Henry Paulson facts for kids

Quick facts for kids

Henry Paulson

|

|

|---|---|

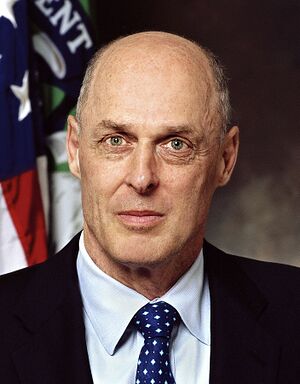

Official portrait, 2006

|

|

| 74th United States Secretary of the Treasury | |

| In office July 10, 2006 – January 20, 2009 |

|

| President | George W. Bush |

| Deputy | Robert M. Kimmitt |

| Preceded by | John W. Snow |

| Succeeded by | Tim Geithner |

| Personal details | |

| Born |

Henry Merritt Paulson Jr.

March 28, 1946 Palm Beach, Florida, U.S. |

| Political party | Republican |

| Spouse | Wendy Judge |

| Children | 2, including Merritt |

| Residences | Chicago, Illinois, U.S. Barrington Hills, Illinois, U.S. |

| Education | Dartmouth College (BA) Harvard University (MBA) |

| Signature | |

Henry Merritt Paulson Jr. (born March 28, 1946) is an American business leader and government official. He is known for being the 74th United States Secretary of the Treasury from 2006 to 2009. Before this important role, Paulson was the head of a large investment bank called Goldman Sachs.

He worked as Treasury Secretary under President George W. Bush until the end of Bush's time in office. In 2011, Paulson started the Paulson Institute. This organization works to help the economy grow in a way that protects the environment. It focuses mainly on the United States and China. He also works as a leader for a global fund called TPG Rise Climate.

Contents

Early Life and School Years

Henry Paulson was born in Palm Beach, Florida. His father was a jeweler. He grew up on a farm in Barrington, Illinois. Paulson was a Christian Scientist. He has family roots from Norway, Germany, and English Canada. He achieved the highest rank in the Boy Scouts of America, becoming an Eagle Scout. He also received a special award for distinguished Eagle Scouts.

Paulson was a good athlete at Barrington High School. He played wrestling and football. He finished high school in 1964. Paulson then went to Dartmouth College, where he studied English and graduated with high honors in 1968. At Dartmouth, he was part of a fraternity called Sigma Alpha Epsilon. He was also a top football player, earning honors in the Ivy League and nationally. After Dartmouth, he earned his Master of Business Administration (MBA) degree from Harvard Business School in 1970.

Starting His Career

From 1970 to 1972, Paulson worked at The Pentagon. He was a staff assistant for a high-ranking defense official. After that, he worked for U.S. President Richard Nixon's administration. He was an assistant to John Ehrlichman from 1972 to 1973.

Time at Goldman Sachs

Paulson joined Goldman Sachs, a big investment bank, in 1974. He worked in their Chicago office. He became a partner in the company in 1982. From 1983 to 1988, he led the Investment Banking group for the Midwest. He became the managing partner of the Chicago office in 1988.

He later became co-head of Investment Banking. Then, he was the Chief Operating Officer. Eventually, he became the chief executive (CEO) of Goldman Sachs. During his time there, Paulson built strong connections with leaders in China. He visited China more than 70 times.

Before becoming Treasury Secretary, Paulson had to sell all his stock in Goldman Sachs. This was to avoid any conflicts of interest with his new government job. His stock was worth over $600 million in 2006.

U.S. Secretary of the Treasury

President George W. Bush chose Paulson to be the Treasury Secretary on May 30, 2006. The United States Senate approved his nomination on June 28, 2006. Paulson officially started his job on July 10, 2006.

As Treasury Secretary, Paulson talked about important economic issues. One issue he highlighted was the large difference between the richest and poorest Americans. He also worked to help homeowners who were struggling during the subprime mortgage crisis. He helped create the Hope Now Alliance for this purpose.

Paulson also played a key role in U.S.-China relations. He started and led the U.S.-China Strategic Economic Dialogue. This was a way for the two countries to discuss important economic topics. In 2007, he told an audience in China that the country needed to open up its financial markets. He believed this would help their economy grow.

Important Statements

In April 2007, Paulson said the U.S. economy was healthy. He also thought the housing market was getting better. He stated that "the housing market is at or near the bottom."

In August 2007, he explained that problems from U.S. subprime mortgages were mostly contained. He said this was because the global economy was very strong.

In March 2008, Paulson spoke about the economy. He said the main goal was to limit the impact of financial problems on everyday life. He stressed the need for stable financial markets. He also said banks must continue to lend money to people and businesses.

In May 2008, Paulson believed that U.S. financial markets were recovering. He told The Wall Street Journal that "the worst is likely to be behind us."

After a bank called Indymac Bank failed in July 2008, Paulson tried to reassure the public. He said, "it's a safe banking system, a sound banking system."

