Royal Bank of Scotland facts for kids

|

|

Dundas House in Edinburgh, built in 1774, acquired by the Royal Bank of Scotland in 1821 and still its registered office

|

|

|

Formerly

|

Adam & Company Public Limited Company |

|---|---|

| Private | |

| Industry | Financial services |

| Founded | 31 May 1727 |

| Headquarters | Edinburgh, Scotland, UK |

|

Key people

|

|

| Services |

|

|

Number of employees

|

71,200 |

| Parent | NatWest Group |

The Royal Bank of Scotland Public Limited Company (in Scottish Gaelic, Banca Rìoghail na h-Alba) is a big bank in Scotland. It helps people and businesses with their money. It is part of the NatWest Group, which also includes NatWest and Ulster Bank. The Royal Bank of Scotland has about 700 branches, mostly in Scotland. You can also find branches in many larger towns and cities across England and Wales.

This bank is completely separate from the Bank of Scotland, which is another bank based in Edinburgh. The Bank of Scotland is actually 32 years older than the Royal Bank. The Royal Bank of Scotland was started to be a bank with strong ties to the British government at the time.

In 2019, the bank became a direct part of NatWest Holdings. This happened after new rules were made to separate the main banking business from other parts. The investment banking part of the group is now called NatWest Markets. To make this legal, the old Royal Bank of Scotland company was renamed NatWest Markets in 2018. At the same time, another bank called Adam and Company took on the name The Royal Bank of Scotland. Adam and Company continued to offer private banking services under the RBS brand until 2022.

Contents

The Royal Bank of Scotland's Story

How the Bank Started

The Royal Bank of Scotland began with a group of investors. They were part of a company that failed, and they received money as part of the deal when Scotland and England joined together in 1707. This group, called the "Equivalent Company," decided they wanted to start a bank.

The British government liked this idea. The "Old Bank," which was the Bank of Scotland, was thought to have supported the Jacobites, who wanted to bring back the old royal family. So, the "New Bank" was officially created on May 31, 1727. It was named the Royal Bank of Scotland. Archibald Campbell, Lord Ilay, became its first leader.

On May 31, 1728, the Royal Bank of Scotland came up with a new idea: the overdraft. This was a big step forward in modern banking. It allowed a merchant named William Hogg to borrow £1,000 even if he didn't have that much money in his account.

Early Rivalry with the Bank of Scotland

The Royal Bank and the Bank of Scotland were fierce rivals. They often tried to make each other's banknotes less valuable. The Royal Bank would collect many of the Bank of Scotland's notes. Then, it would suddenly demand that the Bank of Scotland pay them back in cash.

To pay these notes, the Bank of Scotland had to ask for its loans back quickly. In March 1728, it even had to stop making payments for a short time. This hurt the Bank of Scotland's reputation. It also gave the Royal Bank a chance to grow its own business.

Both banks eventually realized that these tactics were hurting everyone. They made a truce, agreeing to accept each other's banknotes. This agreement finally happened in 1751.

Growing Across Scotland

The bank opened its first branch outside Edinburgh in 1783, in Glasgow. More branches soon followed in places like Dundee and Greenock.

In 1821, the bank moved its main office in Edinburgh to Dundas House. This beautiful building was designed by Sir William Chambers and finished in 1774. Inside, there's a grand banking hall with a blue domed roof decorated with gold stars. Dundas House is still the bank's official head office today.

Throughout the 1800s, the bank grew by joining with other Scottish banks. For example, it took over the Dundee Banking Company in 1864. By 1910, the Royal Bank of Scotland had 158 branches and about 900 staff members.

In 1969, the Royal Bank of Scotland merged with the National Commercial Bank of Scotland. This created a new parent company, which was later renamed The Royal Bank of Scotland Group in 1979. This group became NatWest Group in July 2020.

