Jay Cooke facts for kids

Quick facts for kids

Jay Cooke

|

|

|---|---|

|

|

| Born |

Jason Cooke

August 10, 1821 Sandusky, Ohio, U.S.

|

| Died | February 16, 1905 (aged 83) Elkins Park, Pennsylvania, U.S.

|

| Occupation | Financier |

| Spouse(s) |

Dorothea Elizabeth Allen

(m. 1844; died 1871) |

| Children | 8, including Jay Cooke Jr., Laura E. Cooke, Henry E. Cooke, and Sarah E. Cooke |

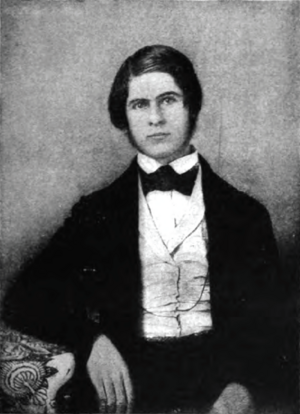

Jason Cooke (born August 10, 1821 – died February 16, 1905) was an important American financier. He helped the Union pay for the American Civil War. He also helped build railroads in the northwestern United States after the war. Many people see him as the first big investment banker in the U.S.

Contents

Early Life and Family

Jay Cooke was born in Sandusky, Ohio. His parents were Eleutheros Cooke and Martha Carswell Cooke. His father, Eleutheros Cooke, was a lawyer in Ohio. He was also a member of the Ohio government and the U.S. Congress.

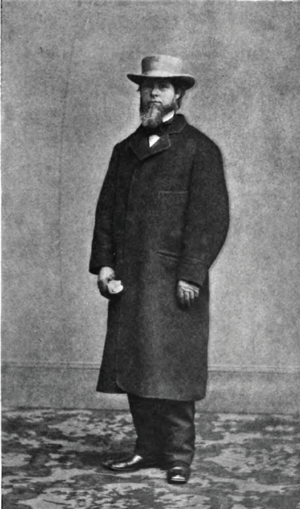

Helping to Fund the Civil War

In 1838, Cooke moved to Philadelphia. He started working at a banking company called E. W. Clark & Co. He became a partner there in 1842. In 1858, he left that company.

On January 1, 1861, just before the American Civil War began, Cooke opened his own banking business. It was called Jay Cooke & Company in Philadelphia. Soon after the war started, the state of Pennsylvania borrowed money from his firm. This money helped them pay for their war efforts.

In the early days of the war, Cooke worked with the U.S. Treasury Secretary, Salmon P. Chase. They got loans from big bankers in the Northern states. Cooke's company was very good at selling government notes. Because of this, Secretary Chase asked him to sell special government bonds. These bonds were worth $500 million.

The government had tried to sell these bonds before but failed. Cooke was promised a small fee for selling them. He then started a huge sales campaign across the country. He hired about 2,500 people to sell the bonds. These agents traveled through every Northern and Western state. They even went into Southern states that the Union Army controlled.

Cooke also got most Northern newspapers to help. He bought ads and worked with editors. They wrote long articles about why buying government bonds was a good idea. These efforts encouraged people to buy bonds to help the war. They also showed people how they could make money by doing so. Cooke quickly sold all $500 million in bonds, and even more!

Cooke also helped set up national banks. He quickly started a national bank in Washington and another in Philadelphia.

In 1865, the government needed money urgently. After other banks struggled to sell more government notes, they asked Cooke for help again. He sent agents to small towns and even mining camps in the West. He also convinced local newspapers to support the loans. Between February and July 1865, he sold notes worth $830,000,000. This money helped supply and pay the Union soldiers during the final months of the war.

Cooke was known for a new banking practice called price stabilization. This is when bankers help keep the price of new investments steady. Investment bankers still use this method today.

Even though Cooke's work was praised as patriotic, he made a lot of money. Some people accused him of corruption. They said he was slow to put the money from bond sales into government accounts. In 1862, a politician suggested an investigation, but it never happened.

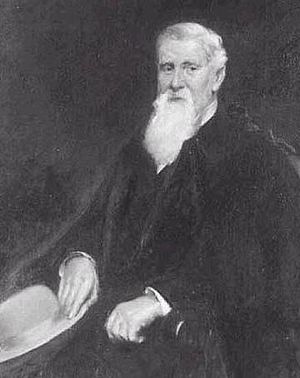

Northern Pacific Railway and Later Life

After the war, Cooke became interested in developing the northwestern U.S. In 1870, his company helped pay for the building of the Northern Pacific Railway. Cooke loved Duluth, Minnesota. He wanted to make it a major city, like Chicago. He started buying railways with a big dream. He wanted to connect the Pacific Ocean to Duluth. This would allow goods to travel through Duluth into the Great Lakes shipping system. From there, they could go to markets in Europe.

However, his company spent too much money on this project. When the Panic of 1873 began, his company had to stop its operations. Cooke himself went bankrupt. Jay Cooke was also involved in financial issues with the Canadian government. This caused the Canadian Prime Minister, Sir John A. Macdonald, to lose his job in 1873. Cooke's shares in the Northern Pacific Railway were later bought cheaply by George Stephen and Donald Smith. They then finished building the Canadian Pacific Railway.

In the mid-1860s, Cooke had brought his son-in-law, Charles D. Barney, into his company. After the Panic of 1873, Jay Cooke & Company collapsed. Barney then led a new company called Chas. D. Barney & Co. Cooke's son, Jay Cooke, Jr., also joined this new firm.

By 1880, Cooke had paid off all his debts. He also became rich again by investing in a silver mine in Utah. He died in Elkins Park, Pennsylvania, on February 16, 1905.

Other Achievements and Giving Back

Jay Cooke owned a summer home on Gibraltar Island in Lake Erie, Ohio. It was built in 1864-65 and is still there today. This island was used by Commodore Perry as a lookout during the Battle of Lake Erie in 1813.

Philanthropy

Cooke was a very religious person. He regularly gave 10 percent of his income to religious and charity causes. He gave money to the Philadelphia Divinity School. He also helped build Episcopal churches. One of these is St. Paul's Episcopal Church in Elkins Park, Pennsylvania. He also helped build St. Paul's Episcopal Church on South Bass Island, near his summer home. After he lost his Ogontz estate when he went bankrupt, he later bought it back. He then turned it into a school for girls.

Legacy and Honors

Several places are named after Jay Cooke:

- Jay Cooke State Park, a large park near Duluth, Minnesota.

- The village of Cooke City, Montana.

- Cooke Township in Cumberland County, Pennsylvania.

- Jay Cooke Elementary School in Philadelphia, Pennsylvania.

- Cooke Road in Cheltenham Township, Pennsylvania.

- Jay, Pitt, and Cooke Streets in the Lakeside neighborhood of Duluth, Minnesota.

- A statue of Jay Cooke by Henry Shrady is in Jay Cooke Plaza in Duluth, Minnesota.

Images for kids

See also

In Spanish: Jay Cooke para niños

In Spanish: Jay Cooke para niños

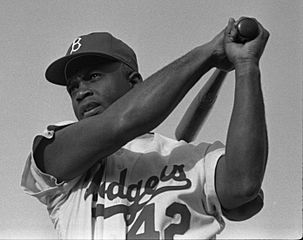

| Jackie Robinson |

| Jack Johnson |

| Althea Gibson |

| Arthur Ashe |

| Muhammad Ali |