Accounting facts for kids

Accounting is like keeping a detailed financial diary for a business. It's all about tracking and sharing money information with people who need it, like managers and shareholders (people who own a part of the business). Many people call accounting the "language of business" because it helps everyone understand how a company is doing financially.

People who do accounting are called accountants. They also check a company's financial records, which is called auditing. In Great Britain, a qualified accountant is often called a "chartered accountant". In the United States, they are called a "Certified Public Accountant" or "CPA".

Accountants write down every time a business spends or earns money in special books called ledgers. This information is then used to create reports about the company's money, usually every month, every three months, and once a year. These yearly reports show how much money the company took in and what it spent money on. They also show if the company made a profit (earned more than it spent), who owes the company money, and who the company owes money to. Big items the company bought, like buildings or machines, are also listed.

Many people look at these reports:

- Managers and investors use them to make smart choices about how to spend money in the future.

- Banks and other lenders check the reports before deciding to lend money to the company.

- Tax authorities (the government people who collect taxes) look at them to make sure the company is paying the right amount of taxes.

Contents

What Does the Word "Accountant" Mean?

The word accountant comes from the Latin word computare. This word means "to reckon, count, or number."

The original spelling was "accomptant." But over time, people stopped saying the "p" sound. So, the word slowly changed in both how it was said and spelled to become "accountant" as we know it today.

How Does Accounting Work?

A basic idea in accounting is shown by this simple equation: Assets = Liabilities + Equity

- Assets are things a business owns that have value, like cash, buildings, or equipment.

- Liabilities are what the business owes to others, like loans or bills.

- Equity is the money that belongs to the owners of the business after all debts are paid.

A Brief History of Accounting

Accounting is a very old practice. It started when humans began to farm and live in towns and cities. People needed a way to keep track of their crops and other valuable things.

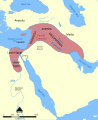

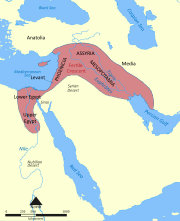

Early Records: Ancient Mesopotamia

The oldest accounting records found are over 7,000 years old. They come from ancient Babylon, Assyria, and Sumer. People back then used simple ways to record how their crops grew and how their animal herds increased. It was easy to count and see if they had extra food or animals after harvest or when young animals were grown.

A big step forward was the invention of bookkeeping using small clay tokens. This helped people keep track of things in a new way.

Later, in the 12th century A.D., an Arab writer named Ibn Taymiyyah wrote a book called Hisba. This book described accounting systems used by Muslims even before the mid-seventh century A.D. These systems were influenced by Roman and Persian ideas. Ibn Taymiyyah's book showed a complex government accounting system.

Accounting in the Roman Empire

The Res Gestae Divi Augusti (meaning "The Deeds of the Divine Augustus") is a famous record from the Roman Empire. It was Emperor Augustus's way of showing the Roman people how he managed public money. It listed all his spending, like gifts to people, land for soldiers, and money for building temples or shows. This record shows that Roman leaders had very detailed financial information. They used this information for planning and making decisions.

Historians Suetonius and Cassius Dio wrote that in 23 BC, Augustus created a rationarium (an account). This listed public income, money in the treasury, and money held by tax officials. It even named the people who could provide detailed reports. This shows how close the financial information was to the emperor himself.

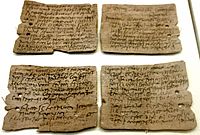

The Roman army also kept very careful records of cash, goods, and transactions. For example, at the fort of Vindolanda around 110 CE, records show that the fort could track daily income. This might have come from selling extra supplies or goods made in the camp. They also recorded items given to slaves, like beer and nails for boots. The fort bought supplies for many people, like 5,000 measures of cereal for brewing.

The Heroninos Archive is a large collection of papyrus documents from Roman Egypt in the 3rd century CE. Most of these are letters, but many are also accounts. They show how a large private estate was managed. The estate had a complex and organized accounting system. Each local farm manager kept their own daily accounts for things like paying workers, growing crops, selling produce, and general spending. This information was then put together into one big yearly account for each part of the estate. This detailed information helped the owner make better economic decisions.

Luca Pacioli and Modern Accounting

Luca Pacioli (1445–1517), also known as Friar Luca dal Borgo, is often called the "Father of Accounting." He wrote a textbook in Latin in 1494 called Summa de arithmetica, geometrica, proportioni et proportionalita. This book was used in schools in northern Italy where sons of merchants and craftsmen learned math.

This textbook included the first printed description of how merchants in Venice kept their accounts. They used a system called the double-entry bookkeeping system.

In double-entry bookkeeping, every financial action has two parts: a "debit" and a "credit." These two parts must always balance each other out.

Pacioli didn't invent this system, but he was the first to write it down clearly. That's why he's called the "Father of Accounting." The system he described is very similar to how accounting works today. He wrote about using journals and ledgers. He even warned that a person shouldn't go to sleep until their debits and credits were equal! His ledger included accounts for assets (things of value), liabilities (debts), capital (money), income, and expenses. He also showed how to close accounts at the end of the year and suggested using a trial balance to check if the ledger was balanced. His book also talked about accounting ethics and how to track costs.

Accounting After Pacioli

The first book about accounting written in the English language was published in London, England, by John Gouge in 1543.

In 1588, John Mellis from Southwark, England, wrote a short book with instructions for keeping accounts.

Another important book, The Merchants Mirrour, was written in 1635 by Richard Dafforne, an accountant. This book mentioned even older accounting books. One chapter, "Opinion of Book-keeping's Antiquity," stated that the bookkeeping methods described were used in Venice two hundred years earlier.

Richard Dafforne's book was very popular and had several editions. This shows that many people in the 17th century were interested in the "science" of accounting. Since then, many books have been written about accounting, and many people have become professional accountants and teachers. This proves that professional accountants were working as early as the 17th century.

Different Kinds of Accounting

- Financial accounting is about collecting, recording, and summarizing money information. This information is then put into reports like a profit and loss account, a balance sheet, and a cash flow statement. These reports follow specific rules for legal, professional, and market needs.

- Management accounting helps managers make decisions. It involves creating systems for planning and checking how well a company is doing. It also uses financial reports to help plan a company's future money strategy.

- Open-book accounting is a rule where businesses in a financial relationship agree to show each other their accounting books.

- Tax accounting focuses on making sure a business follows all tax laws and pays the correct amount of taxes.

- Accounting scholarship is the study of the ideas and theories behind accounting.

A financial audit is when someone checks a company's financial records. An external audit is done by an independent (unrelated) auditor. They look at financial statements and records to see if they are true, fair, and follow standard rules like Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). An internal audit is done by employees of the company to get information for their own management.

Images for kids

See also

In Spanish: Contabilidad para niños

In Spanish: Contabilidad para niños

| Kyle Baker |

| Joseph Yoakum |

| Laura Wheeler Waring |

| Henry Ossawa Tanner |