Wachovia facts for kids

|

|

| Public | |

| Traded as | NYSE: WB |

| Industry | Financial services |

| Fate | Acquired by Wells Fargo |

| Successor | Wells Fargo |

| Founded | June 16, 1879 |

| Defunct | December 31, 2008 (as an independent corporation) October 15, 2011 (as a brand) |

| Headquarters | Charlotte, North Carolina, U.S. |

| Products | Banking, Investments |

| Owner | Wells Fargo |

Wachovia was a large company that offered many money services. Its main office was in Charlotte, North Carolina. Before another company called Wells Fargo bought it in 2008, Wachovia was the fourth-largest bank in the United States.

Wachovia helped people and businesses with banking, managing their money, and investing. At its biggest, it had offices in 21 states, from Connecticut to Florida and west to California. It also had more than 40 offices around the world. Wells Fargo bought Wachovia on December 31, 2008. This happened because the government wanted to prevent Wachovia from failing. The Wachovia name slowly disappeared over three years. By October 15, 2011, all Wachovia branches became Wells Fargo branches.

Contents

How Wachovia Worked

Wachovia was formed in 2001 when two banks joined together. These were the original Wachovia Corporation from Winston-Salem, North Carolina, and First Union Corporation from Charlotte.

The company had different parts to serve its customers:

- General Bank: This part helped regular people, small businesses, and larger companies with their everyday banking needs.

- Wealth Management: This part helped people with a lot of money manage their investments and trusts.

- Capital Management: This part managed investments and retirement plans. It also helped people buy and sell stocks.

- Corporate and Investment Bank: This part worked with big companies on things like investments and financial advice.

Wachovia also had a part called Wachovia Securities. This group helped people buy and sell stocks across the U.S. and in six countries in Latin America. In 2009, Wachovia Securities became part of Wells Fargo and was renamed Wells Fargo Advisors.

The company's investment banking services were also under the Wachovia Securities name. Its investment management group was called Evergreen Investments. Later, in 2010, Evergreen joined with Wells Fargo's investment funds.

Where the Name "Wachovia" Came From

The name Wachovia (pronounced wah-KOH-vee-uh) comes from an Austrian name, Wachau. When settlers from the Moravian Church arrived in Bethabara, North Carolina, in 1753, they named the land Wachovia. They chose this name because the area reminded them of the Wachau valley along the Danube River. Today, the area once known as Wachovia is mostly Forsyth County, North Carolina. The biggest city there is now Winston-Salem.

First Union's Story

First Union started as Union National Bank on June 2, 1908. It was a small banking desk in a hotel lobby in Charlotte.

In 1958, this bank joined with First National Bank and Trust Company of Asheville, North Carolina. They became First Union National Bank of North Carolina. The company First Union Corporation was officially formed in 1967.

By the 1990s, First Union had grown into a powerful bank in the Southern U.S. In 1995, it bought First Fidelity Bancorporation in Newark, New Jersey. This made First Union a big bank in the Northeast. In 1998, it grew even more by buying CoreStates Financial Corporation from Philadelphia. One of CoreStates' older banks, the Bank of North America, was the first bank ever created in America in 1781.

Wachovia's Story

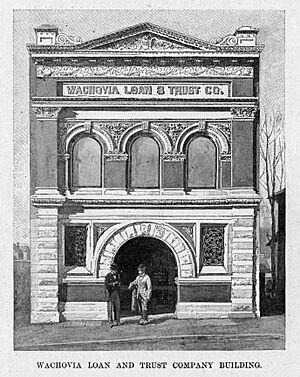

The original Wachovia Corporation began on June 16, 1879. It started in Winston-Salem, North Carolina, as the Wachovia National Bank. James Alexander Gray and William Lemly helped start this bank. In 1911, it joined with Wachovia Loan and Trust Company. This trust company was very large for its time.

Wachovia grew to be one of the biggest banks in the Southeast. This was partly because of its accounts from the R.J. Reynolds Tobacco Company, which was also in Winston-Salem. By the end of 1964, Wachovia was the first bank in the Southeastern United States to have over $1 billion in money and assets.

Wachovia continued to grow by buying other banks. In 1986, it bought First Atlanta. This bank was the oldest national bank in Atlanta, started in 1865. This purchase meant Wachovia had two main offices, one in Winston-Salem and one in Atlanta. In the 1990s, Wachovia expanded into South Carolina and Virginia by acquiring more banks. In 1997, it entered Florida for the first time.

First Union and Wachovia Join Forces

On April 16, 2001, First Union announced it would buy Wachovia. This deal was worth about $13.4 billion in First Union stock. The new combined bank would be based in Charlotte and use First Union's business structure. However, it would take on the more famous Wachovia name and its stock symbol.

Many financial experts were surprised by this merger. They thought Wachovia might be bought by another bank, SunTrust, not First Union. Some people were worried because First Union had problems with a previous merger. Also, people in Winston-Salem were sad to lose a major company headquarters. First Union tried to ease these worries by keeping some important offices in Winston-Salem.

