Bayer facts for kids

|

|

Headquarters in Leverkusen

|

|

| Public | |

| Traded as | |

| Industry |

|

| Founded | 1 August 1863 |

| Founder | Friedrich Bayer |

| Headquarters | Leverkusen, North Rhine-Westphalia, Germany |

|

Area served

|

Worldwide |

|

Key people

|

|

| Products |

|

| Revenue | |

|

Operating income

|

|

| Total assets | |

| Total equity | |

|

Number of employees

|

101,369 (2022) |

Bayer AG is a large German company that works with pharmaceuticals (medicines) and biotechnology (using living things to make products). It is one of the biggest companies in the world in these areas. Bayer's main office is in Leverkusen, Germany. The company makes medicines, healthcare products for everyday use, and products for farming like agricultural chemicals and seeds. Bayer is also part of the Euro Stoxx 50 stock market index, which includes 50 of the largest companies in Europe.

Bayer was started in 1863 by Friedrich Bayer and Friedrich Weskott. They first made dyes. Over time, Bayer grew and started making other things. In 1899, Bayer launched a medicine called Aspirin, which is still very well-known today. Aspirin is on the WHO Model List of Essential Medicines, meaning it's considered very important for a basic health system.

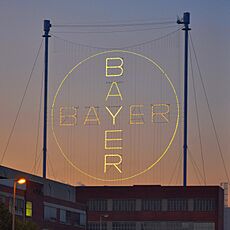

In 1904, Bayer got a special trademark for its "Bayer Cross" logo. This logo was put on every Aspirin tablet, making it a famous symbol. In 1925, Bayer joined with five other German companies to form IG Farben, which became a huge chemical and pharmaceutical company. After World War II, IG Farben was broken up, and Bayer became its own company again. Bayer played a big part in rebuilding West Germany after the war.

In 2016, Bayer bought the American company Monsanto. This was a very big deal for a German company. However, this purchase led to many legal issues, especially about Monsanto's Roundup herbicide. Bayer also owns the Bundesliga football club Bayer 04 Leverkusen.

Contents

Company Beginnings

How Bayer Started

Bayer AG began as a factory making dyes in 1863. It was founded in Barmen, Germany, by Friedrich Bayer and his partner, Johann Friedrich Weskott. Friedrich Bayer was in charge of the business side of things. The company's most important products were dyes called Fuchsine and aniline.

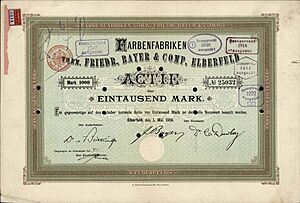

In 1866, the company moved its main office and most of its factories to a bigger area in Elberfeld. Friedrich Bayer's son, also named Friedrich Bayer, joined the company in 1873. After his father passed away in 1880, the company became a joint-stock company, meaning it was owned by many shareholders. It was called Farbenfabriken vorm. Friedr. Bayer & Co.

Since there wasn't enough space to grow in Elberfeld, the company moved to a village called Wiesdorf by the Rhein river. A new city, Leverkusen, was founded there in 1930. This city became the home of Bayer AG's main office. The company's well-known logo, the Bayer cross, was first used in 1904. It shows the word BAYER written both up and down, sharing the letter Y, all inside a circle. A lighted version of this logo is a famous sight in Leverkusen.

The Story of Aspirin

Bayer's first really important product was acetylsalicylic acid, which is now known as Aspirin. This medicine came from salicylic acid, a traditional remedy found in the bark of the willow tree. By 1899, Bayer had registered the name Aspirin as its trademark for this medicine around the world.

However, after World War I, the United States, France, and the United Kingdom took over Bayer's assets and trademarks. Because of this, and how widely the word was used, "aspirin" became a general term for the drug in these countries. Even so, "Aspirin" is still a registered trademark of Bayer in over 80 countries, including Canada, Mexico, Germany, and Switzerland.

Aspirin is a very important medicine. In 2011, about 40,000 tons of aspirin were made each year. In the United States alone, 10 to 20 billion tablets were used to help prevent heart problems. Aspirin is also on the WHO Model List of Essential Medicines, which lists the most important medicines needed in a basic health system.

