Robert Mundell facts for kids

Quick facts for kids

Robert Mundell

|

|

|---|---|

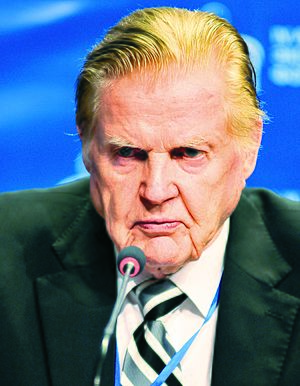

Mundell in 2011

|

|

| Born |

Robert Alexander Mundell

October 24, 1932 Kingston, Ontario, Canada

|

| Died | April 4, 2021 (aged 88) |

| Nationality | Canadian |

| Institution | Johns Hopkins University (1959–61, 1997–98, 2000–01) University of Chicago (1965–72) Graduate Institute of International Studies in Geneva, Switzerland (1965–75) University of Waterloo (1972–74) McGill University (1989–1990) Columbia University (1974–2021) Chinese University of Hong Kong (2009–2021) |

| Field | Monetary economics |

| School or tradition |

Supply-side economics |

| Alma mater | University of British Columbia University of Washington London School of Economics Massachusetts Institute of Technology |

| Doctoral advisor |

Charles Kindleberger |

| Doctoral students |

Jacob A. Frenkel Rudi Dornbusch< Carmen Reinhart |

| Contributions | Mundell–Fleming model Optimum currency areas Research on the gold standard |

| Awards | Nobel Memorial Prize in Economics (1999) |

| Information at IDEAS / RePEc | |

Robert Alexander Mundell (October 24, 1932 – April 4, 2021) was a famous Canadian economist. He was a professor at Columbia University and the Chinese University of Hong Kong.

Mundell won the Nobel Memorial Prize in Economic Sciences in 1999. He received this award for his important work on how money moves between countries and how to create the best currency areas. He is often called the "father" of the euro currency. His ideas helped lead to its creation. He also helped start a way of thinking about economics called supply-side economics. Mundell is also known for two important economic ideas: the Mundell–Fleming model and the Mundell–Tobin effect.

Contents

Early Life and Education

Robert Alexander Mundell was born on October 24, 1932, in Kingston, Ontario, Canada. His mother was Lila Teresa Hamilton, and his father was William Mundell, a military officer. Robert grew up on a farm in Ontario. After World War II, his family moved to British Columbia. In high school, he enjoyed boxing and chess.

He studied economics and Russian at the University of British Columbia. He then received scholarships to the University of Washington and the Massachusetts Institute of Technology (MIT). He also studied at the London School of Economics. He earned his PhD from MIT.

Later in his career, Mundell taught at many universities. These included the University of Chicago (1965-1972), the University of Waterloo (1972-1974), and Columbia University (from 1974 until his death). He also taught at McGill University.

Career and Economic Ideas

From 1974, Robert Mundell was a professor at Columbia University. He held Columbia's highest academic rank, University Professor, from 2001. Early in his career, he taught at Stanford University and Johns Hopkins University. He also worked at the International Monetary Fund (IMF).

In the 1970s, Mundell did important work on how money works between countries. This research helped create the euro currency. For this work, he won the Nobel Prize in Economics in 1999. He also advised many important groups, including the United Nations, the IMF, the World Bank, and the Federal Reserve Board.

Mundell's main contributions to economics include:

- Ideas about optimum currency areas (regions that would benefit from sharing a single currency).

- Helping to develop the euro.

- Helping to start supply-side economics, which focuses on how tax cuts can boost the economy.

- Studying the history of the gold standard, a system where a country's currency value is linked to gold.

- Predicting the high inflation of the 1970s.

- Developing the Mundell–Fleming model, which explains how economic policies work in countries with open economies.

- Developing the Mundell–Tobin effect, which looks at how inflation affects interest rates.

International Money and Exchange Rates

Mundell was known for supporting tax cuts and supply-side economics. However, he won the Nobel Prize for his work on currency areas and how money is exchanged between countries.

In the 1960s, Canada, Mundell's home country, allowed its currency to "float" (its value changed based on the market). This made Mundell study floating exchange rates.

In 1962, he worked with Marcus Fleming to create the Mundell–Fleming model. This model showed that a country cannot have three things at once:

- Control over its own economy.

- Fixed exchange rates (where its currency value is set against another).

- Free flow of money in and out of the country.

A country can only achieve two of these three goals.

Mundell's work suggested that the Bretton Woods system (a system of fixed exchange rates after WWII) broke down because of disagreements over inflation. He believed that leaving this system would lead to "stagflation" (high inflation and slow economic growth). In 1974, he suggested big tax cuts to help the economy.

Mundell also believed that in a floating exchange rate system, the money supply can only grow if a country has more money coming in than going out. In 2000, he suggested that Canada should permanently link its dollar to the U.S. dollar.

The "Father of the Euro"

Robert Mundell is often called the "father of the euro" because he strongly supported a single European currency. From the 1960s, he pushed for a European Economic and Monetary Union and the creation of the euro.

In 2014, Mundell spoke against the idea of a "fiscal union" in Europe. This would mean a central European authority controlling all taxes and duties. He felt this would be too much power given away by individual countries. He also opposed countries being responsible for each other's debts.

Awards and Recognition

Mundell received many awards and honors:

- The Guggenheim Fellowship in 1971.

- The Nobel Memorial Prize in Economics in 1999.

- He was made a Companion of the Order of Canada in 2002.

- He received an honorary degree from the University of Paris in 1992.

- He was a Fellow of the American Academy of Arts and Sciences in 1998.

The Mundell International University of Entrepreneurship in Beijing, China, is named after him.

In his Nobel Prize lecture, Mundell talked about the 20th century. He said that the international money system depends on the power of the countries involved. He divided the century into three parts based on how money was managed globally.

Television Appearances

Mundell appeared on TV shows like CBS's Late Show with David Letterman. He also appeared on Bloomberg Television to discuss the euro and European financial issues.

He was also a special guest at chess events, making the first move in games.

Personal Life

Robert Mundell was married to Valerie Natsios-Mundell. They had a son and lived in Siena, Italy, from the late 1970s. He also had two sons and a daughter from an earlier marriage. Sadly, one of his sons passed away before him in a car accident.

Robert Mundell died on April 4, 2021, at the age of 88. He passed away from cholangiocarcinoma, a type of cancer.

See also

In Spanish: Robert Mundell para niños

In Spanish: Robert Mundell para niños

- Redundancy problem - suggested by Robert Mundell.

- List of economists

- Acmetal

- List of University of Waterloo people

Selected publications

- Mundell, Robert A (1968) (in en). Man and economics. New York: McGraw-Hill. OCLC 167951.

- Mundell, Robert A (1971) (in en). Monetary theory; inflation, interest, and growth in the world economy. Pacific Palisades, Calif.: Goodyear Pub. Co.. ISBN 0876205864. https://archive.org/details/monetarytheoryin0000mund.

- Conference on the New International Monetary System, ed. (1977) (in en). The new international monetary system. New York: Columbia University Press. ISBN 0231043686. https://archive.org/details/newinternational0000conf.

- Mundell, Robert A (1968) (in en). International economics. New York: Macmillan. OCLC 239387.

| Roy Wilkins |

| John Lewis |

| Linda Carol Brown |