In August 2008, Paulson said there were no plans to put money into Fannie Mae or Freddie Mac. However, on September 7, 2008, both companies were taken over by the government.

In November 2008, Paulson spoke to lawmakers. He said there was no guide for dealing with such a severe financial crisis. He explained that they adjusted their plans to stabilize the financial system.

The 2008 Financial Crisis

In March 2008, Paulson released a plan for a new financial system. He said the old system needed to be updated. This was because global markets and financial services had changed a lot. He believed a new system would be more flexible and better protect investors.

Lehman Brothers Bankruptcy

Paulson and Federal Reserve Chairman Ben Bernanke faced a big challenge when the investment bank Lehman Brothers was in trouble. They tried to find a buyer for Lehman Brothers. However, a deal could not be reached, and Lehman Brothers went bankrupt. This event caused a lot of problems in the financial markets.

Paulson said that the American people could still trust in the financial system. But after Lehman's failure, credit markets froze. This meant that many companies could not get the money they needed to operate. This led to major problems in the U.S. stock and bond markets.

U.S. Government Economic Rescue of 2008

Paulson led the government's efforts to prevent a major economic collapse. The stock market dropped significantly, and global markets were in chaos. Paulson helped pass a law that allowed the Treasury to use $700 billion to stabilize the financial system.

He also worked with Ben Bernanke to help American International Group (AIG). AIG was a huge insurance company that was close to failing. They provided AIG with a large loan to prevent its bankruptcy. This was important because AIG held many retirement plans and life insurance policies for Americans.

Paulson believed that the best way to fix the frozen financial markets was to put money directly into financial institutions. The government would take a small ownership share in these banks. This plan was presented to the leaders of nine major banks in October 2008.

Time magazine recognized Paulson's role in the crisis. They named him a runner-up for their 2008 Person of the Year. They said that "if there is a face to this financial debacle, it is now his."

Some people raised concerns about Paulson's past role as CEO of Goldman Sachs. They wondered if there were any conflicts of interest. However, Paulson had sold all his stock in Goldman Sachs before becoming Treasury Secretary. This was to follow ethics rules.

After Public Service

After leaving his government job, Paulson spent time at Johns Hopkins University. He wrote a book about his experiences as Treasury Secretary called On the Brink: Inside the Race to Stop the Collapse of the Global Financial System. It was published in 2010.

In 2014, Paulson testified in a lawsuit involving AIG. He said that the terms of the AIG bailout were meant to be tough.

In 2015, he received an honorary degree from Washington College. In 2016, Paulson supported the United Kingdom staying in the European Union. He also supported Hillary Clinton for president in the 2016 election. He wrote that the Republican Party was supporting ideas based on "ignorance, prejudice, fear and isolationism."

Paulson is a leader in the Climate Leadership Council. He has co-authored a plan for a carbon fee and dividend in the United States. This plan aims to help reduce climate change.

The Paulson Institute

On June 27, 2011, Paulson announced the creation of the Paulson Institute. This is a non-political organization that works to improve the relationship between the U.S. and China. It aims to help maintain global order. Paulson also became a senior fellow at the University of Chicago's Harris School of Public Policy.

Author

In his book On the Brink, Paulson shares his experiences during the 2008 financial crisis. His second book, Dealing with China, talks about his career working with Chinese leaders. It describes how China's economy has changed. This book was chosen by Facebook founder Mark Zuckerberg for his book club.

Community Activities

Paulson loves nature. He has been a member of The Nature Conservancy for many years. He was also the chairman of their board. He worked with former Chinese President Jiang Zemin to protect a place called Tiger Leaping Gorge in China. Paulson also helped lead a group called Risky Business. This group raised awareness about how climate change could affect the economy. He is a long-time supporter of Rare (conservation organization), where his wife Wendy is a leader.

Paulson believes strongly that human activity affects global warming. He supports taking immediate action to reduce this effect.

When he was CEO of Goldman Sachs, Paulson oversaw a large donation of land in Chile for conservation. He has also personally donated a lot of his wealth to conservation causes. He has promised to give his entire fortune for the same purpose after his death.

Personal Life

Henry Paulson met his wife, Wendy Judge, when he was in his senior year of college. She graduated from Wellesley College.

They have two adult children. Their son, Henry Merritt Paulson III, is known as Merritt Paulson and owns sports teams. Their daughter, Amanda Paulson, is a journalist. She also graduated from Dartmouth. The Paulsons became grandparents in June 2007.

They have homes in Chicago and Barrington Hills, Illinois. In 2016, Wendy Paulson talked about how important Christian Science teachings are in their lives.

Awards and Recognition

- 2007: Golden Plate Award from the American Academy of Achievement.

- 2011: The Committee of 100's "Leadership Award for Advancing U.S.-China Relations."

- 2016: Environmental Law Institute's Environmental Achievement Award.

- 2009: Harvard Business School's Alumni Achievement Award.

See also

In Spanish: Henry Merritt Paulson Jr. para niños

In Spanish: Henry Merritt Paulson Jr. para niños