Expanding into England

As London became a major financial center, Scottish banks wanted to open branches there. The Royal Bank of Scotland opened its first London branch in 1874. However, English banks tried to stop Scottish banks from expanding too much into England.

An agreement was made: English banks would not open branches in Scotland, and Scottish banks would not open branches in England outside London. This agreement lasted until the 1960s.

After World War I, the Royal Bank started expanding in England again. It bought smaller English banks like Drummonds Bank in 1924. It also acquired Williams Deacon's Bank in 1930 and Glyn, Mills & Co. in 1939. These banks later became Williams & Glyn's Bank and eventually took on the Royal Bank name in 1985.

International Growth

The Royal Bank of Scotland opened its first international office in New York in 1960. Later, it opened offices in other U.S. cities and Hong Kong. In 1988, the bank bought Citizens Financial Group, a bank in the United States. Citizens Financial Group then bought several other American banks.

From 1988 to 2015, the Royal Bank of Scotland owned Citizens Financial Group. It also had a large share in the Bank of China for a few years.

Recent Changes

In 2008, the Royal Bank of Scotland faced big problems and needed help from the government. It became a company mostly owned by the UK government.

In June 2012, some computer problems stopped customers from getting to their accounts. The bank worked to fix this and improve its systems.

In 2014, the Royal Bank of Scotland said it would move its main office to London if Scotland voted for independence. This would have changed where the bank paid its taxes. However, Scotland voted to stay part of the UK, so the headquarters remained in Edinburgh.

In 2015, the Royal Bank of Scotland sold its private banking business in other countries to a Swiss bank. It continued to offer private banking in the British Isles.

In 2017, it was reported that the Royal Bank of Scotland, along with other banks, had processed some suspicious money transfers. The bank worked to improve its checks to prevent such activities.

In early 2018, the Royal Bank of Scotland Group changed its structure. This was to follow new rules that separate everyday banking from riskier investment banking. As part of this, all Royal Bank of Scotland branches in England and Wales that were near a NatWest branch were closed. Customers could use NatWest branches instead.

On February 14, 2020, it was announced that the Royal Bank of Scotland Group plc would change its name to NatWest Group plc. This change happened on July 22, 2020.

Changes to Williams & Glyn

After the government helped the RBS Group in 2008, the European Commission asked the group to sell part of its business. This was because the government's help was seen as a special advantage.

The Royal Bank of Scotland planned to bring back the old name Williams & Glyn for the part of its business it had to sell. This included its Royal Bank of Scotland branches in England and Wales and some NatWest branches in Scotland.

In 2013, the Royal Bank of Scotland Group agreed to sell these branches to a group called Corsair. The plan was for these branches to become a separate bank called Williams & Glyn. However, in 2016, RBS decided not to go through with the sale because the new bank might not be able to stand on its own.

In 2017, a new agreement was made. RBS Group was allowed to keep these parts of its business. Instead, it would focus on helping other banks compete better in the UK. In 2018, many of the RBS branches in England and Wales that were supposed to become Williams & Glyn were closed. Customers could use nearby NatWest branches for their banking needs.

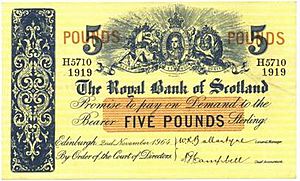

Scottish Banknotes

For a long time, banks in Great Britain and Ireland could print their own banknotes. While the Bank of England eventually became the only bank to issue notes in England and Wales, Scottish banks kept this right. The Royal Bank of Scotland, along with Clydesdale Bank and Bank of Scotland, still prints its own banknotes today.

Scottish banknotes are used widely in Scotland and the rest of the United Kingdom. They are accepted as a way to pay, even though they are not officially "legal tender" like Bank of England notes. In fact, no paper money is legal tender in Scotland, not even Bank of England notes.