There is some debate about who exactly discovered Aspirin at Bayer. Arthur Eichengrün, a Bayer chemist, said he was the first to find a way to make aspirin without causing upset stomachs. He also claimed he invented the name "aspirin." Bayer, however, says that Felix Hoffmann discovered aspirin to help his father, who had arthritis. Many different sources support both claims. Most historians believe that Hoffmann and/or Eichengrün were involved in its invention.

Phenobarbital Medicine

In 1903, Bayer got the rights to a patent for a sleep medicine called diethylbarbituric acid. It was sold as Veronal starting in 1904. Bayer then did more research and discovered phenobarbital in 1911. They found that it was very good at treating epilepsy in 1912. Phenobarbital was one of the most used medicines for epilepsy until the 1970s. Even in 2014, it was still on the World Health Organization's list of essential medicines.

World War I and IG Farben

During World War I (1914–1918), many of Bayer's assets, including the rights to its name and trademarks, were taken in the United States, Canada, and other countries. In the US and Canada, these rights were bought by another company, Sterling Drug. Bayer didn't get them back until 1994.

In 1925, Bayer became part of IG Farben. This was a large German group formed by six chemical companies joining together. In the 1930s, a scientist named Gerhard Domagk at Bayer discovered prontosil. This was the first antibacterial medicine available for sale. It was a big step forward in medicine. Domagk won the Nobel Prize in 1939 for this discovery.

Bayer's Role in World War II

IG Farben, the company Bayer was part of, used forced labor in factories built near Nazi concentration camps, like Monowitz concentration camp (Auschwitz III). By 1943, almost half of IG Farben's workers were forced laborers or conscripts, including 30,000 prisoners from Auschwitz.

After World War II, the Allied Control Council took control of IG Farben's assets because of its role in supporting the Nazi war effort. In 1951, IG Farben was split into its original companies, and Bayer became a separate company again, known as Farbenfabriken Bayer AG. In 1972, its name changed to Bayer AG. Some Bayer employees faced trials after the war for their involvement. In 1995, the CEO of Bayer, Helge Wehmeier, publicly apologized for the company's actions during World War II and the Holocaust.

Bayer's Products

Medicine and Healthcare

In 1953, Bayer introduced the first neuroleptic medicine (for mental health) in Germany. In the 1960s, Bayer also made a pregnancy test called Primodos. This test later caused controversy and was removed from the market in the mid-1970s due to concerns about birth defects. Studies on this issue have been inconclusive.

In 1978, Bayer bought Miles Laboratories, which included popular products like Alka-Seltzer, Flintstones vitamins, and One-A-Day vitamins.

One of the products Bayer acquired was Factor VIII, a medicine used to help blood clot for people with hemophilia. In the 1980s, it was found that some of these blood products were contaminated with HIV, leading to infections in many patients. This was a very serious medical disaster. Companies, including Bayer, then developed safer ways to treat blood products. In 1997, Bayer and other companies agreed to pay $660 million to settle cases for over 6,000 hemophilia patients in the United States who were infected.

Bayer has also faced other issues with its medicines. In the late 1990s, they introduced a drug called Baycol, but it was stopped in 2001 after 52 deaths were linked to it. Another drug, Trasylol, used to control bleeding during surgery, was removed from the market in 2007 due to reports of increased deaths. It was later brought back in Europe but not in the US.

Popular Medicines

In 2014, medicines made up a big part of Bayer's income. Some of their top-selling products include:

- Kogenate (recombinant clotting factor VIII): This medicine helps people with Haemophilia A (a bleeding disorder) by providing a missing clotting factor.

- Xarelto (rivaroxaban): This drug helps prevent blood clots. It is used to prevent strokes in people with certain heart conditions and to treat blood clots in the legs or lungs.

- Betaseron (interferon beta-1b): This is an injectable medicine used to help prevent relapses in people with multiple sclerosis.

- Nexavar (sorafenib): This medicine is used to treat certain types of cancer, including liver and kidney cancer.

- Cipro (ciprofloxacin): This is a widely used antibiotic that helps fight bacterial infections.

- Rennie antacid tablets: These are popular over-the-counter tablets used to relieve indigestion and heartburn.

