burdens. The technical part is trying to guess how much money will come in and go out.

Classification of Budgets

Government budgets can be one of three types:

- Balanced budget: This happens when the money the government collects is equal to what it spends.

- Deficit budget: This is when the government spends more money than it collects.

- Surplus budget: This is when the government collects more money than it spends.

A budget can also be classified by its purpose or how flexible it is.

How Governments Approach Budgeting

- Line-item budgeting: In this traditional method, the government budget is a list of specific things the government plans to spend money on. This approach was developed in the 1920s to help prevent corruption.

- Incrementalism: This approach focuses on making small changes each year. The government takes the previous year's budget and makes only minor adjustments to it for the new year.

- Top-down approach: In this method, a central financial authority (like the Ministry of finance) sets limits for the budget, and then the government fills in the details. This approach started in the 1990s to help control growing budget deficits.

Why Government Budgets Are Important

Government budgets are important for many reasons:

- They provide a planned way for the government to carry out its activities.

- They offer a complete view of how the government handles its money.

- They affect a country's economic activities.

- They are a tool for economic policy.

- They show how well the government is working.

- They ensure the government is accountable to the public.

- They help decide how resources are used.

- They can help a country's economy grow.

- They can help reduce poverty.

- They can help reduce unfairness in how income is shared.

See also

In Spanish: Presupuesto público para niños

In Spanish: Presupuesto público para niños

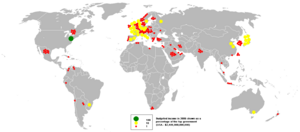

- List of countries by government budget

| Lonnie Johnson |

| Granville Woods |

| Lewis Howard Latimer |

| James West |