“Fabric of Nature” Notes (Since 2016)

Since May 2020, the Royal Bank of Scotland has been replacing its old banknotes with new ones made of polymer (a type of plastic). These new notes are called the “Fabric of Nature” series. The first polymer notes, the £5 ones, came out on October 27, 2016. The £5 note features Nan Shepherd, a Scottish writer, and the Cairngorms mountains. The back shows two mackerel fish.

The £10 polymer note came out in 2017. It shows Mary Somerville, a Scottish scientist, and Burntisland beach. The back of the note features two otters.

"Ilay" Series (Until 2022)

Before the polymer notes, the Royal Bank used the "Ilay" series of banknotes. These notes were named after Lord Ilay, the bank's first governor, whose picture was on each note.

The front of these notes also showed Dundas House, the bank's headquarters in Edinburgh. The background design on both sides of the notes was a star pattern, inspired by the ceiling of the banking hall in the old headquarters building.

The back of the notes featured different Scottish castles:

- £1 note: Edinburgh Castle

- £5 note: Culzean Castle

- £10 note: Glamis Castle

- £20 note: Brodick Castle

- £50 note: Inverness Castle (added in 2005)

- £100 note: Balmoral Castle

All the Ilay series notes were taken out of circulation on September 30, 2022.

Special Commemorative Banknotes

Sometimes, the Royal Bank of Scotland prints special banknotes to celebrate important events or famous people. These notes are often collected and don't stay in circulation for long. The Royal Bank was the first British bank to print these special notes in 1992.

Some examples include:

- A £1 note for a European Union meeting at Holyrood Palace (1992).

- A £1 note for the 100th anniversary of writer Robert Louis Stevenson's death (1994).

- A £1 note for the 150th anniversary of Alexander Graham Bell's birth (1997).

- A £20 note for the 100th birthday of Queen Elizabeth The Queen Mother (2000).

- A £5 note honoring golfer Jack Nicklaus at his last Open Championship (2005).

- A £1 note for the opening of the Scottish Parliament (1999).

- A £50 note for the opening of the Royal Bank of Scotland's new headquarters in Gogarburn (2005).

- A £10 note to celebrate the Diamond Jubilee of Elizabeth II (2012).

- A £5 note to celebrate the Ryder Cup golf tournament.

Bank Services

The Royal Bank of Scotland offers many banking and insurance services for individuals and businesses. Besides regular branches, phone banking, and internet banking, they have also used "mobile branches" since 1946. These are converted vans that travel to serve people in rural areas. There are currently 19 mobile branches.

The bank is regulated by important financial authorities in the UK. It also takes part in the Faster Payments Service, which helps make payments quicker.

In 2006, the Royal Bank of Scotland Group was the first in Europe to try out PayPass contactless debit and credit cards. These cards let you pay for things up to £30 by simply tapping your card on a special machine. To make online banking safer, the bank also introduced small hand-held devices in 2007. You use these devices with your card to approve online transactions.

The Royal Bank of Scotland is part of several important banking networks in the UK. It is also a member of the Financial Ombudsman Service, which helps resolve disputes between customers and financial companies.

Bank Branding

The Royal Bank of Scotland Group uses a special logo called the "Daisy Wheel." It looks like four arrows pointing inwards. This design is meant to show how the bank helps gather and grow wealth. The "Daisy Wheel" logo was also used by other banks that were part of the Royal Bank of Scotland Group, like Ulster Bank and Citizens Financial Group.

From 2003, the bank started using "RBS" more often instead of "The Royal Bank of Scotland." This was to make the bank seem more global. However, in 2014, the full bank name started appearing again in advertising. In 2016, it was confirmed that the bank would use its full name for its business in Scotland to show its focus on its Scottish roots.

The Royal Bank of Scotland used to sponsor the Williams F1 racing team from 2005 to 2010. They also supported tennis player Andy Murray since he was 13 years old.

More to Explore

- List of investors in Bernard L. Madoff Investment Securities

| William Lucy |

| Charles Hayes |

| Cleveland Robinson |