Farming Products

Bayer also makes many products for farming, including fungicides, herbicides, and insecticides, as well as different types of crop seeds.

- Fungicides help protect crops from fungal diseases.

- Herbicides are used to control weeds in fields and orchards. For example, Liberty brands contain glufosinate to kill weeds.

- Insecticides are used to protect crops from insect pests. Some of these, like neonicotinoids, have been looked at closely because of concerns about their effects on the environment, especially on honey-bees.

Company Growth and Changes

Buying Other Companies

In 1994, Bayer AG bought the over-the-counter (OTC) drug business from Sterling Winthrop. This allowed Bayer to get back the rights to its "Bayer" name and the Bayer cross logo in the U.S. and Canada.

In 2004, Bayer HealthCare bought the OTC medicine part of Roche. In 2008, Bayer HealthCare also bought Sagmel, Inc., a company that sells OTC medicines in many countries.

Buying Schering

In 2006, Bayer made its biggest purchase ever by acquiring most of the shares of Schering AG for €14.6 billion. Schering was a large pharmaceutical company. In 2007, Bayer fully took over Schering AG and formed Bayer Schering Pharma. This was one of the ten biggest pharma mergers in history at that time.

Other Purchases

Bayer has continued to buy other companies to grow its business.

- In 2010, Bayer bought Bomac Group, an animal health company.

- In 2014, Bayer bought Algeta, a company that worked on cancer treatments.

- Also in 2014, Bayer agreed to buy Merck's consumer health business for $14.2 billion. This made Bayer the second-largest company globally in non-prescription drugs.

- In 2015, Bayer sold its diabetes care business to Panasonic Healthcare Holdings.

- More recently, Bayer acquired BlueRock Therapeutics (2019), KaNDy Therapeutics (2020), and Asklepios BioPharmaceuticals (2020), focusing on new medicines and treatments.

Creating Covestro

In 2015, Bayer separated its materials science division into a new, independent company called Covestro. Bayer kept about 70% ownership at first. Bayer did this because the materials science part of the business had lower profits and needed a lot of investment. By separating it, Bayer could focus more on its life sciences businesses (medicines and agriculture).

Buying Monsanto

In 2016, Bayer offered to buy the U.S. seeds company Monsanto for $62 billion. After some negotiations, Monsanto agreed to a $66 billion offer. To get approval from regulators, Bayer had to sell some of its farming assets to another company, BASF. The deal was approved in 2018, and the sale was completed in June 2018. The Monsanto brand was then stopped, and its products are now sold under the Bayer name.

The purchase of Monsanto was the biggest acquisition ever by a German company. However, it has been seen as one of the worst company mergers in history because of many ongoing lawsuits related to Monsanto's herbicide, Roundup. By 2023, Bayer's value had dropped significantly since the merger.

How Bayer is Organized

| Business unit | share |

|---|---|

| Crop Science | 48.8% |

| Pharmaceuticals | 38.0% |

| Consumer Health | 12.7% |

| Other | 0.5% |

In 2003, Bayer AG changed how it was organized to separate its daily operations from its long-term plans. The main parts of the company became separate limited companies, all controlled by Bayer AG. These included Bayer CropScience, Bayer HealthCare, and Bayer MaterialScience.

In 2016, Bayer started another big reorganization to become more focused on life sciences. After selling off its Chemicals division and spinning out its Materials division, Bayer now has three main divisions: Pharmaceuticals, Consumer Health, and Crop Science.

| Bayer AG | Divested business units | ||

|---|---|---|---|

| Bayer Pharmaceuticals Head of Division: Stefan Oelrich |

Bayer Consumer Health Head of Division: Heiko Schipper |

Bayer Crop Science Head of Division: Rodrigo Santos |

Lanxess (Bayer Chemicals AG) Diagnostics Division Diabetes Devices Division Covestro (Bayer MaterialScience) Bayer Animal Health (sold to Elanco) |

Bayer CropScience

Bayer CropScience makes products for protecting crops, controlling pests that are not on farms, and developing seeds and plant biotechnology. This includes working with genetic engineering for food. In 2002, Bayer bought Aventis CropScience and combined it with its own agrochemicals division to form Bayer CropScience.