On May 14, 2001, SunTrust tried to stop the deal. SunTrust made its own offer to buy Wachovia, which was unusual for banks at the time. SunTrust argued its deal would be smoother and offered more money for Wachovia's stock. However, Wachovia's board of directors chose First Union's offer. After a legal battle, Wachovia shareholders approved the First Union deal on August 3, 2001.

Another issue was credit cards. Wachovia had agreed to sell its credit card business to Bank One. First Union had sold its credit card business to MBNA. After the merger, the new Wachovia decided to buy back its credit card business from Bank One and then sell it to MBNA.

First Union and Wachovia officially merged on September 4, 2001. To avoid problems, the new Wachovia slowly changed its computer systems. This process took almost two years and was finished on August 18, 2003. This slow approach helped prevent many customers from leaving. In fact, Wachovia was often ranked number one for customer satisfaction among big banks after the merger.

The merger also changed the names of several buildings and sports arenas. For example, the First Union buildings in Charlotte became Wachovia Center buildings. Sports arenas in Philadelphia and Wilkes-Barre, Pennsylvania, also changed their names to Wachovia Center or Wachovia Arena.

How Wachovia Grew (2001-2006)

Between 2001 and 2006, Wachovia bought several other financial companies. It wanted to become a national bank that offered all kinds of money services.

Prudential Securities

On July 1, 2003, Wachovia Securities joined with Prudential Securities. Wachovia owned most of the new company (62%). This new firm became the third-largest stock brokerage firm in the U.S.

SouthTrust

On November 1, 2004, Wachovia bought SouthTrust Corporation for $14.3 billion. This merger created the largest bank in the southeastern U.S. It also made Wachovia the fourth-largest bank in the country by assets.

Westcorp

Wachovia bought Westcorp and its banking part, Western Financial Bank, on March 1, 2006. This deal made Wachovia one of the top car loan lenders in the U.S. It also gave Wachovia a small banking presence in Southern California. The Western Financial Bank branches became Wachovia branches in 2007.

Golden West Financial / World Savings Bank

Wachovia agreed to buy Golden West Financial for almost $25.5 billion on May 7, 2006. Golden West operated branches under the name World Savings Bank. This purchase added 285 branches in 10 states to Wachovia. It greatly increased Wachovia's presence in California.

Golden West was the second-largest savings and loan in the U.S. It was known for special loans called "Pick-A-Pay." These loans let borrowers choose different payment plans, sometimes even delaying part of the interest payment. In 2006, Fortune magazine called Golden West Financial the "Most Admired Company" in the mortgage business.

However, buying Golden West turned out to be a big problem for Wachovia. Many of the "Pick-A-Pay" loans were in areas where home prices later dropped a lot, like California, Florida, and Arizona. This led to huge losses for Wachovia. These problems eventually led to Wachovia being sold to Wells Fargo.

A. G. Edwards

On May 31, 2007, Wachovia announced plans to buy A. G. Edwards for $6.8 billion. This created the second-largest retail stock brokerage firm in the United States. The deal closed on October 1, 2007. In early 2008, the A.G. Edwards name started to be replaced by Wachovia Securities.

Wachovia's Financial Challenges (2007–2009)

Wachovia had many risky loans, especially those from the Golden West Financial purchase in 2006. Because of this, Wachovia started losing a lot of money during the subprime mortgage crisis.

In the second quarter of 2008, Wachovia reported a much larger loss than expected: $8.9 billion. This was a very difficult time for the company.

On June 2, 2008, Wachovia's chief executive officer, G. Kennedy Thompson, had to retire. He had been in charge since 2000. The board then hired Robert K. Steel as the new chief executive on July 9, 2008. They hoped his experience would help the company.

Wells Fargo Buys Wachovia

On October 3, 2008, Wells Fargo and Wachovia announced they would merge. Wells Fargo agreed to buy all of Wachovia for $15.1 billion in stock. Wachovia preferred the Wells Fargo deal because it was worth more than another offer from Citigroup. Also, Wells Fargo's business was mostly in the western U.S., while Wachovia was strong on the East Coast. This meant there was less overlap between their branches.

Citigroup tried to stop the deal, saying they had an agreement with Wachovia. They even went to court. However, a judge later overturned the ruling that blocked the Wells Fargo deal. On October 9, 2008, Citigroup gave up its attempt to buy Wachovia's banking parts. This allowed the Wachovia-Wells Fargo merger to go forward. Citigroup later settled a claim against Wachovia and Wells Fargo for $100 million.

The Federal Reserve approved the merger with Wells Fargo on October 12, 2008. The combined company kept the Wells Fargo name and its main office in San Francisco. However, Charlotte remained the headquarters for the combined company's East Coast banking operations. Wachovia Securities also stayed in Charlotte.

The merger created the largest network of bank branches in the United States. Wells Fargo's purchase of Wachovia was completed on December 31, 2008. After this, the Wachovia logo often included the words "A Wells Fargo company."

Former Leaders

- G. Kennedy Thompson (2001–2008)

- Robert K. Steel (2008)

Images for kids

See also

In Spanish: Wachovia para niños

In Spanish: Wachovia para niños

| Kyle Baker |

| Joseph Yoakum |

| Laura Wheeler Waring |

| Henry Ossawa Tanner |