In 2006, it was announced that Bayer CropScience's genetically modified rice had accidentally mixed with the U.S. rice supply. This led to a ban on U.S. long-grain rice imports in the European Union. Bayer later agreed to a settlement of up to $750 million for farmers affected by this. In 2016, Bayer CropScience became one of the three main divisions of Bayer AG. The global headquarters of Bayer CropScience is in St. Louis, Missouri, United States.

Bayer Consumer Health

Bayer Consumer Health manages Bayer's over-the-counter (OTC) medicines. These are medicines you can buy without a prescription. Some of their main products include pain relievers like Bayer Aspirin and Aleve, vitamins like Redoxon and Berocca, and skincare products like Bepanthen.

Bayer Pharmaceuticals

The Pharmaceuticals Division focuses on prescription medicines. These are medicines that require a doctor's order. They specialize in areas like women's healthcare, heart conditions, and serious diseases like oncology (cancer), hematology (blood disorders), and ophthalmology (eye conditions). This division also includes a part that makes equipment for medical imaging and the special liquids needed for them.

Bayer 04 Leverkusen Football Club

In 1904, Bayer founded a sports club called TuS 04. This club later became SV Bayer 04 and then TSV Bayer 04 Leverkusen in 1984. It is usually just known as Bayer 04 Leverkusen. The club is most famous for its football (soccer) team, which plays in the Bundesliga, Germany's top football league. However, the club also has many other sports, like athletics, fencing, handball, and basketball. TSV Bayer 04 Leverkusen is one of the largest sports clubs in Germany. Bayer also supports similar sports clubs at its other locations.

Legal Issues and Settlements

Roundup Herbicide Lawsuits

After Bayer bought Monsanto in 2018, it faced many lawsuits about Roundup, a weed killer made by Monsanto. People claimed that using Roundup caused them to get Non-Hodgkin's lymphoma (a type of cancer). In August 2018, a U.S. jury ordered Monsanto to pay $289 million to a school groundskeeper. This amount was later reduced. In May 2019, a judge ordered Bayer to pay over $2.5 billion to a couple, which was also later reduced.

In June 2020, Bayer agreed to pay $9.6 billion to settle more than 10,000 lawsuits related to Roundup. Bayer said this settlement does not mean they admit fault, but it helps resolve many of the ongoing cases. As of 2023, there were still many claims against Roundup, mostly saying it caused cancer.

It's important to know that many national health agencies and the European Commission generally agree that using Roundup as directed does not cause cancer or genetic risks to humans. However, a U.S. court in 2022 asked the Environmental Protection Agency to re-examine its findings on glyphosate, the main ingredient in Roundup.

Xarelto Medicine Lawsuits

In 2019, Bayer and Johnson & Johnson settled about 25,000 lawsuits related to the blood-thinning drug Xarelto (rivaroxaban). They agreed to pay $775 million to people who said the companies did not properly warn patients about possible serious bleeding from the drug. The companies did not admit fault and had won previous trials.

Contaminated Blood Products

In the mid-1980s, Bayer's Cutter Laboratories found that their blood clotting medicines, Factor VIII and IX, were contaminated with HIV. Despite this, the company continued to sell the unheated, contaminated products in some markets outside the U.S. until 1985. This was because they had a large financial investment in the product and were unable to sell it in Europe and the US. As a result, thousands of patients who used these products became infected with HIV and later developed AIDS.

Dicamba Herbicide Lawsuits

In February 2020, Bayer and BASF were ordered to pay a peach farmer $15 million for damage to his peach trees caused by the herbicide dicamba, which Bayer acquired from Monsanto. The next day, they were ordered to pay an additional $250 million in punishment damages, which was later reduced to $60 million. In June 2020, Bayer agreed to a settlement of up to $400 million for other dicamba-related claims.

PCB Pollution Lawsuits

In June 2020, Bayer agreed to pay $800 million to settle lawsuits claiming that Monsanto had polluted public waterways with PCBs (harmful chemicals) before 1978. However, a U.S. judge later rejected this settlement offer and allowed the lawsuits to continue.

Images for kids

See also

In Spanish: Bayer para niños

In Spanish: Bayer para niños